Summary:

- Futu Holdings’ stock surged 107.7% in the last month, driven by strong Q2 results and China’s unexpected monetary easing.

- Futu’s Q2 revenue grew 25.9% Y/Y, with significant increases in paying clients, user base, and trading volumes, especially in Hong Kong and Singapore.

- Risks include potential market scrutiny of China’s aggressive stimulus and a struggling housing market diverting funds from stocks to real estate.

- Despite high risks, Futu’s geographic diversification and favorable monetary policies in Asia position it for continued growth in trading volumes and client acquisitions.

owngarden

In the nearly two years since recommending Futu Holdings (NASDAQ:FUTU), the stock returned nearly 115%. This is more than double the S&P 500’s return. Granted, shareholders enjoyed most of this digitized brokerage and wealth management’s gains in the last month. The Chinese central bank unexpectedly unveiled an urgent stimulus package ahead of the government celebrating its 75 th anniversary.

What should investors do after FUTU stock abruptly soared?

Strong Second-Quarter Results

In August, Futu posted second-quarter earnings of $1.11 a share. Revenue increased by 25.9% Y/Y to $400.7 million. The firm posted a strong increase in paying and registered clients. Additionally, it increased its user base to 23.3 million, up by 13.3% Y/Y. Although total client assets, daily average client assets, daily average revenue, and total trading volume all grew in the double-digit percentage, FUTU stock did not react at the time.

Chairman and Chief Executive Officer Leaf Hua Li said that the strong quarterly momentum would continue. The firm increased its guidance again, forecasting a growth of 550,000 new paying clients this year. The CEO benefited from a growth in new paying clients in both Hong Kong and Singapore. They collectively contributed to over one-third of the firm’s paying client growth in the second quarter. Futu launched cryptocurrency trading in those two markets. As a result, customers may diversify their holdings beyond stocks into digital currencies.

Investors should expect Futu to outflank the competition by offering a competitive pricing schedule. In Q2, customers in Japan grew by a double-digit percentage. It benefited from a strong product offering, marketing initiatives, and efforts to raise brand awareness.

In Malaysia, Futu reported an increased willingness for clients to take more risks. Leveraged positions increased. This lifted margin financing and securities lending balances by 16.6% sequentially to a record high of HK$43.8 billion (US $5.64 billion).

Opportunity

Futu’s CEO cited a rebound in trading velocity for Hong Kong stocks in Q2. In July, the People’s Bank of China unexpectedly cut its loan prime rates. Investors may infer that volumes will soar by several-fold in the last two weeks. On Sept. 25, 2024, the PBoC cut its medium-term lending facility rate by 30 basis points to 2.0%. In addition, China introduced stimulus measures to prop up its ailing economy. When China’s stock market rose by 8%, its biggest rally since 2008, it will increase stock trading volumes. This will increase all of Futu’s performance metrics, including daily trading volume, assets deposited, and new customer registrations.

In Q2, Futu benefited from 451 IPO distributions, up by 20.6% Y/Y. In addition, it underwrote seven out of the 10 largest Hong Kong IPO listings in H1/2024. Looking ahead, China’s stimulus and interest rate cuts should increase initial public offering activities. This should result in more IPO-related activities for Futu.

Risk

The rapid rise in the Shanghai Composite Index and Hang Seng more than erased a yearlong slump. Risks are high that the market may scrutinize the effectiveness of China’s aggressive central bank actions. The stimulus package this year is around 7.5 trillion yuan (US $1.07 trillion). This accounts for 6% of China’s GDP in 2024. However, investors may speculate that the bank will use 2.5 trillion yuan for mortgage-debt servicing.

China’s home prices fell by 6.8% in August while the value of new homes sold dropped by 23.6%. The housing market might need a bigger stimulus to encourage the Chinese people to buy a second or third home. Money used for real estate instead of stock markets would hurt Futu’s near-term revenue prospects.

FUTU Stock Grades

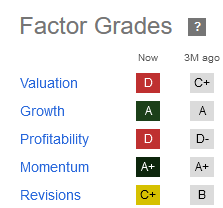

Futu’s valuation grade fell slightly to a “D” after shares gained 107.7% in the last month. The growth grade is an A, while the profitability improved slightly.

Seeking Alpha

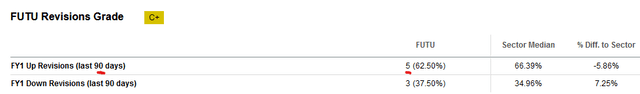

Although five analysts revised their EPS upward in the last 90 days, the revision grade fell to a C+.

Futu will need to post an EPS surprise in its next quarterly report. Analysts would raise their EPS revisions for future quarters in response.

The momentum score is unchanged with an A+.

Your Takeaway

Futu’s impressive rally rewarded shareholders in only a month. While risks are high that profit-takers will send China-based stocks lower, Futu has better geographic diversification. Trading volumes by clients in Singapore and Hong Kong should continue as they benefit from the swift monetary easing from the PBoC. The lower interest rates should encourage traders to move their money out of U.S. Treasury Bills (TLT) and cash. They will invest in cryptocurrencies and Asian-based stocks instead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Please [+]Follow me for coverage on deeply discounted stocks. Click on the “follow” button beside my name. Get do-it-yourself (‘DIY’) Investing Tips and Tricks on a free DIY subscription here.