Summary:

- Energy Transfer’s Q3 2024 results show record volumes and a 12% YoY increase in adjusted EBITDA, highlighting successful growth investments and strong DCF.

- The company’s integrated asset portfolio and expansion in natural gas and NGL exports position it well for future growth and market share.

- Shareholder returns are robust with a 7.5% dividend yield, supported by strong adjusted EBITDA and careful debt management despite significant acquisitions.

- Climate change and the rise of cheaper renewables pose risks, but ET’s strong network and growth potential make it a valuable long-term investment.

Jonathan Kitchen

Energy Transfer (NYSE:ET) is one of the largest midstream companies, with a market capitalization of just under $60 billion. The company is one we recommended after its recent share price appreciation. The company is one of the few companies continuously acquiring peers and growing while continuing to generate strong DCF and shareholder returns.

As we’ll see throughout this article, in an expensive market, the company has substantial potential.

Energy Transfer Q3 2024 Results

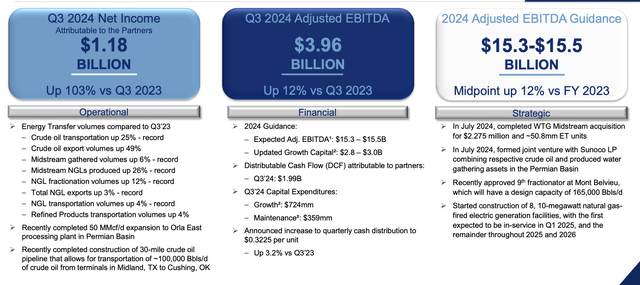

Energy Transfer managed to earn more than $1.1 billion of net income as volumes hit new records.

Energy Transfer Investor Presentation

The company increased volumes by 25% for crude oil transportation and 49% for crude oil export. Midstream and NGL volumes also hit records, even in some of the company’s largest segments, such as NGL exports. The company’s growth investments have resulted in continued growth and incremental assets to the company’s incredibly strong footprint.

The company earned 12% more in YoY adjusted EBITDA, showing the fundamental benefits of these growth investments, as it spent another $724 million of growth capital in the quarter. The company spent $359 million on maintenance and is targeting $2.9 billion in annual growth capital for the year. The company slightly increased its dividend by 3%.

The company’s 7.5% yield costs it ~$1.2 billion / quarter, which enables the company to cover dividends and growth capital. The company is continuing to increase its guidance and has closed its WTG Midstream acquisition. We would have liked to see the company not issue units for that.

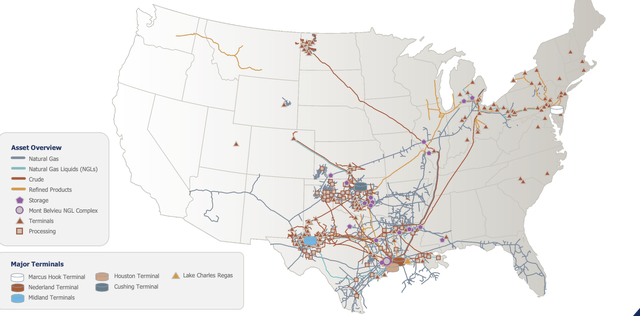

Energy Transfer Footprint

Overall the company has an incredibly strong portfolio.

Energy Transfer Investor Presentation

It has a number of assets and pipelines, including connections to incredibly important terminals capable of moving millions of barrels of crude and oil products per day. The company’s integrated asset portfolio connects to effectively every major market. These strong incremented assets also provide the company with numerous bolt-on acquisitions.

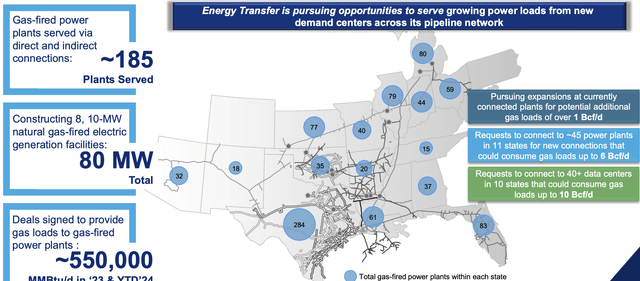

Energy Transfer Investor Presentation

As natural gas sees demand grow as a base-load fuel that’s cleaner than coal, the company is expanding its portfolio. The company expects potential additional gas loads to consume 10+ Bcf / day, especially with the potential growth of data centers. Natural gas represents one of the easiest, reliable fuels for data centers.

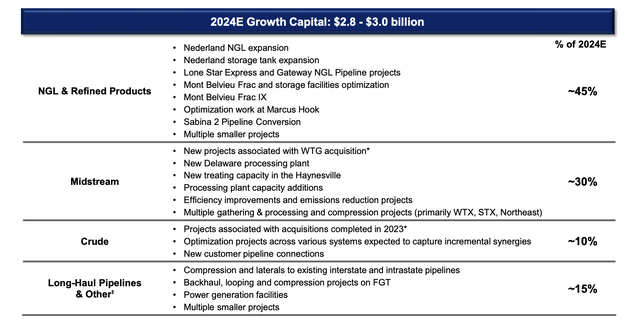

Energy Transfer Export Growth

Overall, the company’s future growth profile remains strong at ~$700 million / quarter.

Energy Transfer Investor Presentation

The company continues to focus on NGL and refined products, which are its largest segment. Many of the company’s projects are bolt-on projects that have strong margin potential for the company. The company’s YoY growth in volumes is a sign of the strength of its projects, and we expect that to continue.

Many of these projects come online in the next 1–2 years to benefit customers.

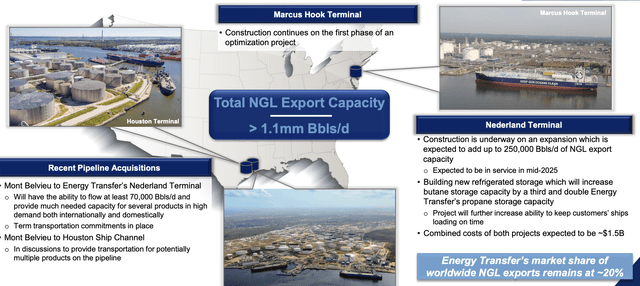

Energy Transfer Investor Presentation

An example of the company’s projects is its world-class NGL export facilities, where the company has more than 1.1 million barrels of export capacity. The company has more than 1 million barrels / day of fractionation capacity at Mont Belvieu and recently approved a 9th fractionation. The company is looking to add additional export capacity to the Houston Ship Channel.

In the Nederland Terminal, the company is expecting to add 250k barrels / day in export capacity by mid-2025. The company is also adding new refrigerated storage to optimize and add capacity, with a total cost of $1.5 billion. The company’s massive size is why it’s maintaining global market share of NGL exports at a massive ~20%.

Energy Transfer Shareholder Returns

The company has continued to expand while focusing on shareholder returns.

Energy Transfer Investor Presentation

The company’s core form of returns is a 7.5% dividend yield, which it can comfortably afford, and which we’d like to continue growing. As a part of this lofty dividend, we don’t like when the company issues equity, given its expense. We’d prefer if the company uses cash for those expensive acquisitions to lower the long-term cost.

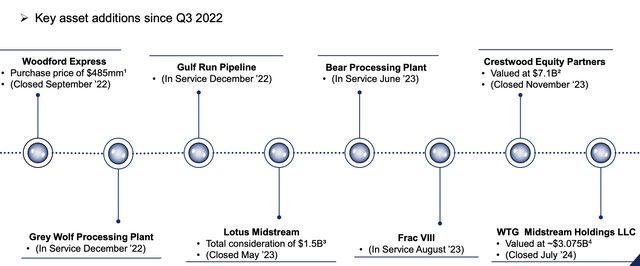

The company has spent more than $10 billion on acquisitions over the last 2 years and while it has significant long-term debt ~$50 billion, it can comfortably manage it given its strong and growing adjusted EBITDA. The company’s DCF yield is ~15% which is what enables it to both continue paying a strong dividend and continue its growth.

Thesis Risk

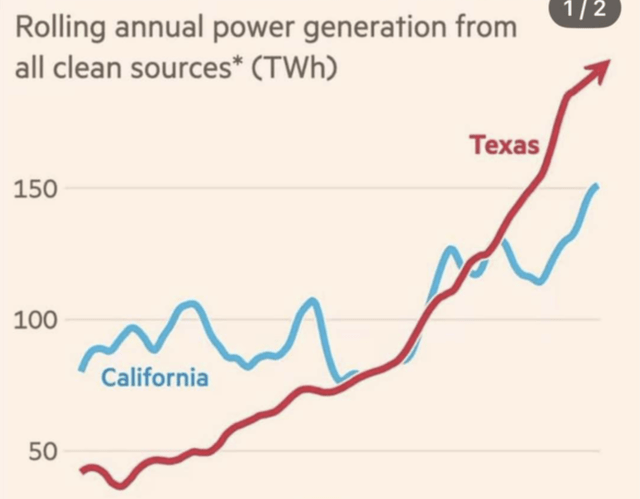

The largest risk to our thesis is climate change and what it entails for the future markets.

This is especially true with some of the largest sources of future energy demand, data centers, coming from major tech companies that can afford to invest in nuclear power. Part of the fundamental problem here is that renewables are simply becoming cheaper than natural gas and oil. That could hurt long-term demand and future returns.

Conclusion

In an incredibly expensive market, there’s not a ton of opportunities left. However, Energy Transfer remains a strong investment opportunity. The company is continuing to grow its adjusted EBITDA while managing its debt, resulting in growing distributable cash flow. It’s incredibly strong network of assets give it substantial growth opportunities.

Going forward, we expect the company’s dividends to continue generating strong returns, justifying the investment by itself. We expect the remainder of the company’s assets to continue their growth, making the company a valuable long-term investment. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.