Summary:

- Goldman Sachs and Morgan Stanley are two of the largest investment banks, excelling in Wealth Management, M&A, Trading, and Brokerage.

- Despite frequent comparisons, the banks have distinct differences in their business plans, priorities, and strategic visions.

- GS has an incredible IB division, but MS’s better ROE in wealth management and more well-balanced business segments should deliver shareholder outperformance in the long run.

- We rate GS a ‘Buy’ and MS a ‘Strong Buy’.

Kawisara Kaewprasert

Goldman Sachs (NYSE:GS) and Morgan Stanley (NYSE:MS) are two of the largest investment banks on earth.

With significant businesses in the Wealth Management, M&A, and Trading & Brokerage segments – and with AUM in the trillions of dollars – each bank is formidable in their own right.

However, while they are often compared to each other on an apples-to-apples basis, as you begin to dissect each company, differences begin to emerge, and the unique aspects of the firms’ respective business plans, priorities, and strategic vision become clearer.

We love investment banking as a business. With naturally hedging business segments for each stage of the economic & rate cycle, it’s hard to argue that scaled players in the space don’t look like solid long-term allocations of capital. That said, it can be hard to decide precisely which stocks to pick within the space.

Today, we thought we’d take a closer look at these two leading firms to decide once and for all which stock might be a better investment over the next 1, 5, 10, and 50 years.

Sound good? Let’s dive in.

Business Overview

Let’s first start with a quick overview of each company’s business. In short, MS and GS are both American investment banking giants, but each has specific strengths that they play to. For MS, the company is becoming more and more focused on Wealth Management, and for GS, they’re more focused on Banking & Trading, especially since their pivot to consumer banking was largely deemed a failure.

Let’s start with GS.

Formally, the company operates three main businesses:

- Global Banking & Markets

- Assets & Wealth Management

- Platform Solutions

‘Global Banking & Markets’ includes segments like Investment Banking (Advisory and Underwriting) and Sales & Trading (Market Making, Financing and Prop in FICC & Equities).

‘Asset & Wealth Management’ includes segments like GSAM, which provides investment vehicles and products across the asset space, and GWM, which provides advice, banking, and lending to HNW clients.

‘Platform Solutions’ includes GS’s consumer segments – mainly Marcus, the Apple Card, and the General Motors (GM) card.

Of these three, substantially two thirds of the company’s revenue is generated from Global Banking & Markets, which is quite different from MS. Additionally, the Platform Solutions segment is also very small relative to the other two.

For MS, the product split is mostly similar, but the revenue split is reversed.

The company operates in three segments, including:

- Institutional Securities

- Wealth Management

- Investment Management

MS’s Wealth Management and Investment Management segments, when combined, are similar to GS’s ‘Assets & Wealth Management’ division, which focuses mainly on investment vehicles & products, advice, and private banking and lending.

MS’s Institutional Securities segment is also basically the same as GS’s Global Banking & Markets business, providing market making, advisory, and underwriting to the capital markets.

The key difference, as we just alluded to, is that MS’s Wealth Management division is larger than the Banking segment, which gives the business an entirely different earnings profile.

Financials

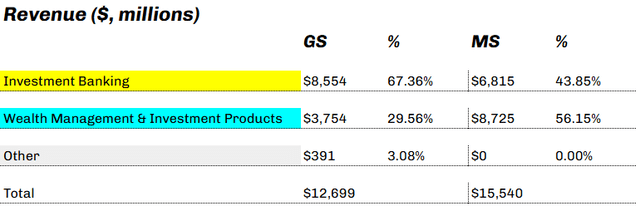

Let’s take a look at how these differences manifest in the Q3 numbers:

PropNotes | Compiled From 10Q’s

As you can see, GS leans more heavily into advisory, underwriting, and trading, whereas MS has been making moves to acquire more AUM to bolster the Wealth Management business. Both company’s businesses in both areas are still quite large, but over time the specialization has become more pronounced. These recent earnings prove that.

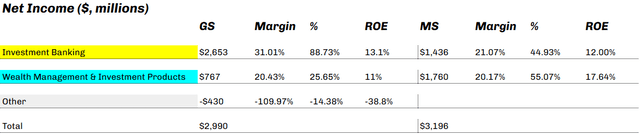

Things get interesting when you look at how this has worked out in terms of profitability:

PropNotes | Compiled From 10Q’s

On the bottom line, GS’s investment banking division has outperformed, with a fantastic 31% net margin, which makes the segment’s importance to the company even more pronounced (at an even larger percentage of the bottom line!). At the same time, the consumer business has been a drag for shareholders, which is a considerable negative. Thankfully, GS is looking at divesting from this venture and re-focusing energy and capital on the core segments.

On MS’s bottom line, the investment banking unit underperformed GS in terms of margin but was roughly in line when it came to assets and wealth management. If you were looking at this from a purely ‘margin’ standpoint, one could easily make the argument that GS is the better business, at least when rates are coming down and M&A is picking up.

However, to some degree, investment banks operate in an interesting way, where the mechanism for getting business isn’t marketing, but rather by using the bank’s balance sheet and equity to attract revenue into the firm.

For example, when an MS market maker gives a hedge fund a better price than GS on a block trade, the hedge fund will transact through MS. The capital backing this better pricing is MS’s balance sheet and human talent.

Consequently, this means that ROE is also a key figure when it comes to profitability, because it describes how much ‘juice’ management can get from allocating shareholder capital into different parts of the business.

Right now, GS’s net margins are a bit better, but MS’s structural ROE is significantly superior.

On the IB side, ROE is similar, in the 12-13% range for both firms.

However, on the asset management side, MS’s 17% ROE is significantly better than GS’s at 11%. This difference means that by buying more and more assets to collate with in the WM division, MS has been boosting the company’s ROE to shareholders by a significant amount.

Less firm assets required, and more net income produced.

This, combined with the company’s more equal split in terms of revenue and net income, means that the company is more well hedged when it comes to the ups and downs of the rate cycle and economic cycle. GS, on the other hand, is more exposed to the cyclical nature of the economy and rates.

Thus, in the short term, GS may perform better than MS given the continued expected rate cuts, but MS will likely prove to be more stable over the long run.

For these reasons, we moderately prefer MS from an ‘organic business’ perspective.

Valuation

However – the organic business is only one component of overall stock returns; the valuation is the other. Even if MS may be more well-positioned for the long run, if the price doesn’t make sense, then GS could very well be the better option.

Let’s take a look at each company’s respective valuation situation.

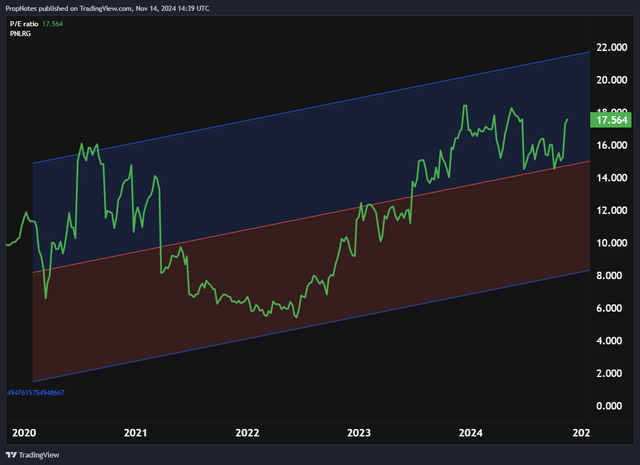

For GS, the company is trading at roughly 3.4x sales and 17x TTM net income:

This is cheaper than the market as a whole, although it is towards the upper end of GS’s historical valuation range, as you can see above.

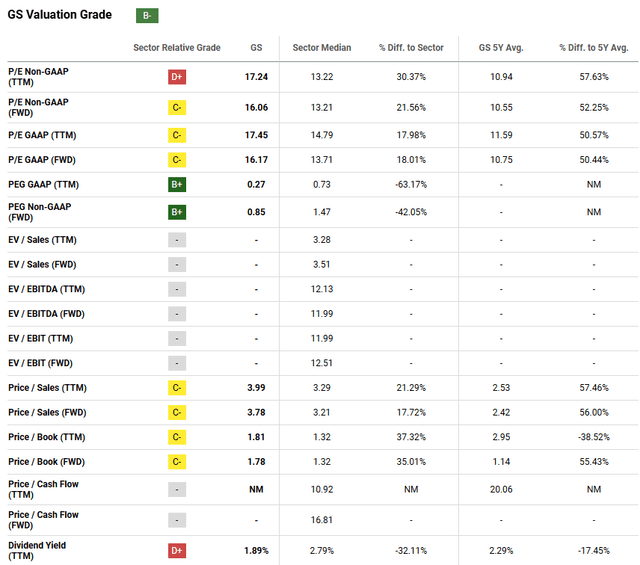

Seeking Alpha’s quant rating system gives the company a ‘B-‘ rating, which is a little bit generous in our view:

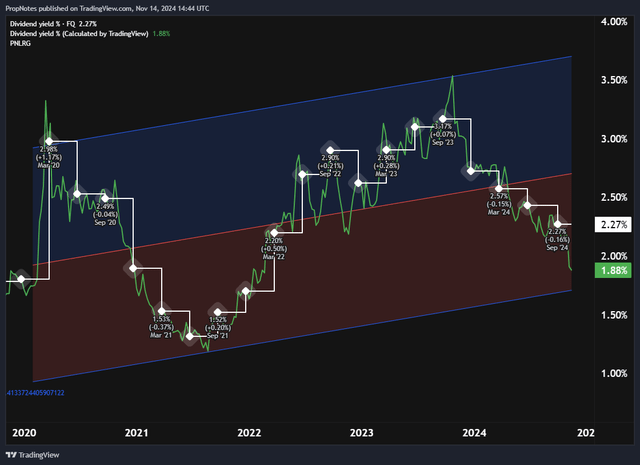

One key issue we have here is the dividend yield, which reflects a portion of the company’s ‘cash returns’ to shareholders.

It’s quite low, which illustrates the stock’s relatively high price:

All in all, GS seems reasonably priced against the market, even if it is a tad expensive by some historical measures.

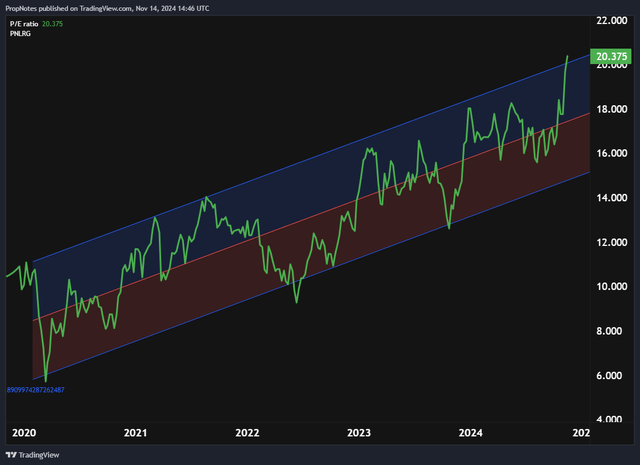

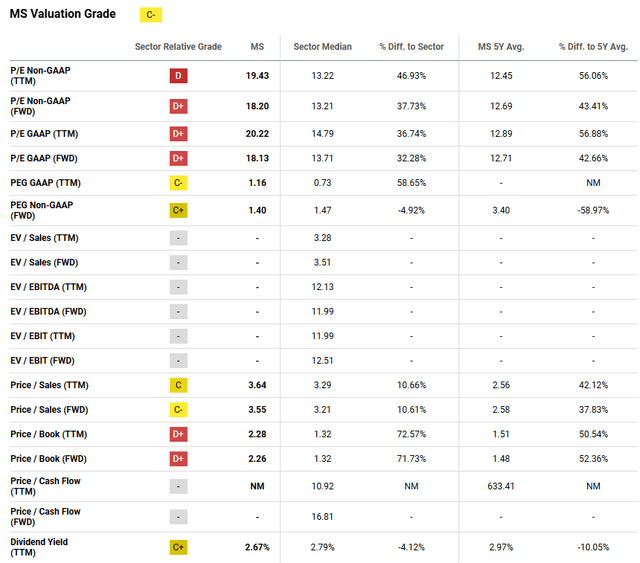

On the MS front, the stock is firmly in the ‘premium’ camp.

MS’s price / earnings ratio is ~20x, which is trading just outside of the company’s historical 5 year linear regression / standard deviation range:

Seeking Alpha’s quant rating system also thinks MS looks at bit expensive, rating the stock a ‘C-‘:

There’s no question that MS is a shade more expensive than GS, especially when you look at the stock on a P/E basis.

GS’s PEG is also more attractive, reflecting better short-term growth prospects (as we discussed), in addition to a lower starting multiple.

Here’s the thing: we believe that MS is priced higher given the company’s stronger profitability profile and long-term stability in the face of economic swings. Plus, GS and MS aren’t that far apart on the multiple, which makes choosing one off these metrics alone a bit more challenging.

With MS, you’re being asked to pay more for a larger, more profitable, more potentially economically resilient firm. With GS, you’re being asked to pay less for a company with stronger growth prospects in the short term but more cyclicality (and a struggling consumer division) over the long term.

Thus, your choice will likely come down to your time horizon. If you’re looking for a long-term play, paying up for MS makes a lot of sense. If you’re looking for a more short-term trade, then GS may be the better pick.

Given our time horizon and investing sensibilities, we prefer MS.

Risks

No matter which you pick, though, there are risks that come with investing into the sector.

First, regulations are a key risk to capital returns for large cap financials.

Capital ratios and other regulatory tools can reduce bank profitability, which can hamper EPS and real returns to shareholders. This also impacts things like buybacks, which can be accretive.

Second, Banks, no matter their business model, have some exposure to the economic cycle. Even MS, with its’ massive WM division, has lots of exposure to asset prices, interest rates, and the business environment.

Thus, keeping an eye on the macro is key when it comes to setting expectations for your returns.

Finally, there’s always a risk that competition gets fiercer in MS and GS’s key markets. Margins are high, which often means that there’s a route in for competition if they want to fight on price. Thankfully, these risks are somewhat reduced given MS and GS’s strong brands, balance sheets, and regulatory stature.

Summary

Overall, there are some risks when it comes to investing into MS and GS. Both banks offer the potential for solid, long term returns on the back of enduring franchises in capital markets, wealth management, and IB.

That said, between the two, we see MS as the more attractive buy.

Thus, our ratings: MS as a ‘Strong Buy’, and GS as a ‘Buy’.

Good luck out there!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.