Summary:

- The Miami-based cruise operator reported its fourth quarter earnings results on the 21st of December, burning through much less cash than analysts initially expected.

- Mr. Market reacted largely positively to the news, as it appears set to push the stock beyond the $10 level once more if the upward price movement continues.

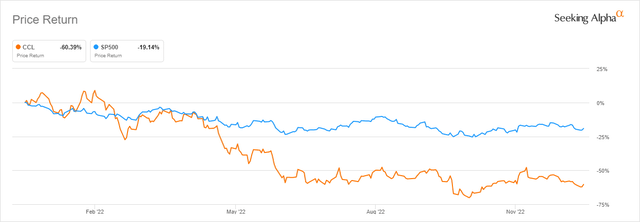

- Carnival is still being chewed up in the markets, losing 60.3% of its value year-to-date as it currently trades at an 83.4% discount to the pre-2020 price.

- We still remain somewhat unconvinced as to the successful recovery of CCL, opting in to wait for a clearer plan on deleveraging and a “show of force” in terms.

- It’s more likely that things will get significantly worse before they get any better for CCL shareholders, as turning the boat around proves to be a much more difficult task.

ocuric

Without any fault of its own and as a result of factors the company had no control over, the basics of an otherwise excellent company that I had admired were all but obliterated. Former pre-pandemic shareholders and those willing to speculate that the stock price would at least marginally recover from its lows have both been largely let down to this point. Suffice it to say that I did not share the sentiment that there was a clear and easy road for Carnival Corporation’s (NYSE:CCL) (NYSE:CUK) recovery, placing me firmly in the camp of those who still remained unimpressed with the company’s present operating outcomes.

Over the period of the last 12 months, I wrote a series of articles elaborating my views on why I believed that the post-pandemic recovery and the subsequent runup for the cruise line stock were largely unwarranted and not supported in terms of business fundamentals. Namely, the level of equity and debt financing that has been conducted in order to keep the company afloat creates a situation where the share price of the business is no longer directly comparable to the pre-2020 share prices but should be valued completely independently.

Unfortunately for the shareholders of the British-American entertainment cruise giant, my negative outlook on the recovery process has so far proven to be largely correct, with the stock price breaking the $10 per share level on a couple of occasions but quickly being pulled back down to the $7-9 range. This time it might be different as the company reported its fourth-quarter earnings results on the 21st of December, highlighting another quarter of excellent operational results, which the market welcomed, pumping the price 5% in a single trading day.

CCL and S&P500 YTD Results (Seeking Alpha)

Insight into Carnival’s fourth-quarter report

Yesterday’s news headlines were largely favorable for the Miami-based cruise operator, which reported its long-awaited fourth quarter business results on Wednesday, the 21st of December. In fact, shares of Carnival rose by 5% as the cruise operator failed to meet top-line expectations, but beat net loss expectations in the meantime. Carnival is still significantly underperforming the S&P 500 (SPY) having generated a negative 60.3% year-to-date return. Overall, the stock market responded well to the news, and it appears set to push the stock beyond $10 once more if the upward price movement continues over the coming few days.

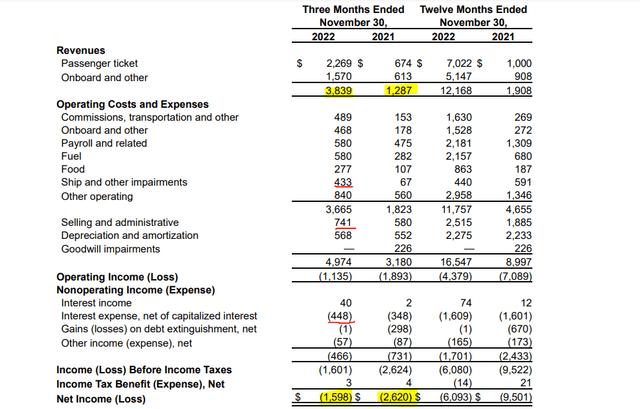

Financial Results (Q4 ’22 Business Update)

The company failed to beat top-line expectations, with quarterly revenue total coming in at $3.83 billion, far less than the $3.95 billion consensus estimate. Still, the top line improved significantly when compared to the $1.28 billion number for the same period last year. To recall, in the record-breaking fourth quarter of 2019, Carnival generated $4.8 billion in revenues.

As opposed to the prior-year fourth quarter’s loss of $2.62 billion, Carnival posted a GAAP net loss of $1.59 billion for the fourth quarter of this year. The adjusted net loss for the quarter was $1.06 billion, as opposed to the $1.95 billion reported in the same period last year. For the same period back in 2019, the Miami-based firm reported a $423 million GAAP net income.

The cruise operator’s loss per share for the fourth quarter was $0.85 per share, which was slightly lower than the $0.89 loss per share analysts’ consensus estimate. The business had posted a $1.72 loss per share in the prior quarter. This means that Carnival lost $5.16 per share in the last twelve-month period.

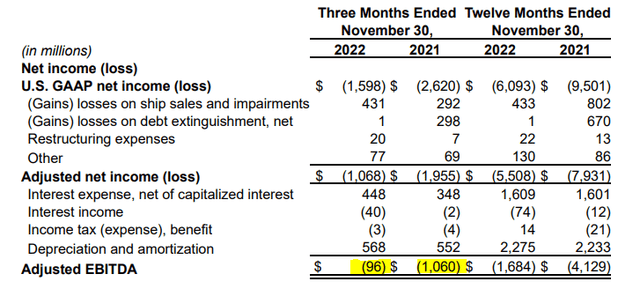

Reported Adj. EBITDA (Q4 ’22 Business Update)

Management landed their third-quarter projection for Adj. EBITDA as they finally reported a breakeven quarter. When compared to the previous quarter, when CCL posted a negative Adjusted EBITDA of $1.06 billion, it’s a substantial improvement. The company still burns through free cash flow, as it reported a negative $1.29 billion figure for the quarter, compared to going through $0.85 billion in the same period last year.

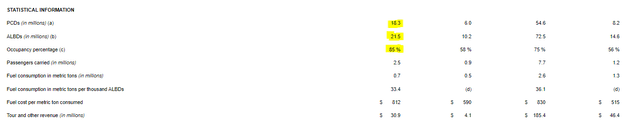

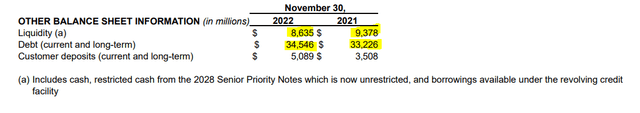

Carnival ends the fourth quarter with a really strong $8.63 billion liquidity position. As of November, total customer deposits have reached a fourth quarter record of $5.1 billion, beating the previous record of $4.9 billion recorded in the same period in 2019. Occupancy rates also have increased by 27% as compared to the last year, marking a significant recovery as the company carried 2.5 million passengers this quarter. However, this remains only a single percentage increase as compared to the third quarter. PCDs increased by 3.3% to 18.5 million, while ALBDs also increased by 1.9% to 21.5 million.

Statistical Information (Q4 ’22 Business Update)

Turning the attention to forecasts for next year, management expects strong operational results for the first half of the year, closing the gap to record 2019 performance. However, somewhat weak financial results will haunt them likely until the back end of the year. Management expects the second half of the year to be much more successful in this context, as they look to end next year with a “significant positive adjusted EBITDA” and likely even the first quarter of a positive FCF stream.

The new CEO also promised to raise advertising spending by as much as 20% compared to the same period in 2019, which I found to be a really fascinating announcement. According to him, a robust wave season should result from the combination of the presumably increased awareness and the 20%–50% value gap to land-based alternatives that, in his words, “should not exist.”

As I mentioned on the previous call, to help support this growth and to drive overall revenue generation, I’ve actively been working with each brand on their strategies and road maps. As a result, I’ve authorized our brands to take a significant step up in advertising activities, including a nearly 20% increase in our investment this past quarter over 2019 to elevate awareness and consideration and to drive demand for both the near and the longer term. This should be particularly impactful with those new to cruise, where we draw about 1/3 of our guests as we position to take share from land-based alternatives.

Josh Weinstein, CEO – Q4 ’22 Earnings Call

I have previously made certain remarks and expressed my concerns over how the company’s ship order book and ship-building-related capital expenditures could potentially bleed out some much-needed free cash flow that would be much better utilized in repurchasing debt. Management made significant efforts to cut back on spending in this regard, slashing some $500 million of capex in 2023 and another $300 million in 2024. However, the company still plans to dedicate roughly $7.5 billion to capital expenditures over the next two years.

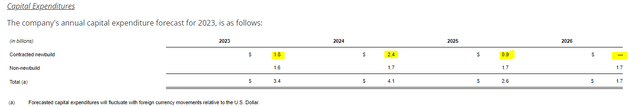

Capital Expenditures (Q4 ’22 Business Update)

Turning to current management projections, Carnival plans to have $3.4 billion in capex in 2023, alongside $4.1 billion in 2024, much of it shipbuilding related. Non-building-related capital expenditures remain larger than flat and should not exceed $1.7 billion per year. The company doesn’t plan any shipbuilding activities in ’26 and will likely see only one or two per year from that point on.

With some back-of-the-paper math, Carnival would have to be successful in generating at least two thirds of the CFO from 2019 to break even. For several years leading up to and including 2019, the company managed to generate around $5.5 billion in cash from operations. Matching or surpassing 2019 levels, which was after all a record year, would free up some $1.0-1.5 billion of free cash flow per year.

Going forward, we are committed to using our expected cash flow strength to repair the balance sheet over time and will be disciplined and rigorous in making new build decisions accordingly. We have just 4 ships on order through 2025 plus our second incredible Seabourn luxury expedition ship to be delivered in 2023. This is our lowest order book in decades. We don’t expect any new ships in 2026 and anticipate just one or 2 new builds each year for several years thereafter.

Josh Weinstein, CEO – Q4 ’22 Earnings Call

This back-of-the-envelope math appears to be supported by the CFO’s comments about the company’s expected free cash flow positive in the second half of 2023. As expected, they plan to pour everything into repaying debt for years to come, hoping to improve the state of the balance sheet. However, this is where we arrive at the big question.

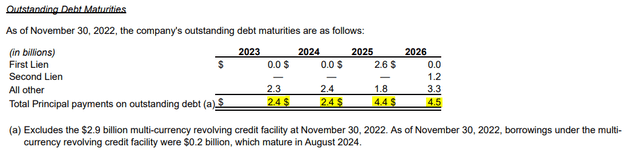

Debt Maturity Schedule (Q4 ’22 Business Update)

Free cash flow is likely not the place to look for Carnival to be able to cover its next year’s debt maturities, as it becomes increasingly likely they will have to do more painful refinancing or drain liquidity even further. In fact, from where we stand today, I find it likely that roughly half of the outstanding debt from now to 2026 will have to be refinanced at very painful rates. It only recently made a $1 billion expensive debt offering to refinance its ’24 maturities.

Outstanding Debt and Liquidity (Q4 ’22 Business Update)

Closing thoughts

From where we stand today, the company is set on a course to achieve extraordinary operational results in the second half of ’23, as well as ’24. The big question is how much of that will translate to the bottom line and whether it will ultimately be to the benefit of the common shareholder. In other words, even with those excellent operational results that will likely rival 2019, I don’t necessarily see their balance sheet significantly improving, as weak cash flow potential indicates that high leverage will remain a reality investors have to face for years. In addition, Carnival will face unexpected headwinds from rising food and fuel prices, as well as the negative forex impact that appears to be a reality, at least in the short to midterm. When we compare Carnival’s performance during the past two years, as well as the ongoing recovery of rival companies like Norwegian Cruise Line Holdings (NCLH) and Royal Caribbean Cruises (RCL), which have arguably fared better than Carnival at it, things look even more depressing for the common shareholder. It’s more likely that things will get significantly worse before they get better for CCL shareholders, as turning the boat around proves to be a much more difficult task than initially expected.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.