Summary:

- Nvidia Corporation recently surpassed Apple as the world’s largest public company by market cap, validating my previous “Strong buy” recommendation with a 36% stock growth.

- Nvidia’s upcoming FQ3 2025 earnings release on November 20 is crucial, with expectations of a dual beat and significant future growth insights from management.

- Strong AI semiconductor momentum is evident, highlighted by Foxconn’s aggressive manufacturing investments and TSMC’s 24.8% revenue growth in October.

- Strategic partnerships with AWS and SoftBank, leveraging Nvidia’s AI capabilities, indicate long-term growth potential, supported by bullish Wall Street analyst releases.

BING-JHEN HONG

Introduction

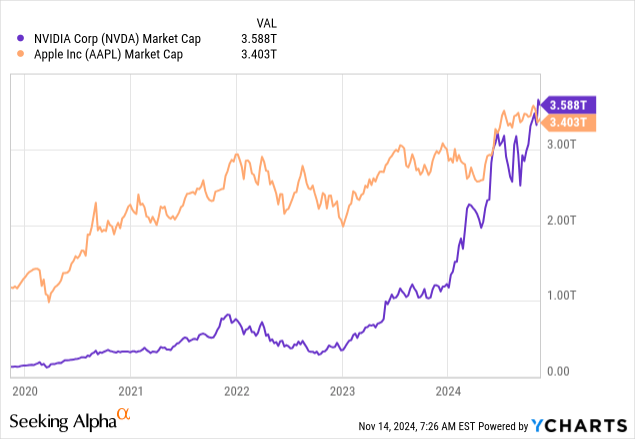

Nvidia Corporation (NASDAQ:NVDA) recently dethroned Apple (AAPL) as the world’s largest public company by market capitalization. It means that my previous “Strong buy” recommendation is doing quite well, and the stock has grown by an impressive 36% since August 2. Making a call before the approaching earnings release is always risky, but I believe that the positives outweigh the negatives, and there is a solid probability that Nvidia will deliver strong earnings with a positive outlook on November 20. My target price is $174, 19% higher compared to the current share price. As a result, I am inclined to reiterate a “Strong buy” recommendation.

Fundamental analysis

As of the end of last week, Nvidia is ahead of Apple in terms of the market cap, which makes it the world’s most valuable company. This is a big milestone for the company, especially in light of the upcoming earnings release. Nvidia is expected to release its FQ3 2025 earnings on Wednesday, November 20 post-market.

Any earnings release is a big catalyst for the stock price, so I want to update my fundamental analysis from the perspective of the upcoming earnings release. I do not worry about Nvidia’s ability to deliver dual beat because the company very rarely disappoints with its performance against consensus. What the management will say during the earnings call about future growth prospects is something much more important, in my opinion.

There are several recent developments and market dynamics suggesting that the momentum in semiconductors for AI is still strong. The trend is highlighted by Foxconn’s (OTCPK:FXCOF) significant investment in manufacturing facilities for Nvidia’s GB200 chips. Moreover, Foxconn recently released its earnings and the company’s management sees calendar 2025 as “AI year.” There is a bullish sign from Nvidia’s another key manufacturing partner, Taiwan Semiconductor Manufacturing Company (TSM). TSM’s October revenue demonstrated a 29.2% year-over-year increase, and a 24.8% growth compared to September 2024.

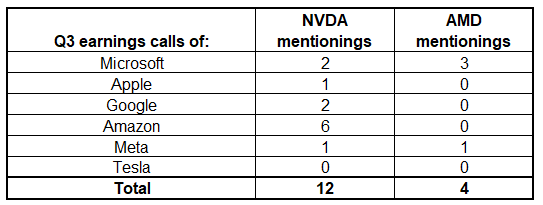

Compiled by the author

The fact that Nvidia usually releases its quarterly earnings much later than other largest tech companies provides an opportunity for valuable analysis. Advanced Micro Devices (AMD) is Nvidia’s closest rival in the AI chips market. The table above shows the frequency of mentions of NVDA or AMD in these tech giants’ latest earnings calls. As we see, Nvidia was mentioned three times more often than AMD. It is important to note that AMD’s higher “popularity” in Microsoft’s (MSFT) latest earnings call should not be misleading. Out of the three AMD mentions, two were in the context of Microsoft’s management naming Copilot’s new technological partners, and there were also Flutter Entertainment (FLUT), Intel (INTC), and Qualcomm (QCOM). The third AMD mention was together with NVDA. I think that the “highest importance” mention was about NVDA as Microsoft’s management emphasized that they are “the first cloud to bring up Nvidia’s Blackwell system with GB200-powered AI servers.”

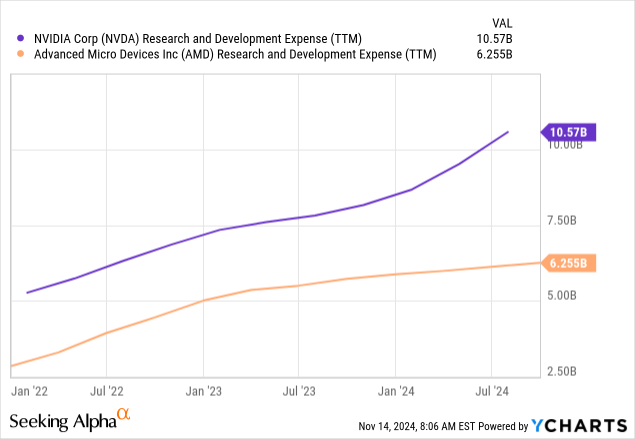

Comparing the R&D spending of NVDA and AMD is a great illustration of why the world’s most technologically advanced companies prefer NVDA over AMD. According to SA News, AWS is reportedly working on a $475 million deal to secure Nvidia processors via the cloud for IBM’s AI training. AWS is the world’s undisputed leader in cloud infrastructure, by the way.

It is not only technological giants that see great potential benefits from technological partnerships with Nvidia. For example, SoftBank’s (OTCPK:SFTBY) telecom unit will use Nvidia’s Blackwell chips to build its own supercomputer. According to the information, Nvidia and SoftBank estimate that telco operators can earn about $5 in AI inference revenue from every $1 of capex it invests in new AI-RAN infrastructure. This fact means that leveraging AI capabilities for the telecom industry is another potential long-term growth driver for NVDA.

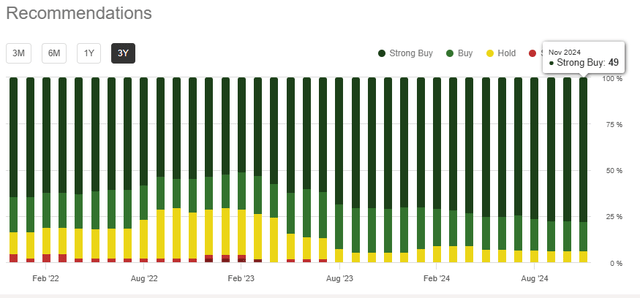

My optimism is also bolstered by recent bullish developments from Wall Street. For example, Mizuho raised its price target for NVDA from $140 to $165 on November 12. Overall, as of today, the stock has 49 “Strong buy” recommendations from Wall Street analysts, which is the highest number of extremely bullish analysts so far.

The picture looks good ahead of Nvidia’s upcoming earnings release. Nvidia’s key manufacturing partners are thriving and are very optimistic about the next calendar year due to strong AI tailwinds. From Q3 earnings call transcripts of the largest U.S. technological companies, we see that they still prefer Nvidia to AMD, its closest rival in AI chips. The massive gap between the R&D spending of these two companies gives me confidence that Nvidia will remain ahead of AMD technologically for long years. The optimism of Wall Street analysts is also strong, which is always crucial before the earnings release.

Valuation analysis

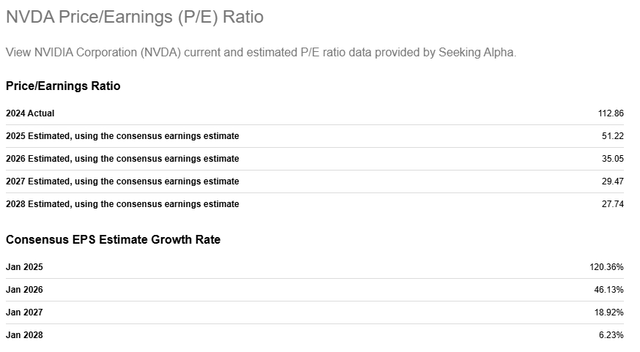

Nvidia’s 2024 actual 113 P/E ratio should not be misleading due to the expected aggressive EPS growth for the next few years. The forward P/E ratio is expected to dip below 30 by FY2027, which is a very aggressive contraction rate. Therefore, the stock looks attractively valued, based on the long-term forward P/E ratio projections.

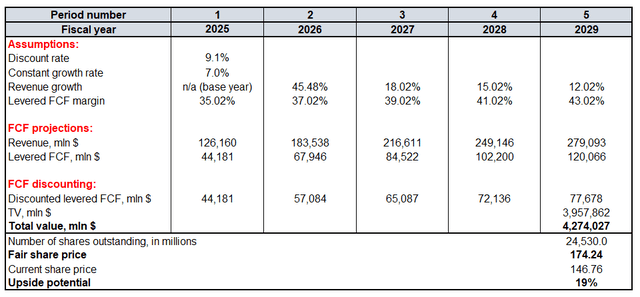

Now I must figure out my target price for NVDA, which I will do with the help of the discounted cash flow (“DCF”) model. The discount rate is a crucial assumption as it significantly affects the present value of future cash flows. I use a 9.1% WACC. Revenue forecasts for FY2025-2027 is an average of at least 30 Wall Street analysts, which I consider a very reliable source. To be conservative, I incorporate a very aggressive revenue growth deceleration by three percentage points yearly. Nvidia’s levered TTM FCF margin is 35.02%, while the last five years’ average is 25%. The company’s ability to deliver operating leverage is apparent when we compare the current FCF margin with the last five years’ average. This makes me incorporate an aggressive FCF margin expansion by two percentage points every year. This looks quite conservative to me, especially when we consider that Broadcom (AVGO) currently generates a 55.5% FCF margin.

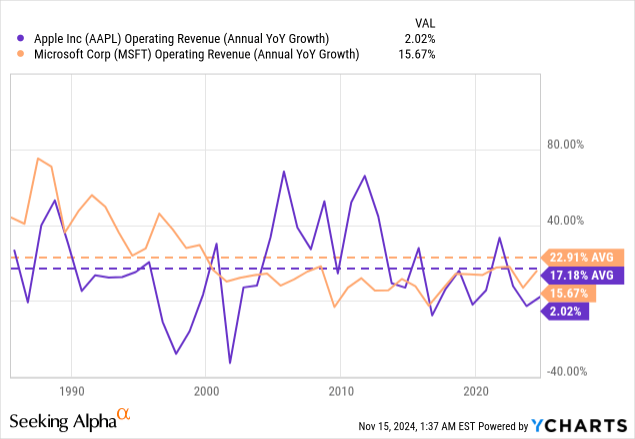

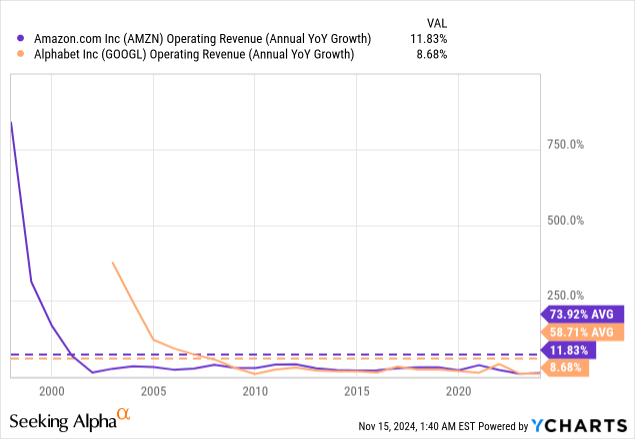

Due to the positive factors for NVDA’s long-term prospects which I share in “Fundamental analysis,” I reiterate my aggressive 7% constant growth rate assumption which I used last time for the terminal value (“TV”) calculation. Nvidia is a younger company compared to Apple or Microsoft, but it is also a dominating force in its domain. These two technological icons managed to maintain around 20% revenue CAGR over four decades, meaning that a 7% constant growth rate is something doable. Companies like Amazon and Google have been maintaining above 50% revenue CAGR over the last half-a-century, which is another evidence that a 7% constant growth rate is not an exaggeration.

Incorporating all the aforementioned assumptions into the DCF model results in a $174 fair share price, 19% higher than the last close.

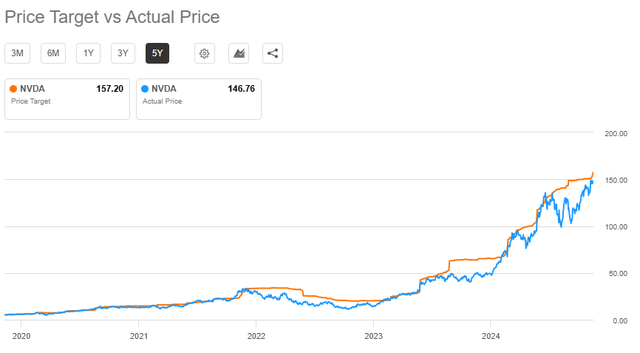

My fair share price estimation is slightly more optimistic than the consensus target price. The average price target from Wall Street analysts is around $158, indicating a 7.5% upside potential. The chart below suggests that NVDA has been consistently following the target price over the last several years.

Mitigating factors

After Donald Trump was elected as the 47th President of the United States, I see the geopolitical risk as the biggest one for Nvidia. Relationships between the U.S. and China is a crucial topic for all chipmakers due to the aggressive trade and technological war between these two countries. Developments around Taiwan will also be crucial as Nvidia outsources its manufacturing to Foxconn and TSM, as mentioned earlier. Therefore, adverse geopolitical developments can disrupt Nvidia’s supply chain.

The fact that Nvidia’s chips look much more compelling compared to AMD’s does not mean that there is no competition risk. The world’s largest tech companies have been expanding quite aggressively in chip designing. The landscape is evolving rapidly, and companies like Google (GOOG) (GOOGL), Meta Platforms (META), Amazon (AMZN), and Apple are in the race. All these companies possess large financial resources and experienced human capital, meaning that the competition is poised to intensify.

The upcoming earnings release might be a big negative catalyst if Nvidia fails to deliver positive revenue and EPS surprises. Any bearish signs from the management hinting that there might be headwinds to ramp up Blackwell production might also be absorbed by the market with panic.

Conclusion

The probability of delivering a strong quarterly report with positive outlooks is quite high, and the stock is 19% undervalued. These two factors are vital to reiterate my “Strong buy” recommendation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.