Summary:

- Nvidia Corporation’s Q3 results are eagerly awaited, with the stock at all-time highs amid AI enthusiasm, but Trump’s policies introduce uncertainties.

- Trump’s tariffs may raise Nvidia’s input costs, but the company could pass these costs to consumers due to inelastic demand.

- Trump’s economic and regulatory policies could foster AI investment, but China relations remain a significant risk for Nvidia’s revenue.

- Despite improved prospects post-election, NVDA faces competition, potential slowing AI demand, and bearish technical indicators, leading to a maintained Sell rating.

J Studios

Thesis Summary

Nvidia Corporation (NASDAQ:NVDA) is set to deliver Q3 results next week, and the stock is making all-time highs. Enthusiasm for AI has not waned, and if anything, it seems like it could accelerate.

But plenty of questions have been raised following the latest election results, as many investors are wondering how Donald Trump’s policies could impact Nvidia and the AI market.

Will tariffs make Nvidia’s products pricier? Will be sales to China become even more restricted? Or could Trump’s policies actually be bullish for AI?

In this article, I’d like to discuss these points in detail, and specifically, how this changes my views on Nvidia.

In my last article, I outlined 7 key threats to Nvidia’s business. And while many of these persist, I do believe that Trump’s presidency will be overall bullish for Nvidia.

However, I maintain my Sell rating on the stock based on the concerns I raised in my last article, which I will also go into here as we review the Q3 earnings.

What’s Trump’s Agenda?

Let’s begin by talking a bit more generally about Trump’s policies and their implications.

The good thing is, this time around, we have a blueprint of what a Trump presidency could look like. Some new variables to be included, like Elon Musk, but we will probably see some similar policies, though perhaps on a much larger scale.

We are, of course, going to stray from any social and political issues and focus solely on those policies that are relevant to markets and the economy.

Namely, we will be discussing tariffs, regulation and economic policy.

Tariffs

Let’s begin with tariffs, which is perhaps one of the most talked about issues. Trump has already talked about slapping 60% tariffs on China, and 10% on the rest of the world.

Now, this affects Nvidia directly, since it relies on numerous foreign companies throughout its supply chain. So, this means potentially higher input price for the company. Or does it?

Economic theory shows us that it is the most inelastic part of the market that bears the cost of tariffs. Are consumers of Nvidia’s chips inelastic? Given that there don’t seem to be any alternatives at this point, they are inelastic, meaning that the cost of tariffs will likely be passed to the end consumer.

Regulation

So, what about regulation? You might think this one’s clear-cut, but far from it. Trump’s office has stated that it wants to impose fewer regulations on AI technology to promote advancements in the field.

However, Elon Musk is part of Trump’s entourage now, and he is heading the Department Of Government Efficiency, or DOGE. While Elon Musk has been a big force pushing AI innovation forward, he has also recently taken a more conservative stance, even going as far as backing a California bill to regulate AI.

So, we actually have somewhat of a contradiction within Trump’s cabinet, not something that unusual. It remains to see how this will play out.

Ultimately, Musk’s Tesla (TSLA) is a big customer of Nvidia and is also directly benefiting from AI innovation.

Beyond that, we could also make an argument that lesser regulation in other industries such as energy could further aid Nvidia’s revenues, as costly energy can be a hurdle towards initiating AI projects.

Economic Policy

This leads us to our final point, which is economic policy, and by this, I am referring to Trump’s views on the economy, Treasury, and the Federal Reserve.

Trump is a big spender and a champion of the markets. We know this from his previous term. Not only did he spend more than any previous President, but he is also a fan of low-interest rates, which makes sense when one remembers this is a man whose companies have filed for bankruptcy in six different instances.

Trump doesn’t like debt, and in fact he has already proposed a cap on interest rates on Credit Cards.

How does this affect Nvidia?

Most of the large investments in Data Center build-outs are being financed through debt, so a more favorable environment, i.e., lower rates should allow this AI build out to continue, perhaps even expand.

Is Trump Bullish Or Bearish For Nvidia?

Overall, it seems like Trump’s presidency should actually be quite bullish for AI and Nvidia. His economic policy should foster more investment while lowering regulations in the sector.

While it’s unclear what the impact of the tariffs will be exactly, we can deduce that Nvidia should be able to pass the costs on to the consumer, and perhaps won’t be that affected.

To this, we could even add an increase in chip demand from crypto mining, as Trump has shown himself to be partial to crypto and even mentioned a strategic Bitcoin (BTC-USD) fund.

However, the biggest unknown remains what will happen with China and US relations, and how this will impact demand from China.

In the last quarter, 12.2% of Nvidia revenues came from China. To be fair, this has come down significantly, but it’s still a significant amount of revenue. Trump’s presidency will no doubt serve to accelerate China’s emancipation from the US.

Trump’s first term made us realize the importance of semiconductors and the necessity of localization, paving the way for China’s semiconductor industry to become self-reliant,

Source: Jinan Lujing from Semiconductor Co, a maker of security chips.

So what can we expect from Nvidia moving forward?

Q3 Outlook And 2025

Nvidia’s earnings will come out on November 20th, and as always, it’s going to be highly anticipated.

For Q3 of fiscal year 2025, Nvidia has already forecast revenue of approximately $32.5 billion, with gross profit margins expected to be around 75%.

Source: Yahoo Finance.

How does that compare to last quarter?

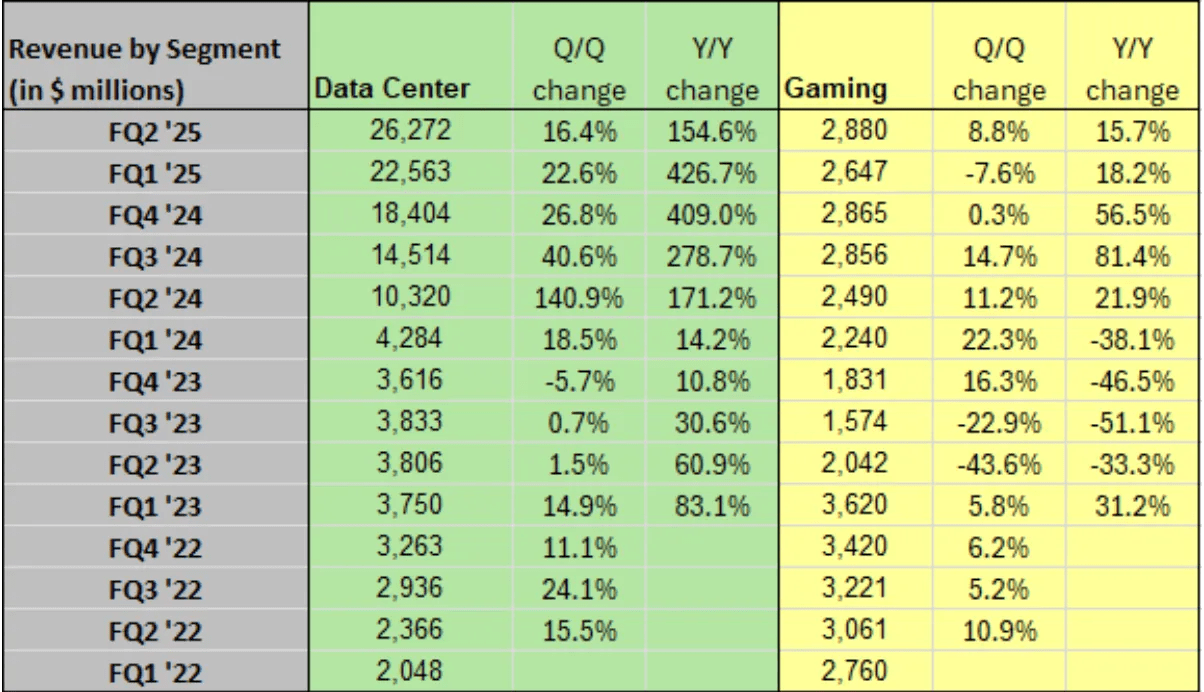

NVDA Revenue Breakdown (SA)

Nvidia brought in $29.152 billion in Q2, meaning we are looking at just shy of 11.5% QoQ growth. As I pointed out in my last article, growth is slowing down. At this point, it’s going to take a big surprise to please investors, in my opinion.

And if anything, I’d say there’s more of a chance that Nvidia will miss estimates if the precedent set by ASML (ASML) and more recently Applied Materials (AMAT) is any indication.

But the biggest focus now will be on the upcoming Blackwell chips, which just scored their first customer, Softbank.

Will Nvidia Blackwell be on schedule? What will the outlook be for 2025? These are the questions investors really want answered.

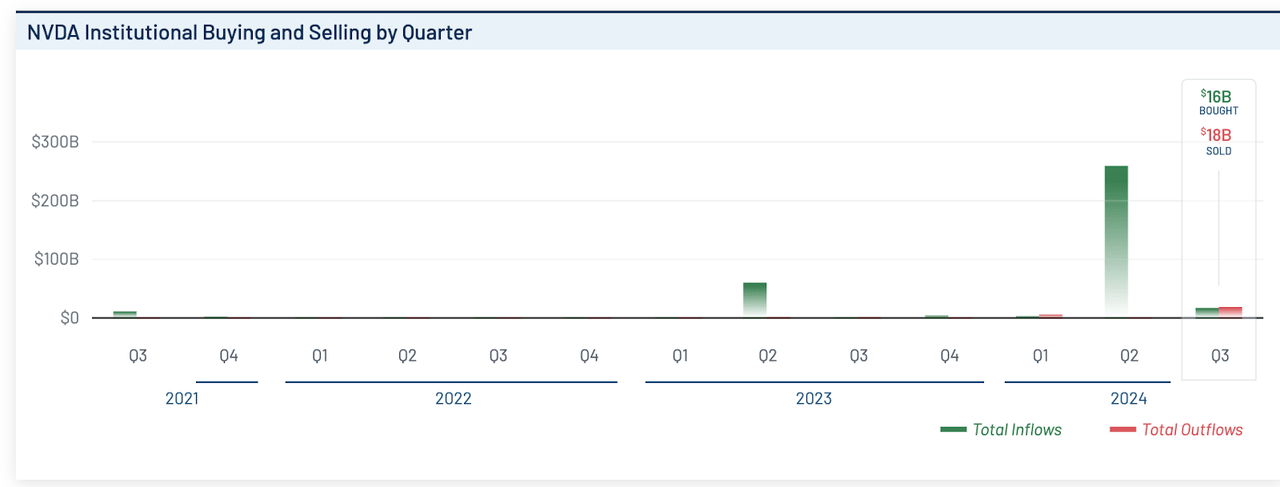

I also mentioned the fact that insiders and institutions had been selling Nvidia. Indeed, we saw net outflows in Q3 for Nvidia.

NVDA Institutional ownership (MarketBeat)

Have the institutions timed the top well? It will also be interesting to see what the latest moves are when the next 13F filings come up.

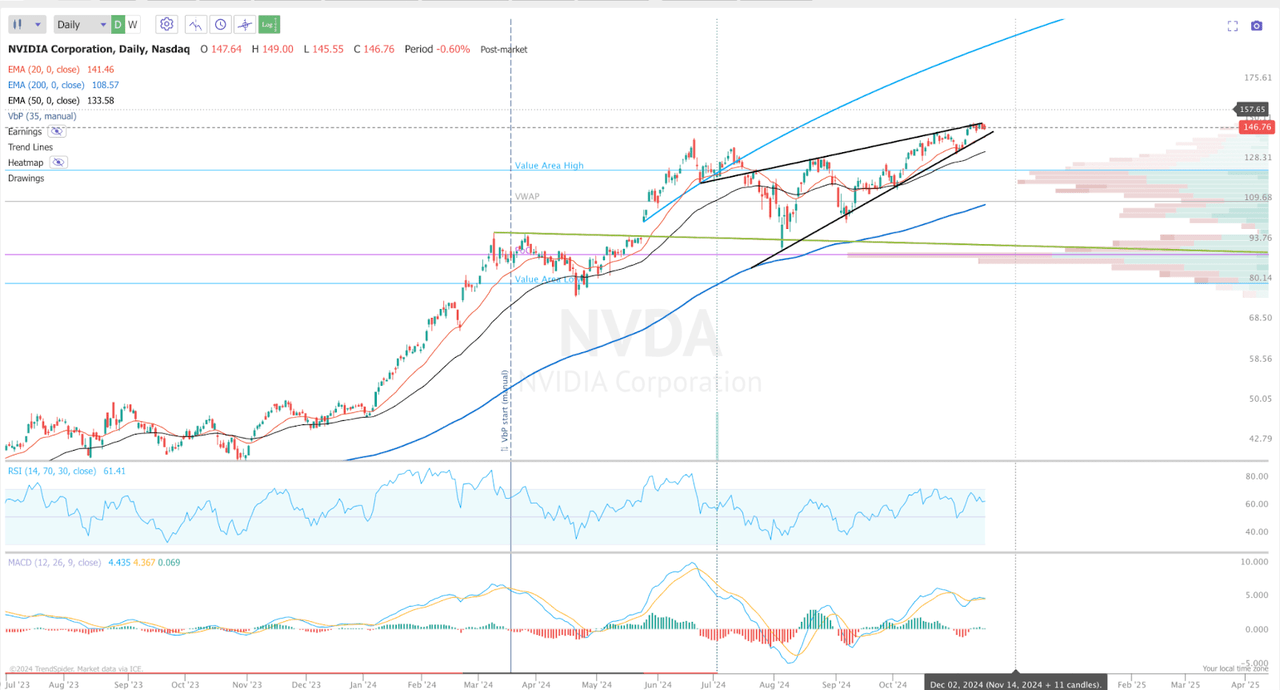

Lastly, reviewing the technical outlook, we actually have a strong setup for a sell-off, with a bearish MACD crossover approaching and an ascending wedge formation in place, which you’d expect the stock to break down from.

Final Thoughts

In conclusion, while I’d say Nvidia’s prospects have improved following the election, it still faces challenges from competition and potentially slowing AI demand, and the technical chart looks exhausted. I wouldn’t be surprised to see Nvidia go the same way as the other chipmakers ahead of earnings next week.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Macro moves markets, and this is what I do at The Pragmatic Investor

Join today and enjoy:

– Weekly Macro Newsletter

– Access to our Portfolio

– Deep dive reports on stocks.

– Regular news updates

Start your free trial right now!