Summary:

- Human nature loves confirmatory evidence, but investing is all about looking for counterarguments proactively.

- As Charles Munger advised, we should comment on a topic until we are able to argue against ourselves better than folks on the opposite side.

- I have been a long-term bull for the energy sector since 2021 and am still bullish.

- In this article, I will argue against myself and analyze the impact of a potential 2023 black swan: $40 dollar oil price.

- I will evaluate the impacts on both the sector represented by the Energy Select Sector SPDR Fund and a sector leader, Chevron.

by Martin Nancekievill

Thesis

Eric Robertsen, the lead strategist at Standard Chartered Bank, outlined a few possible black swan events for 2023 in December 2022. And one of the top possible surprises in his mind is oil price plummeting to the $40 level. The reasoning behind his thinking is quoted below (slightly edited with emphases added by me):

Robertson speculated that “With oil prices falling quickly, Russia is unable to fund its military activities beyond Q1-2023 and agrees to a ceasefire. Although peace negotiations are protracted, the end of the war causes the risk premium that had supported energy prices to disappear completely.” Other reasons Robertson suggested include a deeper-than-expected global recession and a delayed Chinese recovery on the back of an unexpected surge in Covid-19 cases.

All told, these macroscopic factors could cause a 50% collapse of oil prices the way he sees things, translating into a $40 Brent crude price (from the ~$80 level at the time he posted his predictions in Dec 2022).

The thesis of this article is to evaluate the impacts of this black swan event. In the remainder of this article, I will elaborate on my thoughts surrounding the following key points:

- Why I view Robertson’s prediction as plausible but unlikely.

- Why I see the energy sector, represented by the Energy Select Sector SPDR Fund (NYSEARCA:XLE), as a better-protected sector – relative to other sectors – even if his prediction turns out to be correct.

- And finally, why I see leading stocks like Chevron (NYSE:CVX) as even better protected than XLE in this case.

$40 oil is plausible but unlikely

A $40 Brent crude price is certainly plausible and could happen (again). Oil prices are sensitively impacted by a range of geopolitical and macroeconomic parameters and have dropped below $40 several times in the past (as recently as in 2020 during the COVID as you can see from the chart below). The oil price surge since then was triggered by a supply shortage (more on this later) and exacerbated by the Russia/Ukraine war. But even on the back of these strong catalysts, oil prices remained volatile and have pulled back by more than 35% from its June 2022 peak, mostly on the news of OPEC+ output cuts.

Therefore, a $40 oil is certainly plausible due to the factors Robertson mentioned such as the Russian/Ukraine ceasefire, a global recession, and also a delayed China recovery.

Source: Author based on Yahoo! data

However, next, I will explain why I see it as very unlikely for three key reasons. Firstly, $40 oil is a rare event historically. As seen from the chart above, the oil price has only dipped below $40 a total of three times since 2004. And each time, it only remained below the $40 level very briefly. And I believe there is a very good underlying reason behind such rarity. After all, the break-even price for many oil producers (even leading ones such as CVX and XOM as detailed in my earlier articles) is in the $35 to $40 range. So, when the oil price drops below $40, many of them would have to stop operating, which in turn triggers a supply shortage and oil price recovery.

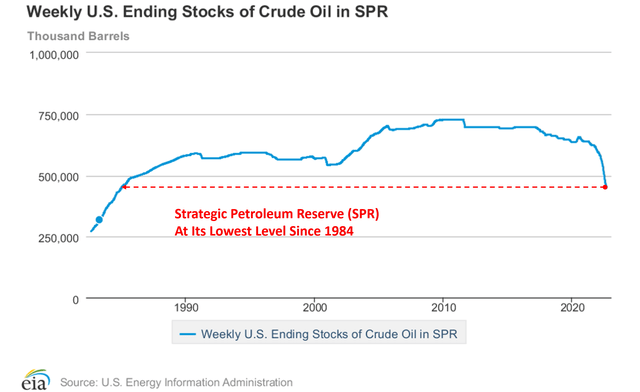

Secondly, the U.S. government will be a large buyer of oil in the near future as it will need to refill its strategic petroleum reserve (“SPR”). Since March 2022, President Biden ordered the release of SPR to combat higher fuel prices. With these releases, the SPR currently sits at 372k barrels according to the latest data from EIA.gov. To put things under a broader context, the current level is the lowest level unseen since 1984.

Then thirdly, refilling the SPR tanks (which are pretty large tanks to refill with more than 200 million barrels released since March 2022) won’t be easy under the current supply conditions.

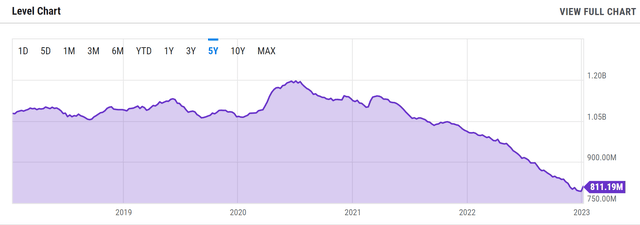

The way I see things, there are only two sources that can be used to refill the SPR tanks: the existing oil stock and the surplus between import and export. Unfortunately, both sources are not promising. The U.S. Crude Oil Stocks are currently at a 5-year low as seen from the 1st chart below. The stocks are hovering around 811M bbl as of Jan 6, 2023, compare to be peak level of around $1.2 billion bbl during 2020.

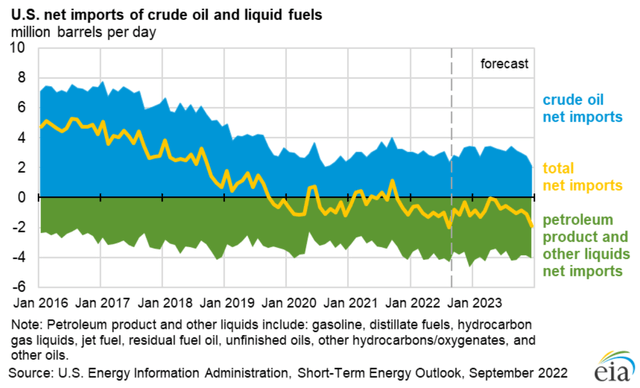

The second source simply does not exist currently or in the foreseeable future according to EIA’s projection as shown in the 2nd chart below. The net import is negative and is projected to stay negative throughout 2023 as seen.

Source: YCharts data Source: EIA.gov

Why the energy sector is the relatively better-protected sector

Next, I will move on to explain why I see the energy sector, represented by XLE, as a better-protected sector even if $40 oil unfortunately happens.

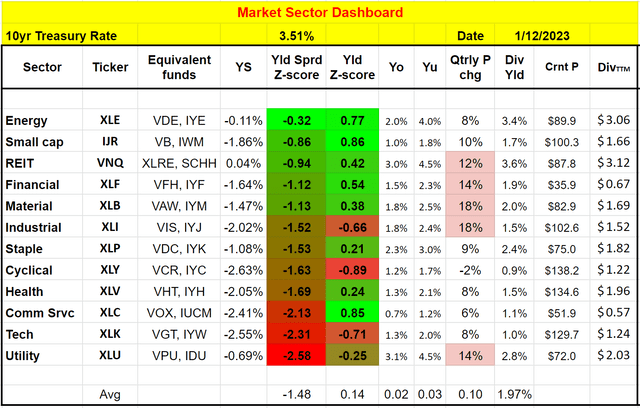

Readers familiar with our writings know about our following market sector dashboard. It’s our go-to place to get an overall picture of the market and its various sectors (BTW, the download link for the Google sheet is here: Market Sector Dashboard). Our key readings of the current market conditions are:

- The overall market is quite expensive, both in absolute terms and relative terms. In absolute terms, its dividend Z-score is about 0.14 (taken as a simple average of the Z-scores of all sectors). In relative terms, its dividend Z-score relative to the 10-year treasury rate is a very negative -1.48, signaling a large risk premium relative to treasury rates – which act as the gravity of all asset valuation.

- The energy sector, represented by XLE or other equivalent funds such as VDE (VDE) or IYE, is among the most attractive sectors. It features a positive and quite attractive dividend Z-score of 0.77. In terms of dividend spread Z-score, it is still negative (-0.31), but only mildly so and reflects a way lower risk premium relative to treasury rates

Thus, looking forward, the case of ~$40 oil price would very likely be accompanied by an overall recession in my view. And in this case, I see the energy sector offers a much wide margin of safety than the overall market of a few other sectors that currently entail way higher risk premiums. A few examples of these sectors are utilities (surprise!), tech, and cyclical, all of which feature large negative dividend Z-scores and also dividend yield Z-scores.

Source: Author based on Seeking Alpha data

Why CVX is even better protected than XLE

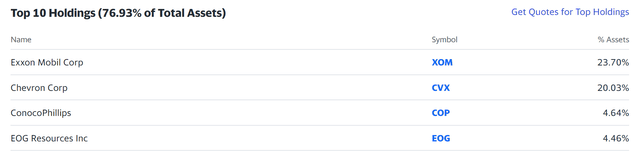

CVX is the top 2 holding in XLE, as seen below. Together with Exxon Mobil (XOM), they represent more than 43% of XLE’s total assets. I’ve written about XOM extensively before, and in this article, I will focus on CVX and explain why I see CVX as even better protected than XLE in the case of an oil price collapse. I am bullish on XOM too and most of my following analysis on CVX can be applied to XOM too.

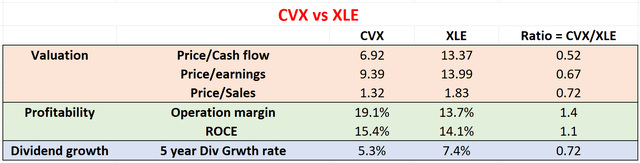

First, compared to CVX (or XOM), the average energy sector is a diworsification. The table below compares the valuation and profitability metrics of CVX and XLE as an example, and the comparison would be similar to other energy funds as well such as VDE.

The financial data were gathered either from Yahoo! or Seeking Alpha after the market close on Jan 11. Considering the recent volatility, these numbers could have been different by the time the article is posted, but I think the overall picture would remain. To wit:

- CVX boasts far superior profitability over XLE both in terms of operating margin (19.1%, about 40% higher than XLE’s 13.7%) and ROCE (15.4%, ~10% above XLE’s 14.1%).

- Yet in terms of valuation metrics, CVX is for sale at cheaper, rather than higher, valuation multiples. The valuation discounts are substantial across all metrics: ~48% in terms of P/cash flow ratio, 33% discount in terms of P/E, and 28% in terms of P/sales.

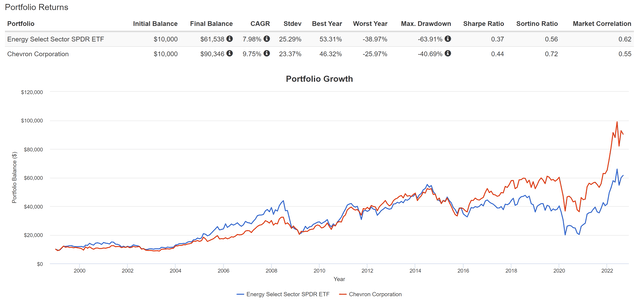

- And lastly, CVX, as a single stock, actually suffered lower volatility risks than XLE as seen in the second chart below. Since 2000, CVX suffered both milder worst-year loss (-25% vs. 38%) and also peak drawdown (-40% vs. 63%) than XLE. Should something as dramatic as oil pricing returning to $50 happen again, I won’t be surprised that CVX offers better downside protection than XLE again thanks to its scale, financial strength, and more diversified revenue streams besides oil.

Source: Author based on Yahoo! and Seeking Alpha data Source: Portfoliovisualizer.com

Risks and final thoughts

Investment in either CVX or the energy sector entails risks too. As aforementioned, oil prices (and natural gas prices too) respond sensitively to a multitude of geopolitical and macroeconomic uncertainties. And there is no lack of such uncertainties ongoing, such as the Russia/Ukraine war, OPEC+ next moves, COVID, and China’s economic growth. Due to these risks, I view Robertson’s prediction of a $40 oil price in the near future as totally plausible.

In terms of business fundamentals, our societal concern for climate and environmental sustainability are long-term risks. Both CVX and the whole energy sector will need to gradually move away from their existing carbon-heavy business model and transition into a more sustainable energy future. Their path will be long and uncertain.

However, I view Robertson’s prediction as very unlikely for three key reasons: the record low U.S. SPR, record low oil stocks, and also net negative imports.

In terms of actionable ideas, even if a $40 oil price does happen, I see the energy sector as a better-protected sector. I see little chance for a $40 oil price to happen without being accompanied by an overall recession. And in this case, I see the overall market, especially a few other sectors such as tech and cyclical, to fall much harder than the energy sector given their current risk premium. And finally, I see leading stocks like CVX and XOM as even better protected than XLE considering their superior profitability, large valuation discounts, and more diversified profit sources than XLE.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.