Summary:

- Chevron Corporation investors celebrated a massive 2022, with CVX posting a 1Y total return of nearly 50%.

- Analysts have recently cut Chevron’s estimates through H1’23, likely reflecting lower underlying energy prices and worse macro headwinds.

- But Chevron bulls have continued to defy gravity, with no capitulation moves to force out weak holders seen yet.

- China’s recovery could help mitigate underlying weaknesses. But a global recession should not be ruled out.

Mario Tama/Getty Images News

Chevron Corporation (NYSE:CVX) investors have not experienced the battering in the underlying oil and gas markets, recording a highly successful 2022. Accordingly, CVX posted a 1Y total return of nearly 50%, outperforming its 5Y and 10Y total return CAGR of 11.4% and 9.2%, respectively.

Warren Buffett’s (BRK.A, BRK.B) confidence in the leading integrated oil and gas company has also lifted buying sentiments, as Chevron Corporation investors look toward another solid run in 2023.

We highlighted in our previous update that investors shouldn’t ignore the weakness in the underlying markets. Despite that, CVX sellers have largely shrugged it off, even as it has underperformed the S&P 500 (SP500) since early November.

Chevron CEO Mike Wirth remains focused on his company’s execution, as the company lifted its CapEx outlook for 2023 and looked to capitalize on higher energy prices. While investors/analysts have discussed a more significant share buyback program, we believe the opportunity for Chevron to invest is constructive in its efforts to improve the supply/demand dynamics.

Notwithstanding, Wirth also lamented in a recent Bloomberg interview about the Biden Administration’s insinuations that the energy industry has not invested “enough,” given the high energy prices. Notably, Chevron has updated its CapEx estimates of $17B for 2023, with $4B earmarked for its Permian production. However, Bloomberg also highlighted that it remains well below its 7Y pre-COVID average of $30B.

Therefore, we assessed that Chevron remains well-placed to benefit from robust profitability margins moving ahead, even as underlying oil prices have continued their volatility.

In a recent filing, Exxon Mobil (XOM) stated that it expects a “negative impact” from lower energy prices in its upcoming Q4 earnings release. However, it has also been mitigated by derivative gains. Also, Chevron recorded derivative gains in Q3’22, even though it still recorded an accumulated derivative loss of nearly $1.12B for the first nine months of 2022.

Therefore, we believe Chevron is also not immune to the volatility in the underlying energy markets, suggesting investors need to be cautious.

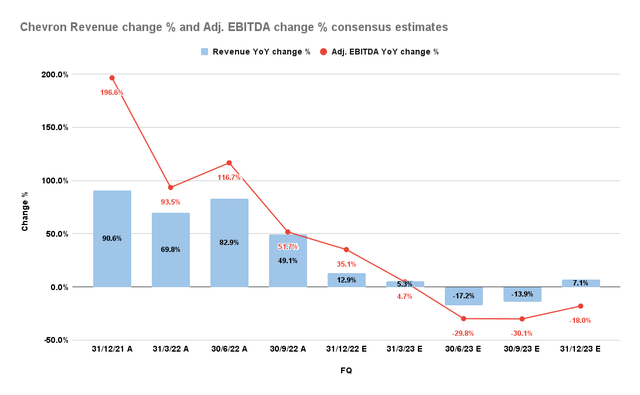

Chevron Revenue and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Analysts have turned more pessimistic in Chevron’s topline and profitability growth through H1’23, in line with the industry’s lower upward net earnings revisions. Accordingly, oil and gas industry analysts have slowed down their upward revisions through December. Despite that, the energy sector is still expected to perform very well in 2023.

Chevron’s growth momentum is projected to recover in H2’23, likely suggesting that the fallout in the energy market is not expected to persist. China’s recovery from its COVID flare-ups could be a critical underpinning to that thesis as the government pivots back to rescue its flailing economy and lift its recovery in 2023.

However, the threat of a global recession still needs to be considered, even though the U.S. economy might potentially dodge one after last Friday’s (January 6) more positive employment report.

Despite that, Europe’s core inflation remains stubbornly high, indicating that the recovery could be uneven, with Asia’s demand likely weakening. Also, there are conflicting commentaries on whether China’s energy demand could be lifted significantly while its industrial activity remains weak. Notably, Japan has overtaken China as the world’s largest LNG importer in 2022. Notwithstanding, Bloomberg also reported that China had increased its crude buying, “snapping up cargoes of crude that would normally head to Europe.”

Hence, we believe it’s challenging for investors to assess with a high degree of certainty for now on the mitigating impact of China’s energy demand outlook until there’s more certainty on the resumption of its industrial activity.

As such, we believe macroeconomic factors could continue to dominate the buying sentiments on CVX in the near- and medium-term as investors position their exposure after a record run-up from its COVID lows.

CVX last traded at an NTM EBITDA of 6.1x, in line with its 10Y average. It’s also well above its lows in July (4.5x), possibly explaining why the market did not re-rate it. The potential for growth normalization has likely kept market operators cautious over its prospects in 2023/24, coupled with worsening macro headwinds.

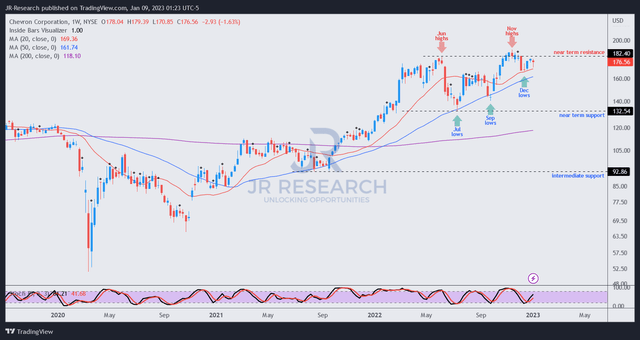

CVX price chart (weekly) (TradingView)

Despite that, CVX remains well-perched against its recent November highs, suggesting that sellers have yet to force a capitulation on weak holders.

Moreover, CVX remains priced at a premium against its peers’ median of 4.3x NTM EBITDA (according to S&P Cap IQ data). Hence, we assessed that the reward/risk remains skewed to the downside, even as China’s recovery could improve buying sentiments.

But, we don’t think CVX will crash to lows in early 2021, with China’s structural demand/supply dynamics remaining robust. But, a lower entry level could markedly improve investors’ potential market outperformance. Also, we encourage Chevron Corporation investors sitting on massive gains to continue cutting exposure. New Chevron investors should continue waiting on the sidelines.

Rating: Sell (Reiterated).

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!