Summary:

- Alibaba Group Holding Limited has delivered a robust fiscal Q2 2025 earnings double beat, underscoring restored strength across its core commerce and cloud businesses.

- The combination of operating efficiency improvements, stabilizing take rates, and high-margin revenue growth are also alleviating pressure from ongoing R&D investments in recent quarters.

- Looking ahead, Alibaba benefits from three impending catalysts that would drive a sustained uplift to its growth trajectory and risk premium reduction, and underpin value accretion from current levels.

maybefalse

It has been a whirlwind for Alibaba Group Holding Limited (NYSE:BABA) stock and its Chinese peers recently. Beijing’s streak of stimulus measures introduced since October and the central government’s vow to reach the “about 5%” growth target for 2024 have been key boosters for the broader Chinese market. It has also done wonders in restoring investors’ confidence in companies like Alibaba, which have been consistently demonstrating idiosyncratic fundamental improvements. Yet, the recent shift to measured fiscal updates from Beijing has also swiftly dented said investors’ confidence. The state of uncertainty over the extent of Beijing’s latest streak of policy support is bringing back fears of another “false dawn” in restoring Chinese valuations.

The uncertain macroeconomic backdrop casts a brighter light on Alibaba’s earnings outperformance for F2Q25 and the robust outlook provided, in our opinion. The company’s latest fundamental results continue to reflect its consistent positive progress in restoring idiosyncratic strength, which is a major plus for mitigating exposure to lingering macroeconomic risks. This is expected to better position Alibaba for incremental upside if Beijing does extend robust economic support for Chinese markets.

In addition, we see three impending catalysts that would underpin a sustained upward valuation re-rate to the Alibaba stock. They are also adequately diversified across Alibaba’s core operating segments, which would reinforce prospects for a favorable outcome. With Alibaba’s latest earnings outperformance laying a supportive foundation, we believe the anticipated catalyst-driven value accretion remains underappreciated at current levels.

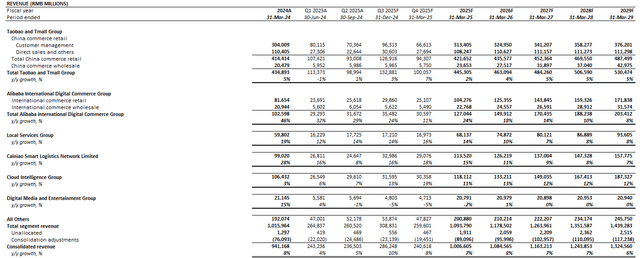

Taobao and Tmall Group Acceleration

Alibaba’s Taobao and Tmall Group (“TTG”) grew revenue by 1% y/y during F2Q, effectively reversing declines observed in the preceding quarter driven by continued strength in GMV expansion and stabilizing take rates. The results are further complemented by management’s expectations for a strong growth outlook underpinned by robust 11.11 momentum, as well as observations of broad-based China retail sales improvements in October.

Specifically, the company closed its 16th annual 11.11 Singles’ Day shopping festival with a bang, underpinned by multiple records across key performance metrics for the TTG segment. Almost 600 brands across the Taobao and Tmall platforms delivered GMV greater than RMB 100 million during the promotional period, marking an increase of 46% y/y. And 45 brands exceeded the RMB 1 billion GMV threshold, which corroborates robust share gains during this year’s 11.11 shopping festival. The company also saw its premium 88VIP members, which hold the highest spending power on the platform, increase their purchasing activity by more than 50% y/y this time around.

These results continue to align with management’s reiterated focus on optimizing GMV through a “user first” strategy before ramping up efforts toward monetization and improving take rates. But both fronts have been delivering positive progress, nonetheless. This is supported by the narrowing growth gap between GMV and customer management revenue. Specifically, management highlighted GMV growth during F2Q in the high single-digit percentage range, while CMR expanded by 2% y/y, which suggests a one percentage point reduction in the growth gap compared to F1Q.

In addition to signs of additive growth from robust 11.11 momentum, the TTG segment’s anticipated acceleration in the current quarter is also corroborated by the broad-based strength observed in the Chinese consumer. Specifically, China retail sales have kicked off the December quarter to a strong start. October retail sales in China grew 4.8% y/y, which outperformed the average estimate of 3.8% by wide margins and marked the country’s strongest spending month since February. More importantly for Alibaba, China’s online retail sales led to growth at 16% y/y, reaching RMB 1 trillion in October.

This robust base excludes broader momentum observed in China’s consumption levels through the 11.11 Singles’ Day shopping festival. The event has alone generated an estimated RMB 1.44 trillion in sales through November, representing a growth of 27% y/y. This is further corroborative of records set by Alibaba this time around, underpinning a strong foundation for further acceleration ahead as TTG’s newly implemented “user first” strategy continues to deliver.

Alibaba Cloud Revival

Alibaba Cloud was a bright spot for the company’s latest earnings outperformance. The unit grew revenue by 7% y/y to RMB 29.6 billion during F2Q, which was consistent with management’s expectations for restored acceleration during the fiscal second half. This was primarily driven by sustained double-digit percentage growth in public cloud revenues, complemented by the fifth consecutive quarter of triple-digit percentage growth in AI-related product sales.

Admittedly, the cloud unit’s maintained single-digit percentage pace of growth continues to highlight the toll of its transition away from low-margin project-based revenues, which started last year. However, the gradual pace of improvement continues to reinforce accretion stemming from management’s growing focus on acquiring higher-quality revenues. This is consistent with significant progress delivered from the newly implemented “integrated cloud and AI development strategy,” which underpins the consistently elevated growth levels observed in public cloud and AI-related product sales over recent quarters.

We expect this pace of improving growth to exhibit more evident acceleration through F2H25, which is consistent with management’s expectations for restored double-digit percentage cloud growth later in FY2025. This is supported by tangible evidence, which we believe remains underappreciated. Specifically, Alibaba has recently completed a record cloud deal with Xiaohongshu – China’s Instagram equivalent – after working together for about a year. The company has just finished migrating 11 years’ worth of data from Xiaohongshu onto its cloud earlier this month. The project involved migrating 500 petabytes of data, marking one of, if not “the,” the largest project of its kind, ever, according to both companies.

We believe the partnership with Xiaohongshu is symbolic of Alibaba Cloud’s inflection point, especially amidst the ongoing AI transformation. Recall that Alibaba Cloud’s latest downtrend cycle was unleashed by the loss of a major global customer – speculated to be ByteDance – in 2021, and exacerbated by a simultaneous Chinese big tech crackdown. Yet, this time around, Alibaba Cloud has gained a record project, which provides validity to its leading prospects in capturing opportunities stemming from the multi-year AI transformation cycle.

Prospects of an Apple Partnership

Alibaba Cloud’s recent partnership with Xiaohongshu effectively validates its technological expertise critical in the AI-first era. It is also a structural step in the right direction for Alibaba’s public cloud computing capabilities, which would further complement its proprietary large language model (“LLM”) developments through Qwen as well.

Specifically, Alibaba’s latest Qwen 2.5 LLM series has quickly become “one of the leading models in the global open-source ecosystem”. This continues to corroborate management’s previous commentary that Alibaba’s proprietary LLMs have become one of the most familiar among both local Chinese and global developers. Robust developers’ adoption is further complemented by Qwen’s expansive exposure to retail consumers through integration with critical day-to-day apps like Alibaba’s very own Taobao and Tmall.

We believe this marks a key competitive advantage for Alibaba in the potential race to become Apple Inc.’s (AAPL) AI partner in China. As discussed in our previous analysis of the stock, we believe Alibaba is capable of hitting two birds with one stone for Apple. Its proprietary Qwen model effectively addresses the needs of the iPhone maker’s two most critical end-markets – namely, developers and consumers – making Alibaba a strong contender for being the deployment partner of Apple Intelligence in China.

Based on Apple’s latest update on the roll-out of Apple Intelligence, the next-generation software underpinning its AI upgrade supercycle has already begun deployment in the U.S., with more features to come in December. It is also expected that Apple Intelligence will enter the EU in April, as the company continues to work diligently to ensure compliance with the local Digital Markets Act regulations.

Although management has continued to stay mum on when the growth-driving software will arrive in China – one of its largest and highest-growth markets – we suspect a decision will be made by the end of 2025. This would coincide with the planned iPhone 17 launch, and corroborate Apple Inc. (AAPL) CEO Tim Cook’s recent commitment to deepening investments in innovation in China during its recent visit to the region.

Admittedly, it remains unknown on whether Alibaba would benefit from Apple’s eventual roll-out of AI features in China. But any global partnership of this extent would further validate Alibaba’s technology expertise – particularly in AI – and reinforce confidence that the worst of Beijing’s regulatory chokehold is over. There appears to be a policy shift towards support for local technology development and foreign investments. We believe this would significantly reduce the China-specific risk premium that has been weighing on Alibaba’s valuation multiple recently, and unlock a sustained upward re-rate for the stock.

Fundamental Considerations

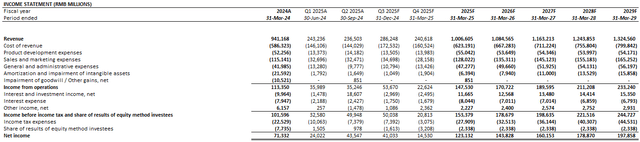

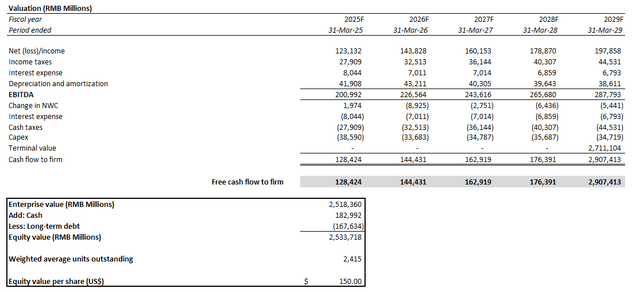

Adjusting our previous forecast for Alibaba’s F2Q25 results and anticipated forward outlook, we expect the company to grow revenue by 7% y/y to RMB 1 trillion (~$139.2 billion) in the current fiscal year. Alibaba Cloud’s acceleration will likely become tangibly evident in the coming quarters, as public cloud instance deployments complemented by AI-related demand continues to ramp.

Meanwhile, previously observed margin pressures attributable to investments in AI-related products and bettering the local and global e-commerce user experience are expected to see greater relief in the coming quarters. This is already corroborated by stabilizing take rates in the core TTG segment during F2Q, as merchant and consumer monetization efforts ramp up alongside sustained efforts in optimizing GMV expansion over recent quarters. The increasing cloud revenue mix shift towards more profitable public cloud and AI-related product revenues are likely to drive further margin accretion, underpinning a recovering balance between Alibaba’s latest investment cycle and related returns.

Valuation Considerations

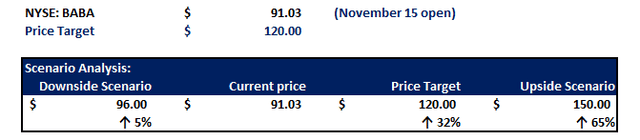

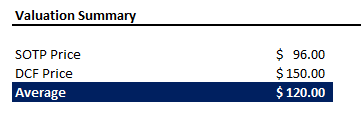

On the valuation front, we are setting a raised base case price target of $120 apiece. This would represent an upside potential of 32% from the stock’s open price of $91.03 on November 15.

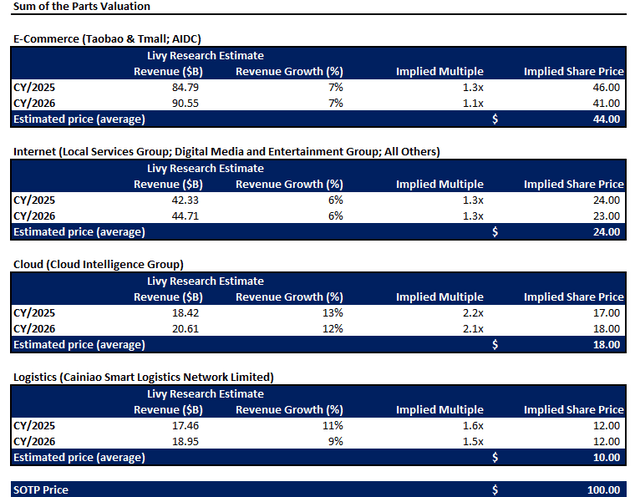

The base case price is determined through a weighted average of results from the sum-of-the-parts and discounted cash flow valuation analyses. We believe this valuation approach would appropriately reflect the estimated intrinsic value of Alibaba based on its FCF prospects, while also including consideration for the multiple discounts attributable to China-specific risks embedded in the valuation of its comparable local peers.

Author

The SOTP analysis considers peer multiples on a relative basis to growth across the Chinese Internet, e-commerce, cloud, and logistics sectors. The valuation method offers an appropriate reflection of the Alibaba stock’s prospects on a relative basis to its local peers, in our opinion, given their similar risk profiles.

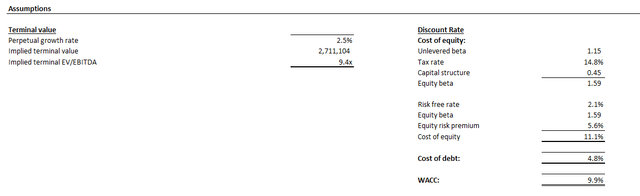

The DCF approach considers cash flow projections taken with Alibaba’s fundamental prospects discussed in the earlier section. A WACC of 9.9% in line with Alibaba’s risk profile and capital structure is considered. The analysis also assumes an implied perpetual growth rate of 2.5% on 2029E EBITDA in determining Alibaba’s anticipated terminal value.

Conclusion

Admittedly, Alibaba stock continues to face lingering China-specific risks, spanning uncertainties in local macroeconomic conditions and impending tariff shocks under the upcoming Trump Administration. There are also signs of intensifying global competition stemming from local and international rivals like JD.com, Inc. (JD) and Amazon.com, Inc.’s (AMZN) newest “Haul” bargain platform.

But Alibaba continues to boast idiosyncratic strength that is becoming more evident with consistent positive fundamental progress delivered under new management over recent quarters. This accordingly reinforces Alibaba Cloud’s trajectory to restore double-digit percentage growth by the end of the year, complemented by a robust December-quarter growth outlook for the core e-commerce arms. The company’s emergence as a competitive participant in local and global AI developments, underpinned by a growing profile of reputable partnerships, will also be key to diminishing the China-specific risk premium that has been weighing on the stock lately. Taken together, we expect the materialization of Alibaba’s broad-based profile of impending catalysts to underpin further value accretion for the stock, which remains underappreciated at current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.