Summary:

- The Federal Reserve’s 25 basis point rate cut is set to benefit AGNC Investment, enhancing profitability and potentially increasing its valuation multiplier due to lower interest costs.

- AGNC Investment’s interest income grew 28% Y/Y in Q3, while interest expenses rose 27%. Lower financing costs imply improving spread potential.

- AGNC’s book value, previously hit by rising rates, could normalize and reprice upwards, making it a promising investment as the Fed cuts rates.

- Risks include potential Fed reluctance to lower rates due to inflation or stronger-than-expected economic growth, but AGNC’s 15% yield and low price-to-book ratio remain attractive.

ryasick

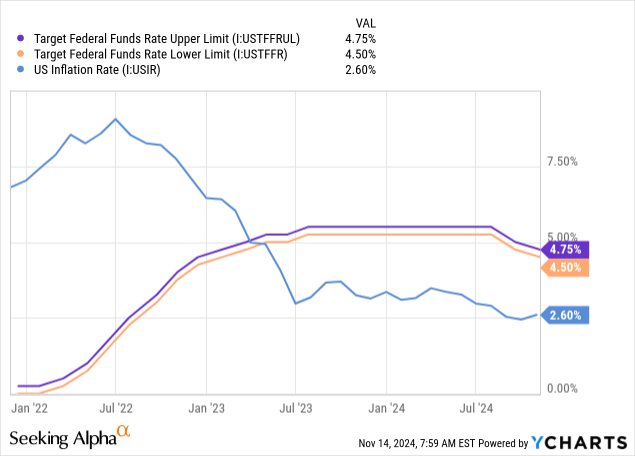

The Federal Reserve lowered the federal fund rate, a key overnight borrowing rate, by 25 basis points last week, which brings total interest rate cuts this cycle to 75 basis points. A beneficiary of these federal fund rate cuts, and the ones that have yet to be announced, is set to be AGNC Investment (NASDAQ:AGNC), a top tier mortgage REIT that is chiefly investing into agency mortgage-backed securities. In my opinion, AGNC is set to see an improving profitability picture, related to lower federal fund rates and interest costs, in the quarters ahead and I consider AGNC to be a top investment for investors that want to generate high, recurring dividend income!

Previous rating

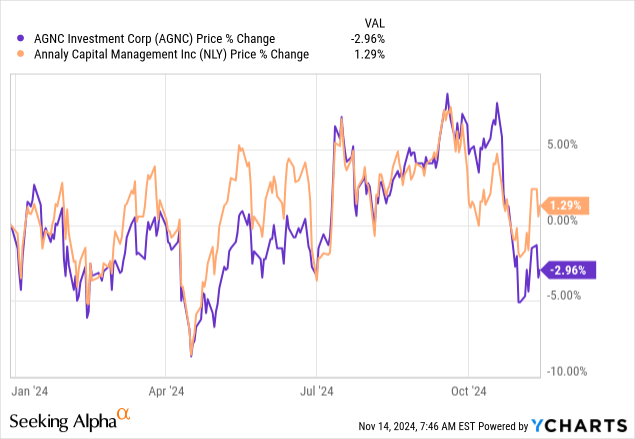

I rated shares of AGNC Investment a hold at the end of July — AGNC Investment’s 14.3% Yield Is A Hold — because lower federal fund rates indicated a more favorable financing environment for mortgage REITs. Further, AGNC’s book value has stabilized and shares are now trading at a premium to book value. With interest rate uncertainty out of the way, I believe that AGNC could be a top income investment for investors in 2025 and beyond.

Solid growth in interest income, spread improvements await

AGNC is a leading mortgage REIT with considerable investments in rate-sensitive mortgage-backed securities. These mortgage securities, like other fixed income investment, pay recurring income, but also benefit from lower interest rates. In other words, mortgage-backed securities are attractive investments for mortgage REITs just at a time when the Federal Reserve is lowering the federal fund rate… which is exactly what we have been seeing since September. At the end of Q3’24, AGNC owned $67.9B in mortgage-backed securities, showing 14% quarter-over-quarter growth.

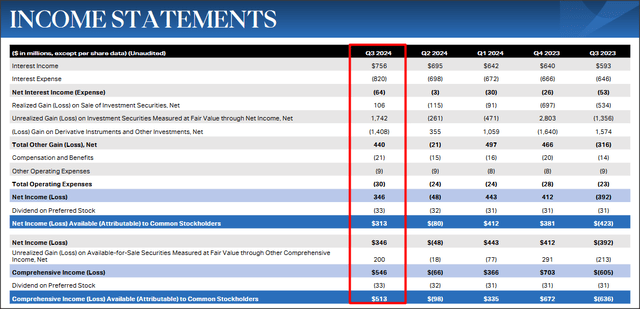

AGNC reported $756M in interest income in the third fiscal quarter, showing 28% year-over-year growth. At the same time, the mortgage REIT’s interest expenses, by far the biggest expense category for AGNC, increased 27% year-over-year to $820M. Additional federal fund rate cuts help AGNC lower its interest expenses and improve AGNC’s spread profile.

Obviously, the Federal Reserve is set to lower federal fund rates even more, even after inflation for the month of October ticked up to 2.6%… which was the first increase in seven months. The Federal Reserve is widely expected to lower federal fund rates in December by 25 basis points, and more rate cuts await investors in 2025.

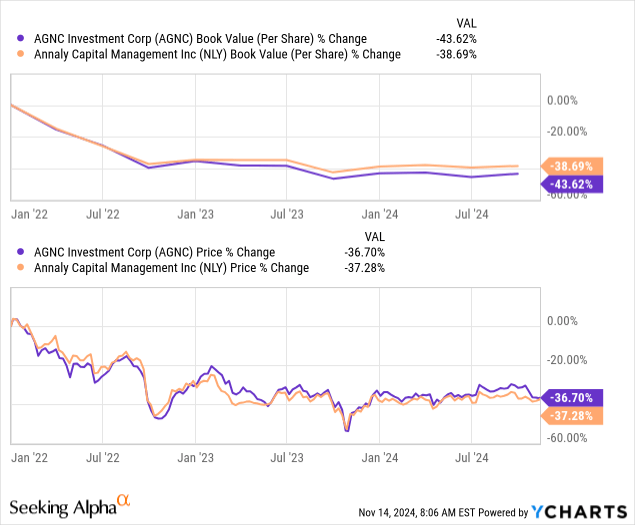

Book value stabilization and valuation

AGNC, as well as Annaly Capital Management (NLY), have suffered steep declines in their portfolio and book values in the last three years, which has been a result of surging interest rates. The Fed’s shift (which started in 2022) has caused major damage to AGNC’s book value. The mortgage REIT’s book value dropped 44% in the last three years, while Annaly’s book value got crushed by 39%. The drop-off in book values has almost perfectly been reflected in both REIT’s share price declines over this time period.

The reason for the decline in book value is that both AGNC and Annaly hold large portfolios of mortgage-backed securities on their balance sheets, which tend to decrease in value in a rising-rate environment. However, the opposite effect is also true: if federal fund rates decline, mortgage-backed securities portfolio reprice to the upside, meaning AGNC could be a promising investment now that the Federal Reserve is loosening its monetary policy.

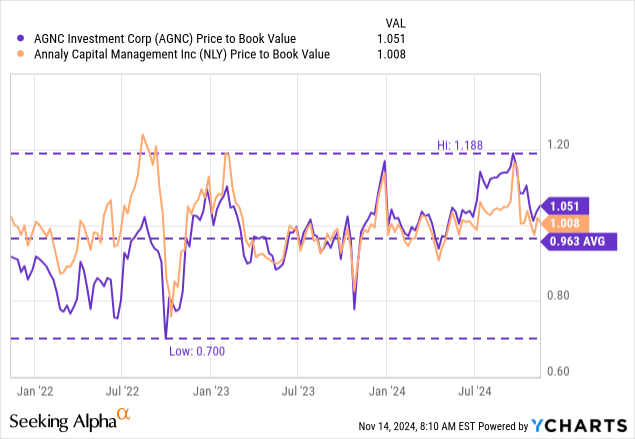

Shares of AGNC are currently priced at a 5% premium to book value, compared to a 0.96X 3-year average price-to-book ratio. Compared to Annaly, shares of AGNC slightly more expensive, which does make much sense to me considering that both mortgage REITs own large portfolios consisting of the same mortgage-backed securities. However, as I said in my recent work on Annaly — A 13% Yield You Don’t Want To Miss — the change in the federal fund trajectory is potentially a game-changer for mortgage REITs, including AGNC.

Therefore, I am up-grading shares of AGNC to buy, and I could potentially see a revaluation to a higher P/B range if the Federal Reserve lowers the federal fund rate in the coming quarters. As was the case with Annaly, I see a valuation range of 1.10-1.15X book value as realistic because mortgage REITs with large mortgage-backed securities portfolios tend to benefit from lower interest costs and improving profitability/spread profiles. With a $9.50 per-share GAAP book value as of the end of the September quarter, this multiplier range translates into a fair value range of $10.45 to $10.93 per-share.

Risks with AGNC Investment

The biggest risks for AGNC, as I see it, relates to a potential reluctance of the Fed to lower federal fund rates. This could be the case in two scenarios: 1) Inflation resurges, or 2) The U.S. economy goes into a new up-leg, boosted by a post-election surge in business and consumer confidence. Higher for longer interest rates would stand in the way of a re-pricing of AGNC Investment’s portfolio, which is packed with rate-sensitive mortgage-backed securities portfolio, and delay any positive effect on the REIT’s interest costs. What would change my mind about AGNC is if the mortgage REIT were to see a slump in its book value, or if we were to see a postponement of rate cuts on the part of the Federal Reserve.

Final thoughts

AGNC is a top income investment for me, especially as we head into 2025. The mortgage REIT is heavily invested in rate-sensitive mortgage-backed securities which are set for a revaluation to the upside if the Federal Reserve keeps cutting the federal fund rate in 2025, which is what I expect. Most importantly, I don’t really see a realistic scenario in which AGNC is going to bleed as much book value as it did in the last three years, which translates to an appealing risk profile for investors looking for recurring income. With a revaluation catalyst on the horizon as well, I believe the risk profile for AGNC is favorable, and I am up-grading shares to buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC, NLY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.