Summary:

- Applied Materials, Inc.’s stock is in a free-fall due to underwhelming earnings and guidance, breaking critical support levels and showing bearish technical indicators.

- Q4 earnings were slightly above expectations, but margins and revenue growth remain unimpressive, with no clear path to improvement.

- The company’s focus on share buybacks is a positive, but demand and margin concerns persist.

- Despite a lower valuation, AMAT’s lack of growth and margin expansion justifies a continued sell rating, with no compelling reason to own the stock.

Monty Rakusen

Applied Materials, Inc. (NASDAQ:AMAT) is in a free-fall after disappointing investors again with its latest quarterly earnings. While the earnings themselves and first quarter guidance were fine, they simply weren’t good enough again, and shares are getting pummeled.

The last time I covered the stock was after another earnings report that was just okay. I noted the stock was a sell at that time, when shares were going for $207 per share. The stock is down almost 20% since then, and I’m honestly not seeing a great deal to change my mind after Q4 results. Let’s dig in.

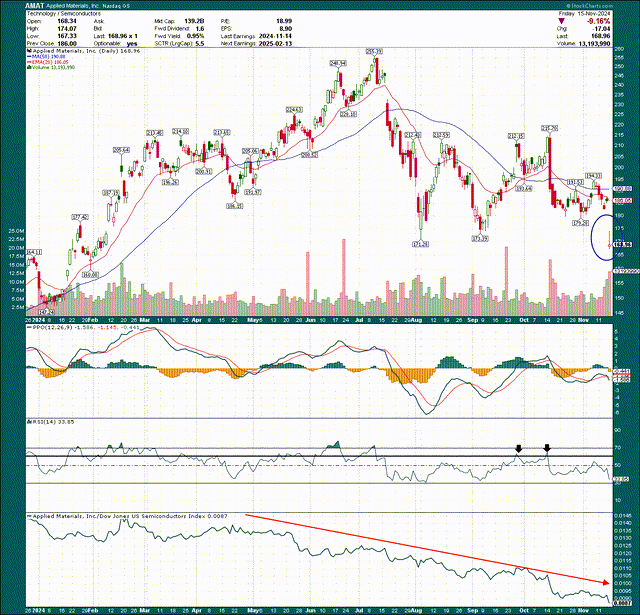

A massive breakdown

Last time I covered Applied Materials, there was notable resistance in the way for bulls. On Friday, the stock definitively broke critical support, traded up during the day, and then was sold heavily into the close. That’s not a good look for the bulls, as the bit of buying we saw was quickly overwhelmed with sellers eager to unload the stock.

That candle is nasty, and in particular, since it followed a massive gap down. The first test for the bulls now is to reclaim $172 or better. I suspect it will be some time before that occurs.

The PPO is under the centerline, indicating more bearish momentum than bullish. The RSI has failed to cross 60 and sustain it since July, with both attempts being swiftly rebutted. And relative strength really couldn’t be much worse. Applied Materials shares have been awful this year, while the semis as a whole have helped drive this relentless bull market.

On the technical front, I see absolutely no reason I’d want to go anywhere near this stock.

“Okay” isn’t good enough

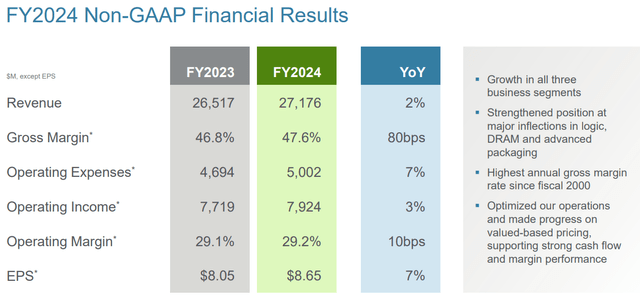

Earnings for Q4 came to $2.32 in adjusted EPS, which was 13 cents ahead of expectations. Revenue was up just under 5% year-over-year to $7.05 billion, and beat estimates by $80 million, or about 1% ahead of estimates.

Gross margin was 47.5% of revenue, and operating income came to 29.3%. All of these numbers were about what was expected, and to me, continues to show why I was not particularly bullish on the stock before. Namely, margins continue to make absolutely no progress, revenue growth is ho-hum when there are so many semiconductor stocks with better growth, and there doesn’t seem to be a path forward. We’ll dig deeper in just a bit.

The company continues to spend most of its FCF on shareholder returns, including $1.44 billion in share repurchases during the quarter. That tailwind to EPS (via a lower share count) is useful, particularly when the actual business isn’t growing at particularly spectacular rates. As the stock gets cheaper – as it did on Friday – buybacks make even more sense, so I’m a fan.

Looking ahead, guidance is for $2.11 to $2.47 in adjusted EPS for the first quarter, with the midpoint of $2.29 slightly above consensus of $2.28. Revenue is supposed to be $6.75 billion to $7.55 billion, with the midpoint of $7.15 billion, somewhat light of $7.25 billion consensus. That is driving demand concerns for AMAT, and with demand concerns come margin concerns. The natural outcome of that uncertainty is a lower share price, so nobody should be surprised shares broke down following the earnings report.

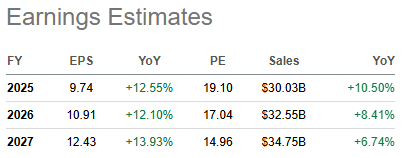

In my August article, estimates for fiscal 2025 were for $9.79 in EPS and $30.36 billion in revenue. Today, EPS is a nickel lower on revenue that is expected to be about $300 million lower.

Seeking Alpha

With the new information that was received during the fiscal Q4 earnings release, I suspect we’ll see further revisions in the coming days and weeks. Point being, there was already a fair amount of pessimism around the company’s 2025 prospects, and it disappointed anyway.

My concerns

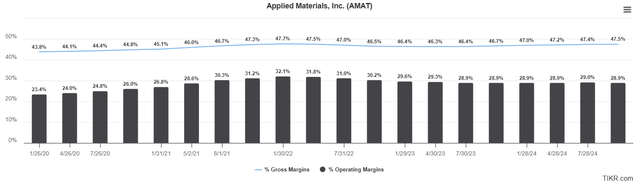

I mentioned margins above, and this is something I’ve said in prior work on AMAT; I’m simply not seeing any evidence this company can boost its profitability over time.

Gross margins were up 80bps YoY in 2024 for the full year, but operating margins only rose 10bps. In other words, the company burned through 70bps of potential margin improvement by spending too much elsewhere. With constantly rising revenue and strong industry tailwinds, I just don’t think this is good enough for a premium valuation — or even peer valuation — for the stock.

We have trailing-twelve-month gross and operating margins above, and we can see this has been the case for a long time. This isn’t a new problem, but the company still cannot find a way to boost margins.

Display continues to be a drag on the company’s results, with both revenue and operating margins sharply lower YoY in Q4. While the segment is small, it’s definitely not helping with 2.4% operating margins.

Semiconductor Systems is gradually seeing operating margin expansion, but progress has been slow, along with tepid top-line growth. Point being, I don’t see anything to get excited about here from a growth perspective, and I suspect the next few quarters will look just like the chart above. Maybe I’ll be proven wrong, but there’s simply no evidence here.

With that in mind, the stock should be trading discounted to its peers, so we must be careful about calling the stock “cheap” just because its absolute valuation is lower than some peers; that’s where it should be.

Cheap, but is it cheap enough?

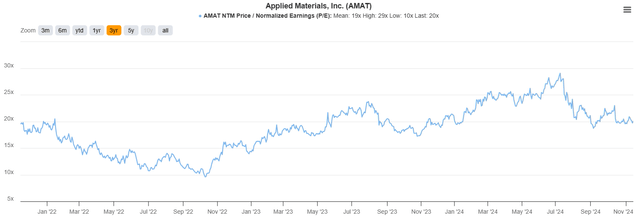

The one thing bag-holding bulls are likely clinging to after Q4 results is the valuation, but I’m not really seeing the bull case there, either.

Shares are trading at ~20X forward earnings, and while that is cheaper than it’s been for much of this year, it’s still above the three-year mean of 19X. AMAT isn’t growing revenue particularly quickly, its margins haven’t moved for years, and there appears to be no end in sight. I’d suggest that the downside risk of the P/E ratio is higher than the upside risk, even from 20X earnings. There are only so many times a company can disappoint Wall Street, and it appears to me from the reaction of the Q1 guide that AMAT has gone through its allotment.

While AMAT isn’t a screaming sell like it was in August, I simply see no reason to own this stock. At best, I think it will chop around for the foreseeable future, and at worst, just continue to sell off. Nothing about the Q4 report made me change my mind, so I’m sticking to my sell rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.