Summary:

- Disney shares surged due to strong Q4 earnings and a resurgence in Disney+ subscribers, driven by the ad-supported tier, which now comprises 37% of U.S. subscribers.

- The ad-supported tier has attracted cost-conscious consumers, contributing to Disney+ flipping to profitability and boosting overall company performance.

- Despite Disney’s content library lagging behind Netflix, the nostalgia factor and cheaper ad-supported option are drawing in new subscribers effectively.

- I’m upgrading DIS stock to a buy, I see a potential 24.25% upside as the ad-supported tier accelerates subscriber growth and profitability.

Jesse Grant/Getty Images Entertainment

Co-Authored By Noah Cox and Brock Heilig.

Investment Thesis

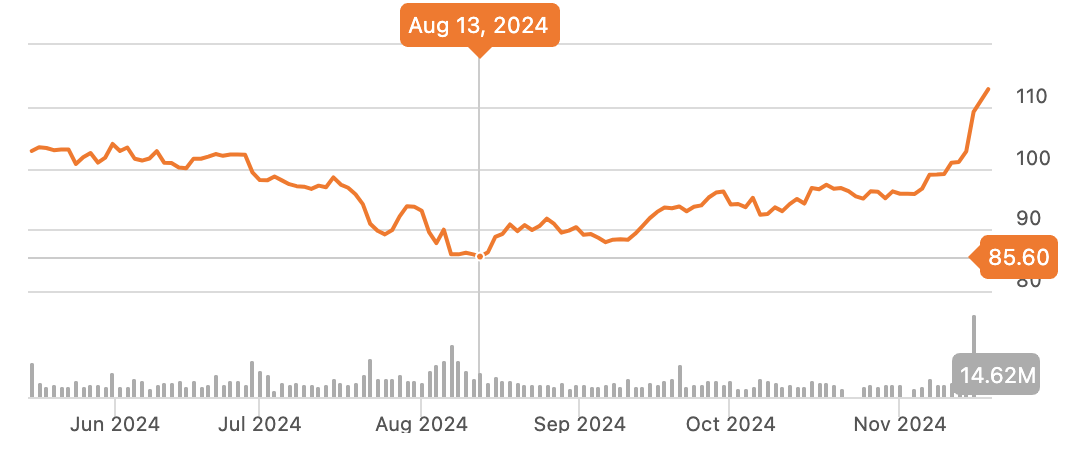

Walt Disney (NYSE:DIS) shares are up 8% since earnings yesterday morning, and are up 15.45% since the last time I wrote on the entertainment giant in early July. When I last covered Disney on July 8, shares were worth $97.69, and shares later in the summer fell off as investor concern grew about whether the Disney+ streaming model was going to lead to long-run greater margins.

However, shares bottomed in mid-August and are now bouncing back. I believe this has been driven by improving metrics within Disney+.

DIS Performance (Seeking Alpha)

The secret sauce driving this resurgence in strong streaming growth is their ad-supported tier of content (which it appears CEO Bob Iger might not have meant to disclose these stats on the earnings call).

Iger’s disclosure that 37% of Disney+ subscribers are in the “ad-supported” tier, means Disney is pulling in cost-conscious consumers by offering a strong foot in the door with an ad-supported offering for the company to gain more subscribers.

I’ll dive into this more, but the strong Ad tier performance is a game changer for me. With this, I am now a buy on shares, upgrading from my stance from a strong sell just a few months ago.

Why I’m Doing Follow-Up Coverage On Walt Disney

When I wrote my last piece of research in July, I was a strong sell on Disney.

At the time, Disney’s heavy reliance on their Direct To Consumer (DTC) segments had not met expectations, with streaming metrics falling short due to the loss of 1.6 million subscribers during the quarter. This quarter, they added a total of 4.5 million subscribers worldwide (earnings presentation).

With this, I found at the time that Disney was falling behind competitors like Netflix. Disney’s year-over-year revenue growth of less than 3% was more than 10 percentage points behind Netflix’s projected year-over-year revenue growth of 13% to 15%.

I was also worried about Disney’s content slate, which may have looked promising to some, but as I have discussed since the article, competitor Netflix (NFLX) has been using AI to help enhance their content slate and optimize what content consumers are actually seeing.

However, this quarter’s earnings report completely changes my opinion on the company. With EPS and revenue both beating expectations (coupled with much stronger performance within Disney+ itself) I feel much better about the company’s direction.

The purpose of this follow-up coverage is to show that this quarter has changed the narrative with the House of Mouse. That’s why I am bullish.

Disney Q4 Earnings Review

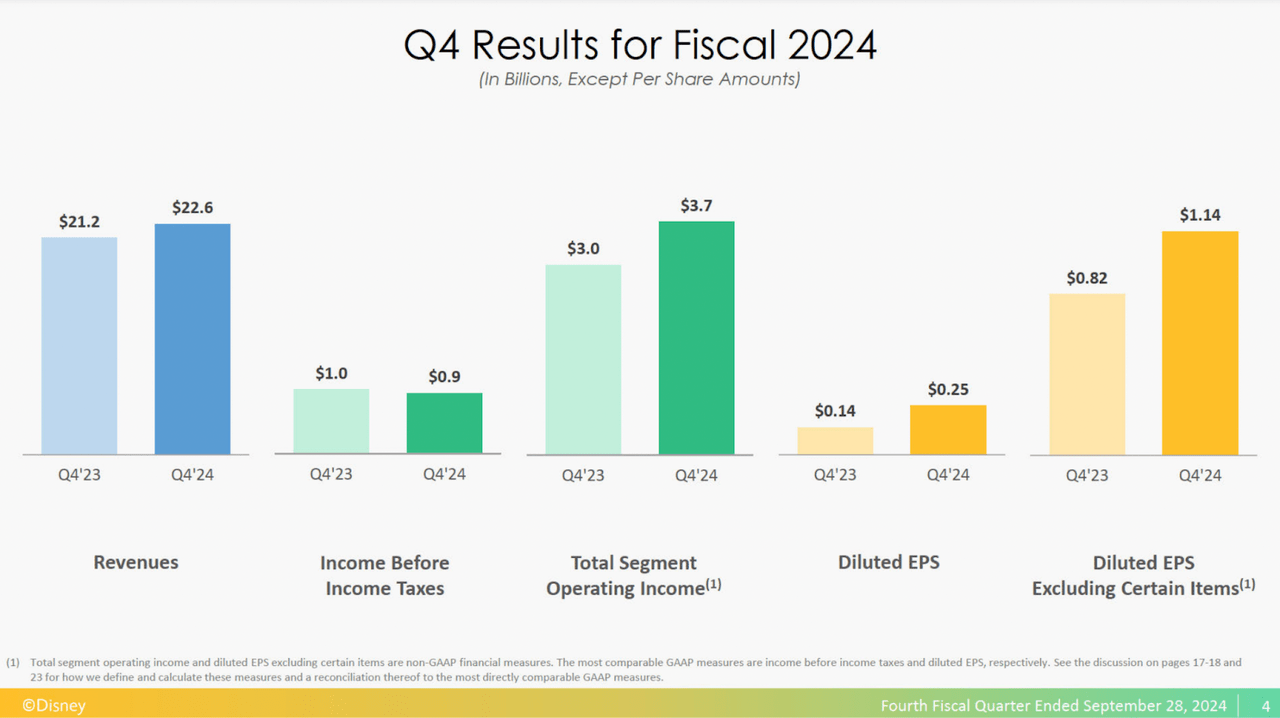

In FY Q4, Disney showcased solid growth on both the EPS and revenue front when the firm reported Thursday. The company reported an EPS of $1.14 in Q4, which beat expectations by $0.03/share and 6.28% higher than Q4 of 2023.

Adding to this, revenue for the company was also up 6.28% year-over-year. Disney posted a total revenue of $22.6 billion, which outdid the Q4 2023 total of $21.2 billion by about 6%. This also beat expectations by $79.87 million.

The Q4 numbers in 2024 as compared to the Q4 numbers in 2023 are below. I think the company has staged an impressive ramp up in performance.

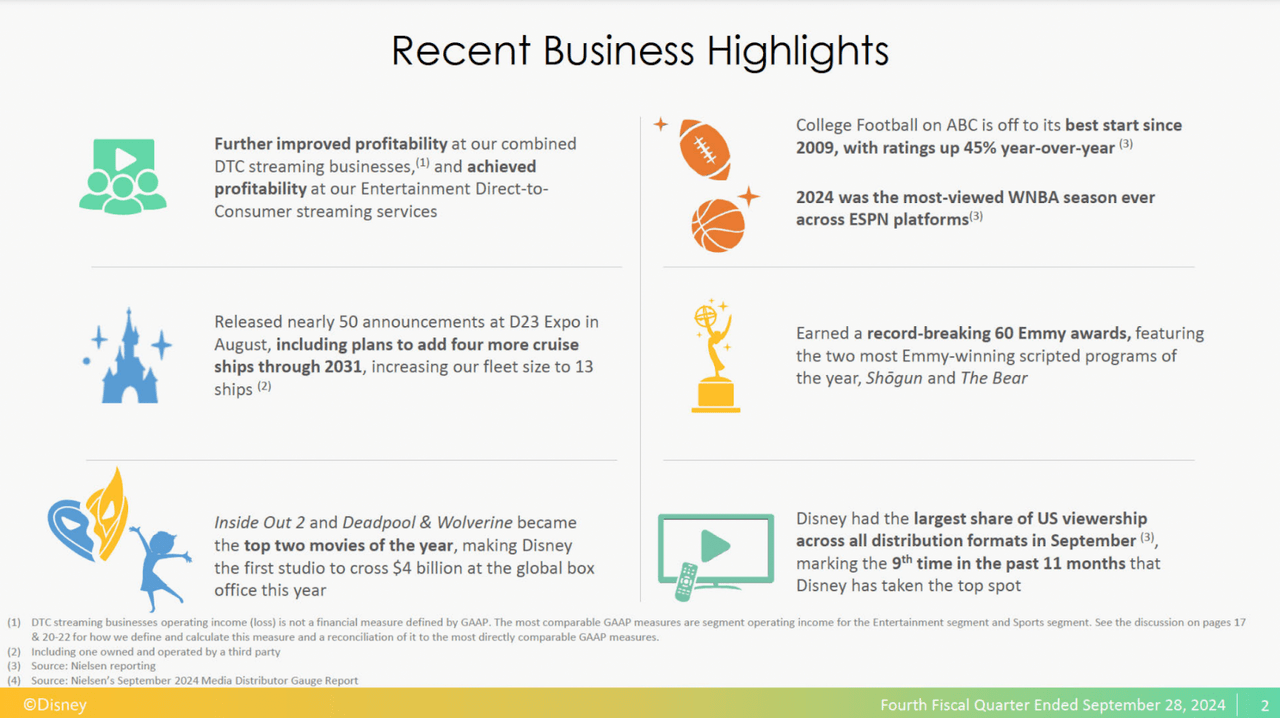

Overall Disney has a strong quarter to highlight in their earnings presentation. Disney produced the “top two movies of the year” with Inside Out 2 and Deadpool & Wolverine.

Disney also reportedly has had the largest share of US viewership across all distribution formats for nine of the past 11 months. While Netflix has been giving them a run for their money, their distribution channels combined are still unmatched.

Business Highlights (Seeking Alpha)

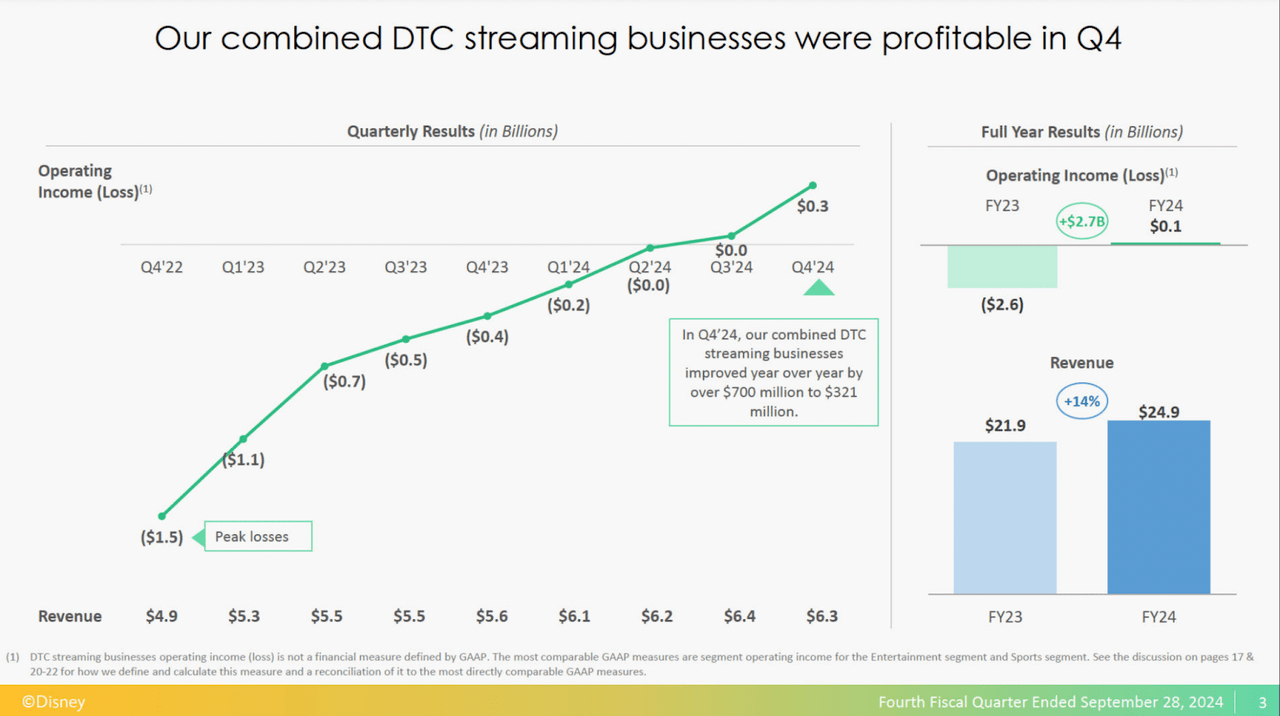

Here’s what I liked most from the earnings deck: the Disney+ streaming division (DTC) flipped to a profit year over year, which shows their streaming service can now start to contribute to the bottom line. This is a big deal.

DTC Performance (Seeking Alpha)

During the earnings call, Disney Chief Executive Officer Bob Iger disclosed that Disney’s AVOD (Advertising-based Video on Demand) tier makes up 37% of all subscribers in the United States and 30% of subscribers worldwide.

So right now, in the United States, about 60% of all new subs are going to – are buying our streaming services, advertiser support or AVOD, Iger said.

I think right now, I think it’s 37% of total subs in the U.S. are AVOD subs and – 37% in the U.S. and 30% globally. So the pricing that we recently put into place, which has increased pricing, was actually designed to move more people in the AVOD direction because we know the ARPU and interest in it from advertisers and streaming has grown.

A few moments later, it appears Iger may have questioned — on an unmuted mic — whether he was supposed to divulge those numbers.

I don’t know if I was “supposed to disclose those AVOD numbers,” he said.

While potentially accidental, this disclosure was big. It helps us because it explains how Disney is driving subscriber growth. I am excited by what we’re seeing.

DIS Stock Valuation

Interestingly, while Disney’s forward Non-GAAP P/E is 48.38% higher than the sector median, it’s well below its 5-year average of 42.19. Disney currently sits at 20.12, while the sector median price-to-earnings ratio is just 13.56. This is a grade of a D- by Seeking Alpha.

However, with Disney’s new ad-supported tiers (that are apparently gaining traction) I feel far more confident management can drive real, profitable growth. This ad-supported option gives potential consumers a cheaper way to subscribe to the streaming service.

With this, I believe growth should accelerate. With 60% of all new subscribers being via the “ad-supported” tier, this indicates that the company is ramping up new subscribers and this has been the secret sauce to how they have gotten streaming to become profitable. With this, I think P/E should grow to about 25 times earnings. If this growth were to happen, it would represent roughly 24.25% upside for the company.

Risks

While the financials behind Disney+ are showing a remarkable acceleration, Disney is still operating with a more stale content library compared to competitors like Netflix. As I mentioned in my last research article, Disney’s original intent with Disney+ was to have one content library that stored years of content that the company had produced, dating back to some of the more iconic movies from the early 20th century.

This has been a difficult hill for Disney to climb in recent years as Netflix, arguably the biggest competitor to Disney, has been consistently putting out new content with their massive content budget. With Netflix expanding their content library at a faster rate than Disney, this puts pressure on the company to spend as much to keep up. Disney also has to fight the AI optimization algorithms Netflix has implemented to get viewers to spend more time on their platform (and likely less on platforms like Disney).

At least, this has been my assumption. This ad tier completely flipped the assumption on its head.

This new ad tier is helping push the case that Disney is mainly attracting consumers for their old-time movies and TV shows rather than for any new content they are putting out. I originally thought this was an unsustainable model because consumers are always looking for the next best piece of entertainment to watch. But what I forgot about was nostalgia.

Nostalgia is likely driving consumers to purchase Disney+ subscriptions, they just have a lower willingness to pay for this subscription.

This is where the “ad-supported” tier comes in. This tier increases the receptiveness for consumers and makes the purchase more justifiable. The data seems to back this up as well, with management commenting on the earnings call that roughly 60% of all new Disney+ subscribers are signing up for the “ad-supported” tier.

To be clear, Disney still has to long-term build out more content. But for now, the older content slate has a lot more staying power with consumers than I originally thought it did.

Takeaway

Disney shares have staged a remarkable move upward after earnings were released on Thursday, and have staged a strong turnaround since shares bottomed in August. The company experienced a strong Q4, and they saw dramatic growth year-over-year from 2024 to 2023. I am way more optimistic about their business than I was before.

Driving this is their resurgence in Disney+ as the company is bringing in a lot of new subscribers via its “ad-supported” tier.

This is a game changer for Disney because it helps them keep pace with Netflix even as they ramp up new content. Netflix has an advantage over Disney in producing more content, but Disney has an advantage in hauling in new subscribers via its AVOD tier and ‘nostalgia’ to neutralize this effect.

As a cheaper option for subscribers, this AVOD tier, combined with the strong Q4 numbers, is what has propelled Disney’s sudden stock increase.

With this, I am upgrading my rating on Disney to a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.