Summary:

- ET and WMB have been huge winners over the past 3 years.

- Both are enjoying strong growth tailwinds today.

- I share why I think only one of them is worth buying right now.

canakat

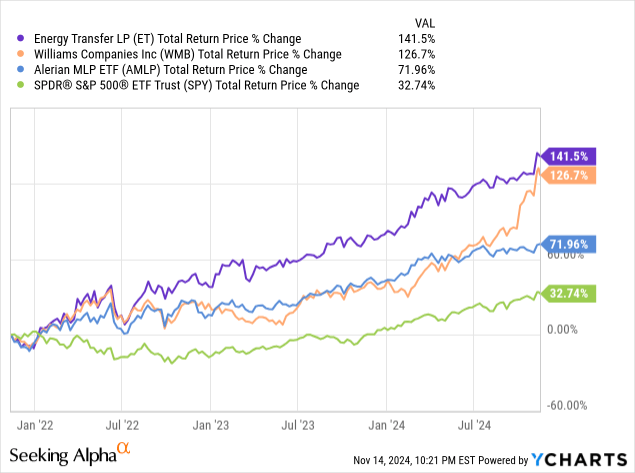

Two of the biggest winners in the midstream space over the past three years have been Energy Transfer (NYSE:ET) and Williams Companies (NYSE:WMB). Neither of these stocks generates much hype in the broader financial media, but they have been phenomenal compounders for investors astute enough to pick up on their attractive dividends, solid growth outlooks, strong balance sheets, and robust business models. As a result, I have been bullish on both for quite some time, discussing them both most recently here and here. After both stocks have run up significantly and outperformed the broader midstream space (AMLP) and stock market (SPY) in recent years, the question arises: are they still worth buying today?

In this article, I will explain why I believe only one of these midstream stocks is still worth buying.

Business Models

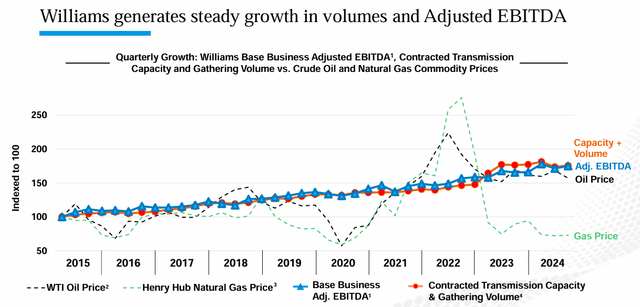

When it comes to business models, both companies are quite strong. WMB’s business centers on its crown jewel, the Transco pipeline asset. It also owns the high-quality NW pipeline and gathering and processing businesses. Management is particularly bullish on Transco, which benefits from significant and consistent demand due to its strategic positioning, providing stable cash flow through all economic and energy industry conditions. Additionally, Transco offers numerous growth opportunities, including supplying natural gas to data centers and supporting the growing U.S. LNG export market. This positions WMB for sustained growth for years to come as well as stable cash flows through all sorts of cycles, as its history has demonstrated.

WMB Performance (Investor Presentation)

Meanwhile, ET boasts one of the most diversified midstream businesses today, with no single segment contributing more than 25% of its EBITDA and less than 15% from any single sub-segment. ET derives 20% of its EBITDA from crude oil, 25% from NGL and refined products, 20% from midstream, 20% from natural gas pipelines and storage, and 15% from stakes in Sonoco (SUN), USA Compression Partners (USAC), and other investments. This diversification minimizes ET’s exposure to any single asset type or commodity and provides strong geographic diversification. Moreover, 90% of ET’s EBITDA comes from fee-based contracts, reducing its commodity price risk.

Balance Sheets

Regarding balance sheets, both companies are in excellent shape with BBB credit ratings from S&P. WMB’s leverage ratio is lower at 3.75x, compared to ET’s 4–4.5x target range. WMB expects its leverage to decline further to 3.6x next year as new growth projects come online. ET—which has come a long way in the deleveraging department in recent years and has also recently redeemed the vast majority of its preferreds—also expects its leverage to decline to the low end of its target range, and both businesses enjoy ample liquidity and well-laddered debt maturities, allowing them to pay down debt opportunistically or refinance as necessary. While WMB’s lower leverage gives it a slight edge here, ET’s diversification offsets this advantage to some degree.

Growth Outlooks

In terms of growth potential, WMB has numerous attractive investment opportunities through its Transco pipeline’s positioning to meet growing LNG export and data center demand. As a result, management forecasts a 5–7% long-term adjusted EBITDA CAGR, supported by projects coming online in late 2024, 2025, 2026, and even 2027. This gives it a very clear line of sight to strong growth for the foreseeable future. Analysts seem to agree, predicting a 6.1% EBITDA CAGR through 2028 and a 7.4% CAGR in distributable cash flow per share.

ET, meanwhile, also benefits from growing LNG and data center demand, including requests to connect up to 40 data centers in 10 states, consuming up to 10 Bcf/day, requests to connect to ~45 power plants in 11 states for new connections that could consume gas loads up to 6 Bcf/d, and plans to pursue expansions at currently connected plants for potential additional gas loads of over 1 Bcf/d. It is also investing to continue expanding its leading NGL pipeline and fractionation asset base. However, ET’s growth outlook is slightly more modest, with analysts projecting a 4% EBITDA CAGR and a 4.7% distributable cash flow CAGR through 2028.

Dividends

When it comes to dividends/distributions, WMB’s expected dividend CAGR through 2028 is 7.1%, while ET’s is projected to be 5.2%. While both of these payout growth rates are projected to be around the high ends of their per share distributable cash flow growth CAGR projections, this is not surprising given that both companies have conservative payout ratios. WMB’s DCF coverage ratio of its dividend stands at 2.1x, and ET’s is at 2.0x for 2024. In contrast, many of their peers—such as MPLX (MPLX) and Plains All American Pipeline (PAA) (PAGP)—are pursuing coverage ratios of around 1.4–1.6x. Granted, both WMB and ET are investing more aggressively in growth projects than MPLX and PAA are, but they could still certainly afford to have lower coverage ratios of their payouts given the strength of their balance sheets and stability of their cash flows. As a result, as their leverage ratios decline further, dividend growth rates may accelerate. On top of that, ET is also planning to prioritize unit repurchases once its leverage target is achieved, which could further reduce its payout ratio and potentially pave the way for distribution growth acceleration as well.

Valuation

In terms of valuations, ET emerges as the clear winner when compared with WMB. This is because WMB trades at a rich 13x EV/EBITDA, which is well above its 11x historical average, along with a dividend yield of 3.6% which is well below its 5.2% historical average. In contrast, ET trades at a discounted 8.4x EV/EBITDA, well below its 11.3x historical average, with a 7.7% dividend yield that is slightly above its historical 7.6%.

Investor Takeaway

While WMB has slightly stronger growth prospects and a little bit better balance sheet, ET’s significantly cheaper valuation and meaningful distribution yield advantage outweigh these factors in my view. Both companies have executed well and enjoy growth tailwinds, but I rate WMB a hold and ET a buy right now. However, I see better opportunities than either of these right now in the midstream space and I am focusing on other stocks in my core and retirement portfolios at High Yield Investor, though I could see myself buying back into ET in the future (after selling it earlier this year) depending on market conditions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MPLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want access to our Portfolios that have crushed the market since inception and all our current Top Picks, join us for a 2-week free trial at High Yield Investor.

We are the fastest growing high yield-seeking investment service on Seeking Alpha with a perfect 5/5 rating from 180 reviews.

Our members are profiting from our high-yielding strategies, and you can join them today at our lowest rate ever offered. You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!