Summary:

- Occidental Petroleum’s impressive 3Q 2024 results include record production of 1.4 million barrels/day and a strong FCF of $1.5 billion.

- The CrownRock acquisition boosts production, with 109k barrels in 3Q 2024 and an expected 50% growth in 4Q, enhancing portfolio strength.

- Financially, Occidental is rapidly de-leveraging, repaying $4 billion in debt and trading at a double-digit FCF yield, promising substantial shareholder returns.

- Risks include potential crude oil price drops due to OPEC+ production changes, but the company’s robust asset portfolio supports future growth.

Vladimir_Timofeev

Occidental Petroleum (NYSE:OXY) is a company that we’ve varied on as the company has cycled between heavily undervalued, like when we recommended it in March 2020, and our most recent article, where we recommended selling. Since that last article, the company has underperformed the market by more than 20%. As we’ll see throughout this article, the company is worth investing in again.

Occidental Petroleum 3Q 2024 Results

The company had a very impressive quarter with a market capitalization of $47 billion.

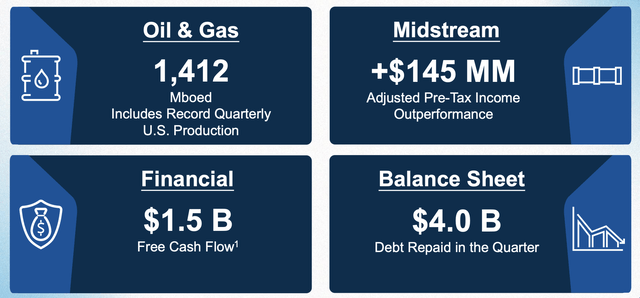

Occidental Petroleum Investor Presentation

Occidental Petroleum achieved record production of more than 1.4 million barrels/day. The company managed to achieve an incredibly strong FCF of $1.5 billion, coming out to just over $11/barrel in FCF. The company has continued to see strong performance from its midstream business, which provides strong dividends.

The company is also repaying debt with its $12 billion CrownRock acquisition.

Occidental Petroleum Oil and Gas Update

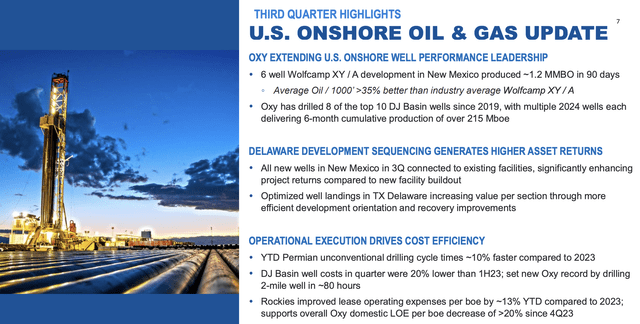

The company’s overall portfolio focused on U.S. shale remains quite strong.

Occidental Petroleum Investor Presentation

The company remains one of the most successful producers in the region with strong continuous acreage. That has resulted in the company having 8 of the top 10 DJ Basin wells since 2019. The company’s 6-well Wolfcamp development produced a massive 1.2 million barrels in 90 days and the company’s oil remains well above the industry average.

The company’s integrated asset portfolio of wells is well-connected to existing facilities to keep costs low and cycle types quick. The company is working to continue improving operations.

Occidental Petroleum Investor Presentation

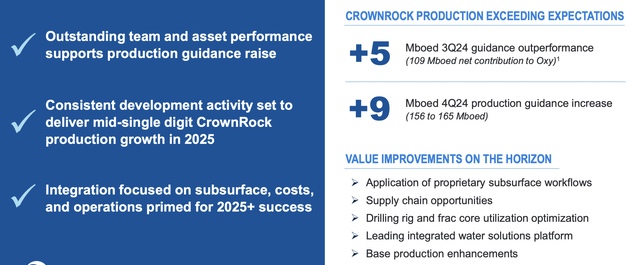

The company has continued to outperform guidance with its CrownRock acquisition. That resulted in 109 thousand barrels in extra 3Q 2024 production, which the company expects to grow by 50% going into the 4Q. The company expects mid-single-digit CrownRock production growth in 2025, which will support continued portfolio growth.

As a result, the company expects to continue its success going forward.

Occidental Petroleum Portfolio Improvements

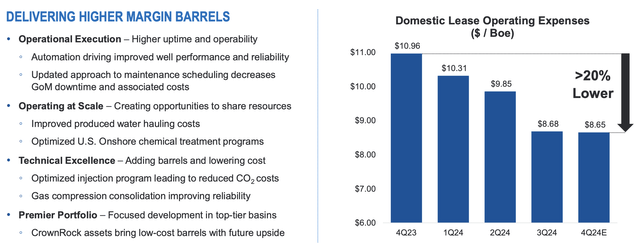

Overall, the company’s portfolio remains exciting.

Occidental Petroleum Investor Presentation

The company is expanding its scale after its CrownRock acquisition, making itself more competitive. Even YoY domestic lease operating expenses have declined more than 20%, which is essential in a low-price environment. The company needs to be able to perform well for the long term in a world where WTI might be in the $50s-$60s/barrel.

Occidental Petroleum Investor Presentation

Occidental Petroleum has continued to advance an impressive DAC program. Lower DAC costs could enable oil to remain relevant for much longer if the carbon can easily be removed from the world. The company expects 250 ktpa in mid-2025 capacity. For perspective, 2 barrels of oil is ~1 tonne of CO2, so the company would need ~1000 of the above plants to offset its emissions.

Costs of $500/tonne of CO2 would need to be cut substantially ($250/barrel of oil). We see a factor of 10x minimum to start potentially making it economical.

Occidental Petroleum Financial Improvements

Overall, Occidental Petroleum has continued to improve its financials substantially.

Occidental Petroleum Investor Presentation

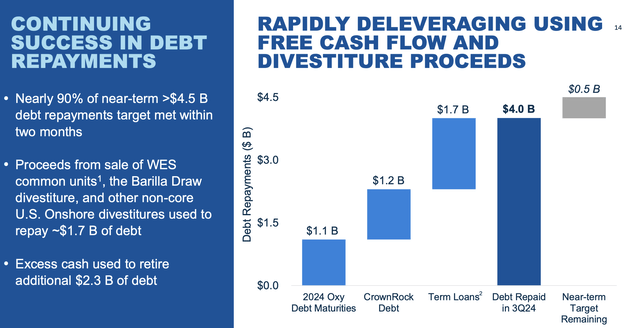

The company is rapidly de-leveraging with its cash flow and repaid $4 billion in the most recent quarter. As a result, the company has very little of its near-term targets remaining. The company has earned cash from divestitures and WES common unit sales, with the company’s stake in WES worth billions of dollars.

That will help the company improve financially. The company has a double-digit FCF yield at its current valuation, which could help support substantial shareholder returns.

Thesis Risk

The largest risk to our thesis is crude oil prices. The market is currently supported by OPEC+ production cuts, and if those end, it could have a massive impact on prices. OPEC+ might be reluctant to support additional shale drilling. A market downturn could also impact crude oil prices, which would hurt the company’s future returns.

Conclusion

Occidental Petroleum has an impressive portfolio of assets. The company has continued to integrate its CrownRock acquisitions and lower its costs. The company’s drop in share price as oil prices have improved has enabled the company’s cash flow to improve substantially. The company is now trading at a double-digit FCF yield.

The company has an exciting portfolio of assets that will help support future growth. Going forward, we expect the company to continue generating valuable returns, making it an exciting investment. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OXY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.