Summary:

- Coca-Cola is our preferred defensive income stock, and now it offers competitive dividend yield.

- The company has increased dividends for 61 consecutive years, with a 70% payout ratio, and it can maintain dividends even amidst volatility.

- Coca-Cola’s growth is driven by emerging markets and strategic acquisitions, despite challenges like dollar appreciation.

- The stock is trading at fair value, offering stable returns and a reliable income stream, making it a preferred defensive investment.

PM Images

Coca-Cola (NYSE:KO) is one of the strongest consumer staples companies in the world. While most of its peers struggle with competition from private-label brands, Coca-Cola is as strong as ever and continues growing sales volumes partly due to its strong position in emerging markets. It is a very profitable and cash-generative business.

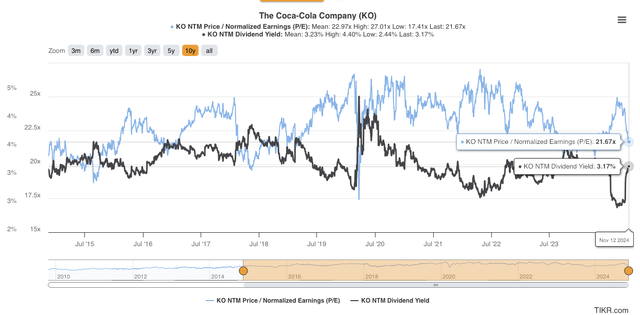

This stock is currently trading at a 22X forward PE multiple and a 3% dividend yield, in line with a 10-year average. Coca-Cola is a great quality company and has been able to increase its dividend for 61 years in a row. The S&P 500 Dividend Aristocrats ETF (NOBL), by comparison, is currently offering only a 2% yield.

In the rather generously priced market of today, it is not easy to find attractive yields with such a low risk and also long-term growth potential, but Coca-Cola could now be the one to consider.

The business does face volatility in reported earnings due to FX movements, but the underlying growth will enable the business to continue raising the dividend.

Over the past 5 years, the KO dividend has grown by 3.8% per annum on average. If this pace is maintained, shareholders could expect to earn Total Returns of at least ~7% per annum going forward.

Coca-Cola is our preferred defensive stock, while it will not make us rich, it will continue paying dividends and growing unit sales volumes almost under all economic scenarios.

Coca-Cola has been a disappointment in the past, but it has a lot of untapped potential

Despite the phenomenal brand strength and continuing growth, Coca-Cola has been a disappointment for investors, underperforming the S&P 500 (SPY) by over 3X over the last 10 years. It has even underperformed the XLU marginally. Why would such a great business underperform so terribly?

The revenues generated by Coca-Cola last year were practically at the same level as in 2014 and this is the main reason for underperformance. However, this is not an indication that consumers are falling out of love with Coke! The actual unit sales volumes of Coca-Cola’s beverage brands have been rising. Their product prices have also increased considerably.

There were two main reasons for weak revenue growth:

- Disposals of bottling businesses,

- Dollar appreciation.

Bottling, however, is a low-margin business as compared to the core activity of concentrated sales. As Coke sold its bottlers, the operating profit margin of the group grew. Even though the revenues have stayed flat, the operating profit of the group has increased by 25%. Re-franchising bottling operations thus did not hurt the reported earnings and the value.

The dollar appreciation, on the other hand, had a very significant negative impact on the reported earnings of Coca-Cola. As we pointed out in our previous article: Coca-Cola: 30%+ Upside If Dollar Gains Revert In 2024/2025, the reported earnings were reduced by 31% over the last five years alone by the dollar appreciation.

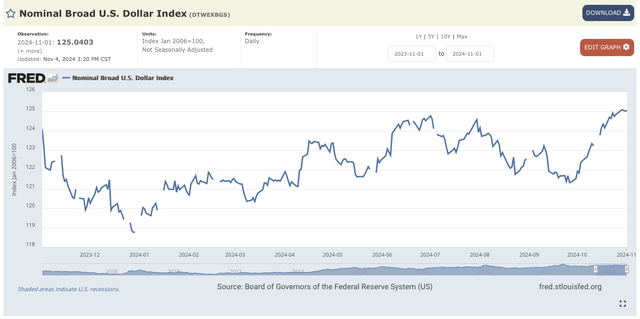

Currency pair movements are notoriously hard to predict, and it would be difficult to make a strong investment case based on a long-term dollar depreciation assumption. Having said it, at the moment the U.S. economy is performing stronger than almost any other major country in the world excluding India. It does seem like the dollar should be at its peak right now.

The dollar should weaken eventually, and once it does, the reported earnings of Coca-Cola will receive an outsized boost. While we should not pin the valuation on uncertain future events, this does represent a significant margin of safety in value.

On top of this, Coca-Cola sales volumes are growing in emerging markets and the company has been acquiring new beverage brands and scaling some of them effectively due to its extensive distribution footprint. This company can continue growing even without currency tailwinds.

Recent financial performance

Unfortunately, the dollar might strengthen further before it falls. The dollar has been on the run since the end of September and received a further boost after Donald Trump won the election. The reported earnings of Coca-Cola will be facing headwinds once again and the share price of KO has declined by ~12% in response to this recent negative development. Coca-Cola is now expecting a mid-single-digit FX headwind on reported earnings for 2025.

U.S. Dollar Index (FRED)

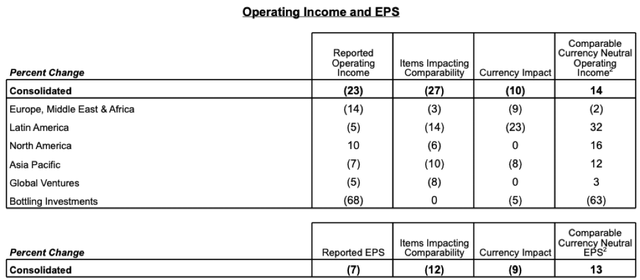

The company reported third-quarter earnings at the end of October. The earnings per share of the business declined by 7%, but the comparable currency-neutral EPS increased by 13%. The reported earnings were negatively affected by dollar appreciation and the re-measurement of the contingent consideration liability related to the acquisition of fairlife.

EPS Bridge (The Coca-Cola Company)

During the quarter unit case, volume declined by 2% in Europe, the Middle East & Africa as growth in water, sports, coffee, and tea was more than offset by declines in Trademark Coca-Cola. In Latin America, however, unit case volume was flat as growth in Trademark Coca-Cola was offset by declines in water, sports, coffee, and tea. Unit case volume was flat in North America.

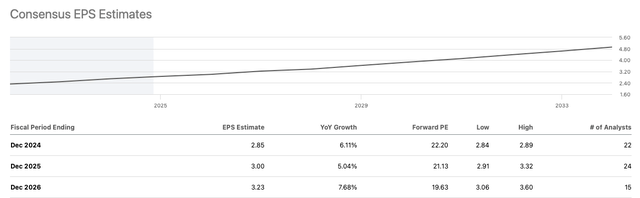

The company expects comparable EPS (non-GAAP) growth of 5% to 6% in 2024, excluding the negative currency effects. Reported earnings per share, however, are likely to be lower than last year.

The comparable earnings per share are expected to continue growing at mid-single digits over the next few years. While 5-7% adjusted earnings growth is not particularly exciting, Coke’s earnings are stable and not dependent on economic cycles.

Considering that analysts expect continuing earnings to grow by ~5% during FY2025 and that the company now expects a mid-single-digit FX headwind in that year, we can deduce that the reported earnings are likely to stay flat in that year.

EPS Estimates (Seeking Alpha)

Coca-Cola will remain a dividend king

The reported earnings will likely continue to fluctuate with FX movements, but despite these fluctuations, Coca-Cola has been able to increase dividends for 61 consecutive years. KO will not deliver impressive growth going forward, but it is an excellent income stock.

As of November 12, 2024, Coca-Cola has declared a quarterly dividend of $0.485 per share, resulting in an annual dividend of $1.94 per share. This equates to a dividend yield of ~3%.

The company has a dividend payout ratio of ~70%, which allows it to maintain distributions even when earnings dip temporarily. The debt levels are also comfortable with the Net Debt/EBITDA ratio standing at ~2X.

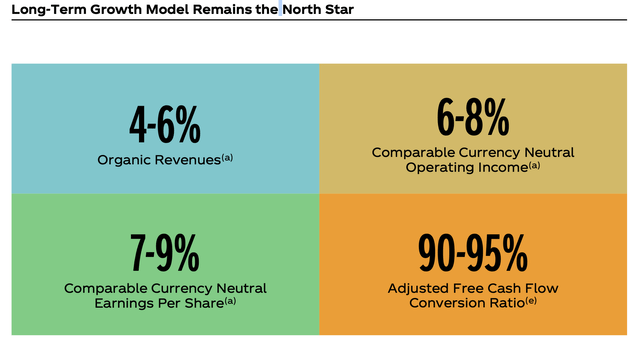

This capital-light business can maintain a generous dividend payout and at the same time grow like-for-like sales and continue making acquisitions. We expect KO to generate currency-neutral low double-digit Total Shareholder Returns going forward, in line with the management guidance.

Long-Term Ambitions (The Coca-Cola Company)

Over the past 10 years, unit case sales of the Coca-Cola system kept going up by about 1.7% per annum on average as several non-carbonated drinks brands were added. The trademark Coca-Cola unit sales volumes also kept cropping up albeit at a slower pace than the non-carbonated volumes. While Trademark Coca-Cola sales volumes are rather stagnant or declining in mature markets, the emerging ones are driving volume growth.

Trademark Coca-Cola sales now account for 42% of case volume, down from 47% ten years ago.

We would expect this trend to continue as new brands are acquired and scaled.

|

FY2013 |

FY2022 |

FY2023 |

10 YR CAGR % |

|

|

Unit cases sold (billion) |

28.2 |

32.7 |

33.3 |

1.7% |

|

Unit cases sold Coca-Cola (billion) |

13.3 |

13.7 |

14.0 |

0.5% |

|

Trademark Coca-Cola share |

47% |

42% |

42% |

|

|

Sparkling soft drinks share |

74% |

69% |

69% |

KO operating data

The company expects to achieve a currency-neutral organic sales growth of about 4-6% over the longer term. Which would consist of ~1.5% volume growth as well as ~3.5% pricing increases. Operating income growth, however, could outpace the top-line performance to due structural margin improvements as bottling subsidiaries are sold.

Operating income growth is expected to exceed the revenue growth as franchising efforts continue and core concentrate sales start making up a larger share of revenues. There is also some operating leverage going through the system as marketing spending usually lags comparable revenue growth.

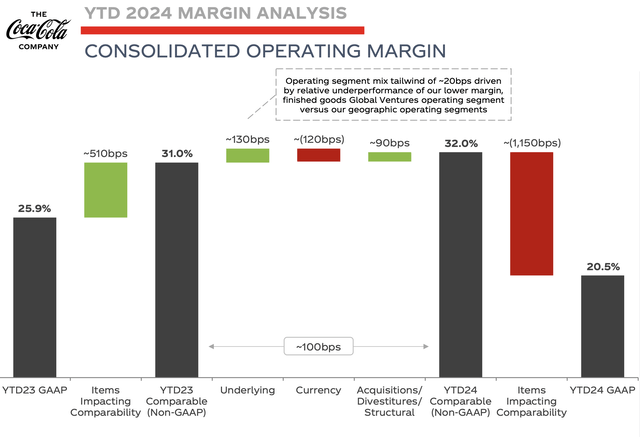

During the first nine months of the year, Coca-Cola generated a 32% comparable operating margin, 1 point higher than during the same period last year, despite currency headwinds.

Margin Bridge (The Coca-Cola Company)

Apart from favorable FX movements, acquisitions are perhaps the main area where Coca-Cola could surprise on the upside as they have been quite successful as of late. The company has an unrivaled distribution reach and a marketing organization of enormous scale.

Acquisitions could boost sales and earnings growth

The management of Coca-Cola will continue acquiring new drink brands and growing non-Coke unit sales volumes. The company even broke a long-term taboo and started selling alcoholic beverages. The company seems willing to target a broader addressable market.

During the last earnings call management pointed out that Topo Chico’s sales volume increased 20% in the quarter and that year-to-date volume has increased ten-fold compared to pre-acquisition levels in 2016.

Post-acquisition, Coca-Cola expanded Topo Chico’s distribution beyond its traditional markets, introducing it to new regions and leveraging its extensive distribution network. The brand was acquired for $220 million and is now worth considerably more. Coca-Cola company wants to repeat the same exercise with even more brands.

Most recently, Coke entered into agreements to acquire Costa Coffee, BODYARMOR, and fairlife. All three of these brands serve different beverage segments and could be used as platforms for future growth.

Even though BODYARMOR has faced challenges, Costa and fairlife are continuing to grow. More acquisitions like this could be made in the future.

Coke seems to be willing to invest in growth aggressively even if it means losses in the near term, having said, the company does have the financial resources to support this growth.

The company still has to improve its scaling strategies for acquired startup brands, however, as Odwalla, witaminwater and Honest Tea have also struggled to reach potential.

Current Valuation Multiples

Coca-Cola is currently trading in line with historic valuation averages. It is a stable and predictable business that does not change much and therefore historic valuation levels can provide a reasonable expectation of fair value. It would appear that Coca-Cola is currently trading close to fair value.

Valuation Multiples (TIKR Terminal)

Having said this, dollar exchange depreciation would allow the business to convert sales and profits into more dollars, providing a boost to the value of the stock. The currency movements are hard to predict, but we are happy to have this margin of safety in valuation.

The bottom line

Coca-Cola is a cash-generative and well-capitalized consumer staples business. While the company is mature and is unlikely to grow rapidly, it was able to gradually increase sales volumes and also raise prices along with inflation. We do expect them to continue increasing sales at mid-single digits going forward.

Dollar appreciation has been a major headwind for the business over the past decade, but even despite this, the company continued increasing the dividend payments.

The business currently pays out ~70% of adjusted earnings and has a conservative level of financial leverage. The company can maintain the dividend even under more adverse economic development.

The business is also highly likely to continue increasing earnings due to growth in emerging markets and new brand acquisitions. The currency will fluctuate, but the dollar cannot continue strengthening perpetually.

Coca-Cola is a stable and reliable company. It will not generate impressive capital gains, but it is one of the most reliable compounders around.

Risks

Reduced Consumption: Surveys indicate that users of weight loss drugs tend to decrease their intake of sugary beverages. For instance, a study found that among daily drinkers of full-calorie soda, 33% of GLP-1 users quit sugary soda entirely, while another third decreased consumption. While weight loss drugs could be a headwind to the business it is unlikely to impair the investment case significantly. Trademark Coca-Cola sales account for only 42% of sales volume and a significant share of this volume is made up by zero sugar drinks. KO also makes ~80% of sales overseas where weight loss drugs might be not as prevalent.

The dollar might continue appreciating over the next few quarters, putting pressure on the reported earnings of KO. The share price could decline as a result.

Regulatory changes, such as the sugar tax could put further pressure on core brand sales.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.