Summary:

- Nvidia Corporation’s AI-driven growth has been exceptional, with data centers now comprising 88% of revenue, leading to a 38% stock increase since my last upgrade.

- Nvidia’s market cap is $3.6T, with a Blended P/E of 58.5x; future growth depends on maintaining its competitive edge in AI and data centers.

- I project Nvidia’s revenue to grow at a 24% CAGR until 2029, potentially reaching a market cap of $5.69T to $6.32T, offering attractive returns.

- Nvidia’s future opportunities include AI, gaming, automotive, and industrial applications, with innovations like the Blackwell GPU architecture driving growth.

JHVEPhoto

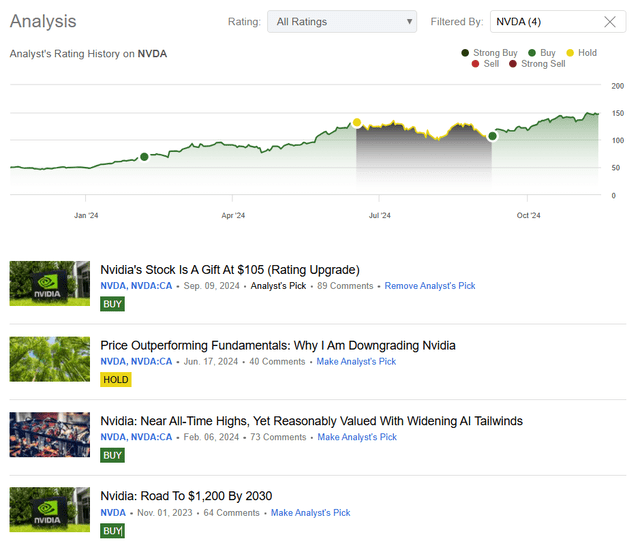

I last wrote coverage about NVIDIA Corporation (NASDAQ:NVDA) back in September, upgrading the stock to a buy in the article “Nvidia’s Stock Is A Gift At $105.” My upgrade followed the broader market weakness in late summer, particularly in the high-flying semis. Despite the downturn, which seemed like a healthy correction, mega-cap companies are not yet showing signs of exhaustion, and their CAPEX spending continues to balloon to record levels, fueling Nvidia’s growth. At the same time, Nvidia’s data center market share remains relatively stable despite increased competition, and the gross margins are continuously healthy, above 75%.

Since my rating upgrade, the stock has been up 38%, compared to a roughly 9% gain in the broader market (SP500), proving my call was accurate. However, I won’t be patting myself on the shoulder just yet, as in the bull market, buying quality almost always means positive returns.

Below, you can see my previous Nvidia calls and the performance that followed:

Previous Coverage (Seeking Alpha)

Now, Nvidia is valued at $3.6T, making it the most valuable company of them all. It trades at a Blended P/E of 58.5x. The fair question to ask ourselves is how large Nvidia can realistically grow, and whether it still presents a good investment opportunity.

I previously purchased shares of Nvidia myself at around $400/share pre-split, and now I am sitting on major gains.

Nvidia’s Previous Growth

Before looking into the future, let’s first look at Nvidia’s success in the past few years and what has fueled its growth.

The adoption of AI has been Nvidia’s primary growth driver, as the company’s innovation has led to being at the right time, at the right place, with the right product. The GPUs using the Hopper Infrastructure, such as the A100 and H100 series, were so far the backbone of AI training and inference, powering generative AI models, such as the widely used ChatGPT, Perplexity, Copilot, etc. The AI “revolution,” a term tossed around a lot, has led to increased demand for Nvidia’s products for cloud computing and enterprise applications without signs of exhaustion, particularly as Nvidia is starting to sell new, more advanced Blackwell architecture.

That’s mainly why Nvidia’s data center segment has experienced exponential growth. It is fueled by the “so-called” cloud hyperscalers such as Microsoft Corporation (MSFT) with Azure, Alphabet Inc. (GOOG), (GOOGL) with Cloud, and Amazon.com, Inc. (AMZN) with AWS, as the CAPEX spend ballooned in the race for the most advanced AI infrastructure.

CAPEX Spending (Sherwood)

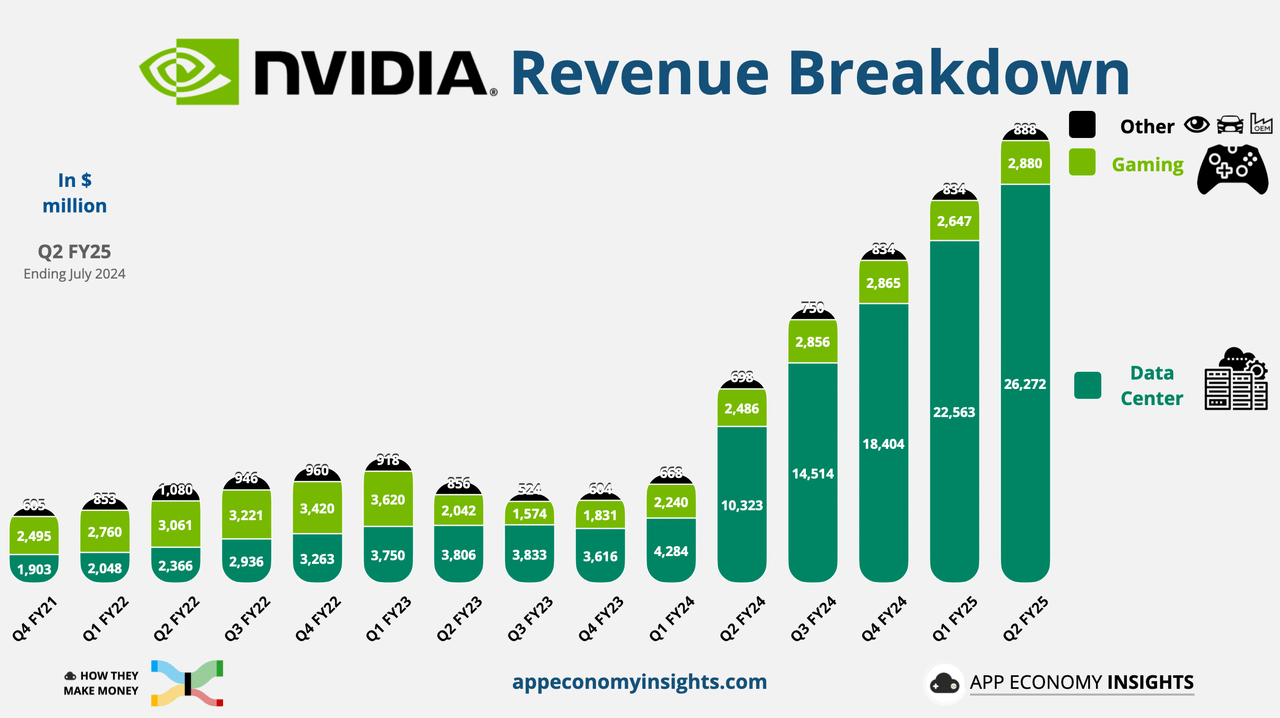

But that wasn’t always the case. Previously, Nvidia’s business has centered around GPUs powering gaming. Still, this narrative is long gone, with the business innovating and ultimately reinventing itself to become the fundamental brick in the new computing era. Data centers now make up around 88% of its total revenue, compared to less than 50% just 2 years ago.

Nvidia Revenue Breakdown (App Economy Insights)

The graphs above very well depict Nvidia’s stellar growth quarter over quarter, but let’s look at annual revenue growth:

- FY22: $26.91B, YoY 61% growth.

- FY23: $26.97B, YoY 0% growth.

- FY24: $60.92B, YoY 226% growth.

- FY25: (Actual YTD $56.08B + Estimate YTG $69.51B) = $125.59B, YoY 206% growth.

These are stellar growth numbers and perhaps the most significant success story I have seen during my investment career. Nonetheless, the law of large numbers is clear: the larger the company gets, the more difficult it becomes to grow its top line, and moving forward, it will become increasingly difficult for Nvidia to grow at such unprecedented rates.

Nvidia’s Future Opportunity

Nvidia’s AI GPU first-mover advantage has given the company a competitive advantage in establishing its market share before any other company could, with Advanced Micro Devices, Inc. (AMD) and Intel Corporation (INTC) now playing catch-up.

According to TechSpot, Nvidia’s GPU market share was 88% in Q1 2024, an increase from 80% in the prior year. That’s particularly important because we see the competition intensify, both from other semi-companies and the already mentioned cloud hyperscalers. They are developing their in-house chips to address their custom needs, but so far, Nvidia’s position remains unchallenged, perhaps due to their engineering superiority. However, as time passes and the generational leaps in technology become less pronounced, I expect Nvidia’s market share to fall, and its gross margin will eventually decline.

Let’s now look at how large the AI chip market is and how fast it’s expected to grow.

If we assume Nvidia’s trailing twelve-month data center revenue of $81.75B and their market share of 88%, we can conclude that the current overall market size is around $92.9B.

If we look at the forecast from MarketsandMarkets, they are estimating the market size to reach $311B by 2029, which would represent a 19% CAGR from today.

However, for instance, AMD is expecting the market to grow to as large as $400B by the end of 2027, which would be a 34% CAGR, which is quite optimistic, in my opinion.

Nonetheless, this shows us that the market size forecasts are all over the place. However, Nvidia is still positioned as the key beneficiary in capturing a significant portion of this opportunity.

If we assume Nvidia’s data center revenue grows in line with the market, Nvidia’s data center revenue could reach anywhere between $138B — $197B by the end of 2027 and $195B by the end of 2029, depending on the growth estimate we use in our calculation, as per below, if we assume no market share loss over the following years:

| Data Center Revenue Growth | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| 19% CAGR (MarketsandMarkets) | $82 | $97 | $116 | $138 | $164 | $195 |

| 34% CAGR (AMD) | $82 | $110 | $147 | $197 |

Several market trends and innovations, such as the new Blackwell GPU Architecture, should unlock this growth for Nvidia. Production is on track to ramp up in H2 2024, and sales will follow suit as soon as Q1 2025. This new architecture promises 25x more cost-effective and energy-efficient GPUs for training LLM, with energy being one of the main hurdles for AI data centers.

Following the successful implementation of generative AI into services such as ChatGPT, Microsoft’s Copilot, and cloud-based offerings, governments around the world are expected to start investing in AI systems tailored to their custom needs. This untapped opportunity could become a significant revenue stream in the future.

But that’s not all. We should not forget other Nvidia business segments, which are poised to contribute meaningfully to revenue growth in the future as well.

Gaming has historically been the core revenue driver. While now the segment makes up around 10% of the overall revenue on a trailing twelve-month basis, the synergies between AI and gaming with enhancements in computer graphics and game dynamics could drive stronger sales in this segment. I am assuming a relatively modest 4-6% CAGR growth.

Likewise, Nvidia’s DRIVE platform has the potential to drive more revenue in the future, particularly as the autonomous vehicle market grows. In fact, the automotive AI chip market is projected to grow 31% CAGR, reaching $109B by 2030. If Nvidia captures 20-25% of this market, it could add $20-30B annually in automotive revenue. Meanwhile, Nvidia’s Omniverse platform and digital-twin technology have broad applications in industrial simulation, robotics, and generative AI, potentially adding $10-$15B in revenue by 2029.

| Segment Revenue | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Data Centers | $82 | $103 | $131 | $165 | $209 | $265 |

| Gaming | $11 | $12 | $12 | $13 | $14 | $14 |

| Automotive | $3 | $5 | $7 | $11 | $17 | $25 |

| Other | $- | $2 | $3 | $5 | $7 | $12 |

| Total | $96 | $122 | $154 | $194 | $247 | $316 |

Combining all the segments, supported by strong AI growth but taking an average 26.5% CAGR growth in the data center segment, Nvidia’s revenue could reach around $320B annually by the end of 2029, supporting further market cap expansion.

Now, the semiconductor business is inherently cyclical, driven by the swings in demand influenced by the underlying economy, and that has had an impact on Nvidia’s net profit margins in the past:

- FY 2020: 25.61%.

- FY 2021: 25.98%.

- FY 2022: 36.23%.

- FY 2023: 16.19%.

- FY 2024: 48.85%.

… and likely will have an impact in the future. Nvidia’s net profit margin over the past 5 years has been 30.5%, but we see a significant divergence from the mean in FY24 thanks to the AI segment, which has fundamentally shifted Nvidia’s business towards a higher margin segment. For the sake of this valuation exercise, I would feel comfortable using a future net margin of around 40%.

A $320B annual run rate revenue and 40% net margin result in a net income of $126.4B by the end of 2029. For the past 15 years, Nvidia’s stock traded on average at a P/E multiple of 36x, but again, the business has accelerated growth and improved margins. Hence, a higher multiple of 45-50x is realistic, thanks to the improved fundamentals.

At a P/E multiple of 45x (bear case), Nvidia would be valued at $5.69T at the end of 2029, and at a P/E multiple of 50x (bull case), it would be valued at $6.32T.

Compared to today’s market cap of $3.6T, this would represent a growth of 58% to 76% in the next 5 years, which I consider relatively attractive.

Investor’s Takeaway

Nvidia has been the key beneficiary of the AI investment narrative, with CAPEX spending ballooning in the race to build “state-of-the-art” AI data centers by the hyperscalers.

As a result, the company has become the most valuable of them all, with a current market cap of $3.6T. It’s valid to ask how far Nvidia can grow as the law of large numbers starts dragging on its growth rates.

In this article, I tried to demonstrate the expected growth rates of data centers, gaming, automotive, and other segments, which will drive Nvidia’s revenue for the remainder of the decade.

Overall, I expect Nvidia’s revenue to grow at 24% CAGR until the end of 2029. If the company manages to retain its net margins at the higher end of the historical range, it could reach a market cap of around $5.69T in the bear case and $6.32T in the bull case, with relatively attractive returns moving forward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, MSFT, GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.