Summary:

- Palantir reported a strong Q3’24 with 30% revenue growth and a significant adjusted operating margin expansion to 38%, achieving a “Rule Of” 68%.

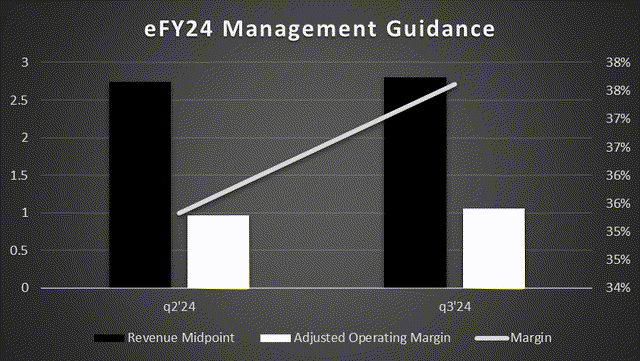

- Management raised FY24 guidance to $2.805-2.809 billion in revenue and $1.054-1.058 billion in adjusted operating margin, with a 38% margin at the midpoint.

- Palantir continues to drive large deals through its AIP bootcamps, closing 104 deals each valued over $1mm in q3’24.

vadimrysev/iStock via Getty Images

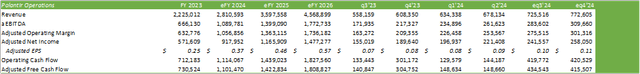

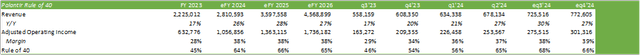

Palantir (NYSE:PLTR) reported a strong beat-and-raise with revenue growing by 30% in q3’24 paired with a significant adjusted operating margin expansion to 38%, resulting in a “Rule Of” 68%, up from 46% on q3’23. Management increased its guidance to $2.805-2.809b in net revenue for eFY24 with an adjusted operating margin of $1.054-1.058b, up from the previous quarter’s guidance of $2.742-2.750b in revenue and adjusted operating margin of $966-974mm. At the midpoint, the new guidance calls for an improved margin of 38%, up from 35%. Management also guided to the higher end of the range for adjusted free cash flow to $1b for eFY24. Given the improved guidance and the potential for accelerated growth going into eFY25, I am maintaining my STRONG BUY rating with an increased price target of $73.70/share at 39.39x eFY26 price/sales.

Palantir Operations

It is clear that Palantir’s AI platform is becoming a major player for enterprise software as adoption continues to accelerate through its impressive 30% sales growth in q3’24. This is primarily achieved through its live data use cases during the AIP bootcamps that are being translated to production-ready models for enterprises to implement and leverage for cost-savings/money-making initiatives. Management believes that their platform will go beyond just making/saving money to acceleration through its AI models.

To support this growth, management remains focused on expanding its operations through hiring technical talent and investments in AIP. As discussed in my previous reports covering Palantir, I believe much of the firm’s success can be attributed to its direct engagement with its potential customers through the bootcamps. Rather than running the typical sales pitch with a software demonstration and a proof of concept, Palantir uses live company data to prove how the product works for the potential customer. This factor, along with the firm’s growth acceleration, gives me reason to remain bullish on the name.

Along with this, customers are expanding their existing contracts with AIP, significantly differentiating Palantir from the “have nots.” Management noted their drive to make AIP the go-to developer platform for AI applications, competing with the likes of Cloudflare (NET) and its developer platform in its secured network ecosystem. Along with custom development features, AIP offers customers a library of pre-built AI applications and builder starter packs, creating a baseline for new customers to quickly ramp up their productivity.

In addition to this, Palantir’s platform is also succeeding with defense technology startups as a secure ecosystem that can allow for the firms to contract with the US government. I believe that this feature is significantly beneficial for companies of all sizes as it allows for easier access to gaining FedRAMP authorization.

Another factor that significantly differentiates Palantir from competing platform companies like C3.ai (AI) is the diversity of industries. C3.ai made its claim to fame through its partnership with Baker Hughes (BKR) and has since expanded into other industries. The challenge faced is that C3.ai didn’t create a universal platform from the get-go and has since played catch-up to developing a catch-all platform. This has resulted in C3.ai significantly lagging in terms of growth, adoption, and profitability when compared to Palantir.

In q3’24, Palantir closed 104 deals valued over $1mm. The firm is realizing an improved deal cycle by taking customers from prototype to production driven by its AIP platform, resulting in both new customer acquisitions and existing customer expansions. Revenue from Palantir’s top 20 customers grew by 12% on a year-over-year basis to $60mm per customer. Total commercial contract value grew by 52% on a year-over-year basis to $612mm with a grand total value of $1.1b.

One example management provided was reducing the time it takes for an insurance company to underwrite policies from 2 weeks to 3 hours through the automation of the underwriting workflows. This was done through the deployment of 78 AI agents. I believe that this will reduce the insurance company’s operational and administrative costs, resulting in major cost savings as well as a positioning of the firm with a shorter sales cycle. Palantir also referred to helping Trinity Rail develop a functional workflow that helped improve the company’s bottom line by $30mm.

On the domestic front, Palantir grew its US commercial business by 54% on a year-over-year basis as well as a 40% year-over-year growth rate for its US government business. Palantir fully ramped up its Titan program in q3’24 as part of its DoD contract. In addition to this, Palantir is finding success with its Maven program that automates the targeting and firing process, resulting in a 99% reduction in necessary staff to manage the system.

Palantir Financial Position

Palantir’s top-line growth began accelerating in q2’23 and has since reached 30% in q3’24 as enterprises and sovereign governments accelerate their AI adoption. I believe Palantir may continue realizing accelerated growth in the coming years as enterprises seek to better manage margins and growth through operational automation and optimization. For this reason, I’m forecasting Palantir to report $2.8b in net revenue and an adjusted EPS of $0.37/share for eFY24. I’m forecasting the top-line to grow by 28% in eFY25 to $2.8b and taper down to 27% growth in eFY26 to $3.6b.

I’m also forecasting Palantir to continue expanding its adjusted operating margin as the firm realizes economies of scale through further customer adoption. I’m forecasting Palantir’s “Rule Of” to expand to 64% for eFY24 and grow to 66% in eFY25. For reference, Palantir calculates its “Rule Of” by adding top-line growth and adjusted operating margin.

One headwind that may hinder some growth is the power constraint as it pertains to the growing data center footprint. As discussed in my report covering Microsoft (MSFT) the data center footprint is forecast to grow at a 23% CAGR through 2030 driven by AI training and inferencing. One major factor that may impede this growth is sourcing baseload capacity. I have reason to believe that the grid is being incrementally stretched thin for additional data center capacity, resulting in the hyperscalers seeking additional power sources, including dedicated baseload capacity through partnerships with the utilities. Given the substantial interest in nuclear power, specifically small modular reactors [SMRs], much of the capacity will not likely be built out until 2030-2035 as the technology has yet to be proven. Given Palantir’s low profile, this may not be a substantial impact to the firm’s growth trajectory.

Risks Related To Palantir

Bull Case

Palantir is driving adoption across both its commercial and government businesses, leading to an acceleration in its top-line growth rate. The firm has proven that its high level of growth doesn’t have to sacrifice margins, resulting in a “Rule Of” 68% in q3’24. I believe that Palantir may also benefit from the recent administration change in the US, as government efficiency will be a primary initiative. Given Elon Musk’s interest in AI development, I believe that Palantir may be well-positioned to expand its roots across various governmental departments to help reduce overhead and administrative costs while boosting performance efficiency.

As it relates to its share price performance, Palantir was added to the S&P 500 on September 23, 2024, resulting in an increased shareholder base through passive investors buying into the index. I believe that this may in part be the cause of the stock’s significant valuation expansion in the last few months.

Bear Case

Palantir’s valuation is at its all-time high at 54x trailing twelve-month sales. This may result in investor hesitancy as shares are significantly more expensive when compared to a year ago when shares were trading below 20x sales.

Palantir is currently expanding its headcount to support the growth of the business. If growth were to stall out or not continue to accelerate at the current rate, the firm may realize margin compression, and in turn, a decline in its “Rule Of”.

The stock performance may also trigger the firm to accelerate its stock-based compensation program if certain market-based vesting criteria are met, resulting in further dilution of the share count. In addition to this, insiders have been consistently selling shares, potentially signaling a more bearish sentiment to investors. To offset stock-based compensation, Palantir repurchased 1.8mm shares in q3’24 with $954mm remaining in its share repurchase program.

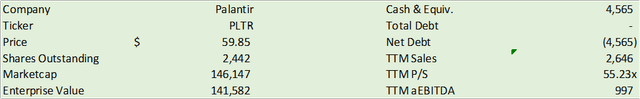

Valuation & Shareholder Value

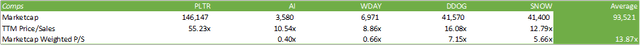

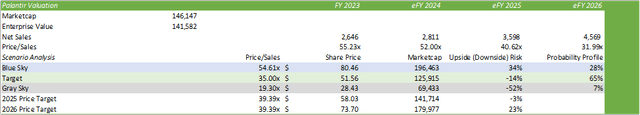

PLTR shares have reached their all-time high in terms of price and valuation, commanding a market cap of $146b at 55x price/sales. PLTR shares are currently trading at a significant premium over its competitors, holding an enterprise-value weighted average price/sales multiple of 13.87x. The purpose of weighting the competitors’ multiples based on enterprise value is to control for size and how much of the market shares command. Despite this high multiple, I believe PLTR’s valuation is justified by its accelerated growth trajectory and its strong profitability.

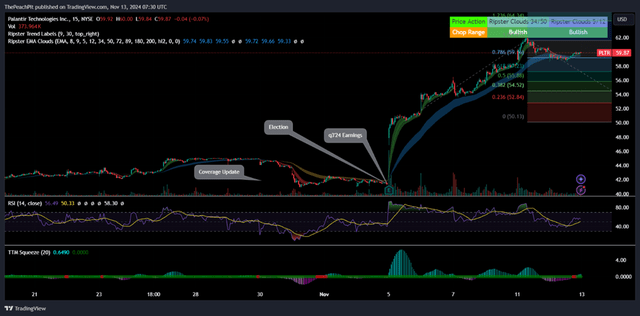

Given the steep run-up in price, I have reason to believe that shares may retrace in the near-term to $54/share before returning to growth.

I believe that the ultimate questions investors must ask is whether the high valuation is justified by the firm’s growth and margins, and whether shares can be sustained at these levels. I believe that with the new shareholder base being included in the S&P 500, PLTR shares have a certain level of baseline growth implied through the growth of the broader market, driven by index investors. Though only accounting for 0.24% of the index, I anticipate that growth in the index will positively impact PLTR shares.

Using an internal valuation model based on my growth forecast and the firm’s historical valuation range, I believe PLTR shares have outpaced its eFY25 levels, suggesting a HOLD rating.

Looking further out to eFY26, I believe PLTR shares may have some gas left in the tank to appreciate by 20% to $73.70/share at 39.39x eFY26 price/sales. Despite the averages used in the model, I believe shares may run as far as $80.46/share at 54.61x eFY25 price/sales if the company continues to outpace expectations in terms of growth and margin expansion.

Given the risks involved, I am maintaining my STRONG BUY rating with a price target of $73.70/share at 39.39x eFY26 price/sales.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR, BKR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.