Summary:

- RFK Jr.’s potential appointment as Health Secretary could increase scrutiny on Pfizer Inc., impacting drug approvals, advertising revenue, and legal risks, affecting stock performance.

- Senate confirmation for RFK Jr. is challenging due to his controversial views, making his path to becoming Health Secretary uncertain.

- Pfizer’s historical legal issues and lobbying activities could lead to RICO charges if RFK Jr. uncovers evidence of fraudulent practices.

- Despite potential risks, Pfizer’s low P/E ratio and robust enterprise value suggest holding shares, as the company can adapt to regulatory changes.

georgeclerk

Thesis: Pharma’s Uncertain Future

We’re going to change the way business is done at NIH. – RFK Jr.

For those of you keeping an eye on your investments while gleaning your daily dose of political news from Elon Musk’s grassroots’ X platform, RFK Jr.’s statement at a Turning Point Action conference likely came as no surprise. Equally, unsurprising—though perhaps no less intriguing—was the persistent pre-election buzz suggesting that a reinstalled President Trump might tap RFK Jr. to head up the Department of Health and Human Services.

The timing of when or where you get your news is, frankly, beside the point. What matters for investors in “big pharma” is the practical reality of this potential appointment and the weighty comments RFK Jr. has thrown into the mix. He’s pledged to investigate what he sees as collusion between the pharmaceutical industry and medical boards, accusing them of stripping licenses from doctors who, in his words, are “trying to heal patients” and treat them properly.

On top of that, he claims the Justice Department will target medical journals he believes are compromised by the pharmaceutical industry, threatening them with criminal and civil RICO actions unless they clean up their act and allow dissenting research to see the light of day. All of which, if it gains traction, could leave quite a mark on your portfolio.

Today, I’m focusing on Pfizer Inc. (PFE). Why? Well, as the political landscape shifts under this potential new administration, and if you’re tuned into health- and pharma-related chatter on X, you might have noticed that Pfizer has become something of a poster child for RFK Jr.’s mission to “Make America Healthy Again.”

X – Wide Awake Media

In late October, Kennedy took to X with a pointed warning:

FDA’s war on public health is about to end. If you work for the FDA and are part of this corrupt system, I have two messages for you: 1. Preserve your records, and 2. Pack your bags.

Not exactly the kind of language to put a spring in Pfizer’s step—or, for that matter, its stock price.

For Pfizer investors, today’s focus is on the potential implications of Trump’s reported choice of RFK Jr. for Health Secretary—a move that could increase scrutiny of drug approvals, impact revenue from advertising, and amplify legal risks for pharmaceutical companies, all of which could ripple through Pfizer’s stock performance.

Naturally, this introduces a layer of uncertainty, as heightened regulatory actions or fresh legal challenges could disrupt the market, particularly if Pfizer finds itself under tighter oversight or facing new business restrictions. That said, it’s a long stretch from here to “what might be.”

So, in today’s discussion, I’ll cover a few key areas: the potential loopholes RFK Jr. might use to become Health Secretary, his relationship with the DOJ regarding RICO actions, the NIH’s ties to Pfizer, the alleged “collusion” between medical boards and Pfizer, and the possible charges Pfizer could face. The goal? To assess the risk landscape for Pfizer investors in light of these developments.

The Loopholes for RFK Jr. to Become Health Secretary

Is the road to becoming Health Secretary an easy one for Robert F. Kennedy Jr.? Hardly. It’s more of an uphill slog. To take the reins at the Department of Health and Human Services (HHS), Kennedy would first have to clear the Senate confirmation process—a task that’s far from straightforward. His well-documented and often controversial views, particularly on vaccines, would undoubtedly be put under the microscope and paraded around for all to see. These positions are likely to draw fire not just from one side of the political aisle, but from both, making the path to confirmation anything but smooth.

Robert F. Kennedy Jr.’s long history of vaccine skepticism—even with his later attempts at clarification—casts him in a rather polarizing light, particularly given that public health policy is at the very heart of the HHS’s mission. Even with President-elect Donald Trump’s backing, he would still have to weather bipartisan scrutiny in the Senate. Republicans uneasy about how his nomination might play in terms of public health optics and Democrats alarmed by his anti-vaccine rhetoric could well join forces to block his path to confirmation.

Senate confirmation is no walk in the park. It involves a string of hearings where nominees are grilled by committees, often with the intensity of a barbecue on a hot summer’s day. For Robert F. Kennedy Jr., this process could easily be delayed—or outright derailed—if his past statements on public health become a sticking point, which they almost certainly will. His proposals to investigate or overhaul federal health agencies are also likely to set off alarm bells for legislators who value the independence of scientific institutions like the NIH or CDC. To clear this gauntlet, RFK Jr. would need some serious political finesse and a rare display of bipartisan support—neither of which is easily won these days.

HHS’s Relationship with DOJ for RICO Actions:

Let’s say the nomination goes through—what exactly is the relationship between the Department of Health and Human Services and the Department of Justice (DOJ)? Well, the DOJ operates independently when it comes to enforcing federal laws, including the Racketeer Influenced and Corrupt Organizations (RICO) Act that RFK Jr. has brought up. That said, as Health Secretary, Kennedy could still wield considerable influence. He’d be in a prime position to share evidence, nudge investigations along, and generally point the DOJ in the direction of pharmaceutical practices he deems worth probing. It’s not direct control, but it’s certainly a lever he could pull.

As it happens, the HHS and the DOJ have something of a working relationship, particularly when it comes to tackling health care fraud. The DOJ’s Criminal Division has a Health Care Fraud Unit that works hand-in-hand with HHS’s Office of Inspector General (OIG), pooling resources and expertise to investigate and prosecute shady dealings in the health care sector. It’s a well-established partnership, though not exactly one that tends to grab headlines.

Pursuing RICO Cases

The RICO Act is basically a heavy-duty legal tool originally made to go after organized crime—you know, mob bosses and their shady dealings. But it’s not just for taking down gangsters. It can also be used to investigate big players in industries like pharmaceuticals if there’s evidence of some sketchy, ongoing illegal activity.

That’s where RJK Jr. comes in. Assuming he takes the Health Secretary role, he’ll get access to all sorts of data, reports, and expert insights. With all that at his fingertips, he’s in a prime spot to dig into the not-so-clean side of pharmaceutical companies and bring any alleged questionable practices into the light.

Recent Examples of Collaboration

As recently as June of this year, the DOJ announced a massive crackdown, charging 193 people—including some doctors—with healthcare fraud. Altogether, the schemes added up to $2.75 billion in false claims. I think a case like this is a perfect example of federal agencies teaming up to take on big healthcare fraud. It’s also a preview of what could become more common under RFK Jr., with a focus on coordinated efforts to clean up the health industry.

NIH’s Relationship with Pfizer

Next on his agenda, RJK Jr. vowed to “change the way business is done at NIH”—a very tall promise. The National Institutes of Health, or NIH for short, has long been hand-in-glove with companies like Pfizer, especially when it comes to clinical trials and research partnerships. This isn’t some clandestine arrangement, but a well-oiled collaboration that funnels heaps of funding into biomedical research. Together, they tackle big-ticket health challenges through public-private initiatives, like the ACTIV project, which was behind fast-tracking COVID-19 treatments, or the Accelerating Medicines Partnership (AMP), where Pfizer and others work on better ways to diagnose and treat diseases.

Pfizer benefits from these NIH collaborations in the form of shared research funding, data, and faster clinical trials. But if RFK Jr. makes a move to redirect NIH’s budget focus to alternative and holistic cures, this could actually shave resources from Pfizer’s conventional drug research. The NIH’s current commitment to advancing treatments through biopharmaceutical advances — immunotherapies and vaccines — could be challenged if non-pharmaceutical alternatives were to replace it, undermining the synergy that drives Pfizer’s drug pipeline.

Alleged Political Collusion of Medical Boards and Pfizer

One of RJK Jr.’s recurring claims is that pharmaceutical companies—Pfizer being a frequent headliner—are in cahoots with medical boards. The accusation is that these companies throw their considerable weight around to keep a stranglehold on the market. This might mean sidelining competitors or nudging outspoken doctors—those who critique mainstream treatments—off the playing field.

As it happens, pharmaceutical companies—Pfizer among them—are no strangers to lobbying. In fact, in 2021 alone, Pfizer spent over $11 million on lobbying activities. Now, lobbying is perfectly legal. The real issue crops up when lobbying morphs into what’s called “regulatory capture.” That’s the moment when the agencies meant to safeguard public interest start acting more like the industries’ personal cheerleaders. And that’s precisely the sort of thing RFK Jr. is pointing his finger at.

Sometimes, pharmaceutical companies have been accused of trying to influence doctors. For example, in 2004, Pfizer had to pay $430 million because it was found promoting a drug called Neurontin (gabapentin) for unapproved uses and giving incentives to doctors to prescribe it. However, for RFK Jr. proving that drug companies are working directly with medical boards to sway their decisions will be extremely tough. It requires clear proof, like emails, records or messages, showing they actually planned and agreed to do so.

Possible Charges Against Pfizer

If RFK Jr.’s momentum gets him to this point, and if investigations actually uncover shady actions by Pfizer, the company could get hit with RICO charges that might look like the following:

- Fraudulent Marketing:

Pfizer’s no stranger to hot water for pushing drugs for unapproved uses. Case in point, back in 2009, they coughed up $2.3 billion in a record-breaking healthcare fraud settlement for illegal drug promotion.

- Bribery and Kickbacks:

Pharma companies, and this includes Pfizer too, have been called out for greasing palms to boost prescriptions. In 2016, Pfizer paid $23.85 million to settle claims that it funneled kickbacks to Medicare patients through a purportedly independent charity.

- Anti-Competitive Practices:

Actions such as lobbying medical committees or journals in favor of one treatment may qualify as anti-competitive. There are no direct Pfizer references, but this is a known problem in the industry.

- Price Manipulation:

Jacking up drug prices unfairly can spark legal trouble. Again, while Pfizer isn’t named in specific RICO cases for this, but other big pharma players have been caught playing these tricks.

Investment Implications for PFE

The question that’s likely bouncing around many Pfizer investors’ minds today is: What do I do with my PFE shares? It’s a fair question because, according to Seeking Alpha’s data, not a single analyst—not on Wall Street, not among Seeking Alpha’s own team—has issued a “Sell” call. Now, if you’re anything like me and have a bit of a contrarian streak, based on what you’ve just read, the idea of going against the grain here is undeniably tempting.

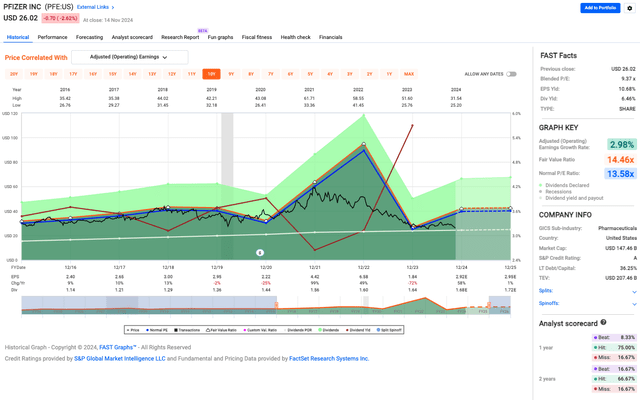

That said, today, keeping things simple, the data is telling me that with PFE’s blended P/E ratio sitting at 9.37x right now, it’s way below its historical average of 14.46x and normal P/E of 13.58x, signaling one of two things: the market’s downplaying Pfizer’s earnings potential while simultaneously already pricing in all the risks, including RFK Jr.’s “potential” actions. Or, yet still, with an EPS yield of 10.68%, Pfizer right now looks solid for value investors hunting for a deal.

So, factoring in the worst—or best, depending on your perspective—that RFK Jr. might bring to the table, let’s not forget that Pfizer is no stranger to legal battles. This isn’t some small-time player fumbling in the dark; it’s a heavyweight with a $207.46 billion enterprise value, comfortably positioned in the cutthroat, innovation-driven world of pharmaceuticals.

Pfizer has the resources to adapt and press on, and it will.

That’s why I’m recommending that investors “Hold” onto their shares, even as the waters ahead look like they might get a bit rough. And who knows? We might just be on the cusp of a major shift—one that could genuinely improve not just national but global health.

If Pfizer decides to embrace adaptation—say, by leaning into emerging areas like the psychedelic market rather than resisting them—we could be looking at a whole new world of healthcare. One where natural alternatives may just make America healthier again.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.