Summary:

- Getting overly bullish on Disney stock now is premature.

- DIS’s performance in Q4 is more of the same in a market different from it was pre-2020.

- We think, at best now, it portends a hold.

Henrik Sorensen

ABOVE: THE LITTLE MERMAID: Too woke to have equalled the original.

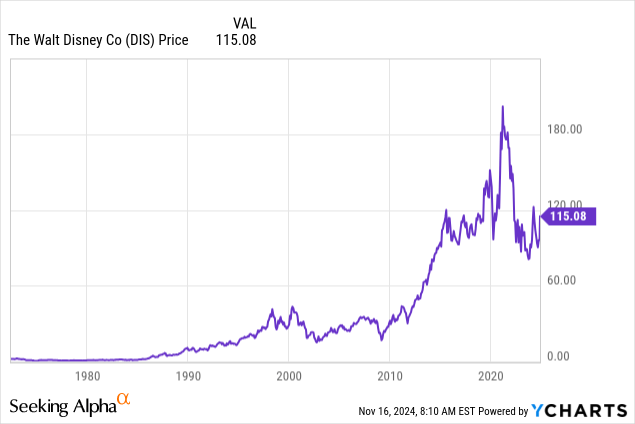

PREMISE: We now have Walt Disney (NYSE:DIS) wind up 4Q24 numbers and by any measure, they were good. Filmed entertainment came through with a solid performance linked to two movies which YTD have grossed over $600m. DTC with growth in subscribers. DIS completed its deal with Reliance of India to assure its big Asian anchor will continue and grow. Response from holders has been understandably near giddy. Some believe the long awaited turnaround in valuation post the horrific decline of the past five years has arrived. And many believe the march back to the all-time high in early ’21 to over $200 may be just over the next trading cycle.

Above: Investors need more quarters like 4Q24 to envision big price recovery.

4Q24 produced a solid $1.14 EPS

Sorry, I’m not buying that big rebound scenario, though DIS’s results are encouraging. On the news, the stock rallied to $115 at writing. Furthermore, DIS has implied guidance for 2026 with an EPS of $6.00 vs. prior call at $5.73. Management is looking for high single digit growth in profits next year, doubling growth in EPS.

All good. But let’s quickly see the components that contributed to this fine 4Q24 results:

- Ad supported tiers for Disney+ up 4.5% largely due to strong response to ad-supported tiers. In brief, these were budget buys that have sent ad supported subs to 37% of the DTC total. But its average revenue growth still trailed Netflix’s (NFLX) 10% by 7%.

- Total revenue was up 6.28% with propulsive assists from three films: Inside Out 2 ($1.6b) and Wolverine, plus Deadpool, all have done well. But hit movies must always be balanced with so-sos and flops. In 2025, we expect the debut of Snow White and Captain America, among other sequels. Both these films could surprise. But industry friends tell me the widespread belief by insiders is that both are headed to flopville big time.

- Since Snow White debuts as one of the wokest DEI movies to date. If it does a $400m belly flop at the box office envisioned, it may finally jolt the DIS honchos to follow a growing trend to toss DEI into the failed garbage dump, joining other films DIS efforts. Don’t bet on it.

- DIS lapdog belief in doing god’s work rather than making money for shareholders is a fatal flaw in its future. The recent presidential election may show public sentiment suggesting a woke bye, bye. But recurring reports of Draconian despair among the presumed wokest base embolden DIS to double down on their compelling need to adapt political stances in films, when in truth they contribute nothing to the grosses.

Recurring defenders of DIS wokeism need to demand that they prove its cling to DEI with a public airing of those films grosses to support its virtue signaling. The new releases noted above were just good movies period.

Walt Disney had some decent successors, but in truth, his chair remains empty. It’s not nostalgia, nor wounded get off my lawn oldsters, it’s the hard reality of the current DIS not reflecting the new realities as the company did when Disney was at the helm.

The good news

- Disney’s DTC is edging on profitability; good news all around. However, bear in mind gains in subs came substantially from bargain hunters. How sustainable will they be once the new subs run through all the legacy DIS IP of long years ago?

- The P/E tells a positive story – mostly. At 20.12 it has been halved since July. That’s the good news. The not so good news is that P/E among peers and relatable stocks are considerably better.

- Filmed entertainment is moving in the right direction with strong grosses.

- Long-term debt remains a drag on the balance sheet at $39b, though the average cost of interest hits about 4.5%. It’s manageable and DIS continues to pay it down from $47b five years ago. But the near $2b interest costs annually does impair market cap.

The not-so-good realities

Linear networks continue to erode. ESPN subs fell to 66m in 2024 from 71m. Management insists on holding this unit and staying deeply invested in sports, though ESPN could fetch as much as $24b if it were sold. DIS just paid the NBA $2.6b for game rights. Yet, average viewership for regular season games is down. The league’s highly valued followership on social media is heavily weighted with teens and near teens, who have limited ad value. The league has had to institute a bogus In Season tournament in an attempt to stimulate the lagging regular season. So overall, while yes, sports programming does well, the soaring rights fees begin to seem wildly excessive.

ESPNBet, Disney’s branding deal with PENN Entertainment (PENN), has yet to make a significant dent in the sports betting sector. Nor are its longer-term prospects trending toward it becoming perhaps a single digit market share owner. The unit is really the result of blunders. First, DIS waited too long to get into sports betting regardless of protests about its family image. Two Penn failed with a costly partnership with Barstool. Its branding deal with ESPN did open a pathway to signups. But it remains a too little too late effort. For DIS, it means $1.5b over ten years in marketing support, not much of a blip per year for ESPN. To me, it adds to a strong case for DIS to finally get common sense and unload ESPN for anything close to $20b plus and use a chunk of the proceeds to accelerate a paydown of debt.

We’re not here to tarnish the 2024 improvement in overall performance. We only point out that the giddy response from some holders and analysts may have gone too far. DIS price recovery entirely comes from existing revenue segments. But to forecast a return to the glories of $200 a share plus is a bit of a bridge too far. Problems persist mainly because its mostly toothless board has not pressed management to make real structural changes in a great business which has become too clunky, too inept creatively to overcome its long-term problems endemic to its existing structure.

We’d like to see more quarters ahead with the propulsion of 4Q24 before we can make sight of a strong run back to anywhere near $200. We think at best, DIS is a hold, but a profit taker stock around $120.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.