Summary:

- Alpha Metallurgical Resources has outperformed the S&P 500, bolstered by a fire at Anglo-American’s Grosvenor mine that reduced global coking coal supply.

- The fire underscores coal’s supply risks amid high demand, potentially tightening the market further. AMR’s strong reserves and export focus position it well.

- Despite current price headwinds, AMR remains profitable and strategically invests in buybacks, making it an attractive, albeit volatile, investment opportunity.

Andrzej Rostek

Introduction

It’s time to talk about coal.

In this case, we’ll discuss Alpha Metallurgical Resources (NYSE:AMR), a company I called “A compelling investment opportunity for those comfortable with volatility” in my most recent article, published on May 6.

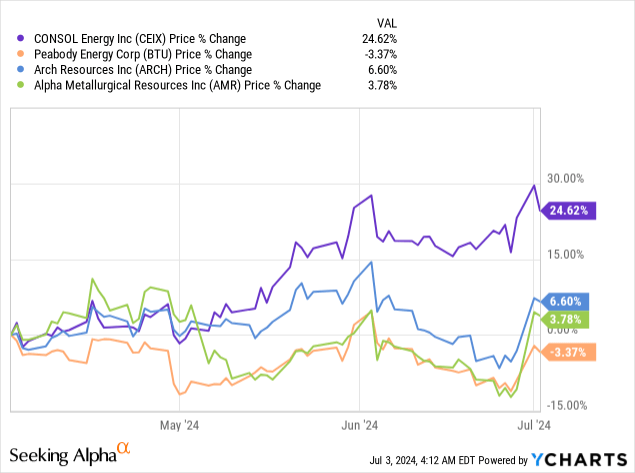

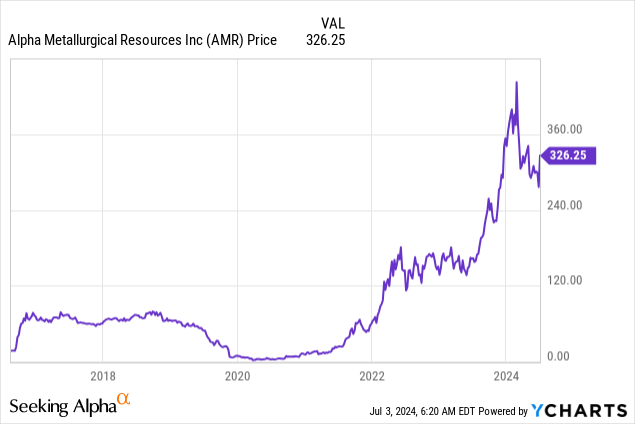

Since then, shares of the miner have risen by 8.5%, beating the impressive 6.2% gain of the S&P 500 by a decent margin.

What helped the company was a major headline on July 1:

The headline caused a jump in the share prices of some of the biggest North American coal producers, including AMR.

Hence, in this article, I’ll take a closer look at the Anglo American fire, explain what it means for the bigger picture, and tell you why I believe Alpha Metallurgical Resources is one of the most undervalued stocks in the basic materials/energy space.

However, before we continue, please be aware that AMR stock is much more volatile than the dividend (growth) stocks we usually discuss. For most people, coal stocks may be wrong – regardless of how bullish I may sound in this article.

Please take that into account.

Now, let’s dive into the details!

A Major Fire – And What It Means For The Industry

Do you remember Anglo American?

It’s the company mining giant BHP (BHP) tried to buy earlier this year.

The company avoided the takeover and started measures to improve its overall market value. This included plans to sell some Australian coal assets, including its Grosvenor mine in Queensland, Australia.

This mine was just hit by a fire, which the company expects to keep production suspended for several months.

As reported by The Wall Street Journal, we’re dealing with a mine producing roughly 3.5 million tons of steelmaking coal per year:

Its most recent guidance includes 8 million metric tons of steelmaking coal in the first half of this year, of which Grosvenor will contribute 2.3 million tons. For the year as a whole, the steelmaking coal business is expected to produce 15 million to 17 million tons, of which Grosvenor was expected to contribute 3.5 million tons.

I believe there are two major implications here. One obvious implication and one less obvious long-term implication.

Implication 1: The mine fire will erase roughly 3.5 million of coking coal production. This reduces global supply, benefitting pricing.

However, 3.5 million tons is not a lot. According to the GMK Center, the annual coking coal market is roughly 1.1 billion tons, which puts the Grosvenor share that just went offline at roughly 0.3%. It’s not insignificant, but it’s not a huge game-changer either.

What matters is the bigger picture. According to the same source, the coking coal industry is expected to see a shortage in the 2030s!

The global steel industry may experience a growing shortage of coking coal in the early 2030s if the industry’s decarbonization is slower than expected or if steel demand is higher. This forecast was voiced by experts at the Indian Steel Association (ISA) summit, SteelMint reports.

[…] Problems with the supply of these raw materials may worsen faster than the development of alternative steelmaking technologies.

[…] The growing shortage of high-quality coking coal could be the only obstacle that could prevent India from meeting its steel production targets in 2023 or 2047. – GMK Center

This brings me to implication 2: Pressure on coal supply could grow.

After the fire, it became once again clear how dangerous and polluting coal production is. While I am a long-term supporter of coal as a transition source, I believe we are looking at even more pressure on supply growth, especially because we are already seeing pledges to phase out coal – despite strong demand.

This is what the International Energy Agency wrote with regards to output cut pledges in light of strong demand:

Global coal demand grew in 2023, despite rapid growth in renewables-based power generation. The largest uptick was observed in the People’s Republic of China (hereafter, “China”), followed by India and other emerging and developing economies. Growing use of coal, mainly for power, has accounted for nearly all the increase in global CO2 emissions since 2019.

[…] A growing number of countries have adopted net zero emissions pledges, which is tantamount to phasing out completely the unabated use of coal and other fossil fuels. At the end of 2023, those pledges covered more than 85% of global energy sector emissions.

These pledges are “dangerous,” as they pressure the supply of a critical commodity in the steel industry (ignoring thermal coal for utilities) in light of what we can assume will be a long-term demand uptrend.

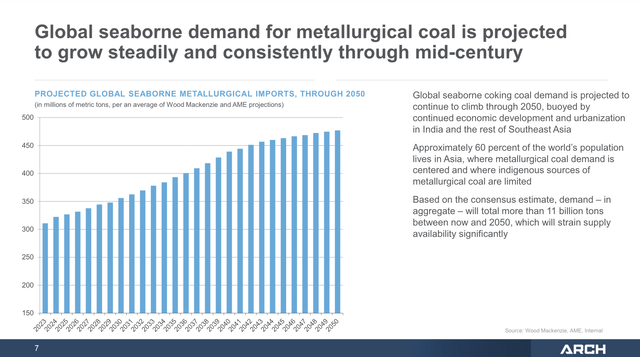

Arch Resources (ARCH), a major coking coal producer, used data from Wood Mackenzie to show that demand is not expected to decline until at least 2050!

Especially in an environment of rising cyclical economic demand and energy prices, I expect coal to become a highly desired commodity.

This bodes well for Alpha Metallurgical Resources.

AMR Remains In A Fantastic Spot

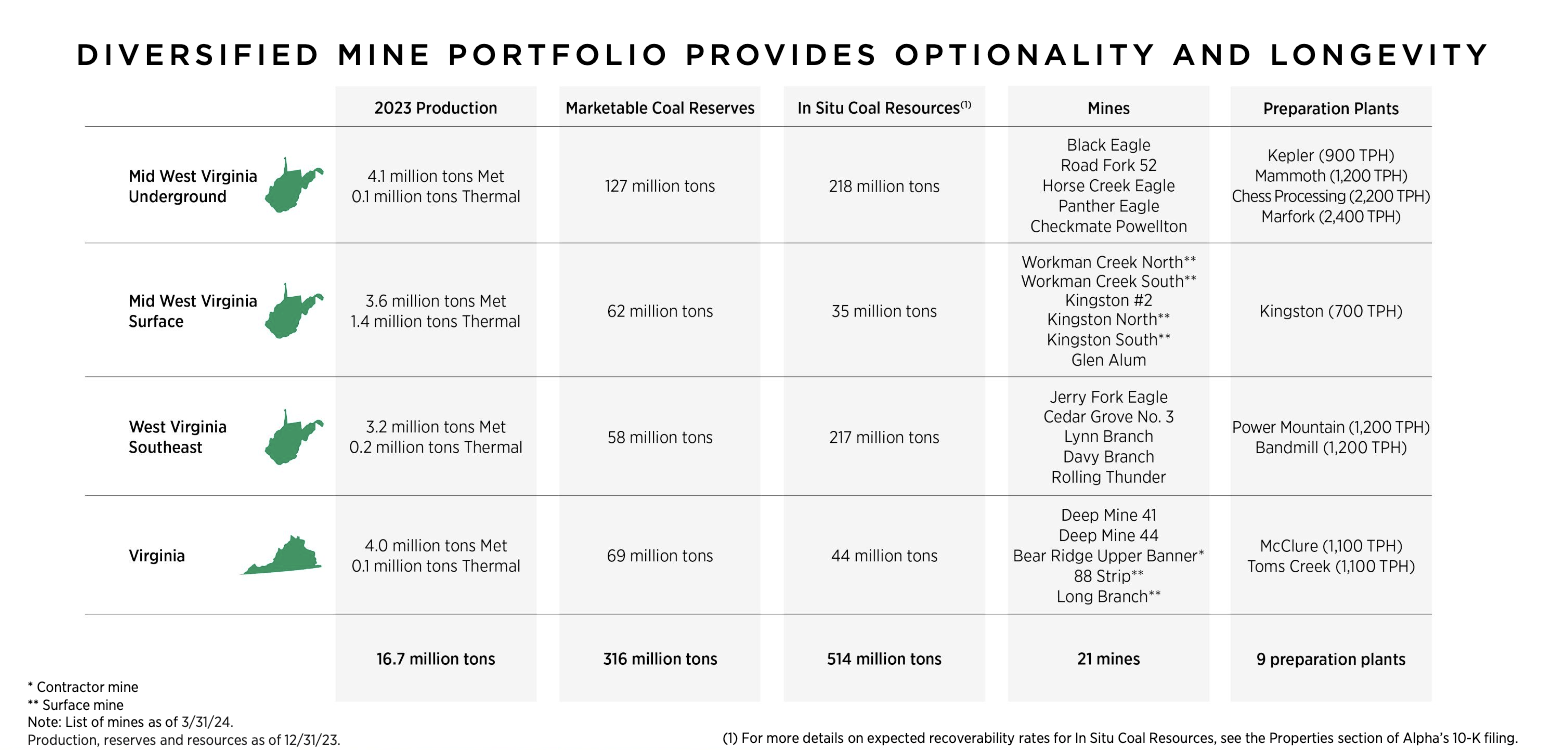

Based in Tennessee, AMR operates mines in Virginia and West Virginia.

These mines produced roughly 16.7 million tons of coal last year and were supported by nine preparation plants. It also holds 316 million tons of marketable reserves (19 years without discoveries) and 514 million tons of In Situ resources.

Alpha Metallurgical Resources

In Situ is a process where coal is converted into gas by injecting oxidants and steam in non-mined coal seams.

In other words, the company is in a great spot when it comes to long-term reserves.

It’s also very efficient. In its 1Q24 earnings call, the company explained its operations are roughly 14% more productive than the next operator in line.

On top of that, the company has another major advantage. It has become a major exporter of coking/metallurgical coal, which is the very market that benefits from the Anglo American mine fire.

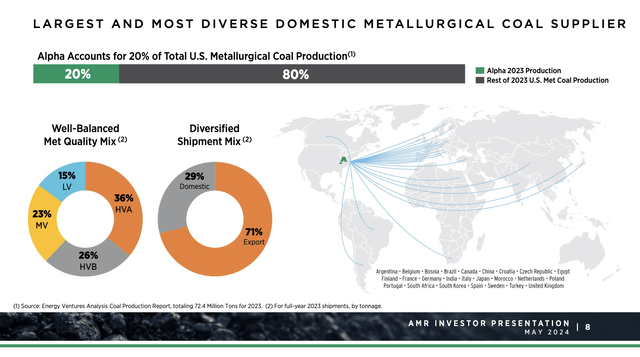

AMR is so large that it produces a fifth of the total U.S. metallurgical coal supply, with more than 70% of it going to export markets.

Moreover, as you may have seen in the GMK Center quote in this article, India is one of the strongest markets in the world for coking coal, as the supply of this commodity seems to be the only thing that can halt the surge in its steelmaking demand.

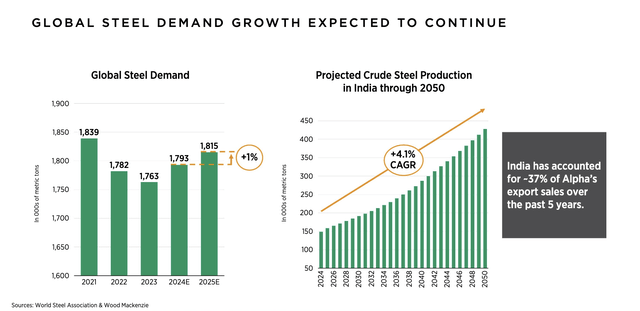

AMR confirms this, as it sees a 4.1% annual growth in Indian steel production through at least 2050. This market accounted for roughly 37% of its export sales over the past five years.

While coal prices are currently a headwind, I expect this business model to turn AMR into a winner again the moment economic demand rebounds.

This is also based on how AMR uses its cash.

As of the first quarter, the company had roughly $269 million in unrestricted cash and a total liquidity of $288 million. It had no borrowings under its lending facility and a strong focus on buybacks.

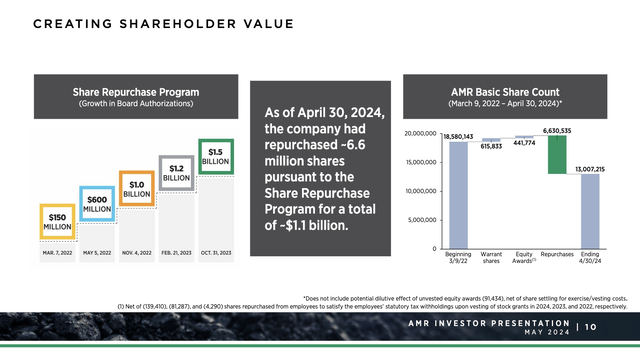

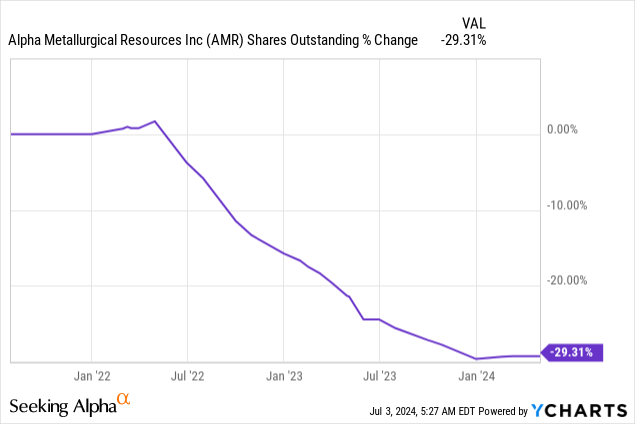

Using the company’s data below, it has spent $1.1 billion to buy back 6.6 million shares since the second half of 2022.

This buyback program bought back roughly a third of the company’s total stock, which added tremendously to its stellar stock price performance.

In early 2022, the company traded at roughly $50 per share. Now, it trades at $326. Earlier this year, its stock price touched $450.

Currently, the company has an authorized buyback permit of $400 million, more than 9% of its $4.2 billion market cap.

What sets AMR apart in this market is that even with subdued prices, it remains profitable.

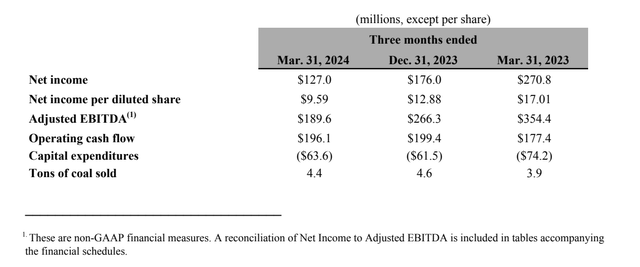

For example, the company sold 4.4 million tons of coal in 1Q24, with realizations for the met segment averaging $166.68 per ton. That’s down from $183.76 in 4Q23.

Even with these lower prices, AMR’s strategic adjustments in production and logistics have allowed it to maintain profitable, with $190 million of adjusted EBITDA and $127 million of net income – that’s more than $500 million on an annualized basis.

Hence, even in this environment, I’m very upbeat about AMR’s valuation.

Valuation

Putting a valuation on any commodity-focused company is tricky, as most companies are highly correlated to the commodities they produce – which makes sense.

After all, commodity price swings have a direct impact on revenues.

Hence, I stick to what I wrote in my prior article:

Last year, the company generated roughly $60 in per-share OCF. As I expect coal prices to gradually rise back to levels seen back then, I expect the company to achieve no less than $60 in per-share OCF in the next three years. This excludes higher output.

It also implies a longer-term price target of $450, 50% above the current price.

I only need to add that in the event of a broad-based growth recovery, I expect AMR to far exceed $450 per share, mainly fueled by aggressive buybacks.

Even in this environment, analysts expect AMR to generate $310 million in 2025E free cash flow (7% of its market cap). Any demand and pricing tailwind could easily result in 10-15% annual buybacks, if not more.

The only thing I need to mention again is that AMR is highly volatile. Personally, I decided to mainly invest in oil and gas through companies with less volatility.

As upbeat as I am about AMR, it’s not a stock that should be owned by conservative investors. Please be aware of these risks.

Takeaway

Alpha Metallurgical Resources presents a compelling opportunity for those comfortable with volatility.

Despite the significant risks of coal investments, AMR’s strategic positioning and operational efficiency make it a standout in the industry.

The recent Anglo-American mine fire highlights the potential for coal supply constraints, benefiting AMR’s market position in a market with increasing supply risks.

With strong reserves, a focus on exports, especially to high-growth markets like India, and an aggressive buyback strategy, AMR is well-poised for long-term gains.

Pros & Cons

Pros:

- A Focus on Met Coal: AMR’s emphasis on higher-margin met coal positions it well to benefit from sustained demand in the global steel industry.

- Robust Export Sales: With over 70% of production going to export customers, AMR is less prone to domestic weakness, including a focus on electric arc furnaces.

- Healthy Balance Sheet: Despite industry challenges, AMR maintains a healthy balance sheet with substantial unrestricted cash reserves.

- Potential for Pricing Rebounds: Any future pricing rebounds in coal could lead to significant improvements in AMR’s financial performance and shareholder returns (buybacks).

Cons:

- Industry Volatility: AMR operates in a highly cyclical industry prone to price fluctuations, exposing investors to significant downside risks during coal price declines.

- Short-Term Headwinds: Recent earnings reflect industry headwinds, leading AMR to slow its aggressive buyback program to focus on financial stability.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.