JHVEPhoto

Investment bank stocks’ strong gains following the U.S. elections is justified given the likelihood of lower taxes, expected delays and further dilution in Basel III final rules, and anticipated in investment banking activity, especially M&A, J.P. Morgan analyst said in a recent note.

“We see this momentum continuing near-term, also supported by a good trading environment in equities and also in credit in 4Q so far,” wrote J.P. Morgan analysts led by Kian Abouhossein.

The firm remains Overweight in investment banks overall.

However, while the Basel III finalization could be delayed and less stringent than earlier proposals, potential deregulation, compared with current rules, will take time to be implemented. They don’t see any changes until the end of H1 2025 or H2 2025.

With U.S. investment banks Goldman Sachs (NYSE:GS) and Morgan Stanley (NYSE:MS) already pricing in the upside scenarios, the J.P. Morgan analysts see more upside potential for European banks.

Long-term, “we prefer European IBs, which also stand to benefit from any potential improvement in client activity levels,” Abouhossein wrote.

Since Nov. 5, Goldman (NYSE:GS) stock is trading at 12.7x P/E 2026E and Morgan Stanley is trading at 15.6x, representing significant premiums to European investment banks Deutsche Bank (DB) at 5.3x and Barclays (NYSE:BCS) at 6x, and even UBS Group (NYSE:UBS) at 10.7x.

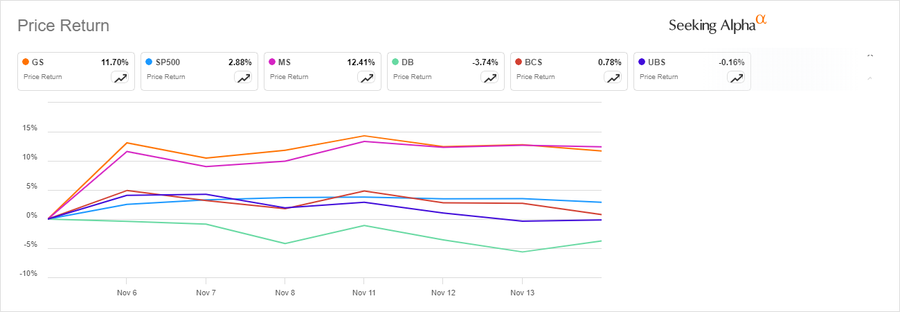

Note that Goldman (NYSE:GS) and Morgan Stanley stocks have each risen about 12% since Nov. 5, outpacing the S&P 500’s 2.9% increase. By contrast, Deutsche Bank (DB) fell 3.7%, UBS (NYSE:UBS) slipped 0.2%, and Barclays (NYSE:BCS) edged up 0.8% during the same period.

Goldman, Morgan Stanley stocks outpace S&P 500, Europe IBs since U.S. election (Seeking Alpha)

Barclays (NYSE:BCS) generates 31% of group revenue from the U.S. For Deutsche Bank (DB), 33% of its investment banking revenue and 17% of its group revenue come from the U.S.

Across the five banks mentioned in this report, the average SA Analyst rating is Buy on all except UBS (NYSE:UBS), which gets a Hold rating. SA Quant system rates Barclays (BCS) a Buy, with Goldman (GS), Morgan Stanley (NYSE:MS) and UBS at Hold.

J.P. Morgan’s long-term global investment banking pecking order is: DB, UBS, Barclays, GS, Société Générale (OTCPK:SCGLF) (OTCPK:SCGLY), MS, and BNP Paribas (OTCQX:BNPQF) (OTCQX:BNPQY), Abouhossein and colleagues said. “In a European context, we had already shifted our portfolio towards higher non-net interest income gearing through our top picks, UBS, DB, and Barclays.”

Among diversified and investment banks, the SA Quant system ranks Wells Fargo (WFC), Banco BBVA Argentina (BBAR), PNC Financial Services (PNC), and Mizuho Financial (MFG) the highest.

Dear readers: We recognize that politics often intersects with the financial news of the day, so we invite you to click here to join the separate political discussion