Summary:

- Microsoft achieved 16% YoY revenue growth in Q1 2025, reaching $65.6 billion, driven by cloud and AI.

- Azure grew 33% YoY, fueled by high-value contracts and 12% growth attributed to AI-driven services adoption.

- A 98% annuity-based revenue model and $259 billion in RPO ensure predictable and stable future income.

- Microsoft invested $20 billion in CapEx, focusing on cloud and AI infrastructure to drive long-term growth.

- EPS rose 10% YoY to $3.30, showcasing robust financial performance despite Activision and AI infrastructure costs.

Jean-Luc Ichard

Investment Thesis

Microsoft’s (NASDAQ:MSFT) Q1 2025 results showcase robust 16% year-over-year (YoY) revenue growth, driven by Azure’s 33% expansion and increasing AI adoption. With a 98% annuity-based revenue model and $259 billion in RPO, Microsoft’s cloud and AI dominance ensures predictable growth. Strategic investments in AI infrastructure, growing cash flow, and future solid guidance position Microsoft for sustained leadership in transformative technologies, solidifying its long-term value and competitive edge in the cloud and AI markets.

Microsoft Q1 2025: 16% Revenue Surge Driven by Cloud and AI Leadership

Microsoft’s Q1 2025 earnings pointed to significant growth across the business segments. The top-line is now at $65.6 billion, marking a 16% increase YoY. This growth reflects the continued strength in Microsoft’s commercial and consumer offerings, with 10.76% compound annual revenue growth (based on TTM) over 10 years.

At the bottom line, EPS grew 10%, reaching $3.30, which indicates robust profitability despite pressures such as the Activision acquisition and higher CapEx in cloud and AI infrastructure. The company’s ability to achieve 16.86% annual growth on bottom-line for 10 years highlights its long-term progressive execution while integrating AI into its business models.

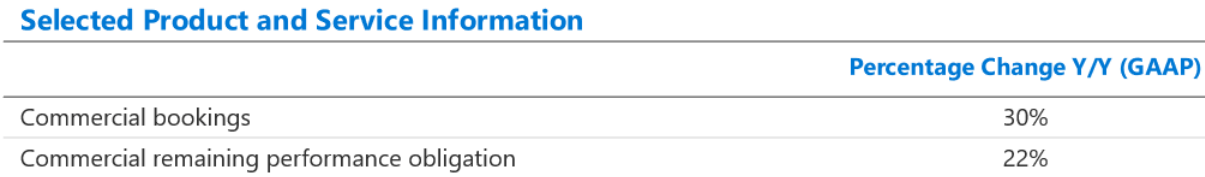

To begin with, the core revenue driver behind Microsoft’s strong performance is its continued dominance in the cloud space (specifically through Azure and Microsoft 365). The growth in bookings and large contracts continues to hold momentum. For instance, commercial bookings surged 30%, with a notable increase in high-value contracts, including a rise in $100 million-plus Azure contracts.

Q1 2025 Presentation

Moreover, the company’s commercial remaining performance obligation (RPO) increased by 22%, hitting $259 billion. This represents the value of contracts Microsoft expects to recognize as revenue in the upcoming quarters. With that, ~40% of this RPO may be recognized within the next 12 months and is growing by 17% from the previous year, pointing to the solid RPO pipeline and stable forward revenue.

The increasing percentage of annuity-based revenue (now at 98%) indicates the company’s transition to a more predictable, stable, and recurring revenue model. This shift boosts valuations and positions MSFT stock for continued value growth on a forward basis, as the revenue growth matches the premium valuation.

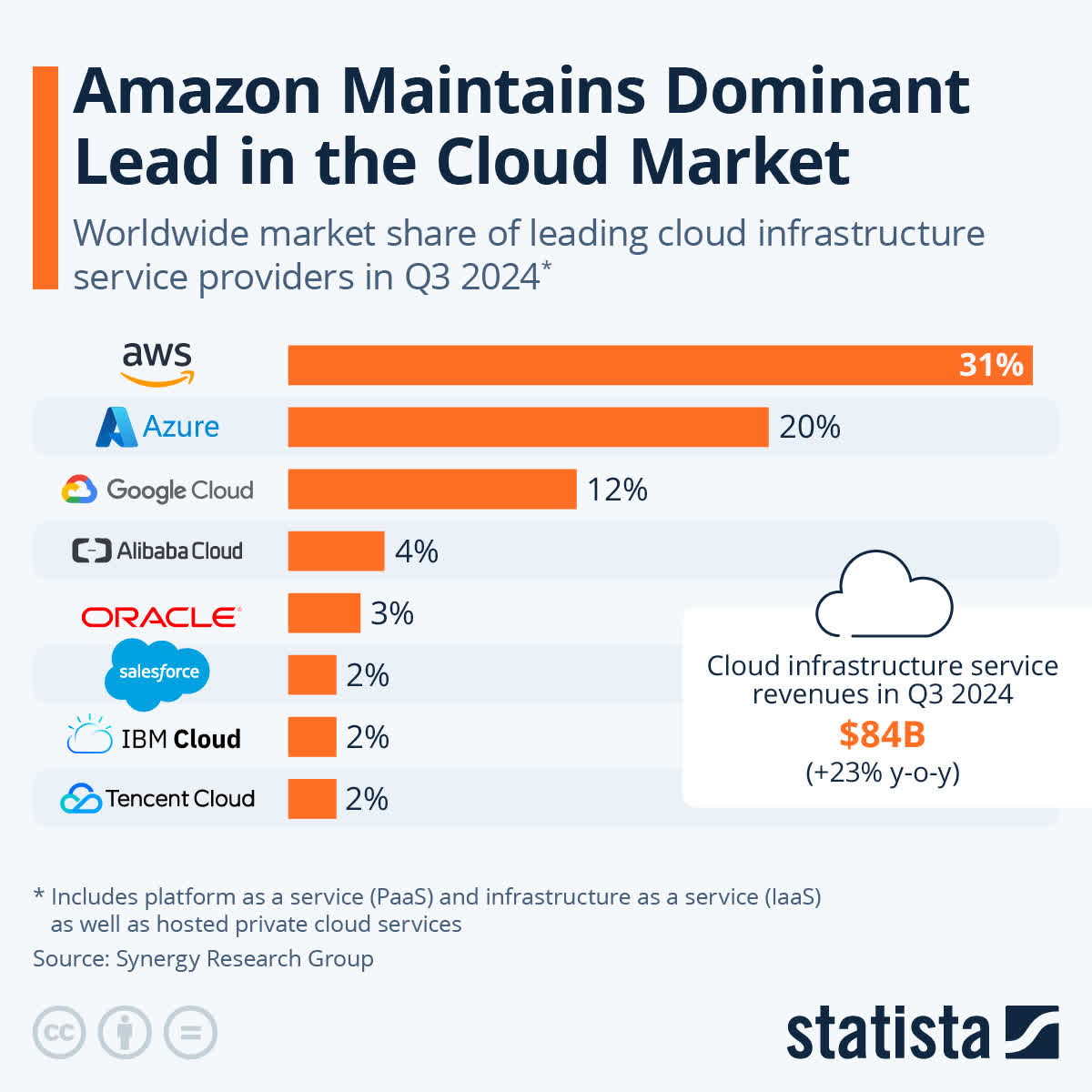

In detail, Microsoft’s commercial business holds solid growth in areas like cloud and AI. Microsoft Cloud revenue reached $38.9 billion with a 22% YoY increase, indicating the company’s market share growth trajectory in the cloud. Although there is a slight decrease in the cloud’s gross margin percentage based on increased AI infrastructure costs, the company’s gross margin dollars improved by 13%. In short, while scaling AI infrastructure has reduced margins in the short term, the overall cloud segment is still a massive revenue and bottom-line contributor.

The revenue may expand rapidly as the company invests heavily in AI. For instance, AI services contributed ~12 percentage points to Azure’s 33% growth. Fundamentally, AI adoption across Azure may create additional opportunities for higher-value and long-term contracts. Further, Microsoft aims to lead the AI revolution, expecting AI-related revenue to surpass $10 billion annually by Q2 2025. This milestone aligns with the trend that its top-line is growing faster than its direct peers (cloud, OS, and devices) after the AI wave (November 2022).

CapEx is another fundamental that is pushing Microsoft’s long-term top-line growth potential. In Q1 2025, Microsoft’s CapEx was $20 billion, which aligns with expectations, with $14.9 billion allocated to property, plant, and equipment (PP&E). Most of this expenditure is directed toward cloud and AI infrastructure (including AI servers, CPUs, and GPUs). These long-lived assets may support monetization for the next 15 years or more. Even with this massive investment in cloud and AI infrastructure, cash flow from operations increased by 12% ($34.2 billion) based on solid cloud billings and collections. This cash flow growth is critical to reinvesting in strategic AI initiatives and cloud capabilities.

Looking ahead, Microsoft’s outlook for Q2 2025 continued strong growth across its business segments. The company expects revenue in the Productivity and Business Processes segment to grow by 10-11%, driven by M365 commercial cloud growth of 14%, alongside sustained momentum in consumer cloud subscriptions.

Lastly, the Intelligent Cloud segment is projected to see a revenue increase of 18-20%, with Azure’s growth expected to be particularly strong, potentially reaching 31-32% year-over-year in constant currency. Thus, the strategic focus on AI and cloud infrastructure is expected to drive much of this growth, with Microsoft continuing to benefit from both the scaling of Azure and increasing AI consumption.

statista

Microsoft’s AI Ambitions Face $100 Billion Investment Hurdle Amid Slowing Azure Growth

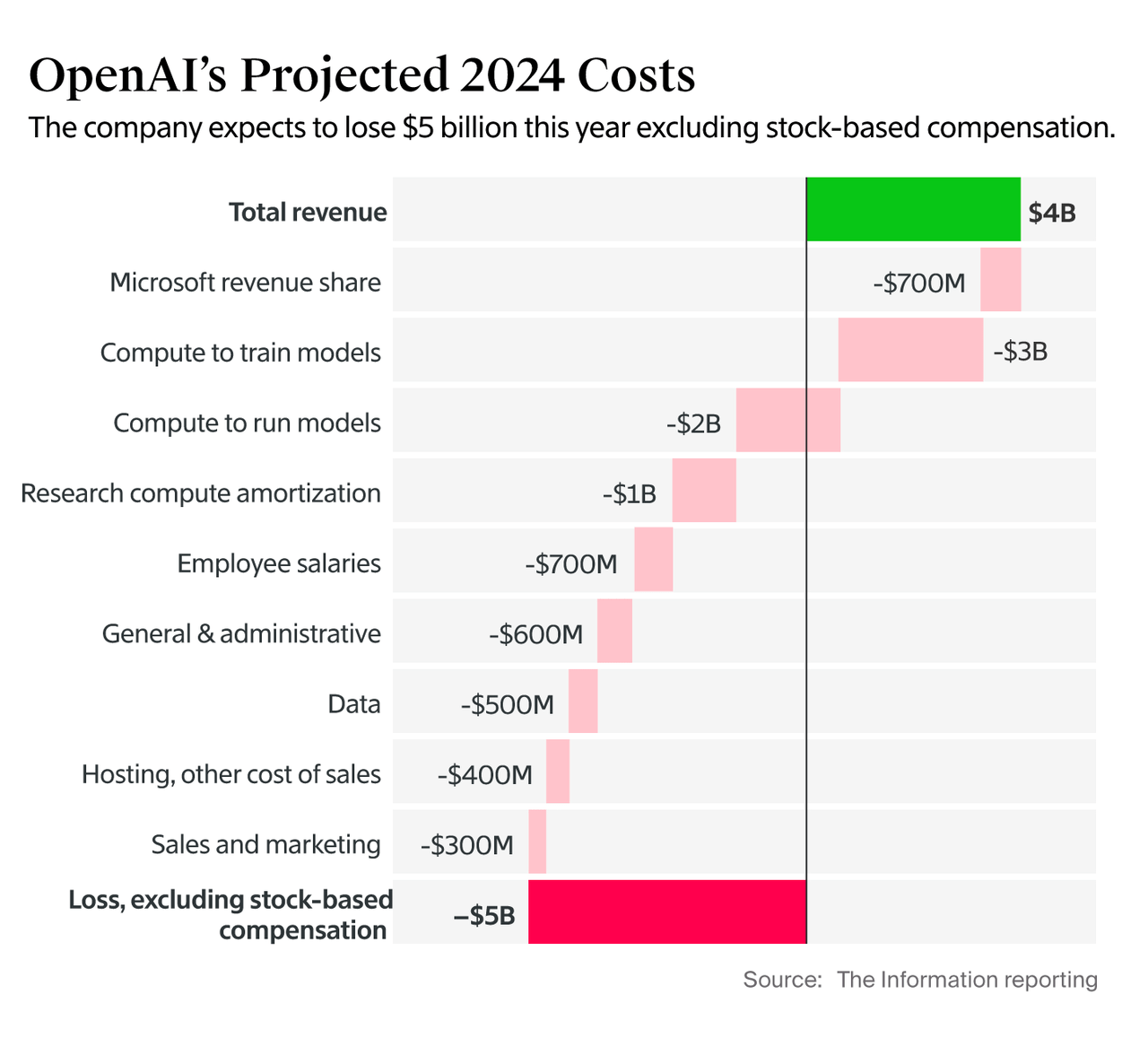

Microsoft faces significant internal constraints tied to the cost and complexity of developing next-generation AI models. The continued investment required for training the foundational models may reach tens of billions or even $100 billion. Fundamentally, this substantial capital outlay is directly tied to the revenue generated from inference, creating a dependency on monetization to justify and sustain these investments.

While advancements in Moore’s Law, silicon efficiencies, and algorithm optimization help manage costs, the pace of required innovation and training must continue to align with anticipated demand. This balancing equation limits how aggressively Microsoft can expand its AI capabilities. Furthermore, infrastructure depreciation and the need to refresh fleets annually compound the financial pressure, creating long-term rapid top-line growth without clear pathways to profitability.

The cyclical nature of investment, where funds spent on training must be offset by revenue from inference, also creates financial vulnerabilities. If demand forecasts materialize, Microsoft can avoid overextending its resources. These internal limitations may restrain Microsoft’s ability to scale its AI ecosystem as aggressively as competitors or as quickly as market opportunities arise.

Moreover, Microsoft’s Azure revenue growth is decelerating. In Q1, Azure reported 34% growth in constant currency, slightly above the guided 33%. However, this growth included one-time revenue recognition benefits. The underlying consumption growth, excluding these benefits, was closer to 33%. Moving into Q2, Microsoft anticipates decelerating to the low 30% range. This decline is due to supply chain constraints and tougher YoY comparisons. The declining growth rate highlights a structural weakness. The company’s heavy reliance on continuous supply-demand matching sustains its cloud business.

Interestingly, the CFO acknowledged that stable consumption rates from Q1 to Q2 translate into something other than equivalent revenue growth due to these external and operational constraints. While Microsoft expects a reacceleration in H2 fiscal 2025, this dependency on resolving supply issues highlights vulnerabilities in its growth strategy. Additionally, the slower revenue growth relative to CapEx investments raises concerns about the efficiency and timing of capital deployment, which, in turn, may impact stock performance.

Finally, Microsoft’s $13 billion investment in OpenAI is structured under equity. With that, the company absorbs a fraction of OpenAI’s losses quarter by quarter (with losses tripling to $14 Billion in 2026). While this partnership supports Microsoft’s lead in AI, it points to the open cost of staying at the forefront of AI competition. Balancing these high upfront costs with sustainable revenue growth remains an issue in the upcoming quarters. For instance, at the product level, adopting AI solutions like Copilot also requires significant customer education, skilling, and change management, which slows the pace of enterprise-wide adoption and could dampen revenue growth in the near term.

Takeaway

Microsoft’s Q1 2025 results highlight strong growth across its cloud and AI businesses, with 16% YoY revenue growth and $259B in remaining performance obligations. Azure’s continued expansion and a 98% annuity-based revenue model underscore the company’s resilience and growth potential. While significant AI investments and moderating Azure growth present challenges, Microsoft’s focus on innovation and long-term strategy positions it well for sustained value creation and future opportunities in transformative technologies.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.