Summary:

- Netflix’s subscriber growth may be plateauing, with ad-tier gains slowing and lower-paying members affecting revenue growth, signaling potential limits to further expansion.

- Despite record-high net margins from restructuring, cost of revenue has stabilized, indicating potential margin pressures ahead.

- Current valuation metrics look stretched, with a forward P/E ratio near its 5-year average, suggesting Netflix may be losing its growth stock premium.

- Given the slowing growth and stretched valuations, it’s a good time to take profits and step aside for a potential correction.

Alistair Berg

I first wrote about Netflix (NASDAQ:NFLX) (NEOE:NFLX:CA) in January 2022, urging investors to sell before a drop of more than 50%. Wall Street and Bill Ackman got burned on the long side, but I then wrote a Buy recommendation which has risen 275% at the time of writing. In this article, I discuss why I want to cash out on the streaming company.

Ad-tier gains may slow from here

The background to my previous articles surrounded the pandemic-driven growth in subscribers, which led to exaggerated growth expectations. Netflix is a great company and was then oversold. I now believe that the rebound in the stock is reaching its limits and will step aside for a potential correction.

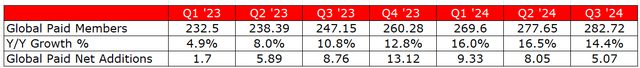

Netflix Subscriber Growth (Netflix)

Netflix has been able to create a strong growth in subscribers following my Buy call. The company had 232.5 million subscribers in Q1 ’23 and has grown that to 282.74 million in the latest quarter.

The first alarm bell is that subscriber growth on an annual basis has plateaued in Q1 of this year. 16% year-on-year growth has slowed to 14.4%, but the worry is that this is the start of a downward trend, or at least the maturing of the ad tier. The ad-supported tier was introduced in late 2022 and has since grown to 70 million subscribers.

The slowdown in growth figures is shown more clearly in Paid Net Additions with the Q4 ’23 figure of 13.12 million slowing to 5.07 million in the recent quarter.

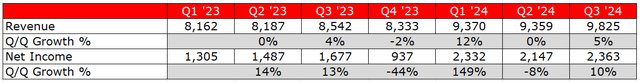

Moving to the company financials, Q4 ’23 also shows quarterly growth in revenue and net income is feeling the effects of the subscriber issue.

Netflix Financials ($ millions) (Netflix/Seeking Alpha)

I believe investors are placing too much weight on subscriber growth and not seeing the underlying pressures.

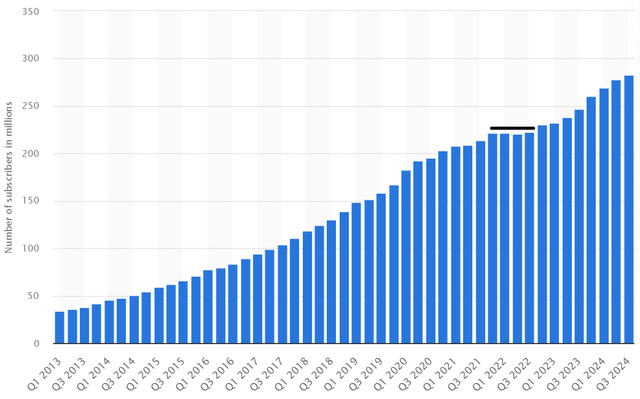

The following chart from Statista shows that subscriber growth was hitting a plateau after the pandemic surge. The company has pulled a rabbit out of a hat with the ad tier and the password-sharing crackdown. However, the additional subscribers amount to around 70 million, which is the current level of ad-supported viewers.

Netflix Subscribers (Statista)

When the world was in lockdown and looking for entertainment, Netflix amassed a peak of around 230 million viewers. If we add on the 70 million budget subscribers, I believe that we could be reaching a significant barrier to further growth.

Incoming subscribers are also paying less than they were before 2022, but some viewers are unhappy with the results. An article from Pocket-Lint highlighted that only the premium tier has 4K resolution and HDR. They suggested only using the premium tier, but we are at the limits of consumers’ desire to pay for it.

Valuation is stretched as subscribers slow

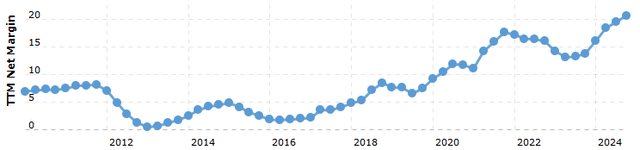

A positive for Netflix has been its ability to push its net margins to record highs. That was driven by the restructuring brought about by the 2021-22 stock price collapse and a reason for my Buy recommendation.

Netflix Net Margins (Macrotrends)

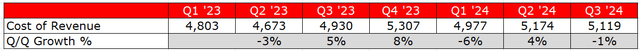

We can see in the cost of revenue trend that further gains are unlikely to arrive. Cost of revenue is still higher than in Q1 ’23 and has moved within a range of $300 million over the last five quarters.

Netflix Costs (Seeking Alpha)

Management also noted in the recent earnings release that Q3’24 operating margin of 30% was above the guidance forecast, which was partly due to “the timing of spending.”

If I am right that subscribers and margins are at risk of a slowdown then we have to turn to the company’s current valuation.

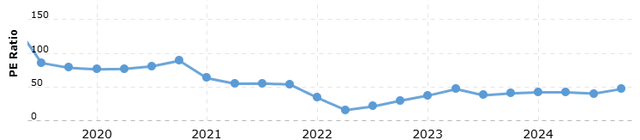

Netflix P/E Ratio (Macrotrends)

The current price/earnings ratio of around 42x on a forward GAAP basis is now only -7% from the 5-year average, according to Seeking Alpha data. The data running back to the pandemic may be highlighting that Netflix is now losing its growth stock premium.

Price/sales of 9.20 on a forward basis is now 41.48% higher than the average over the same timeframe.

Downside Risks to the investment thesis

Netflix is still a strong business, but I am selling due to the current valuation and underlying trends in subscribers and financials. It is still possible that the company can continue to add new subscribers and churn higher. The other risk would be a new product or change to subscription prices or benefits. In my opinion, I believe that the company is riding the current wave and I do not see any significant changes ahead.

From the recent shareholder letter, a focus on Asia-Pacific was positive with 19% year-on-year growth beating all regions. However, Latin America stalled with -0.1 million net additions due to higher prices.

The latest earnings also noted increased prices in “a few countries in EMEA plus Japan, Spain and Italy.”

I see that as another sign that developed country growth rates are peaking. The company has $7.45 billion of cash on hand, but that is not much higher than the $5.12 billion cost of revenue in Q3 ’24. Management comments seem focused on tweaking the current price models and I don’t see any acquisition or game-changing product in the near future.

Conclusion

Netflix became overvalued during the pandemic as analysts applied exaggerated growth expectations to the company. As many walked away from the stock after a price collapse it was simply a great opportunity as the company moved to a period of greater efficiency. After a gain of 275% from my Buy recommendation, I believe that the company has likely reached its limit at current valuation metrics. The ad-supported tier and password crackdown has boosted the turnaround, but additional subscribers from pandemic highs are almost identical to the 70 million ad tier buyers. Growth in subscribers is starting to slow while lower-paying members are no longer contributing to strong growth in revenue. Cost of revenue appears to have settled after management’s strategy change and may be a sign of coming margin pressures. As valuations become stretched, this is a good time to take profit and step aside for a possible correction.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.