Summary:

- Walmart reports their fiscal Q3 ’25 financial results before the opening bell on Tuesday, November 19th, 2024.

- Consensus estimates are for $167.7 billion in revenue for expected y-o-y growth of 4.3%, operating income $6.56 billion for expected y-o-y growth of 8.6%, and EPS $0.53 per share for expected y-o-y growth of 4%.

- While the stock needs a 10-15% pullback given its overbought status, the continued improvement in the operating margin at Walmart US will be a significant plus for shareholders.

Wolterk

Walmart (NYSE:WMT) reports their fiscal Q3 ’25 financial results before the opening bell on Tuesday, November 19th, 2024. (Walmart’s fiscal year ends in January ’25.) Here’s the detail on the consensus estimates coming into Tuesday’s release:

- Revenue estimate – $167.7 billion for expected y-o-y growth of 4.3%

- Operating income estimate – $6.56 billion for expected y-o-y growth of 8.6%

- EPS estimate – $0.53 per share for expected y-o-y growth of 4%

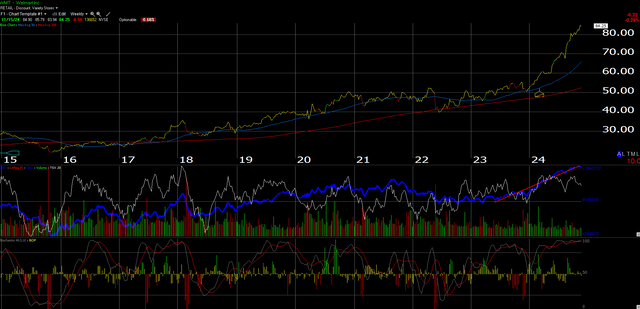

Here’s the weekly Walmart chart showing the stock’s 61% YTD return as of 11/15/24:

The chart shows the stock started to move in the last half of December ’23, and hasn’t stopped since.

The weekly chart shows the stock traded around a split-adjusted $50 per share for most of the pandemic period from late 2010 to 2023.

The lower 1/3rd of the Worden chart shows the stock currently “overbought” (too far extended) on the stochastics, and probably needs a pullback into the low $70s to reset the momentum indicators.

In Q2 ’25, reported in August ’24, Walmart reported what was thought to be a strong comp at 4.2%, since it was lapping a 6% comp from the same quarter in August ’23. Walmart US operating margin rose 20 bps to 5.7% last quarter.

For the holiday ’24 quarter or what is fiscal Q4 ’25, Walmart is expecting $0.53 in EPS on $180 billion in holiday revenue for the Q4 ending in January ’25.

As a Costco member, regular unleaded gasoline has fallen below $3 per gallon this week as of the latest fill-up.

What’s driving the latest surge in the stock price?

The biggest drivers are Walmart’s April 2023 announcement that they were going to start to target their supply chain logistics costs (read this earnings preview from August ’23), and pay particular attention to the segment entitled “historical operating margin”. (Here’s the earnings summary after that August ’23 earnings report.)

Walmart is an AI beneficiary as the August ’23 earnings preview details, but the retail giant is also adding margin-rich revenue from a newly emerged advertising revenue stream. Like the Mega Cap 7 have added “advertising” to their revenue segments, Walmart was very quick to do the same.

In the Q1 ’25 earnings preview, written on this blog in May ’24, it was noted that – according to the conference call notes – roughly 1/3rd of Walmart’s operating income improvement is coming from new business segments, i.e., advertising, membership and data ventures, etc. Again, that’s margin-rich revenue, since it has a better operating margin attached to it than the traditional retail business.

Valuation

Other than the price-to-sales ratio, which is trading right at 1x revenue if the fiscal Q3 ’25 revenue estimate is met (as it’s expected to be), the 34x expected ’25 EPS (calendar ’24) P/E ratio on expected 11% growth makes for a rich multiple. Somewhat assuaging this rich P/E ratio is that Walmart’s “cash-flow per share” is $4.19 versus the trailing twelve-month EPS of $2.38, or 2x cash flow per share versus earnings per share on a TTM basis.

Walmart could and should be buying back more stock, but the Walton family does not want the family’s ownership position to drift too far above 50%, so that limits the company’s ability to repurchase stock.

The retail giant was spending about $2 billion per quarter on buybacks, but with the performance of the stock this calendar ’24, the Board has cut back to about a $1 billion repo rate per quarter. The Walmart family’s ownership position is thought to be around 46% currently, which would give the Walmart Board room to repurchase more stock, but the move in the stock price has undoubtedly curtailed the repurchase appetite.

Summary / conclusion

To keep this earnings preview short and to the point, while the stock needs a 10-15% pullback given its overbought status, the continued improvement in the operating margin at Walmart US will be a significant plus for shareholders.

With the earnings summary on Walmart later this week (after the numbers are sliced and diced and estimates updated), the earnings review will cover Walmart in relation to Amazon (AMZN). Both retail giants are slated to do $700 billion in revenue in what for both companies is calendar 2025.

Walmart’s operating margin history is really interesting: from the late 1990s through the January ’16 quarter, Walmart US was putting up an operating margin between 6-8% pretty routinely. Since that fateful January ’16 quarter, Walmart could only print a +6% operating margin once after that, and that was in the middle of Covid, and that specifically was the July ’21 quarter (+6.2%) – and then the subsequent 12 quarters or 3 years have all been 4-5% operating margin quarters for Walmart US.

These new businesses for Walmart may take a while to scale enough to impact a retail juggernaut that is on track to generate $700 billion in sales in calendar ’25.

The new revenue streams are great, but the operating margin is the story, and it’s not going to be a linear progression.

Personally, I’d love to see the stock correct 10-15% after earnings. It will be a good chance to buy more, and Walmart is already a top 10 holdings for clients as of October 31, ’24.

None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee or suggestion of future results. Investing can, and does, involve the loss of principal, even over short periods of time. None of the information on this blog may be updated, and if it is updated, may not be done so in a timely fashion. All consensus EPS and revenue estimates (any estimate cited) are sourced from LSEG.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.