Summary:

- Despite slow growth and premium valuation, I recommend holding AAPL due to a positive growth outlook and substantial shareholder value creation.

- Economic variables like GDP growth, consumer confidence, exchange rate, and interest rates significantly influence AAPL’s revenue growth, with a positive outlook for 2025.

- Regression analysis shows 84.5% variability in revenue explained by economic variables, indicating a strong model fit and reliable growth predictors.

- AAPL’s fair value is $196.25, suggesting a 12.82% premium, but its consistent value creation and positive EVA justify holding the stock.

Shahid Jamil

Investment Thesis

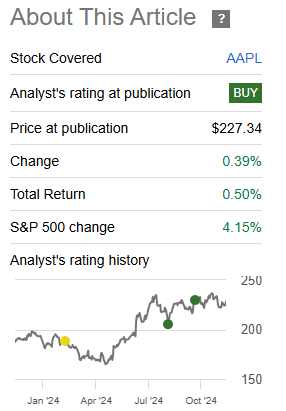

On September 21, 2024, I published a bullish article where I recommended a buy decision for Apple Inc. (NASDAQ:AAPL) (NEOE:AAPL:CA) where I argued that the weak iPhone 16 debut would recover. While this came to pass with its Q4 2024 iPhone sales at a record $46.2 billion, a 6% YoY growth, the stock hasn’t changed much because, since my last analysis, it has gained just 0.39% compared to the S&P 500 at 4.15%. To me, this reflects a potentially weak market sentiment.

Seeking Alpha

This brings me to evaluating the changing investor sentiments, with most of them turning to a sell decision. As I was writing this article, the last five articles on AAPL on SA were all bearish with at least a sell rating. Most investors, based on my assessment, are concerned with the company’s valuation and weak growth. Consequently, in this analysis, I will dive deeper into these two aspects through a multiple linear regression model and a DCF model for each, respectively.

Following my empirical analysis, I agree with most investors that AAPL is trading at a premium valuation, but I don’t think it warrants a sell decision. As for me, AAPL is a hold because my assessment leads me to the conclusion that it will continue with a modest growth, which will likely keep rewarding investors with premium gains on the stock.

The Growth Consideration

1. Where I’m Coming From

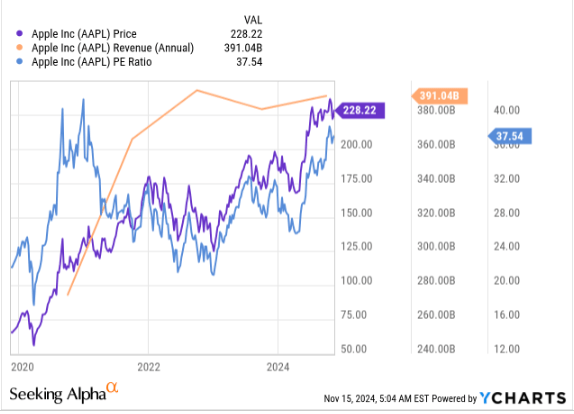

In Q4 2024, 2024, Apple reported revenue of $94.9 billion a 6% YoY growth. For the entire 2024 FY, revenue came in at about $391 billion, marking a 2% YoY growth. While these figures are far from convincing, it is even discouraging when viewed on a comparative basis. With a YoY revenue growth of 2.02%, AAPL is way below the sector median of 3.8%, and with its YoY EPS growth of -0.82%, it lags behind the sector median of 6.67%. It is a phenomenon that comes alongside 23 downward EPS revisions compared to 13 upward revisions and 29 revenue downward revisions against 7 upward revisions. Given this background, I believe investors must be concerned with Apple’s growth. However, I think the most important thing is to evaluate the forces behind it and that’s where I will dive deeper into.

First off, we all need to appreciate the fact that despite AAPL serving in the IT sector, its products are discretionary, and they are mostly influenced by the disposable income of its consumers. As a result, the company’s growth is therefore dependent on the economic climate because, to a greater extent, it dictates or rather shapes the consumers’ purchasing behaviors. In this analysis, I will consider four major economic variables that I believe influence this company’s growth and assess its outlook. Of course, I agree with many analysts that innovation and, for that matter, AI adoption, and diversity serve as major growth catalysts, but they all play within the economic parameters.

2. The Variables

In my analysis, I will be considering four major economic variables that I believe influence AAPL growth namely; consumer confidence index [CCI], GDP growth, exchange rate, and interest rate. Below is how each of them affects Apple’s growth.

Beginning with the CCI is a measure of the degree of optimism that consumers feel about their general economic status and their financial health. When the consumers have a high confidence, it often leads to higher spending particularly on non-essential items like Apple’s premium products, leading to higher sales and eventually strong growth figures.

The exchange rate is a very important variable in this analysis. Being a global company, AAPL earns about 53% of its revenue from international markets. As a result, the FX has a tremendous impact on its financial performance. When the USD is strong, it makes their products expensive against weaker currencies, potentially reducing sales in those markets. However, this can sometimes turn out to be beneficial when economic growth is high, consumer confidence is high and interest rates are low. This leaves the consumers with high disposable incomes and a high willingness to be potentially price insensitive, therefore making AAPL leverage the strong dollar for higher sales. The overall net effect of this variable will be determined by the output of the regression model.

The other variable is interest rate, which is essentially the cost of borrowing. When the interest rate is low, it lowers the cost of borrowing, making it easier for them to finance large transactions like Apple’s premium products through credit financing. On the corporate side, lower interest rates lower AAPL’s cost of borrowing, making it possible for them to invest in innovation, R&D as well as growth. Conversely, higher interest rate constrains consumer spending and corporate investment, alluding to slow growth.

Lastly, is the GDP growth, which is a measure of the general economic health. Strong growth typically reflects a healthy economy, which boots consumer spending and business investment. Further, economic growth shows a positive correlation with disposable incomes, enabling consumers to spend more on premium products.

In a nutshell, the above variables not only shape consumer behavior and purchasing patterns but also influence the cost of doing business; therefore, the economy is a double-edged sword with both negative and positive implications depending on the economic climate. In light of this background, let’s proceed to the regression model, where I will assess how these variables have been influencing Apple’s growth.

3. The Variables Empirically: Regression Analysis

In this analysis, I have considered data for the last 10 years to form my sample size. While a larger sample is sometimes preferred, I opted for 10 years due to several reasons. First off, my sample size was informed by data availability and quality. While 10 is the maximum years I can easily access the financial data for AAPL from reliable sources like Seeking Alpha, that time frame also guarantees accurate data considering that accounting practices and reporting changes have improved over time making more recent data reliable.

Secondly, was the economic indicator relevance, whereby more recent data have a more direct impact on recent revenue growth trends. Old data might not reflect today’s economic environment, especially considering the changes in global trade and economic policies over the last decade, not forgetting the technological advancement that could influence both consumer behavior and corporate business.

Lastly, I opted for 10-year data because it reflects Apple’s products and strategy changes. Its product line has dramatically changed in the last 10 years to new products such as Air pods and Apple Watch, among others. Further, the company’s strategic shift such as its focus on service and the growth of its ecosystem can only be captured in the most recent data as opposed to old data.

In conclusion, a 10-year sample size is not only relevant but also accurate and reflective of Apple’s current market conditions, economic environment, and digital evolution. In light of this justification, I ran the model at a 95% confidence interval and my data was obtained from several sources. For revenue, I sourced it from Seeking Alpha while for GDP growth and interest rate, I sourced it from Macrotrends. For CCI, I obtained the data from OECD while for the exchange rate (USD to I unit of foreign currency) I got the data from the Federal Reserve G.5A.

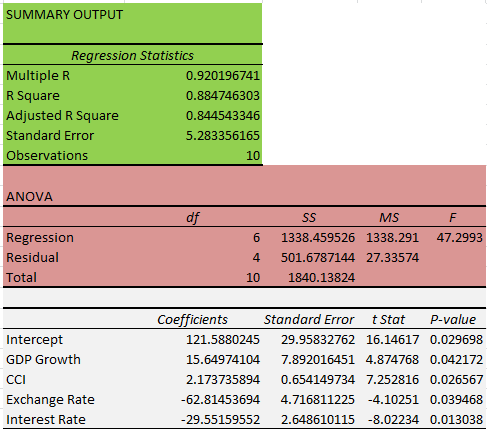

My model assumptions were that the Y (revenue) and X variables (explained above) are linearly related, and the Y variable’s response to changes in any X variable is always independent of the other variables in the model. In light of this background, below is my model output.

Author

Based on this output, the model has an adjusted R square of 0.845, indicating that it explains about 84.5% of the variability in the dependent variable, making it a good fit for this analysis. This is because a larger adjusted R square indicates that the model accounts for a bigger proportion of the variation. Additionally, all variables are statistically significant and therefore dependable predictors of the dependent variable, as indicated by p-values less than 0.05 and t-statistic figures greater than 2 for positive correlation and greater than -2 for negative correlation.

Looking at the variables, GDP growth, and CCI both show positive beta values, indicating a positive correlation with revenue growth. This means that as these variables increase, so does revenue. The exchange rate and interest rate coefficients are negative, indicating that they have an inverse relationship with Apple’s revenue growth. This means that as they increase, revenue drops. The magnitude of each variable is reflected in its better coefficient in their respective direction of correlation. This implies that an incremental unit in the respective X variables results in a change in the Y variable equivalent to the beta coefficient while obeying the correlation direction. Given these results, let us look at the outlook for the respective variables to assess the future growth of Apple.

4. What Lies Ahead

According to the IMF, the global economy is projected to grow by about 3.2% in 2025, which would have a positive impact on its revenue growth given its positive correlation with its revenue growth. Further, it is projected that the consumer expenditure in 2025 will grow to $3.2 trillion, a 6% growth from 2024. This translates to improving consumer confidence, which also has a positive impact on its revenue, as shown by the positive correlation. Additionally, the IMF projects that the interest rate could be cut to as low as 3.5% in 2025 from about 4.5% in 2024. This implies that Apple will receive a major boost in its growth trajectory because what has been a hurdle in its growth path will be subsidized in 2025. Lastly, there is a mixed outlook on the dollar exchange rate in 2025, although it is highly anticipated that the dollar will strengthen. While this could be detrimental for AAPL since it translates to higher prices for its products, I believe this could be offset by the positive projections in the other three variables, translating to potentially strong growth figures for Apple in 2025.

In summary, the overall outlook for AAPL’s growth is bright given the projected strength in its growth variables and the weakening in one of its major growth headwinds. For this reason, I expect stronger growth for this company in 2025.

Valuation

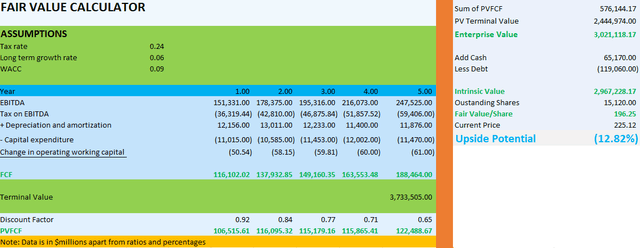

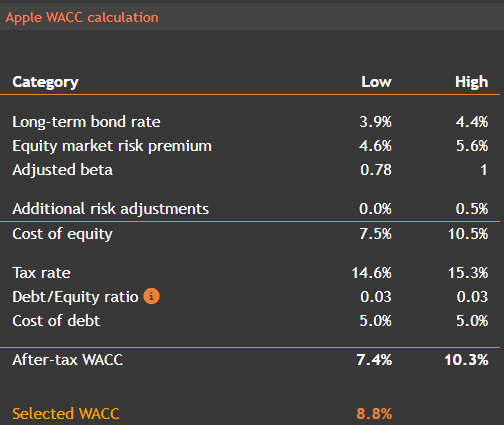

In valuing AAPL, I will use a dcf model to estimate its fair value. While this model has its key limitation being sensitivity to assumptions, I believe it is suitable for AAPL where its future cash flow generation will be a key driver of value. In my calculation, I assumed a growth rate of 5.7% which is the company’s 3-year FCF CAGR. My discount rate was 8.8% which is its WACC according to value investing computed as follows.

Value Investing

My terminal growth rate was determined as follows.

Terminal Growth Rate=(1+growth rate)/(WACC-Growth rate)

I adopted WACC as a discount rate because it reflects the cost of capital, thus accounting for the potential risks associated with the company’s capital structure. In addition, it reflects the opportunity cost by representing the minimum return that the company must earn on its existing assets to satisfy its creditors and other stakeholders.

Given the above background, below is the output of my model.

Based on my results, AAPL has a fair value of $196.25 translating to a premium pricing of 12.82%. While this overvaluation has been a key concern to investors, the question we need to ask ourselves is whether AAPL is a sell. My opinion on the right investment decision is in the succeeding section.

Slow Growth, Premium Valuation: Is AAPL A Sell?

While several investors have recommended a sell decision for AAPL, in my view it is a hold. I think so for several reasons. First off, based on my regression analysis and the outlook of the independent variables, it is likely that this company is likely to experience a stronger growth in 2025 potentially driving the stock upwards. Either way, its share price and PE growth have been relatively consistent with its revenue for the last five years and if this is something we can infer based on the growth outlook previously discussed, then I expect the price and the PE to grow in 2025 translating to more premium gains for current investors and thus a reason to hold.

YCharts

Further, despite the investor concerns, AAPL has created a substantial value for its investors, making it a reliable investment. For instance, its trailing ROE stands at a whopping 157.4% compared to the sector median of 4.12% with a trailing return on total capital of 42.54% compared to the sector median of 2.88%.

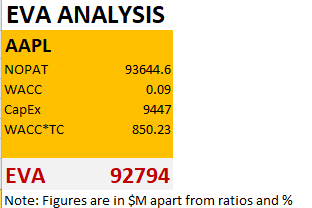

To support that AAPL is a reliable investment creating substantial value for its shareholders is an Economic value added [EVA] assessment. EVA measures the amount of residual wealth it generates over the cost of capital. To put it another way, EVA assesses a company’s actual economic profit to determine whether it is creating value for its shareholders. This is how it is calculated:

EVA = NOPAT – (Invested Capital*WACC).

Where:

NOPAT is net operating profit after taxes.

WACC is the weighted average cost of capital.

Using the above formula, below are my results.

Author

The output shows that AAPL has created a remarkable value for its shareholders, as evidenced by its positive EVA. According to its $92.79 billion EVA, it produced $92.79 billion in value above the cost of the capital that was invested. The fact that this figure not only covers the company’s cost of capital but also produces sizable returns for its shareholders shows that Apple is a good stock to hold. It should be noted all these happened despite the slow growth and premium valuation.

Conclusion

Although AAPL is trading at a premium with slow growth, I don’t think it is time to sell. The growth outlook is bright, suggesting a better year ahead, and the company’s substantial value creation to its shareholders despite the inherent risks (overvaluation and slow growth) qualify it as a good investment. Given this background, I reiterate my hold decision for AAPL.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.