Summary:

- Boeing faced significant challenges in 2023, including the 737 MAX accident, Starliner issues, and a strike impacting production and deliveries.

- Despite a year-on-year decline, Boeing secured $5 billion in airplane orders in October, with continued demand for the 737 MAX and Chinese market deliveries.

- Boeing’s deliveries hit a multi-year low due to the strike, with a 25% decline in units and 27% in value compared to last year.

- Long-term, Boeing is a buy, but near-term focus should be on ramping up deliveries, reducing inventory, and ensuring product quality for balance sheet repair.

nycshooter

For Boeing (NYSE:BA) (NEOE:BA:CA), the year has been a tumultuous one, with the Boeing 737 MAX accident at the start of the year leading to increased oversight and a cap on the Boeing 737 MAX production rate. If that was not enough, the company faced problems with its troubled Starliner capsule and suffered a strike that crippled production and deliveries as is visible in the October figure which I will discuss in this report.

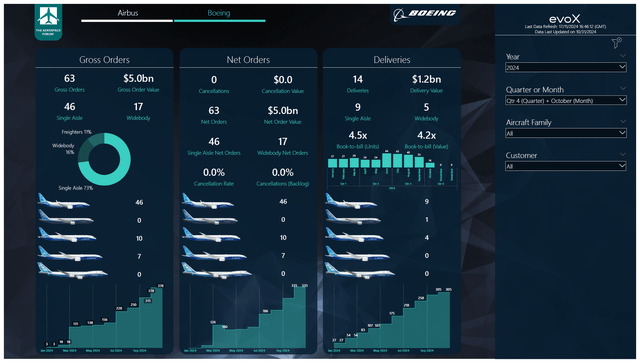

Boeing Books $5 Billion In Airplane Orders

The Aerospace Forum

In October, airplane orders decreased sequentially from 65 orders to 63 airplane orders. So, in some way, you could say that order inflow was stable. Boeing added orders for 46 single aisle jets and 17 wide body jets with a combined value of $5 billion:

- Avia Solutions Group ordered 40 Boeing 737 MAX airplanes.

- LATAM (LTM) ordered 10 Boeing 787-9 airplanes.

- One or multiple unidentified customers placed orders for 6 Boeing 737 MAX airplanes.

- One or multiple unidentified customers placed orders for 7 Boeing 777 Freighters.

During the month, the following changes were made to the order book:

- Emirates was identified as the customer for 10 Boeing 777F airplanes.

- Silk Way West Airlines was identified as the customer for one Boeing 777F.

- LATAM was identified as the customer for 5 Boeing 787-9s.

- China Eastern Airlines was identified as the customer for one Boeing 787-9.

- Qatar Airways was identified as the customer for 20 Boeing 777X Airplanes.

- Luxair was identified as the customer for two Boeing 737 MAX airplanes.

- Xiamen Airlines was identified as the customer for two Boeing 737 MAX airplanes.

- China Eastern Airlines was identified as the customer for one Boeing 737 MAX.

In October, Boeing booked orders for all its key programs. We continue to see order inflow for the Boeing 737 MAX despite the uncertain production and delivery schedule, and perhaps more importantly, we continue to see that Chinese customers are being identified. Usually, the customers behind unidentified orders are being identified upon delivery. So, the identification is a sign that we are seeing airplanes being delivered to China, which is an important market for commercial airplanes.

In the same month last year, Boeing booked 123 gross orders and six cancellations, bringing its net orders to 117 aircraft valued at $7.3 billion. So, without doubt the order inflow is down year-on-year, but I am also not expecting any differently at this point. With airplane manufacturers facing uncertain delivery schedules and even more so for Boeing, there is little reason to order airplanes at this point in time.

Year-to-date, Boeing has gathered 378 gross orders and 43 cancellations, bringing the net orders to 335 valued at $27.3 billion. In the same period last year, the company logged 971 gross orders and 130 cancellations, bringing the net order tally to 841 orders valued at $69.1 billion. Again, the year-on-year decline in order activity is not a surprise due to the uncertain delivery schedule. In fact, the backlog or lower order inflow is not a concern of mine at the moment at all. The backlog even without order inflow supports significantly higher production rates, and Boeing’s focus should be on delivering more aircraft within the control limits of its assembly lines and supply chain.

During the month, the ASC 606 adjustments tally, which records orders for which a purchase agreement exists, but additional criteria are not met, increased by 43 units. A doubtful order for three Boeing 737 airplanes, while 46 were added for the Boeing 777. I believe that the increase in the ASC 606 tally was triggered by further delays on the Boeing 777X program.

Overall, the tally of orders for which a purchase agreement exists, but additional conditions are not met, increased from 741 to 784, meaning that more than 14% of the order book is currently doubtful. However, once the additional requirements are met, we could also see the tally reduce. So, while ASC 606 adjustments may be a prelude to a cancellation, that’s not necessarily the case. Especially over the past year, we saw the tally reduce at times without the order being cancelled, meaning that the additional set of requirements to count the order to the backlog was met.

Boeing Airplane Deliveries Sink Further To Multi-Year Low

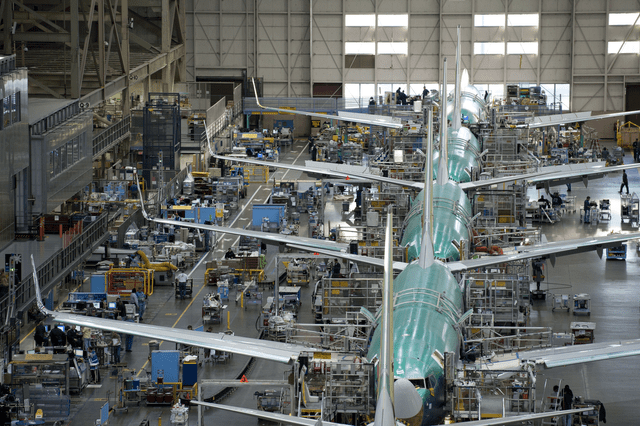

Boeing

In September, Boeing delivered a total of 33 airplanes, consisting of 28 single aisle airplanes and five wide body airplanes valued at $2.3 billion:

- Boeing delivered nine Boeing 737 MAX airplanes.

- Boeing delivered one Boeing 767-300F.

- Boeing delivered four Boeing 787s, two -9 models and two -10 models.

In my orders and delivery analysis for September, I already pointed out that the company’s October delivery numbers would come in even softer due to the strike. Boeing reached an agreement with its workers in early November. So, the November delivery numbers should be better, but it will take a while before all lines are up and running again.

In October last year, Boeing delivered 34 airplanes valued at $3.1 billion. So, we clearly see the impact of the strike in the delivery numbers. To date, Boeing has delivered 305 airplanes with a value of $22.3 billion compared to 405 deliveries valued at $30.4 billion a year ago, indicating a decline of 25% in units and 27% in terms of value indicating a less favorable delivery mix.

The book to bill ratio for October was 4.5x in terms of units and 4x in terms of value, while for the first 10 months of the year, it was 1.2x and 1.4x, reflecting Boeing not producing in line with its production plans. I really would not point at the high book-to-bill ratios to suggest that there is a sign of strength, since the high book-to-bill ratio is primarily driven by extreme weakness in Boeing’s ability to bring its production rates on the Boeing 737 MAX back to the 50+ airplanes per month where it should be.

Conclusion: Boeing Should Start Its Recovery From Here

For Boeing, having some orders to announce is nice. However, the main challenge right now is that it needs its delivery rates to hit levels where it can be cash flow positive, and that will likely not happen until the second half of 2025. That doesn’t mean that everything is bad for Boeing. It is bad, but I also do believe that with the labor agreement in place and the capital raise executed, the company can more realistically look at the future building high-quality and safe planes that will bolster free cash flow. It will be a long time before Boeing will hit production rates that are supportive of demand, but the first steps we are watching now is the ramp up in deliveries and the reduction of its inventory, which, I believe, is a significant part of the balance sheet repair that the company has to go through. I believe that Boeing is a buy for the long term, but in the near-term the company has to execute and show that it can safely and reliably assemble airplanes, recognizing the product quality is the center of its success.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.