Summary:

- Home Depot’s stellar share price performance in recent years has now brought the stock to unsustainably high levels.

- The stock is now trading at an earnings multiple that is hard to justify given the company’s growth prospects and margins.

- In the meantime, there are significant profitability headwinds for Home Depot that will put significant pressure on earnings going forward.

- With limited upside for HD’s share price, the current dividend yield is also not attractive enough to justify buying at current levels.

Oleg Kovtun

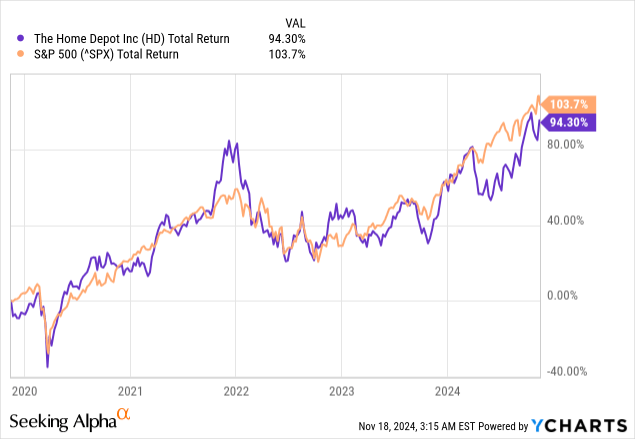

Home Depot‘s (NYSE:HD) share price performance over the past 5-year period has been following closely that of the S&P 500. The broader equity index, however, has become heavily geared towards software giants and semiconductors stocks, which are often growing at double-digit rates and have operating margins well-above those of Home Depot.

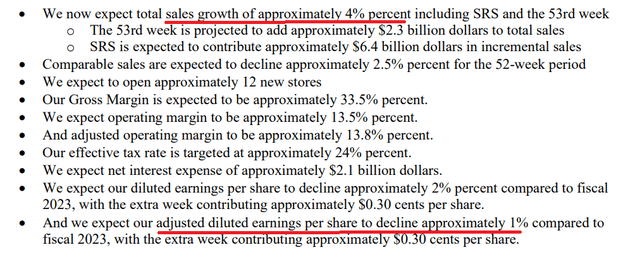

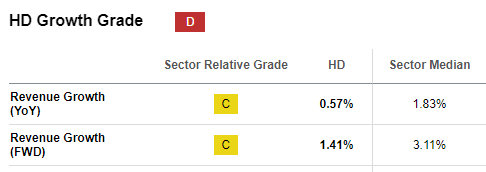

At the same time, HD has an operating margin below 14% and is currently expected to grow at a forward rate of 1.4% – well-below the current rate of inflation.

Seeking Alpha

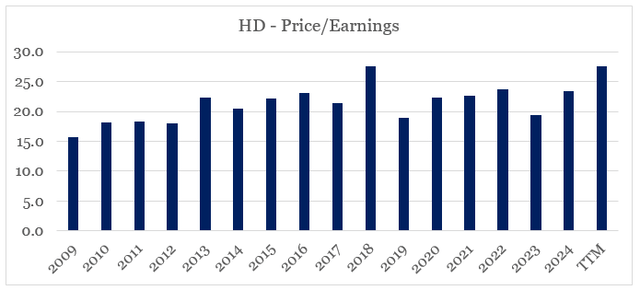

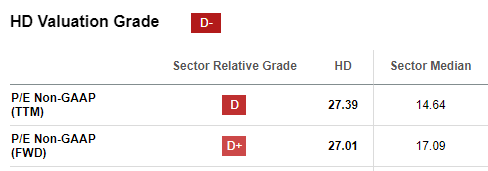

The main problem for HD stems from the fact that as the share price soared, business fundamentals have been lagging behind and as a result, the stock now trades at a record-high level relative to its earnings. Since 2009, the stock’s Price/Earnings ratio has been that high at only one point in time – at the end of fiscal year 2018.

prepared by the author, using data from SEC Filings and Seeking Alpha

But as we will see down below, back in 2018 there was a very good reason why the stock’s P/E ratio skyrocketed. Something that is not the case this time around. Moreover, when we take a long-term view and detach ourselves from monthly and quarterly speculations, we could see that HD’s stock both significantly overpriced relative to its current business fundamentals, and it is also facing significant profitability headwinds in the coming years.

Taking The Long-Term View

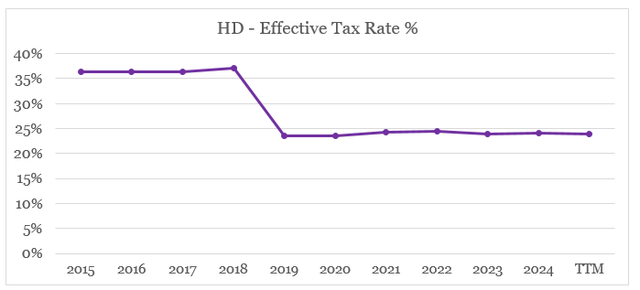

As we saw above, HD stock is now trading at almost 28 times its current GAAP earnings. The only time since 2009 when the stock had a similar P/E ratio was back in 2018, but the high earnings multiple back then was in response to the Tax Cuts and Jobs Act, which reduced the company’s provision for income taxes from more than $5bn to roughly $3.5bn.

Thus, HD’s effective tax rate has fallen dramatically and yet another drop with a similar magnitude seems unlikely even after taking into account all of the promises made by Donald Trump’s new administration.

prepared by the author, using data from Seeking Alpha

But problems for HD shareholders do not stop there. While one could justify the current valuation multiple with overall optimism about the U.S. economy and expectations of deregulation, Home Depot as a business will be faced with more profitability headwinds going forward (or at the very least fading profitability tailwinds).

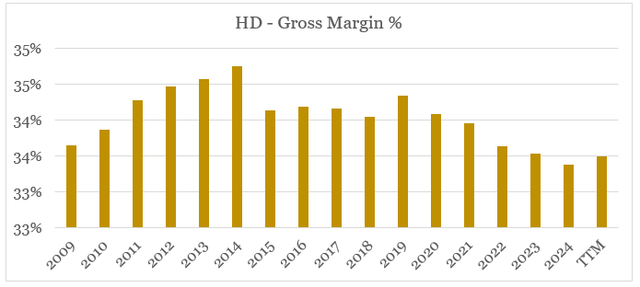

Firstly, the company’s gross margins have been on a downward trend for a very long time as competition in the e-commerce space has been intensifying. The so-called Amazon effect has not missed the home improvement space, and with that, a notable improvement in HD’s gross profitability appears highly unlikely.

prepared by the author, using data from SEC Filings and Seeking Alpha

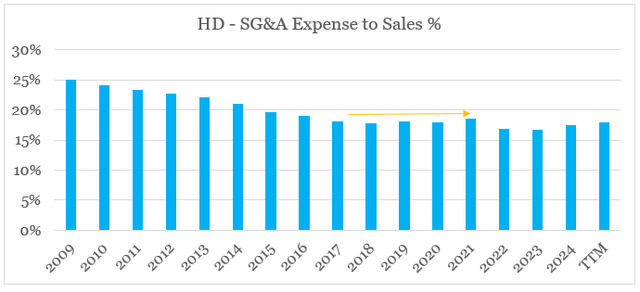

Over the past decade or so, Home Depot’s operating margins benefited from significant economies of scale and technological innovation which improved efficiency. Namely, software implementations, self-checkouts and other initiatives have allowed HD to reduce its selling, general and administrative spend relative to sales.

prepared by the author, using data from SEC Filings and Seeking Alpha

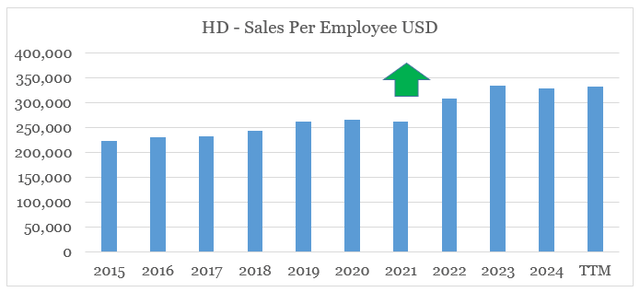

As a result, sales per employee have been on an upward trend over the past 10-year period, especially following the pandemic when demand for home improvements accelerated and the share of self-checkouts increased.

prepared by the author, using data from Seeking Alpha

But as we could see from the graphs above, this trend is now coming to an end and with that, the share of selling, general & administrative expenses to sales has been gradually increasing in the years following the pandemic.

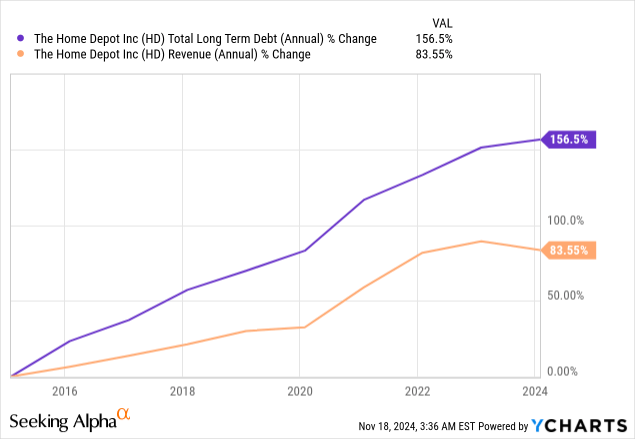

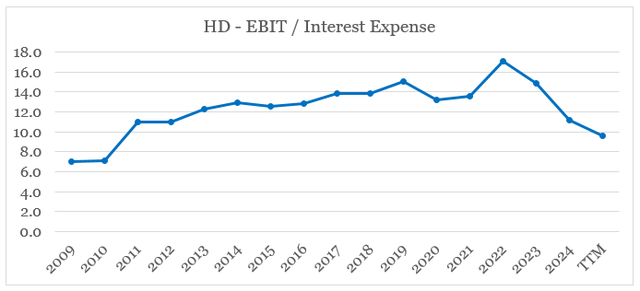

But headwinds for the company’s net income figure do not stop there. The company’s long-term debt continued to increase in recent years at a rate that has been much higher than the company’s revenue increase.

This notable increase in debt in combination with the now normalizing interest rates has resulted in a rapid deterioration of HD’s interest coverage in recent years – a trend that could reverse in the short term, but will continue to put pressure on HD’s net income margins for a very long time.

prepared by the author, using data from SEC Filings and Seeking Alpha

Based on all that, we witness three concurrent headwinds for Home Depot’s net earnings – gross margin pressures due to industry-wide trends, dissipating operating margin tailwinds and higher interest expense. All that makes it highly unlikely that the company would be able to grow its earnings at a rate that would be enough to justify the current record-high Price/Earnings ratio of 27.

Seeking Alpha

The guidance for FY 2024 is likely to be the norm in the coming years, with sales growth barely above running inflation and adjusted earnings per share being flat to declining.

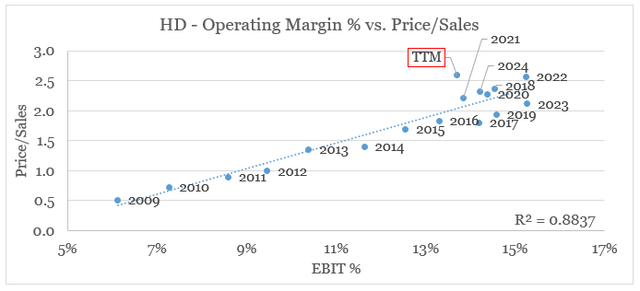

We could also see how overpriced Home Depot share price is by looking at the long-term trend between the company’s operating margin and the stock’s Price/Sales multiple.

As we could see on the graph below, by being a mature company, Home Depot has a very strong relationship between its margins and P/S multiple. The current multiple of 2.6, however, is well above the long-term trend-line and suggests that either HD’s operating margins should increase rapidly or the stock will be subject to a downward multiple repricing.

prepared by the author, using data from SEC Filings and Seeking Alpha

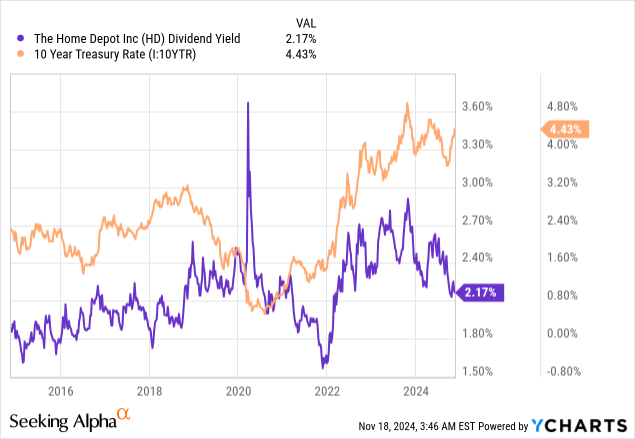

For anyone holding the stock for its dividend, things are not looking good either. The current dividend yield of 2.17% might look attractive on a historical basis, but the gap with the yield offered on 10-year Treasuries is now at record high levels.

With limited upside for HD’s share price going forward, this gap would likely push more market participants towards lower-risk and higher yielding assets.

Conclusion

When speculating regarding the next quarterly results, one could be easily misled that there is a chance for HD to continue performing in-line with high-growth stocks and the heavily tech weighted S&P 500 index. In reality, however, long-term investors in HD are more likely to suffer and experience below-market returns over the coming years. The probability of this happening is now quite high, and there is no way to justify buying HD at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the consumer discretionary space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.