Summary:

- I downgraded NIO to “Hold” due to a weakening long-term bullish thesis and competition. I maintain my rating today – 2 days before its Q3 earnings release.

- NIO’s Q2 2024 saw impressive vehicle sales and revenue growth, but profitability remains elusive with significant net losses and negative EBITDA.

- NIO’s battery swap stations are far from profitability, averaging 30-40 swaps per day, making the expansion strategy risky and delaying consolidated profit.

- Despite its high cash-to-market-cap ratio, NIO’s heavy infrastructure investment and competition from fast-charging tech may lead to the overvaluation of NIO stock.

- What may seem like an objective undervaluation today could in fact become an overvaluation as the company continues to spend significant funds on building out its infrastructure.

Andy Feng

My Thesis Update

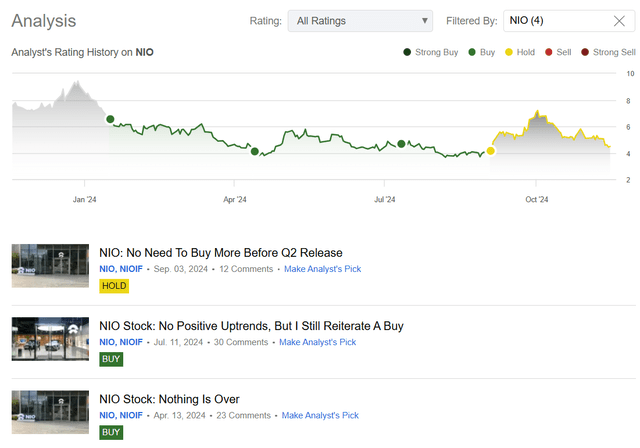

I wrote my 1st article about NIO Inc. (NYSE:NIO) stock in mid-January 2024 and then updated my bullish rating in mid-April and in mid-June. Unfortunately, the stock continued to fall despite a number of positive updates like improved margins and liquidity position. In early September 2024, a couple of days before the release of NIO’s Q2 FY2024 results, I downgraded my rating to “Hold” on the grounds that the then-upcoming event could indeed provide a catalyst for the stock’s upside, but I also feared that my earlier bullish thesis on NIO had weakened in the long run as the company faced competition in the industry and its battery swap business was far from potential profitability. As time has shown, the stock reacted with a positive move after the earnings release, but then NIO declined quite sharply and is now trading in the sub-$5 range ahead of the fourth quarter release.

Oakoff’s coverage of NIO stock, Seeking Alpha

As of today, I am still not sure how sustainable NIO’s current price can be, even with the CCP’s planned stimulus measures. Analysts are forecasting a smooth transition to net profitability (on an adjusted basis) by 2027, but I think NIO may need more time if the trends of recent quarters continue.

My Reasoning

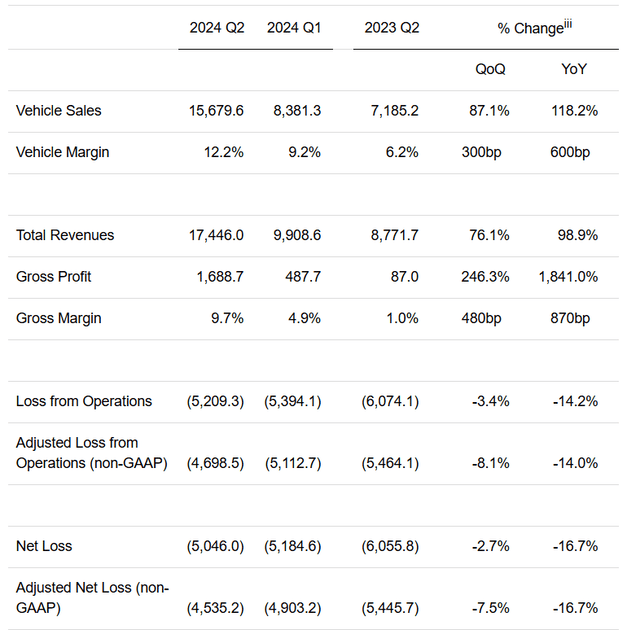

NIO’s Q2 2024 vehicle sales topped RMB15,679.6 million (~$2.16 billion), an increase of 118.2% YoY and 87.1% over the first quarter of FY2024. That’s mainly because the sales surge is based on the record delivery of 57,373 vehicles, which captured more than 40% of the market share in the high-end battery electric vehicle (BEV) segment above RMB 300,000 in China, according to the Q2 press release data. The quarterly revenues of the company totaled RMB17,446.0 million (~$2.4 billion), which represents a 98.9% growth YoY and 76.1% QoQ increase – again, it came primarily from growing delivery volumes but was partly offset by a drop in average selling price as “a result of product mix shifts and user rights adjustments.”

NIO’s Q2 press release

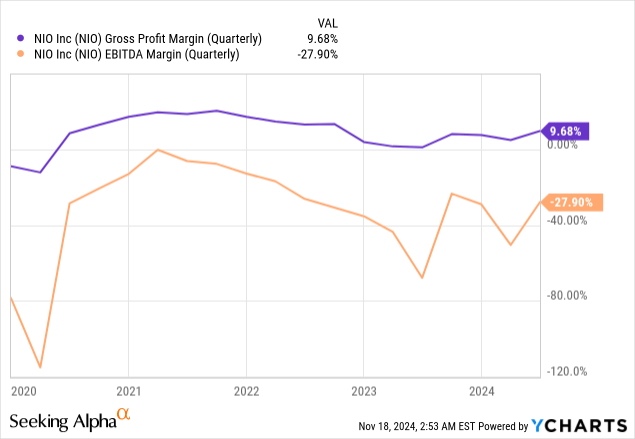

NIO’s Q2 gross profit reached ~$232.4 million, which is 1,841.0% higher than Q2 2023 and 246.3% higher than Q1 2024. So NIO’s gross margin grew to 9.7% from 1.0% for the past year, primarily driven by growing vehicle margins to 12.2% from 6.2% a year earlier and 9.2% in Q1 2024. This higher margin on vehicles came almost entirely from reduced material costs per unit, even at a lower average price. Despite these positive developments, NIO recorded a negative EBITDA and a net loss of ~$694.4 million for the quarter, down 16.7% YoY and 2.7% QoQ (with share-based compensation expenses omitted, the adjusted net loss was ~$624.1 million).

Despite the positive dynamics lately, compared to 2023 NIO has only returned to the negative levels seen in 2021 – this indicates that there hasn’t been any significant improvement over the past 3 years, unfortunately for NIO shareholders.

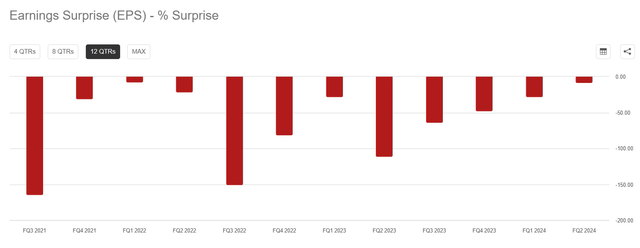

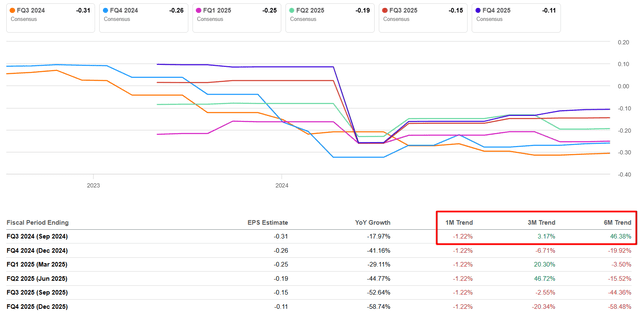

So NIO actually missed analysts’ EPS estimates for yet another quarter – this time by over 7%:

Seeking Alpha, NIO

NIO’s “Power Up Counties” initiative, launched in August 2024, focuses on expanding the network of charging and swapping in all county administrative subdivisions in China, offering a more convenient power source for electric vehicles. It’s also slated to boost further sales and market penetration, but it’s impossible to ignore the issues lying on the surface – the medium-term unprofitability of this initiative:

technode.com

NIO’s massive recharging network for battery swapping can be a profitable model if each completes 60 swaps on average per day, and around 20% of the 2,500 or so facilities are reaching the breakeven point, founder and chief executive William Li said on Tuesday.

Source: technode.com

Analysts from InsideEVs agree that NIO’s battery swap stations can break even if they provide 60 swaps per day, but currently, the average is around 30 to 40 swaps per day. So it turns out that although the company is continuing to expand its network, the swapping stations are still generating losses. With only 20% of the existing network approaching the break-even point, the expansion strategy that NIO believes in now looks like a very risky venture that could postpone NIO’s first consolidated profit for many years.

Although NIO’s swapping technology looks interesting – and I kind of like the concept – fast charging is a great alternative that may eat up a significant market portion of NIO’s future profits. As we know, fast chargers can replenish an EV’s battery to about 80% in 20-30 minutes (depending on the vehicle and charger type). Tesla’s (TSLA) Supercharger network is a prime example of this technology, and judging by Tesla’s recent sales numbers, it seems that owners generally don’t find themselves in an uncomfortable position having to wait 20-30 minutes for charging.

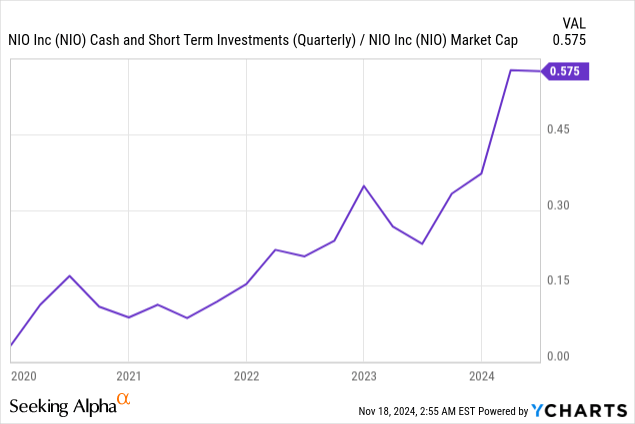

Other significant events during the quarter included the issuing of 30,000,000 Class A ordinary shares for future exercise of options and other share incentive awards “as part of NIO’s ongoing efforts to align employee incentives with shareholder interests.” So as of 30 June 2024, the company’s cash and cash equivalents, restricted cash, short-term investments, and long-term time deposits totaled RMB41.6 billion (~$5.7 billion) in liquidity, and so NIO’s cash-to-market-cap ratio remained well above 50%, making the stock look “too cheap to ignore” as some investors say:

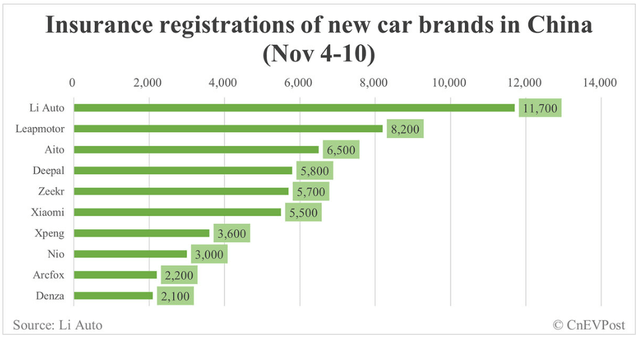

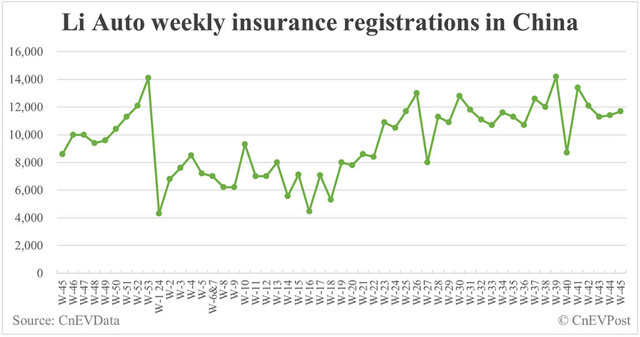

However, I have some doubts about labeling it an undervalued company. As the saying goes, everything is known by comparison. Let’s examine the insurance registrations over the past week, which I believe is a great indicator for identifying trends and comparing different companies in a sample for comparative analysis. For instance, from November 4 to 10, NIO had 3,000 insurance registrations, while one of its competitors, XPeng (XPEV), had 3,600. If we compare the market caps of these two firms, we see a difference of about 22%, which almost exactly corresponds to the difference in the insurance registrations. In other words, there’s no significant difference in valuation between them, based on my unconventional valuation method. However, if we compare NIO’s dynamics of insurance registrations using Li Auto (LI) as a peer, which has a market capitalization 2.4 times that of NIO, we’ll see that LI has nearly 4x the number of insurance registrations of NIO. This suggests that Li Auto is currently more attractively priced than NIO because its market cap should be way bigger looking at the number of vehicles receiving insurance registrations as of late. So in this regard, comparative analysis shows that NIO doesn’t have a strong advantage or superiority over other emerging Chinese automotive brands.

chevpost.com

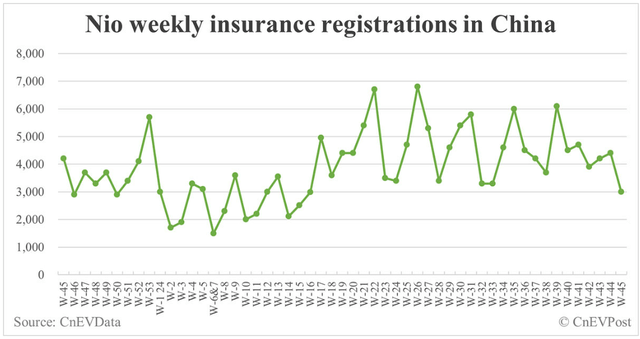

This indirect indicator can also serve as a predictive measure: If that’s the case, it suggests potential issues with sales in recent weeks. While it’s unlikely to impact the Q3 figures, which will be released in 2 days, the last quarter of 2024 could be challenging for the company if the management doesn’t adjust its guidance lower, which seems quite likely and may result in downward pressure on the stock.

chevpost.com

At first glance, it might seem that the seasonal factor plays a significant role here. However, if that were the case, why does Li Auto’s trajectory appear to be a steady upward line at a 45-degree angle?

chevpost.com

The automaker anticipates that it’ll ship between 61,000 and 63,000 cars in Q3 2024, up 10-13.7% compared to the same quarter last year. Revenues are estimated to be between RMB19,109 million (~$2.6 billion) and RMB19,669 million (~$2.71 billion), up only slightly from the year before.

In any case, NIO’s Q3 earnings estimates leave little hope that investors will see the first bottom line beat in many quarters, given the previous misses. After missing on EPS in the second quarter, Wall Street analysts have generally raised their forecasts for Q3 – the only exception being last month’s change of -1.22%, which however appears too small to create a favorable “low base” for an overshoot.

Seeking Alpha, notes added

The EV landscape is becoming increasingly competitive with brands and companies introducing new models and technologies, while the regulatory environment, particularly in major markets such as Europe, could impact NIO’s global growth. We know that NIO is focusing on capturing the European market, but it seems they might have to sacrifice a significant portion of the potential margin, which is unlikely to be good news for investors expecting profitability by 2027 (today’s consensus).

Based on all that, I leave my “Hold” rating unchanged today, 2 days before the Q3 earnings print.

Your Takeaway

While I agree that NIO stock could be a great value opportunity for growth-oriented long-term investors as the company looks to expand its market share and technology presence, I can’t characterize the recent financial results as anything positive.

Although NIO’s swapping technologies remain fascinating, they are still a long way from achieving profitability. As the company continues to invest heavily in developing its infrastructure, it’s almost certain that the timeline for achieving consolidated profit will be pushed a couple of years ahead. If my forecast is correct, the currently perceived undervaluation, reflected in the high cash-to-market cap ratio, will not have a material positive impact: What may seem like an objective undervaluation today could in fact become an overvaluation as the company continues to spend significant funds on building out its infrastructure, and it’s uncertain whether this infrastructure will remain competitive, especially in light of developments by peers such as Tesla. Therefore, I believe that maintaining a “Hold” rating is the most justified and logical stance at this time.

Good luck with your investments!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.