Summary:

- Qualcomm posted $10.2 billion in Q4 revenue (+18% YoY) with 35% YoY EPS growth.

- Record $899 million in automotive revenue (+68% YoY), driven by new vehicle content and AI platforms.

- IoT revenues grew 24% sequentially, powered by new product launches and normalized channel inventory.

- Qualcomm’s licensing business boasts a 74% EBT margin, leveraging its strong 5G intellectual property portfolio.

- Snapdragon platforms deliver cutting-edge AI and power efficiency, solidifying Qualcomm’s edge in AI, mobile, and IoT markets.

G0d4ather

Investment Thesis

Following our latest coverage, Qualcomm’s (NASDAQ:QCOM) performance remained relatively muted despite an earnings and revenue beat, presenting a potential accumulation opportunity for long-term investors. QCOM has strategically positioned to capitalize on explosive growth in automotive, IoT, and AI markets while maintaining leadership in mobile and 5G technology.

Record-breaking automotive revenues and surging IoT performance underscore its diversified growth strategy. Snapdragon platforms, with industry-leading AI and power efficiency capabilities, expand Qualcomm’s edge computing dominance. Combined with a 74% margin licensing business, disciplined operations, and profitability, Qualcomm is a resilient leader in transformative tech markets.

Q4 2024 Breakdown: $10.2 Billion Total with 21% YoY EPS Growth

Qualcomm’s revenue performance in fiscal 2024 reflects solid financial standing. The company hit revenues of $10.2 billion in Q4 with +18% annual growth. Here, its diversified business segments played a central role in these results. The chipset business generated $8.7 billion (+18% year-over-year (YoY) in revenues, and the licensing business contributed $1.5 billion (+21% YoY) to total revenues. The chipset business (QCT) holds most of Qualcomm’s revenue, with its products becoming dominant in markets such as mobile devices, IoT, automotive, and edge AI.

The licensing business (QTL) also led to considerable profitability with an EBT margin of 74%, indicating the high-margin nature of Qualcomm’s intellectual property business. At the bottom-line, Qualcomm had 35% YoY growth in fiscal 2024 normalized diluted EPS that points to the company’s stable capability to generate profits. Interestingly, this growth happened while maintaining flat operating expenses, indicating a solid operational discipline. In short, these results show Qualcomm is scaling operations, managing costs stably, and beating street estimates.

Moreover, Qualcomm’s expansion into automotive and IoT markets is one of its major growth drivers. The automotive revenue in Q4 hit a record high of $899 million, representing a 68% YoY growth. The growth came from increased content in new vehicle launches. Fundamentally, Qualcomm is becoming a leader in automotive connectivity and AI-driven platforms and now leads in digital cockpits and advanced driving assistance systems (ADAS).

Further, Qualcomm’s automotive division (QCT) achieved its fifth consecutive quarter of record revenue. Here, the YoY growth points to Qualcomm’s more profound presence in the automotive industry. Its automotive platforms are now integrated into major car brands like Li Auto and Mercedes-Benz. Platforms like Snapdragon Ride Elite and Cockpit Elite are designed for multimodal AI and driving workloads. Qualcomm’s IoT business also showed robust performance. QCT IoT revenues grew by 24% sequentially. This increase was driven by new product launches and the normalization of channel inventory. Qualcomm’s IoT solutions strategically target industrial edge computing, robotics, and AI, expanding its market.

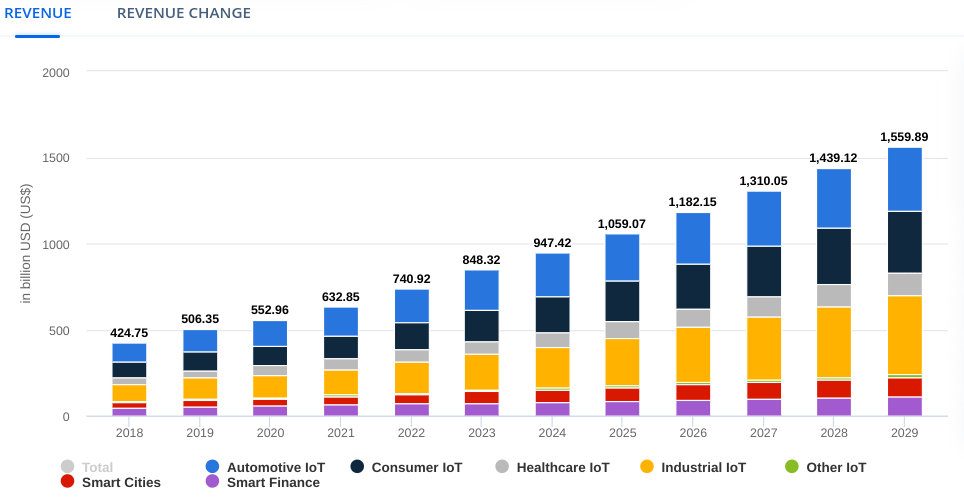

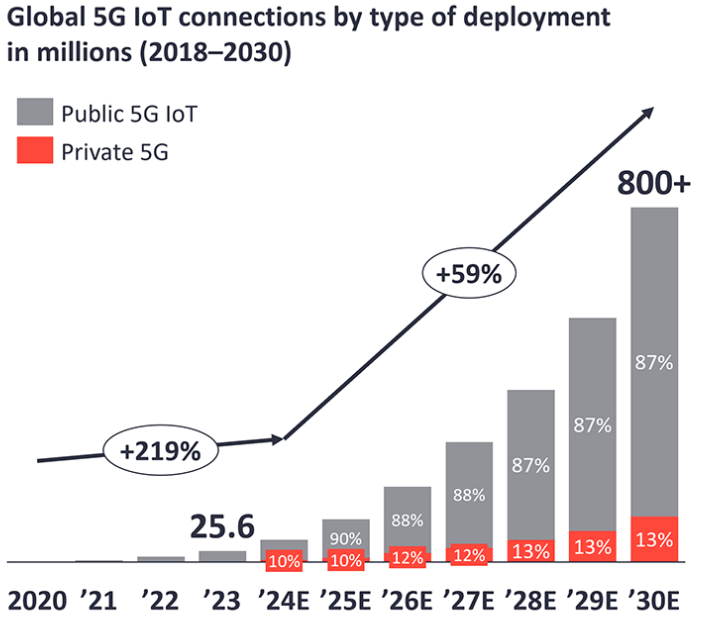

Looking forward, Qualcomm is projecting 50% growth in automotive revenues in the near term. The IoT division is expected to grow by 20%. These projected growth rates show that Qualcomm’s diversification strategy is sharp in capturing beyond the annual IoT market growth of 10.5% (2024-2029).

statista

Over the long-term, Qualcomm’s focus on AI and edge computing may serve as a core factor in its growth. The Snapdragon platforms, like the Snapdragon 8 Elite and Snapdragon X Series, lead in AI performance. Technically, the Snapdragon 8 Elite features a second-generation Oryon CPU that delivers 30% faster performance with 57% less power consumption than its predecessor. This advancement is vital for maintaining a lead in the power efficiency-hungry mobile processor market. The Snapdragon 8 Elite also integrates a hexagon NPU for AI performance and power efficiency. This boosts both AI performance and power efficiency by 45%.

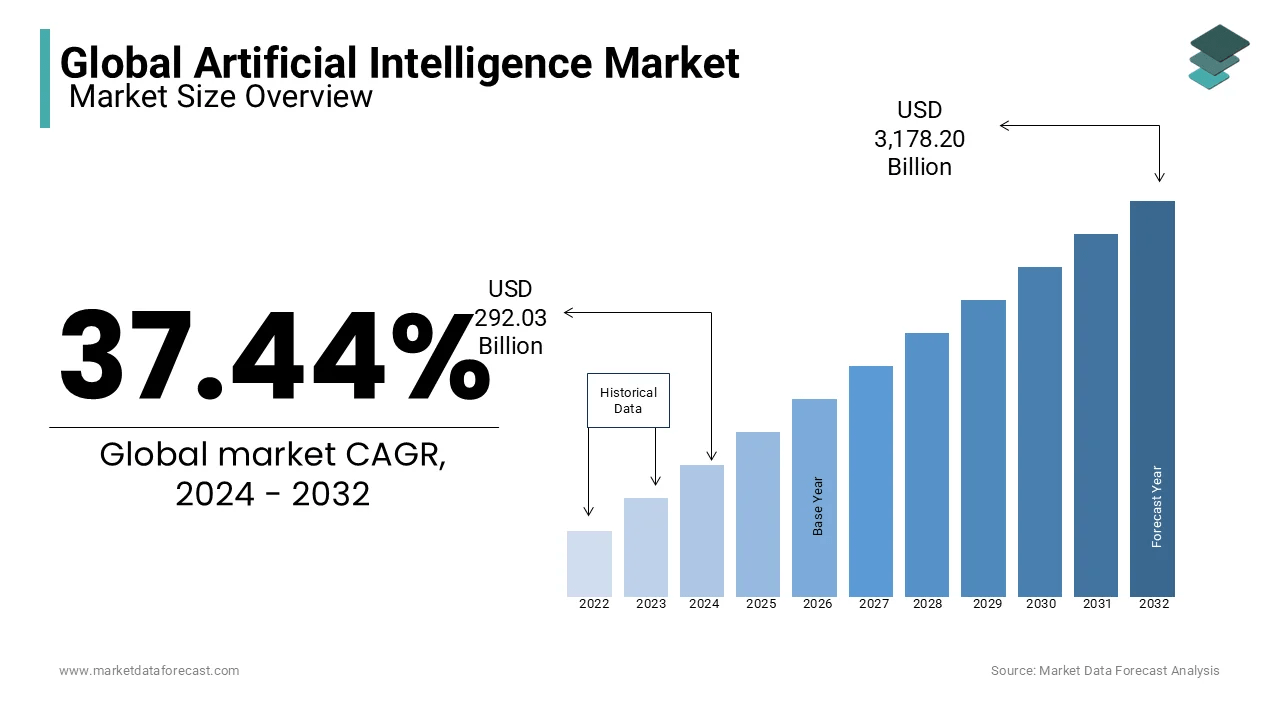

At the core, Qualcomm’s Snapdragon platforms can handle AI and Gen AI tasks in real-time, including natural language processing, computer vision, and multimodal AI, giving Qualcomm a competitive edge and moat. The Snapdragon X Plus targets personal computing by integrating AI-powered features, opening new consumer, industrial, and automotive revenue possibilities. Qualcomm’s edge AI technologies process data locally on devices (ideal for AI PCs) rather than in the cloud. Technologies like Snapdragon AR1 Gen 1 and Snapdragon XR2 Gen 2 power next-gen AR/VR and industrial IoT. In short, Qualcomm’s on-device AI capabilities make it a significant lead in the AI and edge computing market that is growing at a ~37% annual growth.

marketdataforecast.com

Finally, Qualcomm’s licensing business remains one of the semiconductor industry’s highest margin (74%) segments. Qualcomm’s intellectual property portfolio in wireless communications and 5G gives it a strong edge in licensing. The licensing strategy of long-term agreements has paid off, enabling the company to maintain solid margins and predictable revenue.

Progressive licensing renewals in fiscal 2024 reflect Qualcomm’s ability to grow its licensing business and remain a leader in 5G tech. With the growing adoption of 5G, Qualcomm’s licensing business stands to benefit. The widespread deployment of 5G networks and devices may continue to boost Qualcomm’s licensing revenue.

iot-analytics.com

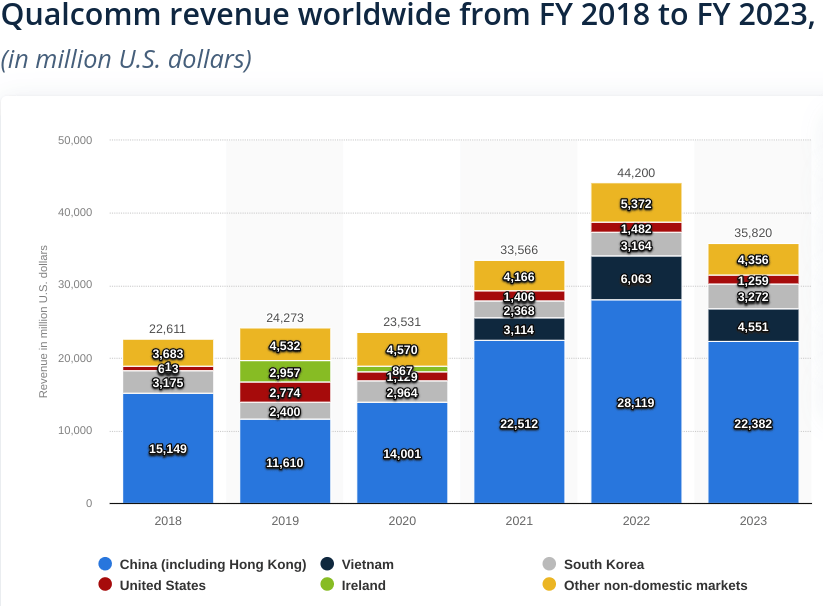

Dependency on Large Customers and Geographic Concentration Risks

Despite Qualcomm’s claims of geographical diversity, China has been a significant driver of automotive growth. Any slowdown in the Chinese market or geopolitical risks under Trump 2.0 could disproportionately impact growth. Qualcomm’s automotive growth is tied to the launches of new models featuring Snapdragon Ride Elite and Cockpit Elite solutions. These technologies involve long design cycles, making them sensitive to delays or cancellations by OEMs under new Tariffs.

In Q4, Qualcomm has seen a strong rebound in China for Android handsets (up over 40% QoQ) but faces challenges elsewhere. In short, Although the company has overcome Huawei’s absence, it remains exposed to geopolitical risks and trade barriers affecting Chinese OEMs. Growth appears uneven, with sequential declines among its top two customers, highlighting geographic and customer concentration risks.

statista

Further, the ongoing legal dispute with ARM over custom-designed CPU licensing rights could pose a significant risk. Qualcomm expressed confidence in its licensing rights, but with the trial set for December 2024, any adverse outcomes could impact its custom CPU developments and licensing revenue. The case outcome could have broader implications for Qualcomm’s stock value based on the change in competitive position, especially in the high-margin premium chipset market.

Moreover, Qualcomm has excluded Huawei from its revenue guidance for the December quarter. In the previous year, Huawei contributed significantly to revenues. However, a decline in business from these major customers is anti-seasonal and poses questions about top-line sustainability. A potential reduction in purchases from other large customers could exacerbate volatility.

Finally, Qualcomm’s planning assumption includes a ramp-down of shares to 20% by the 2026 product launch. This shift would result in a significant revenue decline. This underscores the vulnerability of Qualcomm’s business model to vertical integration trends in the tech industry. Such shifts could require Qualcomm to find new growth avenues in the mid-term or lose substantial market share in its handset business.

Qualcomm: A Discounted Growth Gem With Mixed Signals

Qualcomm’s valuation metrics paint a compelling picture, revealing both attractive opportunities and areas requiring scrutiny. Its P/E Non-GAAP ratios are particularly notable, with the trailing twelve months (TTM) value at 15.72 and the forward P/E at 14.32, reflecting significant discounts of 34.6% and 41% compared to the sector median. This disparity indicates that Qualcomm is relatively undervalued compared to its peers, considering its strong growth prospects in the automotive, IoT, and AI markets.

Besides, Qualcomm’s PEG ratio stands at 0.48, a 52.7% discount to the sector median of 1.02, which indicates high growth at a reasonable price. In contrast, its forward PEG ratio is 2.34, representing an 86.9% premium to its five-year average, indicating that future growth expectations are partly factored into its stock price.

Meanwhile, its EV/EBITDA at 15.09 is well within the comfort zone below the sector median, reflecting Qualcomm’s efficiency and profitability. Its relatively high price-to-book ratio, though, TTM at 6.80 – more than double the median of its sector – does raise some concern concerning valuation against the level of its net assets. It thus sends a mixed signal – the significant growth potential at an attractive price offered on the one hand and, on the other, premium asset valuation for Qualcomm, which prima facie has to offset this positive perspective.

Takeaway

Qualcomm’s diversified growth strategy, led by record-breaking automotive and IoT revenues and its cutting-edge Snapdragon AI platforms, positions it as a dominant player in transformative tech markets. With a high-margin licensing business and disciplined operations fueling profitability, Qualcomm’s future in automotive, AI, and edge computing looks promising. However, geopolitical and customer concentration risks warrant close monitoring. For long-term investors, Qualcomm remains a compelling opportunity in high-growth sectors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.