Summary:

- I initiate coverage on Frontier (buy at $38.50) and Verizon (hold at $39.53) due to the merger’s impact on shareholder value and growth prospects.

- Frontier benefits from a 30-40% premium deal, offsetting its negative cash flow and financing concerns, making it a favorable buyout.

- Verizon faces increased debt and management distraction risks, with potential EPS benefits not expected until 2027, justifying a hold rating.

- FYBR stock’s quant rating driven by deal momentum; excluding this, it would be a sell, highlighting the buyout’s significance for struggling Frontier.

baranozdemir

I am initiating coverage on Frontier Communications Parent (NASDAQ:FYBR) and updating my ongoing analysis on Verizon Communications (NYSE:VZ) in light of shareholder approval of the merger.

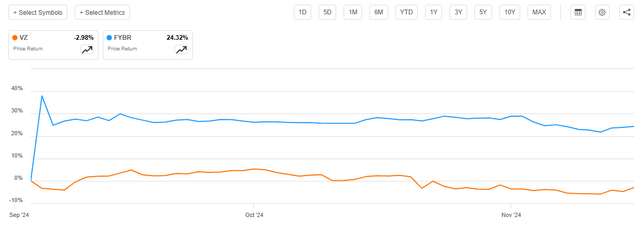

Frontier is up nearly 25% since the deal announcement, while Verizon is down.

VZ return versus FYBR (Seeking Alpha)

The market reaction to the deal aligns with my view, that this is a win for Frontier shareholders and a loss for Verizon.

Frontier shareholders own a company that is expected to lose money as a standalone entity through at least 2027 while expanding fiber passings. Management has expressed concern about financing ability through this period. The deal from Verizon represents a 30-40% premium over historical trading and pre-announcement pricing.

Verizon on the other hand will be weighed down with more debt, and a business that still isn’t growing fast enough. They admit in the offer that it will not be EPS accretive until 2027 at the earliest. Verizon has a very poor track record with M&A, with their big deals almost always decreasing shareholder value.

With the above in mind, I rate Frontier a buy at the deal price target of $38.50, and Verizon a hold at a price target of $39.53, offset by generous dividend potential.

Verizon/Frontier Merger Update

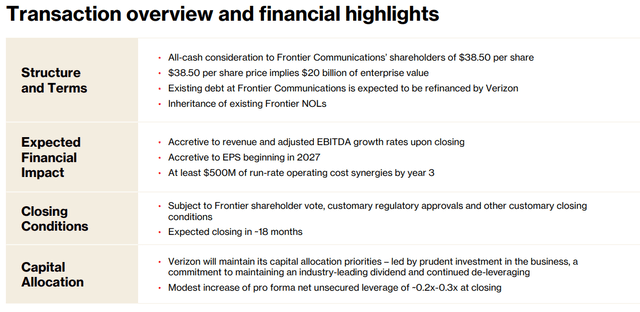

On September 5th, 2024, Verizon announced an offer to acquire Frontier Communications in a cash offer of $38.50 per share. The deal would close in approximately March 2026 pending regulatory approval.

Verizon / Frontier Deal Terms (Verizon Investor Relations)

On November 13th, 2024, Frontier shareholders approved the deal clearing a major hurdle for the transaction.

The selling points on the deal for Frontier Shareholders is that the company is struggling as a pure-play fiber company and with the capital investment needed to grow, they will be cash flow negative through at least 2025 requiring debt financing. The company has been shrinking from a revenue standpoint with rates falling below inflation.

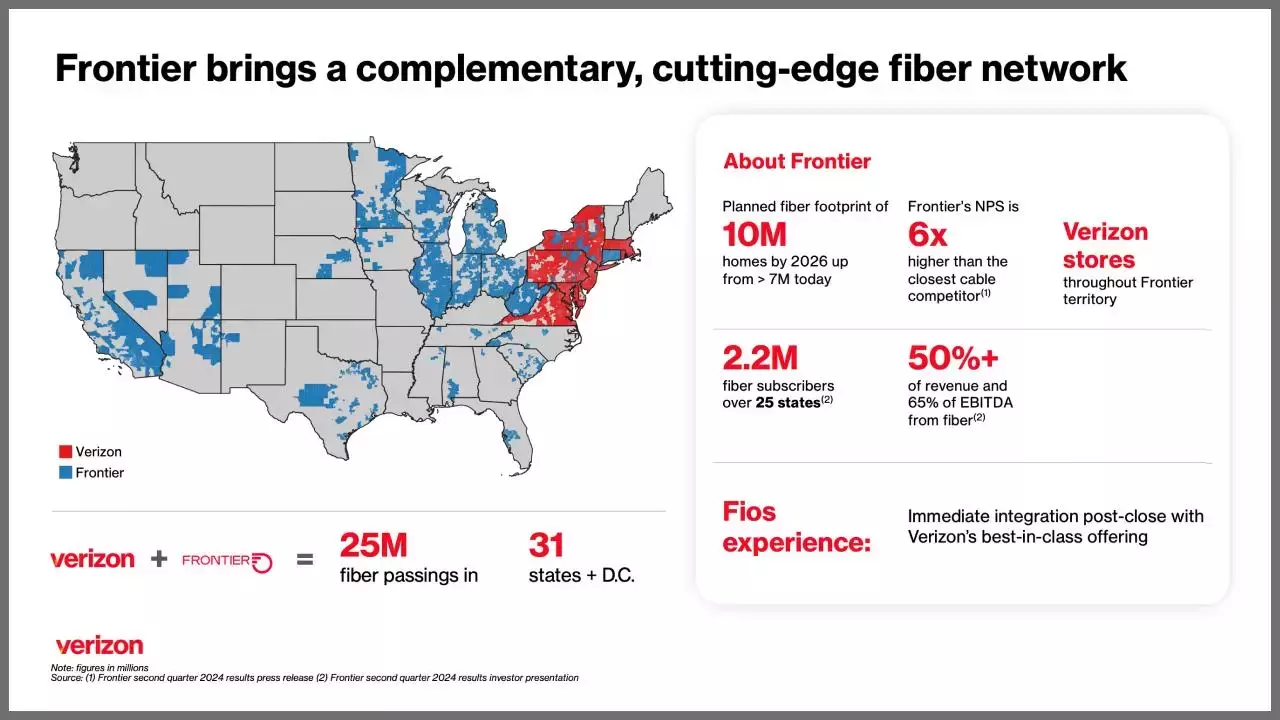

The selling points for Verizon shareholders is a large fiber network that is almost entirely new territory for the company. This gives the company bundling ability in new markets which is their growth focus in a largely mature industry. In addition, long term the deal is expected to drive $500 million in synergy benefit.

Frontier Network (Verizon Investor Relations)

Impact On Verizon Shareholders

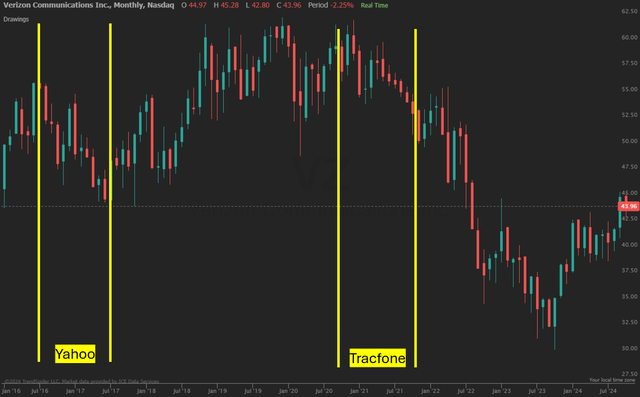

My eyebrows raised extremely high when I saw this deal was announced. Verizon’s record with large M&A deals is extremely poor.

Both Yahoo and TracFone deteriorated shareholder value from announcement to close date. Not to mention Verizon’s purchase of BlueJeans, which they shut down just a few years later. Management tends to get extremely distracted during M&A periods when the massive scale of the existing business requires attention.

Verizon M&A Impact (TrendSpider)

I also feel that the deal is very overpriced for Verizon to see any benefit. $38.50 per share represents a ~37% premium to Frontier’s pre-announcement price or $7 billion in value. Verizon’s main benefits are $500 million in run-rate savings starting in 2027, and incremental EPS likely from bundling starting in 2027.

Using NPV analysis to bring the run-rate savings to today’s value, this is $2.1 billion. That indicates Verizon would need to drive at least $5 billion in value from the business or nearly 5 years of Frontier’s entire operating income.

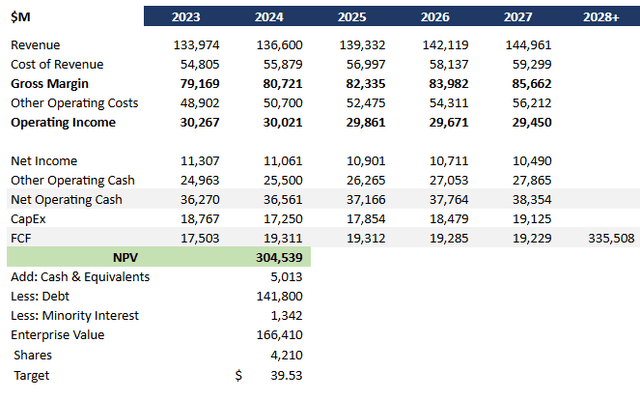

I updated my ongoing DCF analysis on Verizon using the following assumptions:

- Revenue growth of 2% based on management guidance, underlying trends in the business, and overall industry performance

- Cost growth of 3.5% based on the wrap of cost savings initiatives

- The discount rate of 7% based on WACC of 6.7% adjusted for deleveraging shifting more towards equity ownership

- Long-run growth rate of 1% to adjust industry expectations against Verizon’s cost challenges

This DCF analysis yields a price target of $39.53, down from today’s pricing, although still providing a sizeable dividend.

Verizon DCF Analysis (Data: Seeking Alpha; Analysis: Mike Dion)

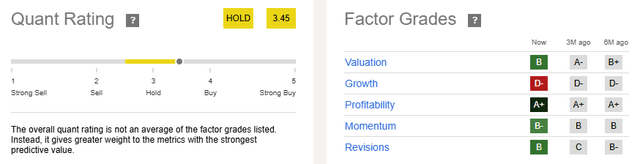

The quant rating is also signaling a hold, driven down by Verizon’s growth challenges as of late, offset partially by a strong profitability rating.

VZ Quant Rating (Seeking Alpha)

Overall, I believe this is an expensive deal for Verizon shareholders with more risk from management distraction than upside potential from the deal unlocking new markets for bundling.

Impact On Frontier Shareholders

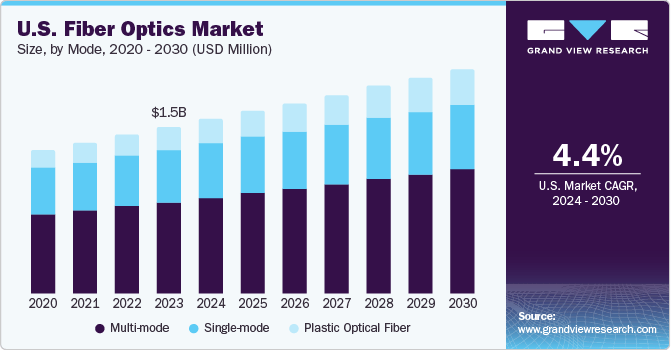

Frontier has been struggling as a standalone fiber company given the limited growth in the market relative to aggressive capex needs. Frontier has struggled to maintain volume, while ARPU has grown below the rate of inflation.

Fiber Market CAGR (Grandview Research)

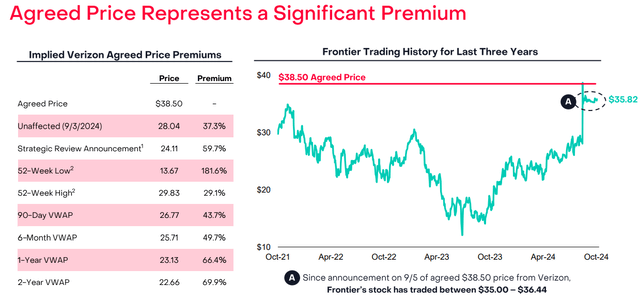

With that in mind, Verizon’s offer represents a price premium along nearly every measure. The deal was a 37% premium to the pre-announcement close and a 66% premium to the 1-year average.

Frontier Implied Price Premium (Frontier Investor Relations)

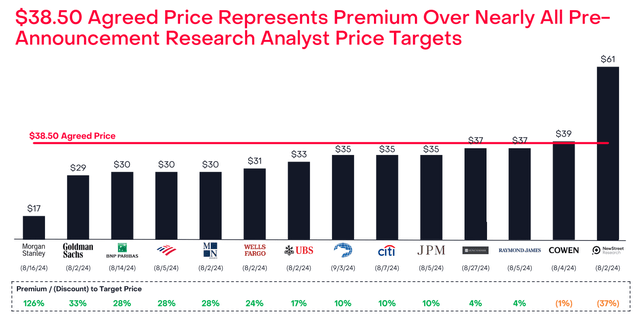

The deal was also a premium to 12 out of 14 analyst estimates prior to the deal announcement.

Analyst Estimates (Frontier Investor Relations)

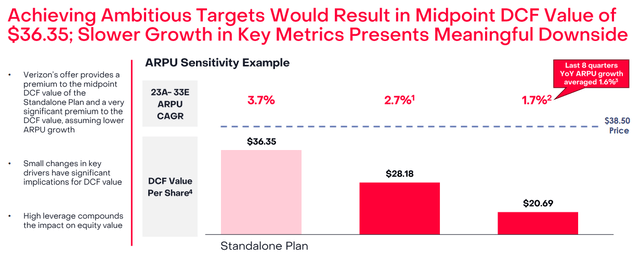

Even more critical (and concerning for Frontier shareholders), growing the business requires several years of negative cash flow and capital investment. In the best case, management expects this to value the company only at $36, while in the worst case, the company is valued at $21. I say the worst case, but management did note concerns about financing the losses as a standalone entity.

Internal DCF Analysis (Frontier Communications)

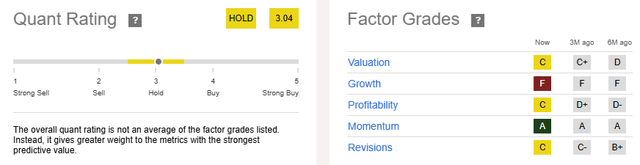

Frontier’s quant rating is currently a hold driven by momentum. Excluding momentum since that is related to the deal, this would quickly fall to a sell absent the buyout offer, in my opinion.

FYBR Quant Rating (Seeking Alpha)

All in all, this is a very favorable buy out for a struggling company where it even admits losses will likely continue for at least three years.

And there is still upside potential on the stock today as investors digest the likelihood of deal completion, representing a great buying opportunity.

Verdict

Verizon gets a very expensive deal that has the potential to distract management and deteriorate value the way Yahoo and Tracfone did. If Verizon executes perfectly, there could be upside potential for shareholders, but we won’t know for at least 3 years. Verizon is a hold purely on the strong dividend at this point, but investors should proceed with caution given their M&A track record.

Frontier shareholders win out as the struggling company with negative cash flow forecasts is purchased at a 20-30% premium based on average of all premium estimates I could locate. It’s also a cash offer putting cash in hand and securing the return in the near-term, while Verizon has to wait to turn the ship around. Based on additional upside to the price and increasing likelihood of the deal going through, I rate Frontier a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.