Summary:

- President-elect Donald Trump’s potential tax credit cancellation could benefit Tesla, Inc., as its affluent customer base is less affected by such incentives compared to competitors.

- Tesla’s market share has declined due to increased competition, but competitors’ cautious investments and financial constraints may allow Tesla to regain dominance.

- Improved EV technology and realistic market expectations position Tesla to capture higher market share, even if EV penetration rates grow slower than initially forecasted.

- Projected $200bn/year revenues and 10-12.5% net margins could potentially help support Tesla’s high P/E ratio, especially with potential growth from initiatives like Robotaxi.

- In the short run, this might further boost enthusiasm for TSLA, but over the long run this is still somewhat speculative and not for the faint of heart.

Brandon Woyshnis

Recent news suggests that President-elect Trump’s transition team may plan to end the $7,500 EV tax credit for consumers. Somewhat surprisingly, anonymous sources also state that Tesla, Inc. (NASDAQ:TSLA) representatives are supportive of this proposed action. While this is still far from certain, would Tesla benefit if this scenario happens? Let’s try out this thought experiment.

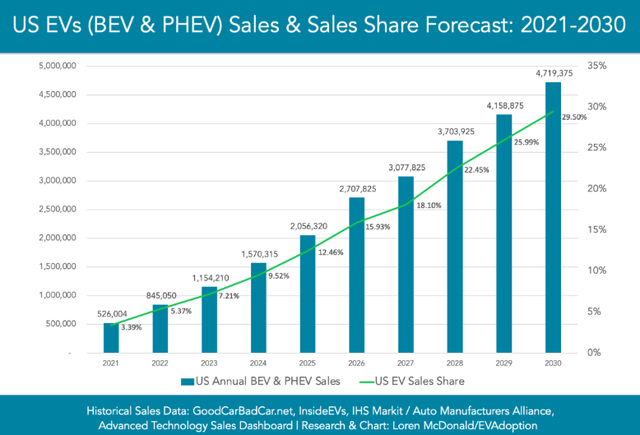

In my previous article, I argued that assuming Tesla would sustain high rates of profitability was unlikely as competition would increase. TSLA’s recent financial statements have indeed shown a deterioration in its profitability as compared to that during the 2021-2022 everything bubble as many companies joined the EV fray. In the past 12 months ended Sep-24, after excluding unusual items, net profit margins were only 8% compared with 14-15% in 2022.

TSLA financials (Seeking Alpha)

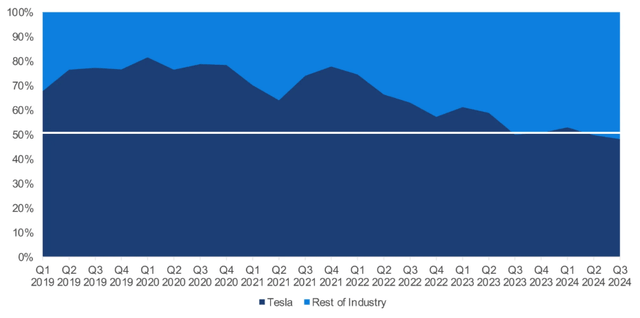

TSLA’s market share in the US declined as well over the past few years from 70-80% in 2019 to 48.2% in Q3-2024, reflecting higher competition.

However, in light of recent news, I’m revisiting my above argument as it appears TSLA may be able to regain market dominance due to shifts in the market landscape in ways that may benefit TSLA.

1. Competitors may become more cautious investing in battery electric vehicles, or BEVs, after finding that this market is not the promised land of growth, particularly in the US:

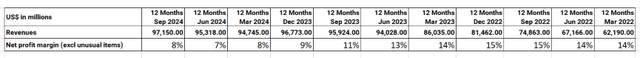

a) The typical growth forecast we saw a few years ago looked like the below, which estimated BEV+PHEV (Plug-in Hybrid Electric Vehicles) sales at 30% of total US auto sales by 2030. Actual figures for YTD Sep-2024 are around 10% (about 80% from BEV and 20% from PHEV. Given PHEV is less than 2% of the overall market and BEV is more relevant to TSLA, we will focus on BEV in this article). Based on these hockey stock growth expectations, automakers made aggressive commitments to invest in EVs.

EV hockey stick growth (Online)

b) In the US, top automakers have made large investments in the BEV sector, but with little to show for it.

BEV as % of total auto sales in Q3-2024 was 8.9%, which is only 1.5% higher than the 7.3% in Q1-2023, almost 2 years ago. If this rate of growth persists, by 2030 BEVs will be 15% of the US auto market, not 30% nor 50%, nowhere near the hockey stick projections.

|

US BEV penetration rate |

Q1-2023 |

Q3-2024 |

|

% |

7.3% |

8.9% |

Source: Cox Auto.

To take Ford (F) as an example. Ford announced in March 2022 plans to invest $50 billion in EVs and related technologies by 2026, but decided to delay $12 billion of EV investments in October 2023 and further announced strategic shifts (read: lower EV investments) in August 2024. The result? Ford sold 23,509 EV cars in Q3-2024, which is 15% higher than the 20k cars sold in Q4-2022, i.e., almost 2 years ago and its BEV business is a drag on accounting profits (with negative $3.7bn in EBIT in YTD Sep-24, and it doesn’t seem like vehicle sales are growing fast enough to achieve the scale necessary to improve profitability).

|

Q4-2022 |

Q3-2024 |

|

|

Ford BEV vehicle sales (#) |

20,339 |

23,509 |

Source: Car Edge.

2. Competitors’ concern about financial KPIs may restrict them from making new bold moves.

a) To continue with the Ford example, it has a market cap of $44 billion. Assuming that reflects the market’s expectation of all future discounted cash flows to shareholders, if Ford spends tens of billions of dollars investing in EV capacity, it is a pretty significant chunk of shareholder value. This is especially if it doesn’t amount to much (Ford’s 23,509 BEV sales in Q3-2024 were about 5% of its total US vehicle sales, even if you add in hybrid EV sales of 48,101, the BEV+hybrid is just 15% of total). Automakers like Ford may find it difficult to justify and/or afford bold moves if there is a policy U turn every few years and the future is clouded with uncertainty.

b) Another example is Volkswagen, which is reportedly considering closing down some plants in Germany and reducing pay, a historic move.

3. Market sentiment and social expectations for the EV transition have been dimmed down:

a) In March 2023, the EU banned the sale of new internal combustion engine (ICE) cars in 2035. By now, automakers are trying to get the EU to cancel/water down this mandate.

b) A few years ago, companies were falling over each other to proclaim their green/EV transition goals and make big commitments, but now that trend has been toned down, so there is less pressure to make bold investment announcements. Now there is a more realistic expectation of revenue growth and profitability of this sector, and it will be much harder to justify major investments to the board based on a leap of faith a second time.

4. If the EV purchase tax credit is cancelled, I expect TSLA to capture higher market share as competitors are hit harder and competitors are less eager to expand EV capacity with the uncertain demand and policy future:

a) My view is that TSLA will be better positioned to weather any EV purchase tax credit cancellation, partly as its customers have higher average household incomes of $133-$150k than median ($70k). They probably will be less swayed either way with or without EV purchase tax credits. According to S&P Global Mobility, TSLA leads the market with a 67.8% loyalty rate (industry average 52.5%), so TSLA benefits from more loyal and affluent customers.

b) Whereas TSLA’s competitors are fighting for the remaining market segment that is more cost sensitive and would be more negatively impacted by the cancelling of the EV credits. For instance, Ford has communicated externally its plans to develop more affordable EVs with a starting price of $25,000. $7,500 would be about 30% of the purchase price, which would be very material for cost sensitive consumers.

c) What’s more, it appears there might not even be that much of an incentive for automakers to produce lower-priced new cars. According to a recent piece by the Wall Street Journal, a decade ago 40% of new vehicle transactions in the US were less than $25,000. This declined to a quarter in 2020 and this year only about 9% were less than $25,000 as automakers shift to prioritize bigger and more expensive vehicles with higher margins.

5. EV technology continues to improve and TSLA will be able to utilize these technologies. Before EVs became mainstream, people used to figure that battery improvements were likely to be slow and marginal. However, now EVs have grown into a big market, there’s a much bigger incentive to innovate batteries and every month or two we hear about a new battery tech breakthrough around the world. While EVs might not achieve the market penetration rate as quickly as originally forecast, improved technologies will likely increase the market penetration rate at least somewhat and these gains will accrue to TSLA.

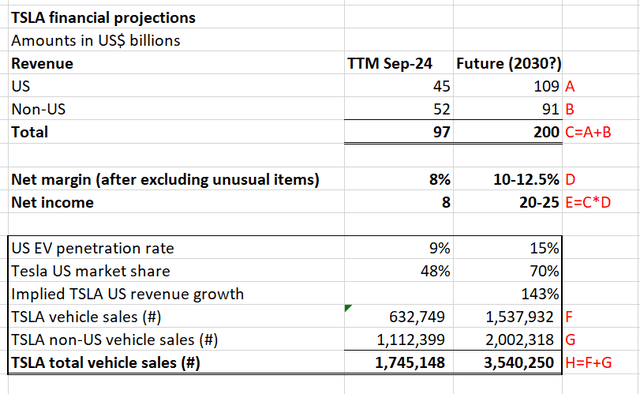

Based on the above, what might the math look like in my opinion?

TSLA forecast (Author projections)

Notes to above chart:

C: I project that TSLA could achieve $200bn/year revenues, mainly from:

1. Growing its US market share as well as moderate growth in BEV penetration rate.

2. Growing in other non-US markets in-line with overall market expansion. Note that global 3.5 million vehicle sales by 2030 is still very much on the low end of market estimates (which range from 3 to 6 or even 8 million vehicles by 2030) but the potential boost to US sales will definitely help make the achievability of TSLA’s forecast more robust.

D: Net margins are expected to increase to 10-12.5% (a haircut from the 14-15% achieved in 2022 to be prudent).

E: Then TSLA could earn $20-25bn a year net income, which would result in a P/E of 40-50, which though somewhat lofty, could still be justifiable if other potential sources of growth such as Robotaxi bear fruit.

Once TSLA starts to regain market share and profitability in BEVs, this could give investors comfort over its ability to sustain its current market cap (which is many times that of competitors) for the foreseeable future.

Risks to above thesis

Obviously, cancelling the $7,500 purchase credit may never come to fruition. Even if it does, automakers might want to stay in BEVs ahead of future market growth and TSLA might not regain its market share or see an improvement in its profitability.

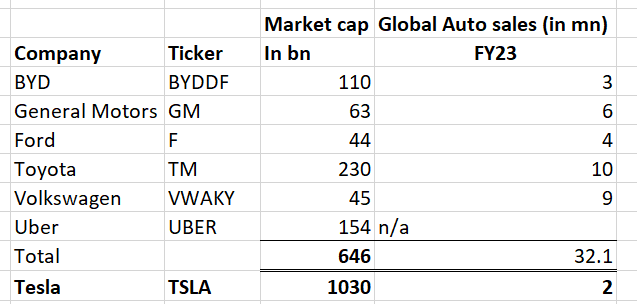

The biggest risk, however, is TSLA is now worth more than BYD (OTCPK:BYDDF), General Motors (GM), F, Toyota (TM), Volkswagen (VWAKY) and Uber (UBER) combined plus another 50%, as shown below. These auto companies produce 32 million vehicles (TSLA produces 2 million annually now and is expected to produce anywhere from 5 to 8 million by 2030) and I’ve thrown in UBER for good measure (assuming that Robotaxi can create as much value for TSLA as Uber’s market cap). It still appears to be a daunting task for TSLA to sustain its market cap even if it gets a lion’s share of the US BEV market: assuming TSLA achieves TM’s profitability, TSLA will need to grow to the size of 3 or 4 TMs, and Robotaxi will need to grow to the scale where it supplants Uber.

Automaker market caps (Seeking Alpha)

Conclusion

My reappraised view of Tesla, Inc. is that changing market dynamics may make TSLA more interesting, and cancelling the $7,500 purchase credit could indeed help drive revenue and profit growth.

In the short run, cancellation of the EV tax credit will improve US market competition dynamics for TSLA, and improving sales and financials may help drive market enthusiasm and momentum to send TSLA’s stock price up further.

Over the long run, TSLA stock is not for the faint of heart. It must sell 20 or 30 million vehicles a year at Toyota levels of profitability and also achieve considerable success with its Robotaxi to perhaps justify its current market cap. This seems like a very challenging goal. Even then, TSLA could very well make headway towards becoming another Toyota or two, but the stock could still sputter somewhere along the road as the market realizes even two Toyotas and an Uber aren’t worth $1 trillion.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.