Summary:

- Alibaba reported better-than-expected earnings for the September quarter, but missed on revenues.

- The e-Commerce company saw a 1 PP revenue acceleration Q/Q due to growing strength in Taobao and Tmall Group, Alibaba’s core domestic commerce business.

- AIDC remained Alibaba’s fastest growing business in the September quarter.

- Alibaba is a capital return play, with significant free cash flow being returned to shareholders through stock buybacks.

- The company’s valuation has become more attractive, trading at a forward P/E ratio of 9.1X, below historical levels.

maybefalse

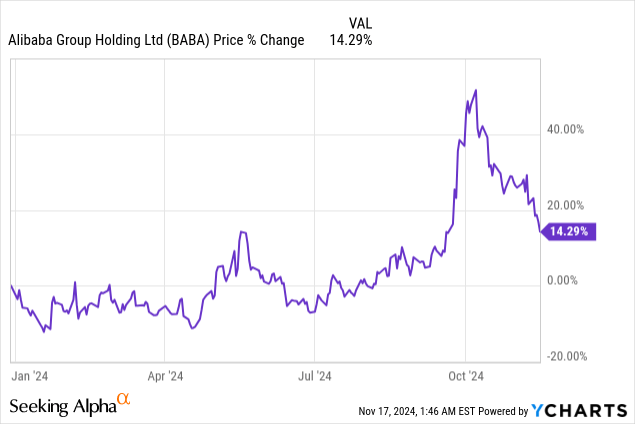

Alibaba (NYSE:BABA) reported mixed results for the September quarter on Friday that beat on the bottom but missed on the top line. The e-Commerce company remains a play on a massive fiscal stimulus package that the Chinese government is organizing in order to give China’s economy a jolt, and Alibaba also once again generated strong free cash flow… which the company is spending chiefly on stock buybacks. Besides Alibaba’s free cash flow strength and China’s fiscal stimulus package, the company’s valuation has become much more attractive again lately.

Previous rating

Alibaba’s shares surged in October on hopes that Beijing would pass a massive spending package meant to stimulate economic growth in China. I discussed this fiscal stimulus plan as well as the potential impact on Alibaba in my work: China Stimulus Plan Is A Game Changer. Investors initially reacted euphorically to the announcement, causing shares of Alibaba and those of other Chinese e-Commerce firms to soar, but expectations have since moderated. However, Alibaba continues to grow in its core businesses and generates a lot of free cash flow, which management is returning to investors. In my opinion, Alibaba is chiefly a free cash flow play and has a very cheap valuation again.

Alibaba beats earnings estimates

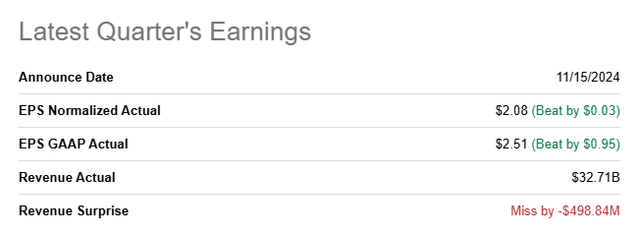

Alibaba generated better than expected earnings for its September quarter: the e-Commerce company reported $2.08 in adjusted earnings per-share, beating the average prediction by $0.03 per-share. The top line missed slightly, as China’s post-pandemic recovery remains sluggish: Alibaba missed the consensus estimate by $498.8M.

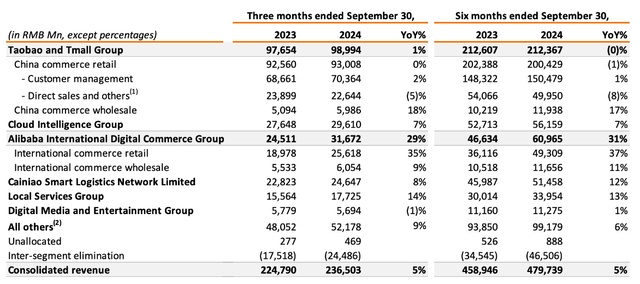

Alibaba generated 236.5B Chinese Yuan, which is the equivalent of $33.7B in revenue in the September quarter, showing 5% year-over-year growth and a 1 PP acceleration compared to the previous quarter. Alibaba’s core business, Taobao and Tmall Group, which essentially consolidated its domestic e-Commerce activities, saw a relatively moderate 1% top-line increase compared to the year-earlier period, but a 2 PP improvement compared to the June quarter.

Taobao and Tmall Group have been seeing weak growth in recent quarters amid a choppy recovery for China’s economy after the COVID-19 pandemic. However, there are other segments, although smaller in size, that are doing quite well for Alibaba, including its Cloud Intelligence Group, which saw 7% year-over-year growth (boosted by AI products) and which reached record revenue of 29.6B Chinese Yuan ($4.2B). Alibaba International Digital Commerce Group posted the highest growth rate of 29% again in the September quarter (it did so also in the June quarter), driven by growth in international commerce volumes.

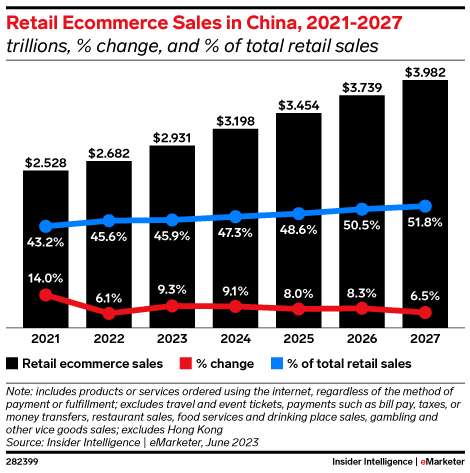

Alibaba’s Taobao and Tmall Group represented 42% of Alibaba’s consolidated revenue in the September quarter, compared to 45% in the June quarter, so the company is going to remain dependent on growth in the e-Commerce business more than anything else going forward. Therefore, prospect for market expansion and higher e-Commerce sales are going to be of utmost importance for Alibaba. According to projections made by research firm eMarketer, China’s e-Commerce sales are set to grow to $4.0T by the end of FY 2027 which implies an annual average growth rate of 7.8% (with FY 2021 being the base year).

eMarketer

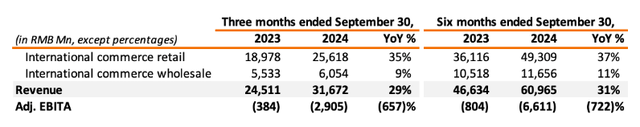

Alibaba International Digital Commerce/AIDC is doing very well for Alibaba and helps the company offset some of its domestic commerce weakness. China is rolling out a multipronged fiscal stimulus package (discussed in my last work on Alibaba) which includes the lowering of mortgage rates and reserve ratios for banks.

This is meant to support the struggling property sector as well as boost consumer spending, which could help chiefly Alibaba’s Taobao and Tmall Group as well as its Local Services Group (Alibaba’s delivery services). Alibaba also completes a considerable amount of e-Commerce transactions that originate from abroad, and this part of Alibaba is doing really well: international retail e-Commerce revenues surged 35% year-over-year to 25.6B Chinese Yuan ($3.7B) in the September quarter.

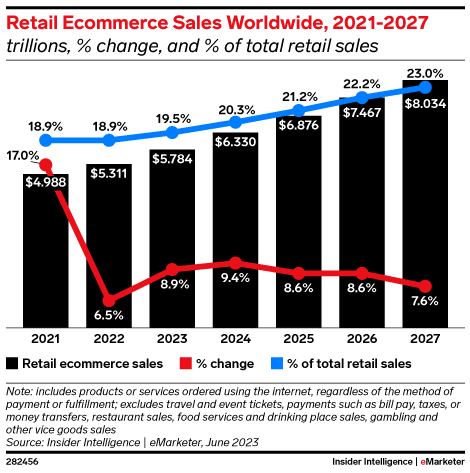

AIDC obviously benefits from growing cross-border trade volumes as well as global e-Commerce growth. Also based off of projections made by eMarketer, global e-Commerce volumes are expected to grow to $8.0T, implying an annual average growth rate of 8%. AIDC would certainly be a beneficiary of continuing cross-border trade and the absence of any trade tariffs.

eMarketer

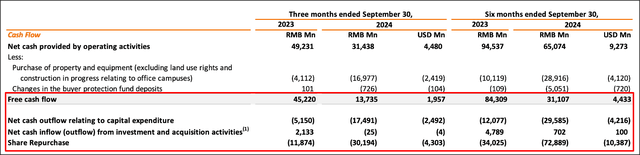

Strong free cash flow value and capital returns

In my opinion, too many investors focus too much on growth metrics, but disregard Alibaba’s enormous free cash flow value. Alibaba generates a ton of free cash flow from its core operations, mainly e-Commerce, and management is returning a large amount of it to shareholders. In the September quarter, Alibaba generated 13.7B Chinese Yuan ($2.0B) in free cash flow and the company completed 30.2B Chinese Yuan ($4.3B) in stock buybacks. In the first half of the current fiscal year, Alibaba generated 31.1B Chinese Yuan ($4.4B) in free cash flow and repurchased 72.9B Chinese Yuan ($10.4B) of shares on the market.

Alibaba’s free cash flow margin in the September quarter was 6% compared to 7% in the previous quarter. I believe Alibaba could easily achieve $10-12B in annual free cash flow in the next two years, assuming that the Chinese economy does not slip into a recession.

Alibaba is buying back more stock at the moment, but hasn’t always done so. The push to buy back more shares, at attractive P/E ratios, was announced earlier this year when Alibaba’s board of directors approved a $25B stock buyback program in order to counter investor concerns about slumping revenue growth. I believe Alibaba could be set to announce a new stock buyback program in the first half of next year, which would obviously provide further support to Alibaba’s share price.

Alibaba’s valuation

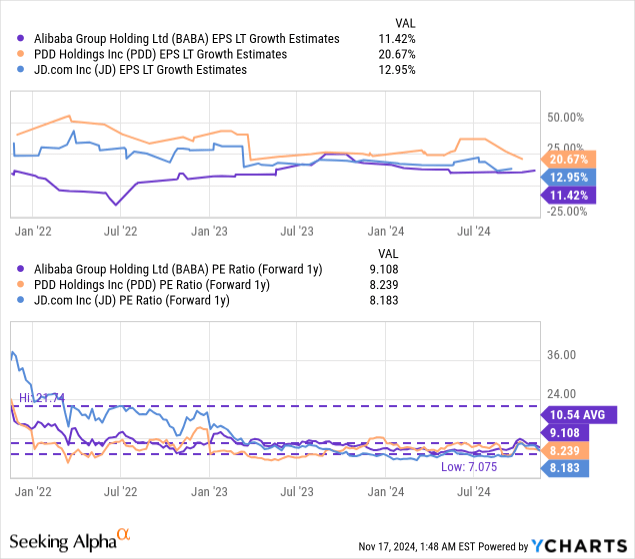

Alibaba’s shares surged in October as Beijing rolled out major stimulus packages to help Chinese consumers that are suffering from a sluggish economic recovery post-pandemic. Currently, shares of Alibaba trade at a forward (FY 2025) P/E ratio of 9.1X which is below the company’s 3-year average price-to-earnings ratio of 10.5X and which implies an earnings yield of 11%.

Alibaba’s valuation, as well as the valuations of other Chinese tech companies, fell drastically in 2020 when China’s Communist Party cracked down on tech monopolies, including Alibaba, in a bid to assert a higher degree of control over the corporate sector. This crackdown is largely to blame for investor reservations about buying Chinese large-cap tech companies and low P/E ratios in the sector.

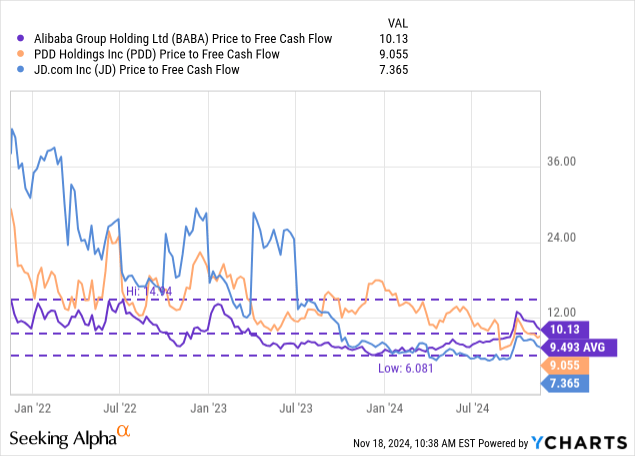

JD.com (JD) and PDD Holdings (PDD), which are rival e-Commerce firms, are trading at forward P/E ratios of 8.2X and 8.2X… and both companies have seen similarly steep valuation drawdowns to Alibaba in the last month.

PDD has by far the fastest expected long term EPS growth of 21% annually, largely because it owns the rapidly growing Temu e-Commerce platform. JD.com, which is also chiefly a capital return play, is expected to grow its earnings 13% annually, which is just about 1.5 PP higher than what investors expect of Alibaba (11.4%). Alibaba, however, is by far the biggest e-Commerce platform and has the most diversified business, in my opinion.

In my last work on Alibaba I calculated a fair value of $128 per-share for Alibaba — based off of a longer term, 10-year historical P/E ratio of 13.0X — which I only slightly adjust after the firm’s Q2 earnings scorecard. The latest consensus FY 2025 EPS projection for Alibaba is $9.75 per-share which calculates to a fair value estimate of $127 (a reduction of $1/share in my fair value target).

I believe some investors have been tempted to take some profits here after shares have had a good run in October, but I don’t see any reason to deviate from my price target of $127 per-share. Alibaba’s operating companies continue to generate a ton of free cash flow and the company is generous with its capital returns. I am especially optimistic about Alibaba benefiting from China’s stimulus spending package in its core Taobao and Tmall Group.

As far as the company’s free cash flow goes, Alibaba is also undervalued based off of this metric, in my opinion: Alibaba is trading at a 10X P/FCF ratio, which is 7% above the 3-year average P/FCF ratio of 9.5X. PDD Holdings and JD.com trade at P/FCF ratios of 9.1X and 7.4X while the industry average P/FCF ratio is 8.9X. Alibaba valuation multiplier therefore implies a solid 10% free cash flow yield which to me is bargain territory. Given the size of Alibaba’s free cash flow, potential to reach $10B in annual free cash flow next year and diversified portfolio that includes growing Cloud operations, I believe Alibaba’s shares are undervalued. Alibaba is also the largest e-Commerce platform in China and buys back more shares than any of its rivals.

I would be totally comfortable paying 13X FCF for Alibaba (which is in-line with its historical ratio as well as the firm’s 5-year average P/FCF ratio of 13.5X), given its dominant position in e-Commerce and strong free cash flow, which equates to a price target of $114 per-share.

Both the low P/E and P/FCF ratios indicate to me that investors are undervaluing Alibaba’s earnings and free cash flow or, put differently, an investment in Alibaba may provide deeper value than investors think. Shares of Alibaba have traded at significantly higher valuation ratios before FY 2020 which is when Beijing-led crackdowns on tech companies caused a suppression of earnings and FCF multipliers. As an example, Alibaba’s 10-year price-to-FCF ratio is 20X. Since China has proven to be much more accommodating lately — the fiscal stimulus plan is just one example — and pulled back from overly aggressive regulatory enforcement actions, I believe that Alibaba has considerable revaluation potential long term.

Risks with Alibaba

The biggest risk for Alibaba, as I see it, relates to a growth slowdown in Taobao and Tmall Group which is the most important segment within Alibaba’s operating portfolio. Further, I would be concerned about a decline in free cash flow as my thesis with regard to Alibaba is chiefly built on the company’s free cash flow strength. Lastly, a reduction in stock buybacks may affect my investment rating for Alibaba negatively.

Closing thoughts

Alibaba’s share price has started to drop off after initial euphoria about China’s fiscal stimulus plan. However, Alibaba is doing better than investors think, in my opinion, chiefly because the company generates a very high amount of free cash flow from its collection of operating businesses, especially e-Commerce. Most importantly, Alibaba is returning a lot of this free cash flow to shareholders through stock buybacks, which fundamentally makes the e-Commerce firm a capital return play. What I really like about Alibaba is that the company has gone through a considerable valuation drawdown in the last couple of weeks, meaning shares of Alibaba are now cheap again with a forward price-to-earnings ratio of 9.1X. In the long term, I see a significantly higher fair value and the risk profile on the drop has improved as well.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA, PDD, JD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.