Summary:

- Once a dominant tech giant, Alibaba Group struggles with a stagnating business and lacks clear growth engines, all while political risk remains ever-present and management has no ideas beyond share repurchases.

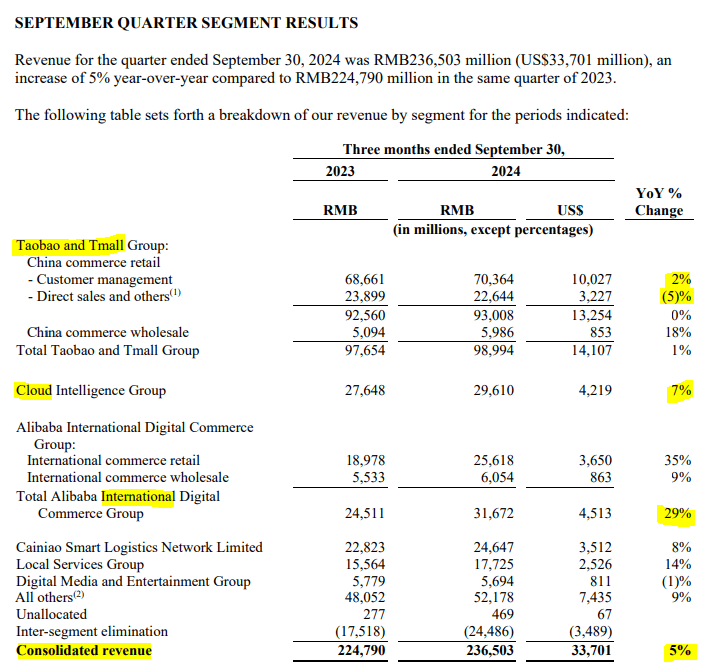

- Alibaba’s revenue and operating income have grown just 5% year-over-year, with key platforms like Taobao and Tmall continuing to underperform severely.

- Alibaba Cloud is growing at just 7%, well below the industry average and AWS’s 18%. I believe geopolitical tensions are deterring private customers from choosing a Chinese player.

- The International Digital Commerce Group, while growing at 29%, remains unprofitable and contributes less than 10% of revenue, facing stiff competition from platforms like Temu and Amazon’s Haul.

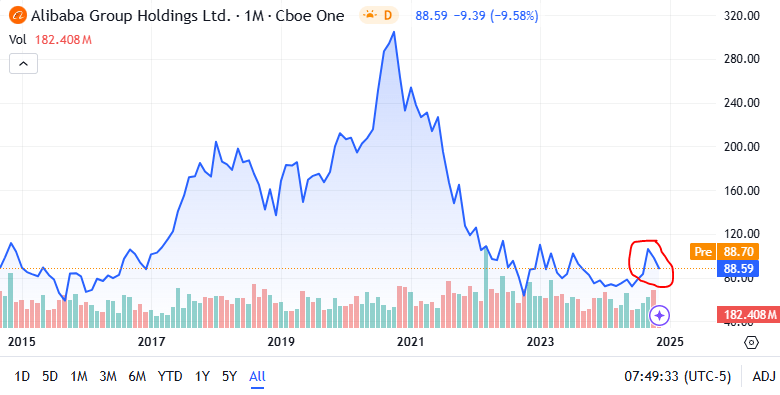

- Despite spending over $4 billion on share repurchases last quarter and more accommodating monetary policy in China, BABA stock price remains roughly at 2014 levels.

maybefalse/iStock Unreleased via Getty Images

Alibaba overview

There is no doubt in my mind that Alibaba Group Holding Limited (NYSE:BABA) is undervalued based on traditional financial metrics. Yet, the market continues to reject the stock, which now trades near IPO levels—down more than 70% from its all-time highs.

Why is this happening? I believe the market is pricing in factors beyond the company’s financials. In this article, I’ll explore the key concerns emerging from the latest quarterly earnings, and why these issues are indeed concerning for potential investors, in my view.

This is my third article on Alibaba for Seeking Alpha. I last covered this stock in August, arguing how weak e-commerce and Cloud business were compounding the still-present political risk tied to investing in China. I encourage readers that are interested in understanding my full take on BABA to read my previous work before proceeding with this article.

Reason #1: Anemic growth means BABA is no longer a growth stock

For the past two quarters, Alibaba has grown at roughly 5% year-on-year. What this indicates, in my view, is that the company has stabilized to a new norm of stagnation, and it cannot be considered a growth stock any longer.

While top-line growth has been stagnant, the bottom line is no better. Income from operations is growing at 5% — in line with revenue — on a quarterly basis, but declining 6% on a six month basis.

This is in stark contrast with the results of Amazon.com, Inc. (AMZN), growing revenue by 7% and Operating Income by 19% as of the last quarter (Seeking Alpha data).

Key BABA financials, Income statement (Alibaba’s last quarterly earnings)

What I find particularly worrying is how growth is disproportionately coming from international operations. Core businesses Taobao and Tmall registered a 5% decline in direct sales, only compensated by a 2% growth in customer management. I see this as a fundamental weakness in Alibaba’s capacity to grow its core e-commerce business. A weakness that has now been repeated for two consecutive quarters.

Reason #2: Sub-par Cloud strategy

According to Statista, the Cloud industry is experiencing a yearly CAGR of 28%, with Alibaba Cloud having a 4% market share at the time of writing.

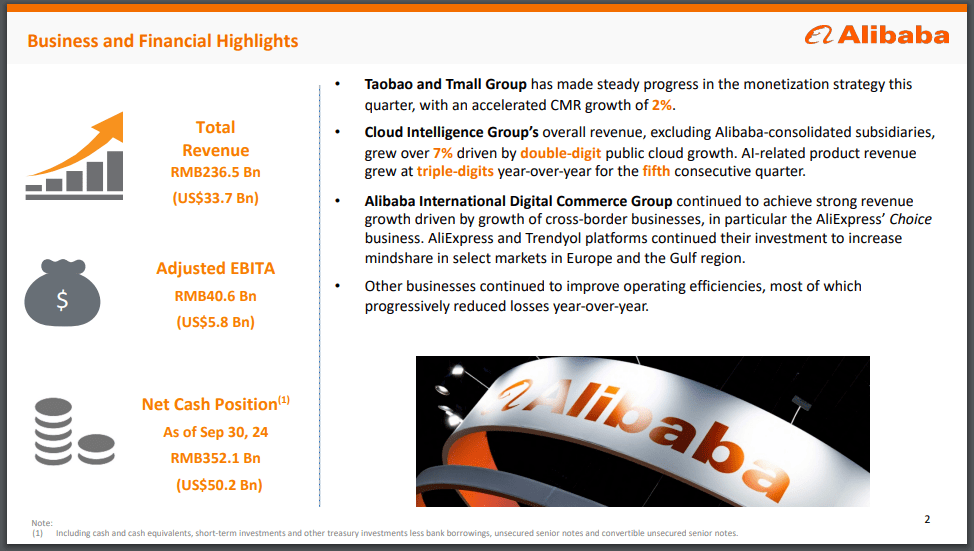

Alibaba’s Financial Highlights (Alibaba’s last quarterly earnings presentation)

Alibaba’s Cloud segment is growing by 7%, driven by what management refers to as “double-digit public cloud growth.” Once again, this figure pales in comparison with AWS, which is growing at 18% as of the last quarter.

What this indicates, in my view, is that Alibaba is failing to grow its market share with private customers, and merely benefiting from the Chinese public sector.

I believe political risk has contributed to these Cloud results. Many private customers might be reluctant to rely on Chinese Cloud infrastructure at a time of high political and economic tensions between China and the West. Precedents, such as that of Huawei, which was partially banned in the US by the current Biden administration, indicate that relying on Chinese software might involve a significant risk.

I consider results of the Cloud segment concerning, especially accounting for the fact that Alibaba’s Cloud was once touted as one of the key growth engines of the company.

Reason #3: International segment is growing, but unprofitable and faces competition

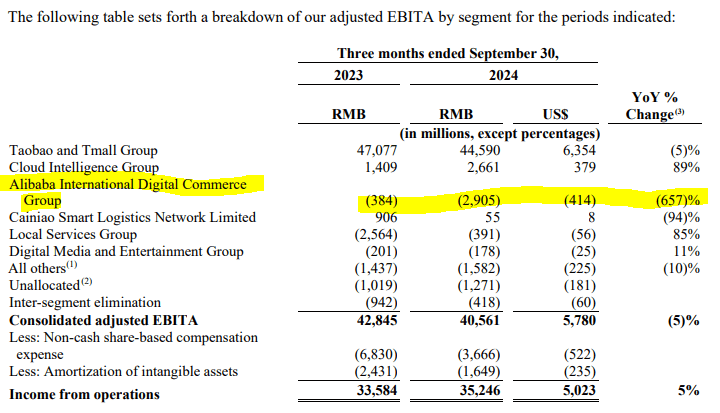

I often see Alibaba bulls pointing at the growth of the “International Digital Commerce Group” as a positive element and potential catalyst for the stock. The issue with that, in my view, is that this segment is still far from profitable. While growing at an impressive 29% year-on-year, It lost the equivalent of roughly $50 Million in the past three months.

Highlighted figures from Alibaba’s Income Statement (Alibaba’s last quarterly earnings)

Even in terms of revenue, the International segment of Alibaba represents less than 10% of total revenue for the company. With the core e-commerce business suffering at home, and Cloud being stagnant for political reasons, I see it unlikely that an unprofitable segment worth less than 10% of revenue can single-handedly “fix” Alibaba.

Additionally, I see a growing headwind for Alibaba’s international commerce segment: competition. The International Digital Commerce Group relies heavily on AliExpress, which at its core serves as a bridge for direct access to Chinese suppliers.

Recently, this segment has faced significant competition from both Chinese and Western players. PDD Holdings, Inc. (PDD) launched Temu, a platform offering Western consumers direct access to Chinese suppliers, directly competing with AliExpress. At the same time, Amazon.com, Inc. (AMZN) has introduced Haul, a mobile platform targeting price-sensitive shoppers who currently browse platforms like Temu and AliExpress.

While Alibaba’s international segment has not yet shown signs of slowing, I believe it is unlikely to sustain its current growth rates for much longer given these competitive pressures.

Reason #4: You can’t stock repurchase yourself to greatness

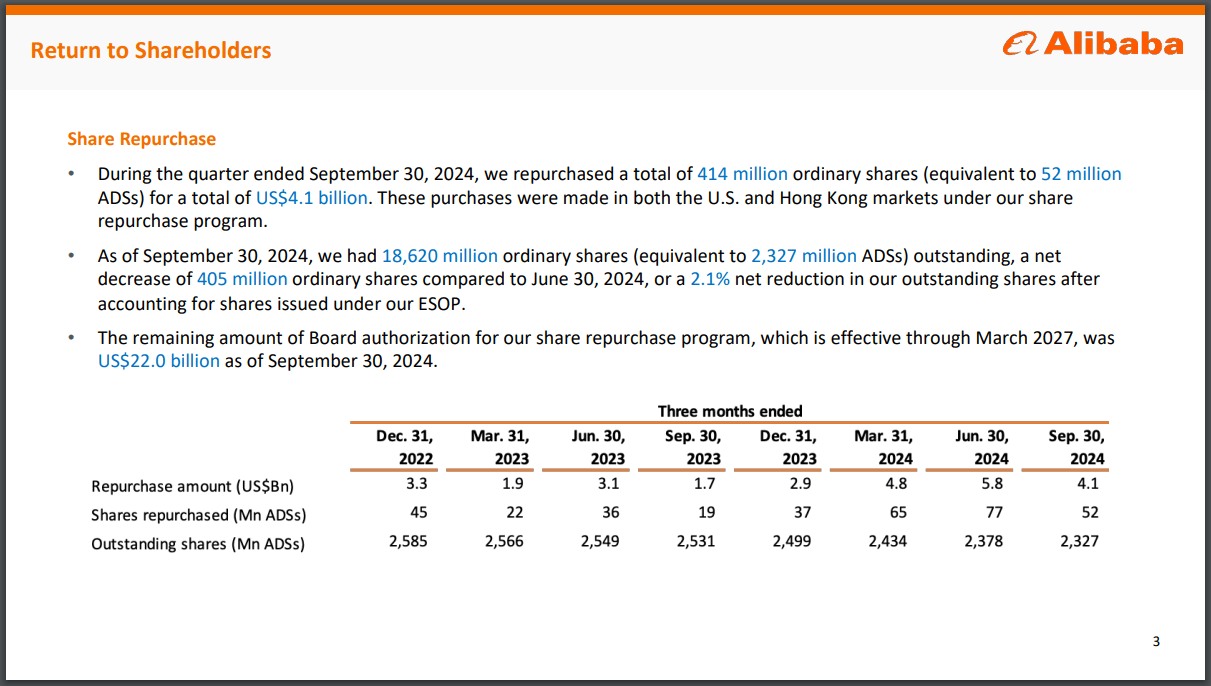

Another element that I often see portrayed as a potential catalyst for BABA concerns stock repurchases. It’s true that Alibaba has allocated substantial funds to buy back its shares recently. In the last quarter alone, the company spent over $4 billion on stock repurchases across the US and Hong Kong markets.

My opinion is that this impressive amount of money would be better spent on figuring out how to fix Alibaba’s core e-commerce business or to find new market segments to enter. Moreover, I find such a strong emphasis on stock repurchases unusual for a company that claims to be a major tech player. It raises questions about whether management has confidence in the company’s R&D and innovation capabilities.

Return to Shareholders, Key Figures (Alibaba’s last quarterly earnings presentation)

While buying back shares at a time when valuations are compressed might make sense in theory, these efforts have so far failed to support Alibaba’s share price.

I think that’s because the market disproportionately rewards growth and profitability, both of which Alibaba lacks at this point. Simply repurchasing shares is unlikely to transform a struggling core business into a high-growth company.

Reason #5: Political risk

Political risk is still, in my view, the main reason why Alibaba trades at a significant discount against any Western competitor. I have covered in detail my thesis about political risk in my first article about this stock, providing a comprehensive historical overview of the CCP’s stance on globalization and openness to the West.

I am not going to repeat myself, and I encourage readers to read that article. What I will add is that, since the publication of the piece, the situation has only gotten worse. The Trump administration is expected to put economic pressure on China via tariffs and a new trade war.

Alibaba’s Stock Performance since IPO (Seeking Alpha)

China recently announced significant monetary measures to prop up its declining consumer confidence and domestic demand. While these actions might be considered positive catalysts for Chinese equities, they have failed to reverse the situation for Alibaba. The initial positive reaction was met with a sell-off, as shown in the chart above.

The reason, in my view, is simple: the CCP policies are aimed at benefiting Chinese citizens rather than catering to the interests of foreign shareholders. Any action taken by the CCP is designed to improve domestic welfare, not to support foreign citizens who have invested in Cayman Islands-based financial instruments tied to Chinese companies.

I recently visited China and was impressed by the country’s significant achievements in politics, society, and the economy. I believe China is far more innovative today than Europe, where I live. However, I still view China as fundamentally uninvestable because its system does not prioritize rewarding foreign shareholders.

Risks to my thesis

The main risk to my bearish investment thesis for Alibaba is the possibility of a pivot in economic or foreign policy by the Chinese Communist Party (CCP). Chinese equities would benefit greatly from increased openness to the West and reduced political tensions. Alibaba, as a leading Tech giant that was disproportionately targeted by the CCP in 2020, would surely benefit too, in my opinion.

In this context, I view Alibaba as an asymmetric bet against the CCP. While this is not a bet I am willing to take, I acknowledge the substantial upside potential if political risk were to diminish.

Another risk is that Alibaba’s management might be able to find a new growth engine for its business, even without repurposing resources that are currently being used for share repurchases. While I do not see this as a likely outcome in light of the last two quarters, Alibaba remains a fairly innovative Tech company. It might just manage to diversify or re-ignite growth in its core business in the upcoming quarters.

Conclusion

As an investor, I constantly strive to look beyond financial metrics to understand the reasons behind a company’s valuation. It’s easy to see that Alibaba is cheap by its P/E ratio or when compared to Western counterparts, but fewer people grasp why it’s cheap—and why buying it might not be “value investing” but rather an example of “catching a falling knife.”

In my view, the market sees Alibaba as a once-dominant Chinese technology giant now struggling with its core domestic e-commerce and Cloud businesses. It appears to lack a realistic growth engine, while its resources and focus are diverted toward share repurchases rather than addressing these challenges or pursuing meaningful innovation.

Yes, Alibaba remains very cheap, and—should the Chinese political risk subside—it is a business that deserves a far better valuation. However, in the absence of a significant shift in economic and political policies by the CCP, this remains a stagnant company unlikely to deliver alpha returns for investors. For this reason, I am rating Alibaba a SELL once again, following two earnings reports that confirm the declining trajectory of a once-great technology giant.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.