Summary:

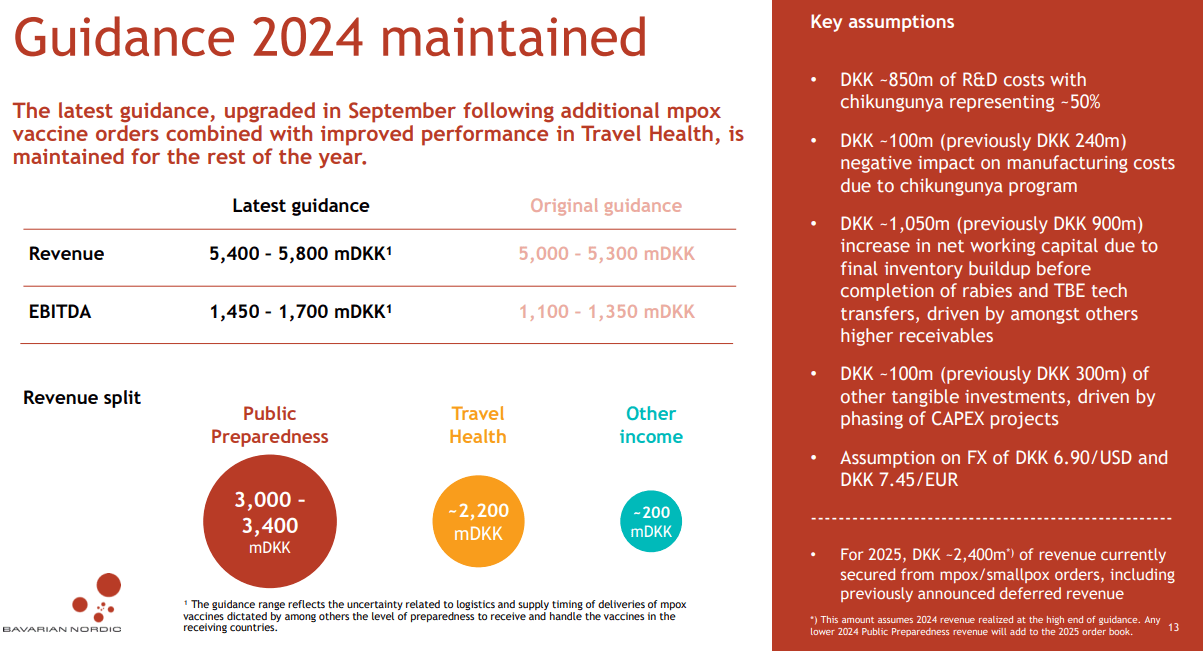

- Bavarian Nordic holds contracts totaling approximately $340 million for 2025, driven by vaccine demand and global health policies.

- Its diversified vaccine portfolio targets smallpox, mpox, rabies, tick-borne encephalitis, and investigational areas like chikungunya.

- BVNKF collaborates with international health organizations, adding both revenue opportunities and dependency risks.

- Regulatory events in 2025, especially for the chikungunya vaccine, are critical to Bavarian Nordic’s near-term revenue growth.

- Despite potential regulatory uncertainties, BVNKF trades at a discount relative to peers, with favorable growth prospects and margins, making it a speculative “Buy.”.

Luis Alvarez

Bavarian Nordic A/S (OTCPK:BVNKF) is a Danish biotech focusing on vaccines for smallpox, mpox, rabies, tick-borne encephalitis [TBE], and ebola immunizations. The company has secured substantial contracts worth roughly $340 million for 2025. These contracts are related to prophylactic government policies to fight against resurgent health threats such as the mpox outbreak in Africa. However, vaccine stocks now have some added uncertainty due to the potential designation of Robert F. Kennedy Jr. as the head of the US Department of Health and Human Services. Nevertheless, I think BVNKF already trades at a discount relative to its peers, plus it has favorable growth prospects and margins into 2025. So, ultimately, I lean towards a speculative “Buy” rating for investors who understand its embedded biotech and regulatory risks.

Vaccine Play: Business Overview

Bavarian Nordic is a Danish biotechnology company that develops vaccines for infectious illnesses. Founded in 1992 and headquartered in Hellerup, Denmark, the company also has research and office facilities in Switzerland, Germany, and the United States. The company’s portfolio includes approved vaccines, such as a non-replicating vaccine for smallpox and mpox, previously known as monkeypox. These are commercialized under Imvamune in Canada, Imvanex in Europe, and Jynneos in the US. Similarly, RabAvert is distributed in the US and Rabipur in Europe to prevent human rabies and prophylaxis after exposure. Also, Encepur is approved in Europe for immunization against tick-borne encephalitis [TBE].

Source: BVNKF’s website.

Furthermore, on September 20, 2024, BVNKF’s mpox vaccine received a label extension to include adolescents aged 12 to 17 in the EU. This was based on the European Medicines Agency [EMA] ‘s recommendation. Also, the World Health Organization [WHO] approved this vaccine for adolescents to enhance protection for this vulnerable group. Additionally, the company is preparing a 2025 relaunch of Vivotif for typhoid and Vaxchora for cholera.

Moreover, BVNKF’s pipeline includes investigational vaccines like CHIKV, a virus-like particle [VLP]-based candidate indicated for Chikungunya prevention. Its BLA submission was completed in June 2024, with the PDUFA date set for February 14, 2025. Also, the Marketing Authorisation Application (MAA) with the European Medicines Agency (EMA) received filing acceptance and validation on July 18, 2024. The launch is expected in 1H2025. Another vaccine candidate is MVA-BN WEV for equine encephalitis immunization. This latter IP was developed with US Department of Defense funding, and its Phase 2 trials are planned for later this year.

Source: Bavarian Nordic Q3 2024 Results Conference Call. November 15, 2024.

BVNKF is also working to extend the global reach of its vaccines, collaborating with health organizations to address emerging infectious threats. The WHO has prequalified BVNKF’s mpox vaccine, which should facilitate its worldwide distribution. Moreover, the company is working with Africa Centres for Disease Control and Prevention [Africa CDC] to increase the production of the mpox vaccine to ensure equitable immunization access in this continent using local capacities. BVNKF has also partnered with Gavi, the Vaccine Alliance, to improve immunization coverage, especially in low-income countries.

Overall, I think this shows that collaborating with NGOs and other international health organizations is a key aspect of BVNKF’s strategic priorities. These collaborations undoubtedly facilitate its revenue growth, making it a key value driver to consider. However, it’s also a potential risk because BVNKF’s revenue prospects would decline significantly if these collaborations ceased.

Mpox Outbreaks and Regulatory Events

Nevertheless, so far, BVNKF has secured orders totaling around $340 million for 2025 for its mpox and smallpox vaccines. This substantial revenue is partially driven by the WHO’s decision to declare mpox a global health emergency for the second time due to the appearance of a new variant of the virus called “Clade lb” in the Democratic Republic of Congo. Since this announcement, 15 African countries have presented more than 29,000 mpox cases in 2024, resulting in 738 fatalities. The outbreak underscores the urgent need for immunizations and the important role of BVNKF in alleviating this crisis.

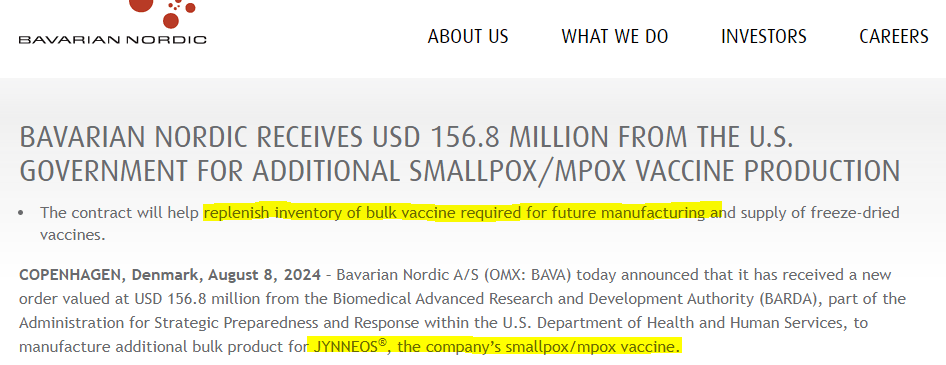

Source: Company’s press release.

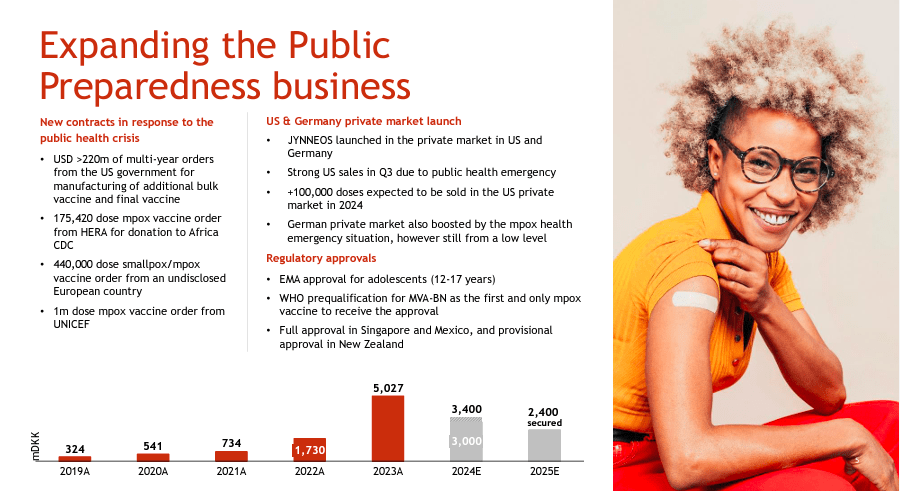

BVNKF’s 2025 revenue contracts include agreements with the US government and Germany. In fact, these governments have already placed orders totaling over 220 million to be fulfilled across several years for smallpox and mpox vaccines. Essentially, this is a prophylactic move on their part in case of any serious outbreaks. This is a lucky tailwind for BVNKF, and I think it should persist into 2025 and maybe 2026. Additionally, more than 100,000 doses will be sold in the US private market.

Likewise, Hera requested 175,420 doses of mpox vaccine for donation to the Africa CDC, and UNICEF ordered 1 million mpox vaccine doses to support developing countries. So, there’s undoubtedly a strong demand for these smallpox and mpox vaccines. It’s challenging to anticipate how long this trend will persist. This is especially true since these organizations could quickly change their healthcare priorities. Nevertheless, BVNKF has a commanding position in this vaccine niche market for now.

Source: Bavarian Nordic Q3 2024 Results Conference Call. November 15, 2024.

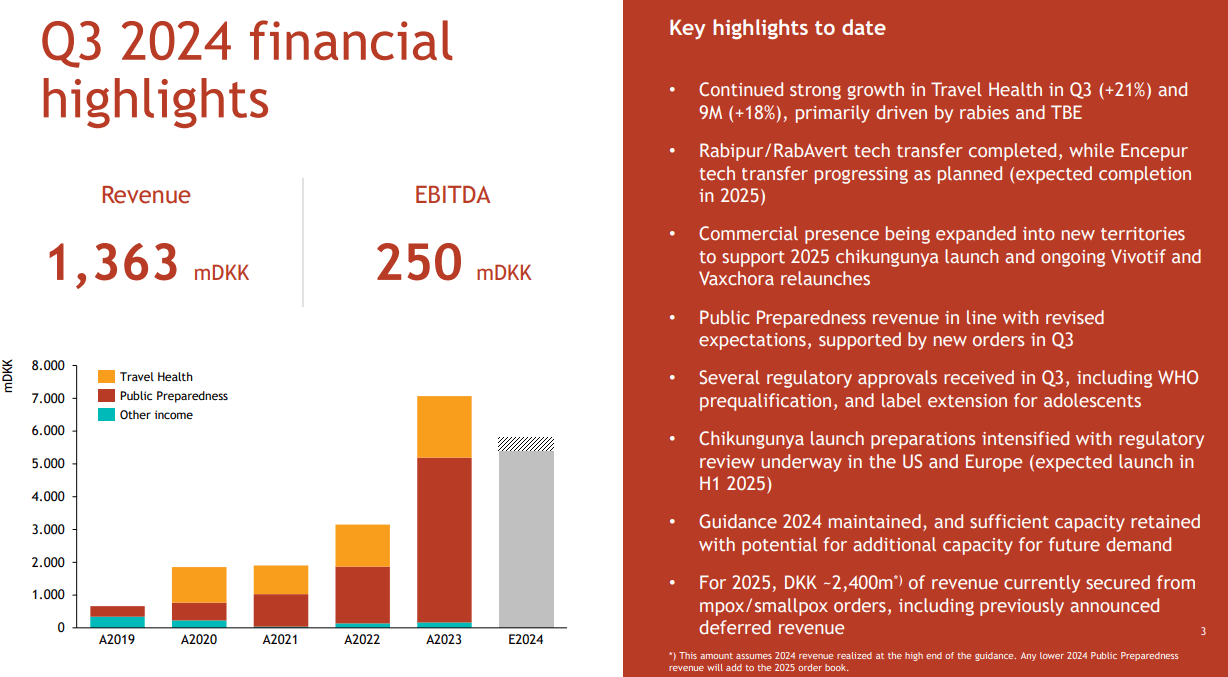

Aside from its mpox and smallpox vaccine businesses, BVNKF also reported promising growth in its Travel Health segment. This revenue vertical presented 21% growth in Q3 and 18% over the first nine months of 2024. For context, this segment includes products for TBE, rabies, cholera, and typhoid, which are immunizations required before regional trips.

Source: Seeking Alpha.

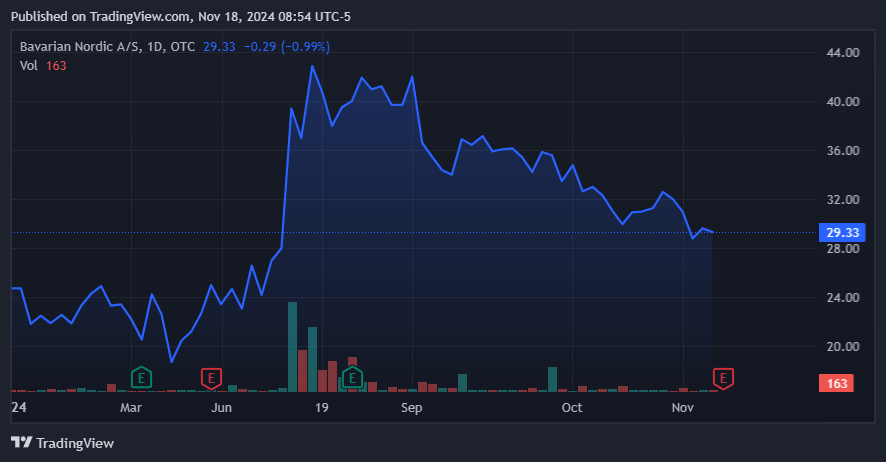

However, despite these achievements, on November 15, 2024, BVNKF stock declined alongside other vaccine manufacturers. This is likely due to concerns related to Robert F. Kennedy Jr.’s designation as the head of the US Department of Health and Human Services, which manages the FDA and CDC. RFK Jr. has been a critic of big pharma and the vaccine industry, so this might create a temporary headwind for companies like BVNKF until we get more clarity on actual healthcare regulatory policies.

Relatively Cheap: Valuation Analysis

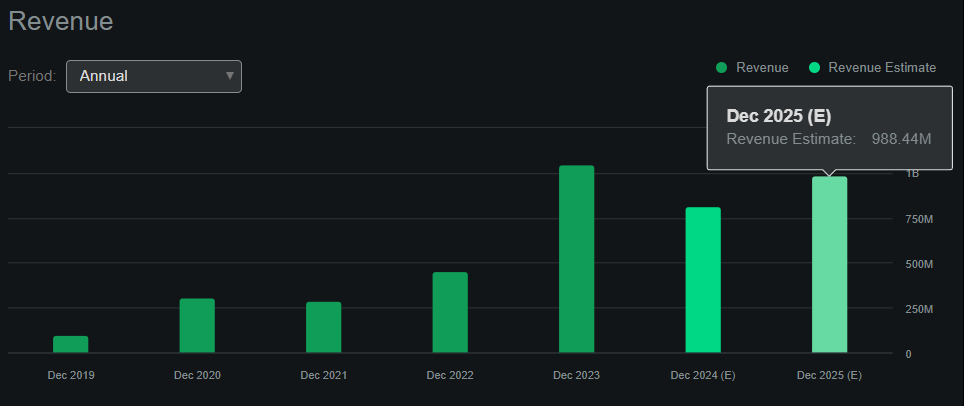

From a valuation perspective, BVNKF trades at a $1.9 billion market cap, making it already a midsized biotech in its sector. Its balance sheet holds $279.6 million in cash and short-term investments against $2.3 million in financial debt. However, it has $487.4 million in total liabilities, mostly from regular operating liabilities. Its book value stands at $1.6 billion, indicating a P/B of 1.2, which seems reasonable. For comparison, its sector’s median P/B is 2.3, so it appears to trade at a discount relative to peers. Moreover, according to Seeking Alpha’s dashboard on BVNKF, the company is projected to generate almost $1.0 billion in revenues by 2025. This would imply a forward P/S of 1.9, which is again lower than its sector’s median forward P/S of 3.7.

Source: Seeking Alpha.

I also estimate the company’s latest quarterly cash burn was $70.3 million by adding its CFOs and Net CAPEX (including intangible asset purchases). This suggests a cash runway of approximately one year, which, I think, is BVNKF’s main drawback. This is a concerningly short runway and suggests the company might have to do an equity raise in the next year or so. Thus, I think this is the company’s main headwind in the near term, which ultimately nudges me towards a more cautious rating. Still, it’s another risk layer that investors must consider because if margins deteriorate in 2025, it could actually mean its cash runway might be even shorter than my estimate. If that happened, it could override BVNKF’s whole investment thesis as it nears the end of its cash runway.

Source: Bavarian Nordic Q3 2024 Results Conference Call. November 15, 2024.

Nevertheless, the company is forecasted to increase its 2025 revenues by about $176.0 million YoY, which could reduce its cash burn significantly. After all, its latest quarterly TTM EBIT margins were 19.8%, which could imply a positive EBIT delta in 2025 of about $34.8 million. While this wouldn’t be enough to nudge it into positive cash flow territory, it could reduce its cash burn significantly and extend its runway. Nonetheless, my view is that margins are likely to improve due to the transfer completion of BVNKF’s rabies vaccine from GSK. Also, the Chikungunya vaccine should contribute positively to margins as well going forward.

Source: Bavarian Nordic Q3 2024 Results Conference Call. November 15, 2024.

So, considering those two variables and its cash runway, I see a “Buy” rating as fair for BVNKF at these levels. In my view, its valuation doesn’t seem to fully account for its promising growth prospects and positive drivers for margin improvement.

Investment Caveats: Risk Analysis

Naturally, this investment does have some key risks to consider. In particular, its Chikungunya vaccine will have FDA and EMA reviews by mid-2025. If either of these regulatory entities rejects or asks for additional data, it could deal a major blow at BVNKF’s investment thesis. This key revenue stream should prompt the market to focus on BVNKF’s narrowing cash runway if it’s eliminated or postponed meaningfully.

Similarly, potential logistical issues, particularly in Africa, could hit the company’s revenue cadence and translate into margin headwinds. Logistical issues could also endanger the company’s reputation with UNICEF or other organizations, creating some additional headline risk for investors. Lastly, it’s also true that BVNKF’s market is inherently competitive, and big pharma is actively developing and commercializing other competing vaccines. Moreover, if better vaccines are developed, it could essentially derail its revenue streams, leading to substantial downside risk. If this bearish scenario played out, I would argue the shares might face significant downside.

Source: TradingView.

Yet, overall, I still think the bull case is more compelling at this juncture. The risks mentioned above seem somewhat low-probability, so I lean towards a “Buy” rating for investors who understand the risks.

Speculative “Buy”: Conclusion

Overall, I see some pros and cons with BVNKF. I ultimately lean towards a “Buy” rating mainly because its revenues are expected to grow into 2025, and margins should also improve. These key value drivers don’t seem to be fully accounted for in its current valuation multiples. In fact, BVNKF trades at a clear discount relative to its peers. So, even if this bullish outlook is speculative, it seems offset by its valuation discount at these levels. Thus, I think taking a bullish stance on BVNKF is worth rating it a “Buy” for investors who understand its embedded biotech risks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.