Summary:

- We’re upgrading Dell Technologies to a buy.

- We think Dell has positioned itself to gain more share in the AI accelerator market with healthier AI GPU supply, new Nvidia Blackwell and potential capacity gain from SMCI’s struggle.

- We think continued hyperscaler capex spend on AI infrastructure and more demand from Tier 2 service providers should boost Server & Networking sales next year.

- We also think next year could bring a fast pace of PC recovery benefiting the company’s Client Solutions Group.

- Management is guiding conservatively and we think Dell is better positioned to outperform.

Anna Bliokh

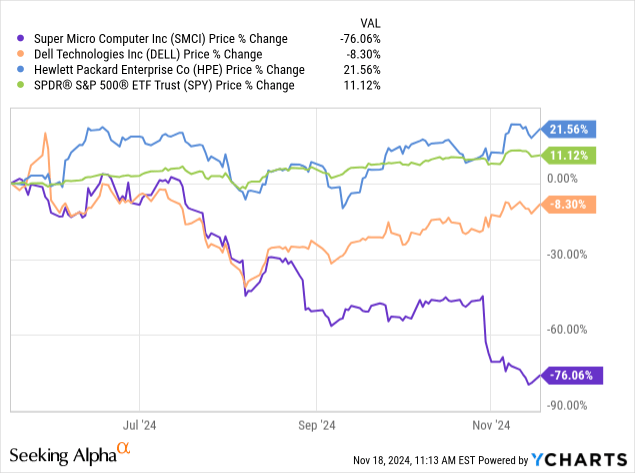

We’re upgrading Dell Technologies (NYSE:DELL) to a buy. A lot has happened since we wrote on Dell last year to reverse our previous expectation that there would be limited room for the company to compete within the AI market. Since our article in late 2023, Dell has positioned itself to commercialize AI and started showing green shoots from this in 2QFY25 feeding high AI processor appetite from “the Tier 2 service providers and clouds and large enterprises that have a case of Nvidia NvyTM real bad now.” We think Dell is even better positioned within this market now that rival Super Micro Computer (SMCI) has seen a catastrophic sell-off, down 77% in the last six months vs. S&P 500, up 11% caused by red flags around its financial reporting, auditor resignation, and Hindenburg short report. SMCI’s loss could be Dell’s gain because SMCI’s edge used to be its first-mover advantage once the AI moment ignited, but now that edge is irrelevant. Based on this and our expectation of recovery in the PC market next year, we’re upgrading Dell to a buy.

The chart below showcases Dell stock against SMCI and S&P 500 over the past six months.

YCharts

A lot is working in Dell’s favor, heading into 1H25, in our opinion, on the AI server front and the PC one.

Dell is positioned to grab a larger share of the AI server market due to two things happening at the moment. The first is hyperscalers, i.e., Meta, Microsoft, Google, and Amazon, continuing to channel their capex spend heavily toward AI infrastructure. The second is a healthier AI GPU supply from Nvidia (NVDA) playing out with the new Blackwell ramp that’ll allow more supply to flow to Tier 2 service providers and enterprise customers. Nvidia CEO Jensen gave a shout-out to Michael Dell, the company’s founder, as the person to talk to about placing orders for Nvidia’s products, including the new ones. Projections from Mizuho firm estimate that “Tier 2 CSPs [service providers] and Enterprise/Sovereign customers will account for approximately 48% of AI server expenditure by 2027,” growing at CAGR of 42% 2024-27. We think AI server orders will increase into the second half of next year and expect Dell to be a benefactor; the company is already getting creative about monetizing AI, offering new products and services to ease enterprise adoption of AI, including Dell Data Lakehouse or Dell PowerEdge XE servers.

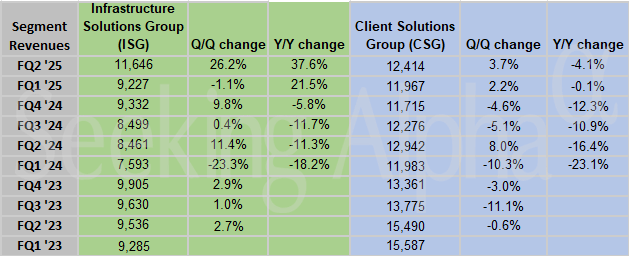

For Q2, last quarter, Dell reported Infrastructure Solutions Group sales up 38% Y/Y and 26% Q/Q to $11,646M, as shown below, largely driven by the 40% Q/Q and 80% Y/Y growth in its Server & Networking sales to $7,672M comfortably ahead of estimates for $5,960M. Management slightly raised FY25 guidance to the range of $95.5B to $98.5B, ahead of the forecast of $93.5B to $97.5B earlier this year. For Q3, Dell expects sales between $24B-$25B, which is in line with consensus at $24.6B. A positive thing about Dell is that its outlook is relatively conservative, meaning management is not guiding for hyper-growth in AI-related revenues. This protects the company from high AI growth-related projections and makes it better positioned to outperform for now.

SeekingAlpha

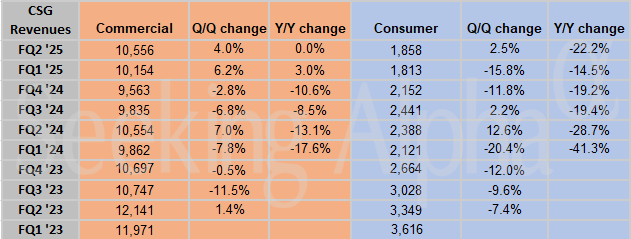

Dell’s Client Solution Group is the other part of its 2025 story, or more accurately, the 2H25 story, and it encompasses the company’s PC and laptop sales. Sales from the group declined 4% Y/Y and grew 3.7% Q/Q to $12,414M. While ISG is Dell’s fastest-growing segment, CSG still makes up most of its total revenue and supplies two groups: commercial and consumer, which grew 4% and 2.5% Q/Q, respectively, last quarter, as shown below. We think sales on the commercial front could pick up next year after a slow recovery this year, particularly supported by Microsoft Windows 10 End of Life in October 2025 and a better macro backdrop post-rate cuts that’ll incentivize more hiring and a commercial PC upgrade cycle. Dell is well positioned to benefit from this as well, being the third largest Desktop and Notebook vendor worldwide in 2QCY24, after Lenovo and HP, according to Canalys research.

SeekingAlpha

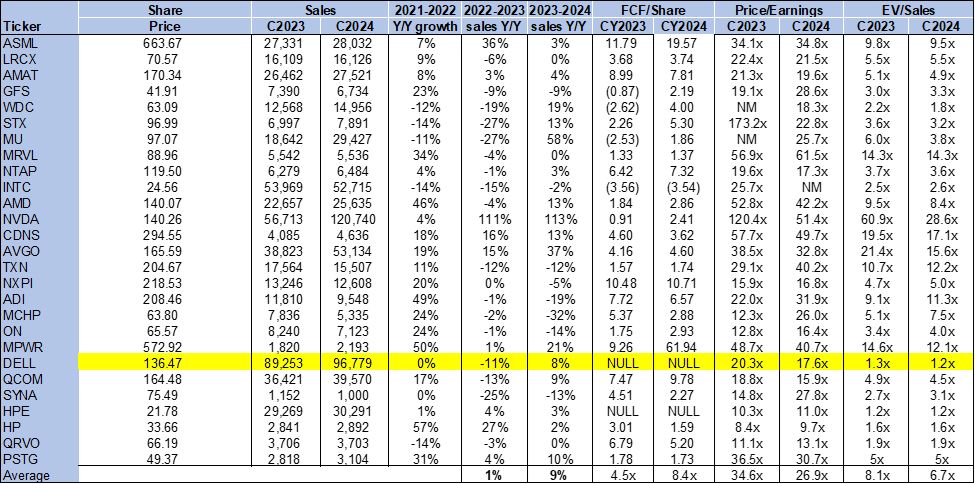

Valuation & Word on Wall Street

The stock is cheap relative to the peer group, although slightly more expensive than when we last wrote about it in October 2023. On a P/E basis, the stock is trading at 17.6x C2024, compared to the peer group average of 26.9x and a previous ratio of 10.4x. The stock trades at 1.2x EV/C2024 Sales versus a group average 6.7x. We think Dell is undervalued and attractive at current levels for its growth prospects in 2025. The following chart outlines Dell’s valuation against the peer group average.

TechStockPros

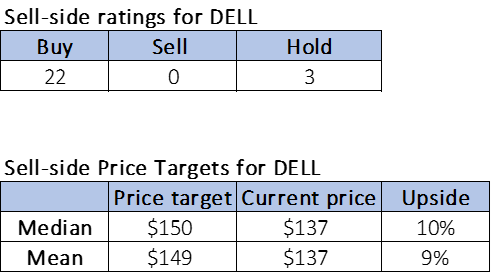

Wall Street also leans towards a buy on Dell. Of the 25 analysts covering the stock, 22 are buy-rated, and the remaining three are hold-rated. The stock is currently priced at $137 per share, with a median of $150 and a mean of $149, for a potential upside of 9-10%. The stock RSI is around the early 60s level, so ideal entry points would be when that RSI number hits the low to mid-40s or below.

The following charts outline Dell’s sell-side ratings and price targets.

TechStockPros

What to do with the stock?

We like Dell and expect it to have more upside next year on better positioning within the AI server market and a faster-paced recovery from the PC Client front. Last quarter confirmed that Dell has the exposure to boost its Server and Networking sales, and management continues to guide conservatively, creating more solid footing for outperformance. The concern around Dell and SMCI is gross margin contraction, i.e., a fear that other Taiwanese ODMs/OEMs will penetrate the market and steal share from these players with lower costs, necessitating Dell or SMCI lower pricing to compete and kiss their margins goodbye. We think this is a real risk but don’t think it’s a relevant one yet, considering that Dell still has the Tier 2 customer base to latch on to and potentially more capacity allocated to it from Nvidia away from SMCI. ISG reported EBIT margins at 11%, up 350 basis points in Q2, easing investor concern about the margin pressure. We recommend investors explore entry points into Dell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.