Summary:

- The cornerstone asset in Denison’s portfolio is the Wheeler River Project located in the eastern portion of the Athabasca Basin in Northern Saskatchewan.

- In turn, most of the value associated with the Wheeler River Project resides inside the Phoenix deposit that is expected to reach first production by 2027 or 2028.

- With cash and physical uranium on the balance sheet worth approximately CAD$348.7 million, Denison should have plenty of options available to finance construction.

- Denison Mines will be on my watchlist moving forward, and if an opportunity presents itself, I will be ready to capitalize on it.

Nuclear power plant using enriched uranium as fuel source hrui/iStock via Getty Images

Summary

The Phoenix deposit is characterized by its proximity to existing infrastructure along with its in-situ recovery method. Those two elements are reflected by the low capital required to bring the deposit into production, and by the low operating costs, which are expected to be among the lowest in the world.

I first got involved in the uranium trade back in 2015, and although prices could continue to increase, the easy money has already been made in my view. Although I fully recognize the world-class status of the Phoenix deposit, the risk/reward proposition offered by the CAD$2.6 billion market capitalization is not compelling enough for me to initiate a position, hence my hold rating.

Denison Mines – Description

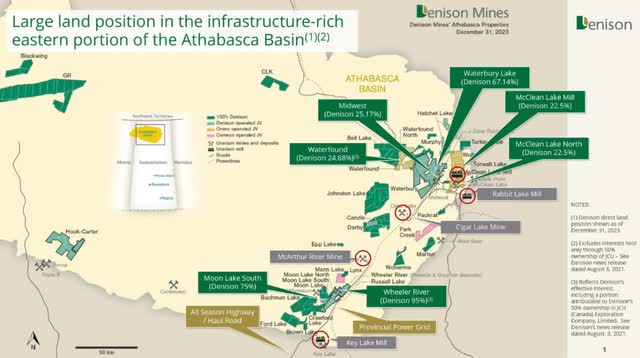

Denison (NYSE:DNN) is a uranium exploration and development company with a 95% interest in the Wheeler River Project located in the Athabasca Basin. The second largest asset in the company’s portfolio is a 22.5% interest in the McClean Lake Joint Venture, which includes various uranium deposits along with the McClean Lake uranium mill currently under contract to process the ore from the Cigar Lake Mine owned by Cameco (CCJ). In addition, Denison owns numerous undeveloped deposits as well as a large portfolio of exploration properties.

Denison Mines Portfolio (Denison Mines)

The name of the company refers to the Denison Mine that operated in the Elliot Lake region of Ontario from 1957 to 1992 during which time it produced 69 million tonnes of ore. The site has been rehabilitated, and its tailings facility is still monitored by Denison.

The Athabasca Basin is one of the most important sources of high-grade uranium and accounts for approximately 20% of the world’s uranium production. Uranium was initially discovered in the region in the 1940s and first production started in 1975 with the opening of the Rabbit Lake Mine. As of the third quarter of 2024, Rabbit Lake remains in a state of care and maintenance following the suspension of production in 2016.

The area also hosts the McArthur River Mine owned by Cameco (70%) and Orano (30%), which is also known as the largest high-grade uranium mine in the world. Following a prolonged period of low prices, the mine was placed on care and maintenance in January 2018.

Wheeler River Project

Phoenix Deposit

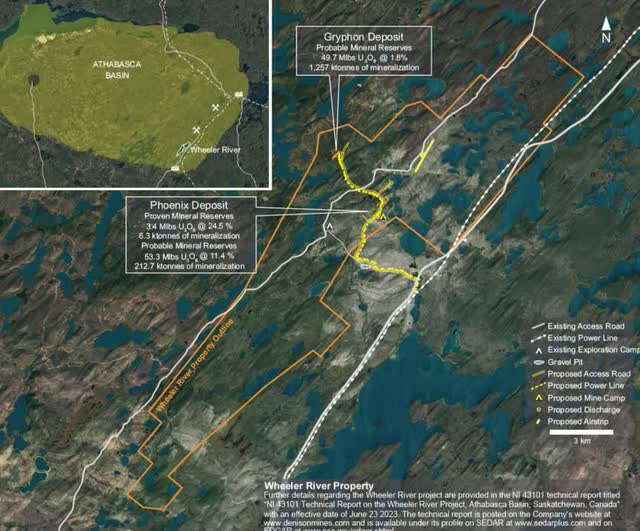

The first element that differentiates the Wheeler River Project is its location in the eastern portion of the Athabasca Basin, as this is where most of the existing infrastructure is located. In comparison, the Triple R deposit owned by Fission Uranium (FCU:CA) and the Arrow deposit owned by NexGen (NXE) are located in a more remote area of the basin where there is minimal infrastructure already in place. The advantage of being close to existing infrastructure is visible in the form of lower initial capital requirements. According to the NI 43-101 Technical Report published in June 2023, the initial capital costs to bring the Phoenix deposit into production are estimated at CAD$419.4 million, which is one of the lowest capital intensities in the industry. In comparison, the initial capital costs are estimated at CAD$1.2 billion and CAD$2.2 billion for Triple R and Arrow, respectively.

Wheeler River Property (Q3-24 Report)

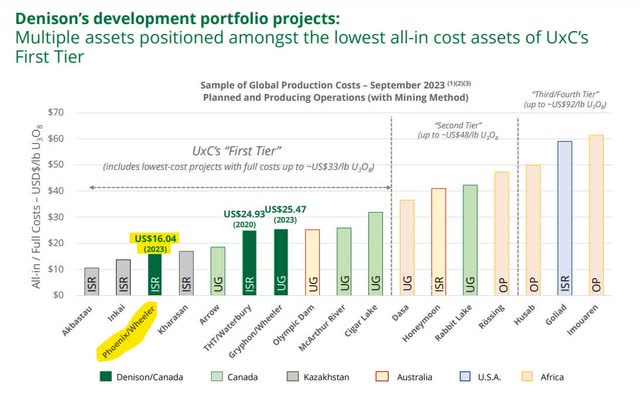

The second element differentiating the Wheeler River Project is its usage of an in-situ recovery method. The impacts become visible when looking at all-in production costs per pound estimated at ~$16.00, which are among the lowest in the world and directly comparable to those of in-situ assets located in Kazakhstan and owned by Kazatomprom (OTC:NATKY). If we look at operating costs, the Wheeler River Project remains one of the most competitive in the Athabasca Basin at $8.51 per pound versus $13.02 for Triple R and $13.86 for Arrow.

All-In Production Costs Per Pound (Denison Mines November 2024 Presentation)

If we combine the low initial capital requirements with one of the lowest all-in operating costs in the world, the economics of the project are robust in almost any uranium price environment. Using a fixed selling price of $65 per pound, the after-tax IRR is estimated at 83.9% with a payback period of only 11 months. As illustrated in the chart below, spot and long-term uranium prices are closer to $80 per pound at the moment, so that would boost the economics of the project even further.

Long-Term & Spot Uranium Prices (Cameco)

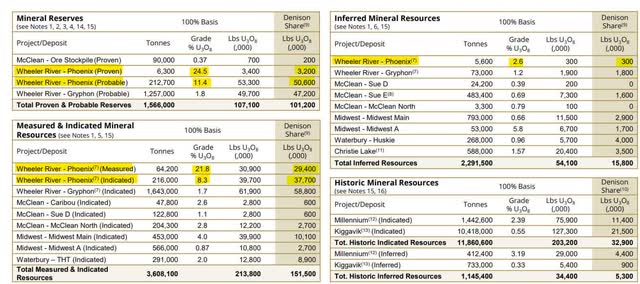

The key strengths of the Wheeler River Project are its proximity to existing infrastructure along with its in-situ recovery method. In terms of size, we are talking about 53.8 million pounds of proven and probable U3O8, which is more than enough to support the construction of a mine, although it is much smaller than Triple R and Arrow.

In my view, economic returns are more important than size alone when it comes to putting a project into production, and over time, once the asset is in production, reserves are likely to increase further. Considering that mine life is estimated at 10 years using the mineral reserves from Phoenix only, it would not make economic sense at this point to invest additional capital to simply increase the reserves. If we add the Gryphon portion of the Wheeler River Project to the equation, mine life increases to 16.5 years. To put those numbers in perspective, the Triple R and Arrow deposits are estimated to contain 93.7 million and 239.6 million pounds of proven and probable U3O8, respectively.

Denison Mines Mineral Resources (November 2024 Investor Presentation)

Gryphon Deposit

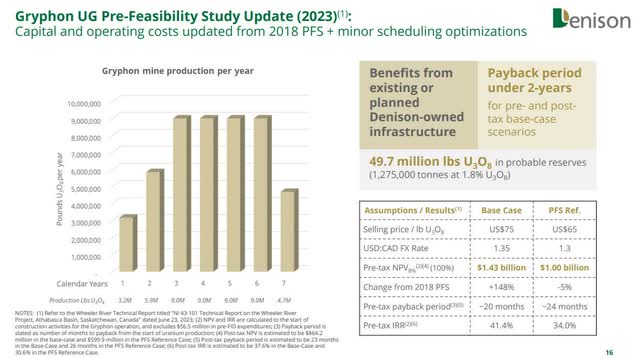

The Gryphon deposit is expected to be mined using conventional underground operations, and the pre-feasibility study assumes that the mined ore will be transported to the McClean Lake mill for processing. As mentioned previously, the mill is currently processing material from the Cigar Lake mine, but it has an additional licensed processing capacity of up to 24 million pounds of U3O8 per annum. In comparison, the mill produced 15.1 million pounds of U3O8 from Cigar Lake in 2023, so there is room to expand production by almost 60%. The proposed production scenarios from Gryphon do not exceed McClean Lake’s production capacity under various assumptions regarding Cigar Lake’s future production. Once again, the proximity to existing infrastructure is an important asset.

22.5% Denison-owned McClean Lake Mill (November 2024 Presentation)

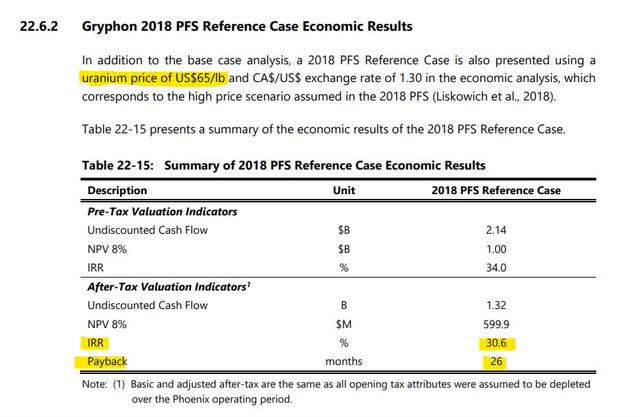

Even though Gryphon creates interesting reinvestment opportunities for the free cash flows that will come out of Phoenix, the project’s economics put it in a lower tier when it comes to economic returns. Using the same assumption of $65 per pound of U3O8, the after-tax IRR is estimated at 30.6% along with a payback period of 26 months.

Gryphon Deposit Economic Summary (November 2024 Presentation)

Using a price assumption of $75 per pound, which is closer to today’s market prices, Gryphon is expected to deliver an after-tax IRR of 37.6% and a payback period of 22 months. The expected returns on invested capital are certainly compelling, although they are not as impressive as those provided by the Phoenix deposit.

The Gryphon deposit adds 49.7 million pounds of proven U3O8 to the Wheeler River Project, which represents an increase of 92.4% versus reserves at Phoenix alone, and with additional ore, the mine life of the project increases to 16.5 years.

Gryphon Pre-Feasibility Update (November 2024 Presentation)

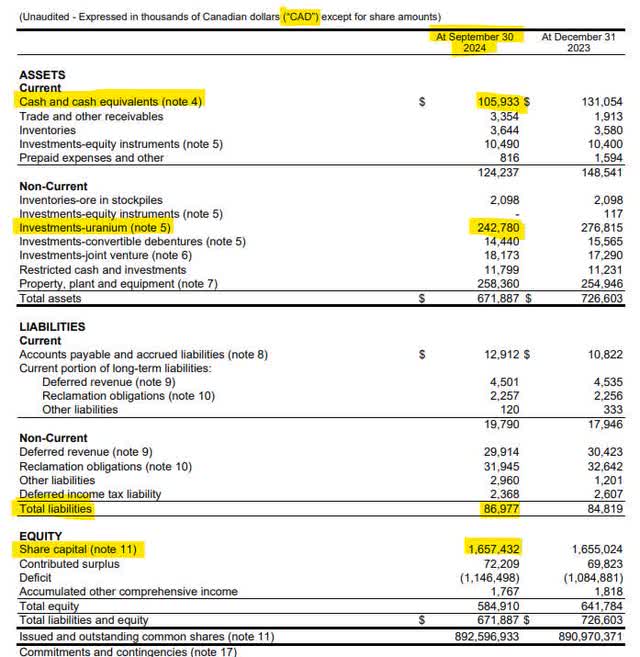

Balance Sheet

With cash and cash equivalents of CAD$105.9 million and investments in physical uranium worth CAD$242.8 million at the end of September 2024, Denison is in a unique position to move the Wheeler River Project into production. Once combined, the cash and the physical uranium are worth approximately CAD$348.7 million, which represents almost 85% of the initial capital requirements of CAD$419.4 million to bring the Phoenix deposit into production.

According to the June 2023 Technical Report, Phoenix is expected to deliver CAD$432.8 million in after-tax cash flows during its first year of full production, so Denison will have plenty of financial resources to advance Gryphon and other exploration projects at this point. From a financial resource perspective, Denison is in a unique position compared to other advanced developers like Fission Uranium or NexGen Energy.

Denison Mines Balance Sheet (Q3-24 Report)

In addition, McClean North is expected to produce around 800,000 pounds of uranium in 2025 on a 100% basis. If we include the Caribou deposit, production could increase up to 3.0 million pounds between 2026 and 2030. Once again, the ownership and the excess capacity of the McClean Mill are key, and mining the small deposits around it is a great way to generate some cash to support the development of Phoenix.

Using a net production to Denison of 180,000 pounds coming from McClean North in 2025, we are talking about CAD$20.2 million in revenue under the assumptions of a $80.00 uranium price at a USD/CAD exchange rate of 1.40.

McClean Lake Mine Restart (November 2024 Presentation)

Valuation

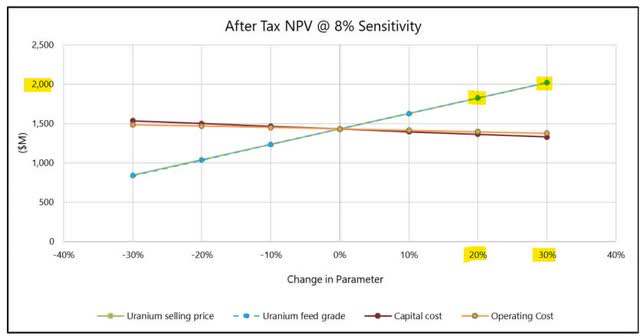

Based on a share price of CAD$2.93, Denison is currently trading at a market capitalization of CAD$2.6 billion. Using a fixed uranium price of $65 per pound, the Phoenix deposit alone has an NPV (8%) estimated at CAD$1.4 billion. According to the sensitivity chart provided in the feasibility study, the NPV (8%) increases to almost $2.0 billion using uranium prices of around $80 per pound, which is more reflective of current market prices. Of note, those numbers are on a 100% ownership basis despite Denison owning 95% of the property.

Phoenix Sensitivity of After-Tax NPV Discounted at 8% (June 2023 Technical Report)

If we subtract the CAD$348.7 million in cash and physical uranium on the balance sheet, Denison is currently trading at 1.2x the net asset value of Phoenix alone using an 8% discount rate and $80 uranium prices.

If we look at it from an undiscounted basis, Phoenix is expected to generate CAD$2.1 billion in after-tax cash flows at a fixed uranium price of $65 over its initial mine life of 10 years, which is slightly below the current market capitalization after having subtracted the cash, the uranium investments, and the 5% interest that Denison does not own.

Of course, there is value associated with the Gryphon deposit, the 22.5% ownership of the McClean mill and the portfolio of development and exploration projects. However, Gryphon is not expected to come into production before the early 2030s, and the development and exploration portfolio is unlikely to move the needle of a $2.6 billion market capitalization, although they add to the upside potential by acting like call options.

Conclusion

The cornerstone asset in Denison’s portfolio is the Wheeler River Project located in the eastern portion of the Athabasca Basin in Northern Saskatchewan. In turn, most of the value associated with the Wheeler River Project resides inside the Phoenix deposit that is expected to reach first production by 2027 or 2028.

The economics of the Phoenix deposit are impressive, especially at today’s uranium prices close to $80. Given the close proximity to existing infrastructure, the initial capital requirements are low at only CAD$419.4 million. In addition, the in-situ recovery method supports low all-in-production costs per pound of ~$16.00. With cash and physical uranium on the balance sheet worth approximately CAD$348.7 million, Denison should have plenty of options available to finance construction.

I first got involved in the uranium industry back in 2015. I remember pitching Cameco during an interview for an analyst position at the Caisse de dépôt et placement du Québec in the fall of 2016. The portfolio manager looked at me and asked how I could pitch such a company, as it was not covering its cost of capital at the time. I told him that uranium prices in the low $20s were not sustainable in the long term, and although I was right from a fundamental perspective, I was completely off on timing. Cameco is up by approximately 500% since, so that would have been an annualized return of about 25% over this 8-year period.

In my view, the easy money has been made in the uranium industry, and Denison’s market capitalization of slightly above CAD$2.6 billion is reflective of that. Of course, uranium prices could continue to rally and cross the important threshold of $100 per pound, but I cannot base my investment thesis on that upside potential alone. In other words, the risk/reward proposition is not compelling enough for me at this point with Denison, although I fully recognize the impressive economics of the Phoenix deposit.

Denison Mines will be on my watchlist moving forward, and if an opportunity presents itself, I will be ready to capitalize on it.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article should be seen as part of a personal notebook documenting a personal journey. Please consider that I have been consistently wrong in the past. I am not in a position to give advice to anyone.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.