Summary:

- Fiverr Q3-2024 results got a warm reception from Wall Street, pushing the stock higher and back to positive territory on a YTD basis.

- The gross merchandise value (GMV) declined for the first time and is expected to continue and decline versus previous guidance for a 1–2% growth on a YoY basis.

- While many investors are cheering for the best-in-class take rate, simple math reveals that the wrong drivers have been fueling this growth, making it less relevant.

- A discounted cash flow analysis implies that investors are buying into the management narrative, pricing in ambitious expectations.

- Considering alternative valuation scenarios and the downward trend of the GMV, I maintain my ‘Sell’ rating for FVRR stock.

izusek/E+ via Getty Images

Fiverr International Ltd. (NYSE:FVRR), the online platform for freelancers, announced its Q3-2024 financial results at the end of October, beating top-line and bottom-line estimates and raising its full-year guidance. The stock reacted positively to this perfect combo, jumping 16% on higher-than-average volume in the subsequent trading session.

In this article, we will start with a quick recap of Fiverr’s latest financial results while also examining the buyback program’s effect on the share price. After that, we will dig into Fiverr’s most important KPI, at least in my opinion, which is Gross Merchandise Value (‘GMV’), and explain why its current downward trend is worrisome and why, at the same time, the Take Rate might have become irrelevant. Lastly, we will evaluate Fiverr using a discounted cash flow model and see whether Fiverr’s new approach towards value creation presents a deep-value opportunity that deserves a second look.

Q3 Recap: The Value Thesis In The Spotlight

In its quarterly letter to its shareholders, Fiverr emphasized the importance of rewarding shareholders through value creation while maintaining growth, a strategic decision the company has adhered to over the last 24 months:

We continue to generate strong cash flow and execute a disciplined capital allocation strategy that allows us to pursue growth while delivering shareholder value

(Fiverr’s letter to shareholders, Q3-2024)

Fiverr’s results come against a backdrop of challenging SMBs sentiment, yet the company generated $99.6 million in revenues during the quarter, an increase of 8% on a year-over-year (‘YoY’) basis, the first back-to-back incremental growth since Q3-2023. The company did print a lower gross margin of just 81%, its lowest since Q4-2022, but its financial income stream still made the difference in the bottom line; this quarter, financial income totaled $6.9 million, an increase of 21% YoY, and net profit was $1.3 million. Despite the full utilization of its stock buyback program and the recent acquisition of dropshipping tools provider AutoDS, Fiverr still boasts a massive portfolio totaling $379.8 million, invested both in short and long-term marketable securities (mostly corporate bonds), providing the company with a steady flow of passive income. As I noted many times in the past, Fiverr’s bottom line without this financial income boost would be negative. To be more precise, Fiverr would never have generated a net profit without this windfall. As we enter an interest rate cut cycle, it’s fair to estimate that this earnings sweetener will gradually fade, especially when ~60% of the portfolio is invested in short-term securities.

Source: Author’s Process of Fiverr’s Shareholders Letters

Since prioritizing profits back in 2022, setting a 25% long-term Adjusted EBITDA margin target, Fiverr has been on a steady path, improving both its margins and absolute profits. At its low point in Q2-2022, Fiverr lost almost $42 million in one quarter (asset impairment was to blame, too). Fast-forward to Q3-2024, Fiverr generated a net profit in six consecutive quarters, including a net profit of $1.3 million in the last quarter. From an Adjusted EBITDA perspective, Fiverr generated $19.6 million in Q3-2024, its highest ever, and sported an Adjusted EBITDA margin of 19.7%, a far cry from the single-digit margin a few years ago, and on the right track to achieving the 25% target.

Source: Author’s Process of Fiverr’s Shareholders Letters

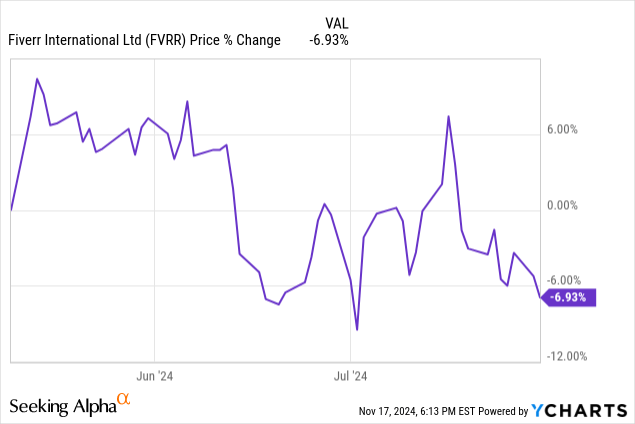

Moreover, Q3 marked the completion of the stock buyback program. As a reminder, back in April, Fiverr announced a $100 million buyback program. During its Q1-2024 earnings call, which occurred on May 9th, Fiverr’s CFO implied that the company hadn’t started yet to buy back its stock, but in its Q2-2024 earnings call, which occurred on July 31st, the CEO stated that Fiverr had completed the buyback. This provides us with a specific timeframe to gauge the buyback effect on the stock’s price, and as you can see below, the results aren’t very encouraging; Fiverr stock slid almost 7% throughout this period.

Fiverr did retire 4.1 million shares or approximately 11% of its outstanding shares, but the immediate boost that was expected did not come to fruition.

The GMV Is Contracting For the First Time

For those of you who need a quick reminder, Fiverr operates an online marketplace for freelance services. Freelancers, known as ‘sellers’, offer their services, or ‘gigs’, to buyers. The value of each transaction on the platform is recorded as part of the Gross Merchandise Value (‘GMV’). Another way to look at the GMV is to multiply the Active Buyers by the Spend Per Buyer (‘SPB’). For example, over the trailing twelve months, there were 3.8 million Active Buyers, and the SPB was $296, resulting in a GMV of $1.12 billion. Fluctuations and trends of the GMV can teach us a lot about the health of Fiverr’s core marketplace, which is projected to contribute more than 70% of the company’s FY-2024 revenues (the rest is coming from related services, a rapidly growing revenue stream).

In my previous articles on Fiverr, I highlighted more than once my concerns over Fiverr’s stagnating GMV, growing around 1–2% on a YoY basis since early 2023. Similar growth guidance was provided by the management team at the beginning of 2024, but since then, one of the underlying drivers has deteriorated rapidly: Active Buyers. In Q3-2024, Active Buyers decreased by 9.4%, the largest decline ever recorded in this KPI. On the other hand, the SPB grew by 9.2%, which was not enough to offset the Active Buyers decline and resulted in a GMV decline of 1%. This is the first time the GMV is contracting since Fiverr went public, and it is a worrisome development for an already questionable growth story. To give you more color, during the heydays of 2020–2021, when Fiverr’s business surged on the back of COVID-19 digital transformation, the GMV grew at an astonishing annualized rate of ~60%. Although during the last 18 months, growth rates have significantly come down to around 1–2%, this new development of a contracting GMV is a red flag investors should monitor closely and may signal a further deterioration in Fiverr’s core marketplace.

Source: Author’s Process of Fiverr’s Shareholders Letters

We must note that Fiverr’s management has been crystal clear about its focus on higher-value buyers with larger budgets, which benefit SPB more than Active Buyers. It’s a message that CEO Kaufman and other executives have repeated many times in the past and once again in the quarterly letter to shareholders:

We remain laser-focused on building a higher quality buyer base with higher spend and better retention that translates into higher lifetime value

(Fiverr’s letter to shareholders, Q3-2024)

The rationale behind this focus stems from the pressure AI is asserting on ‘simple categories’ such as translation and voice-over services, usually associated with lower prices and shorter-term engagement. This inevitably led Fiverr to focus on what it defines as ‘complex services’ that usually command higher prices and longer-term engagement and have a stronger moat against AI disruption. So far, and especially after the GMV’s recent decline, it seems like Fiverr’s new strategy is yet to prove itself. Hearing the company’s CFO during the earnings call, the current GMV downtrend is expected to continue, making the new strategy even more questionable:

We expect GMV will still take some time to recover… we expect spend per buyer to continue growing at a robust pace, offset by the decline in active buyers.

(CFO Ofer Katz, Fiverr’s Q3-2024 earnings call)

The Take Rate Might Have Become Irrelevant

As part of its Q3-2024 earnings report, Fiverr raised its FY-2024 guidance. Investors took it at face value and cheered for the higher numbers, at least for those who were presented in the letter to shareholders:

Source: Fiverr’s Q3-2024 Shareholders Letter

However, a deeper analysis of the guidance, incorporating comments from the earnings call and simple math, shows that things are not as bright as might have seemed at first glance:

| 2024 New Outlook | 2023 Actual | YoY Growth | |

| GMV | $1.105–1.111 billion | $1.13 billion | (2.5%)–(2.0%) |

| Revenue | $388.0–390.0 million | $361.4 million | 7.4–7.9% |

| Adjusted EBITDA | $73.0–75.0 million | $59.2 million | 13.1–23.3% |

| Adjusted EBITDA Margin | 18.8–19.2% | 16.4% | 243–284 bps |

| Take Rate | 35.1% | 31.8% | 330 bps |

During the earnings call, CFO Katz mentioned that the management team expects the Take Rate to grow by approximately 330 bps on a YoY basis, higher than previously anticipated. A 330 bps growth implies a Take Rate of 35.1% by year-end versus 31.8% in 2023.

Our strategy to lean into value-added services to drive take rate expansion continues to pay off, and we continue to invest in going upmarket to unlock long-term growth opportunities…

We continue to drive strong take rate expansion as seller monetization programs benefited from the investments made in the last few months, and AutoDS delivered strong subscriber growth that exceeded our expectations.

(Fiverr’s letter to shareholders, Q3-2024)

Sounds good, right? Not so fast. As you probably remember, Fiverr Take Rate is just the outcome of dividing total revenues by the GMV. If total revenues increase, Take Rate goes up. If GMV decreases, Take Rate also goes up. Based on Fiverr guidance, a 330 bps Take Rate growth implies a Take Rate of 35.1% in 2024. Using the midpoint revenue guidance of $389.0 million, the result is a GMV of ~$1.11 billion, a decline of 2.2% in the GMV on a YoY basis.

Put simply, what Fiverr positively frames as a “Take Rate growth” is not just a result of revenue growth but also of a GMV decline. Now, one may ask – what’s so bad as long as revenues grow? Well, Fiverr’s management team gave us the answer during the earnings call:

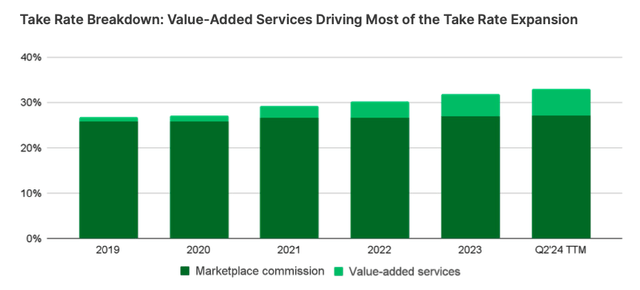

As a reminder, Fiverr’s take rate consists of two distinctive components: first, is marketplace commission of approximately 26% and second is value-added services of an additional approximate 8% take rate. The marketplace commission is directly tied with GMV on the marketplace and has been relatively stable over the years. The expansion of value-added products has driven the vast majority of our take rate expansion.

(CFO Ofer Katz, Fiverr’s Q3-2024 earnings call)

As you can see, the main driver behind the Take Rate growth, through the revenue side of the equation, is the value-added products (which I refer to as ‘related services’). These products are primarily seller monetization programs such as Promoted Gigs, Seller Plus, and AutoDS revenues, Fiverr’s latest acquisition. Such revenues were considered ‘nice to have’ only a few years ago, but now are distorting the meaning of the company’s Take Rate, which in its essence means to present how much Fiverr charges on average from each transaction on its platform.

Source: Fiverr’s Q2-2024 Shareholders Letter

Because the Take Rate is essentially a weighted average, with fewer marketplace transactions contributing at the lower 25.5% rate, the high-contribution related services (assuming a 100% rate) would make up a larger portion of total revenues. The result is sort of an inflated Take Rate, obscuring the fact that the core marketplace activity is weakening.

The Value Thesis Through the Lens of the DCF Model: Are The Bulls Right?

In one of my previous articles on Fiverr, I assigned a weighted average price target of $19 for the stock. Now that Fiverr’s management team has set some concrete financial goals and timelines for the next couple of years, with a major emphasis on value creation through hard rock cash flows, I believe it’s a good opportunity to revisit Fiverr’s prospects from a value-oriented perspective. To that end, I decided to use again the discounted cash flow model to evaluate the intrinsic value of Fiverr. Because the management team has provided investors with cash flow projections back in Q2-2024, that task shouldn’t be very hard and may provide another point of view on the stock.

For those who need a little bit more context, Fiverr’s management team set a few months ago specific financial goals throughout 2027; the long-term 25% adjusted EBITDA margin target was set in 2022, but until recently, there was no timeline for achieving that target. Now, there is one: 2027, and it comes with a free cash flow CAGR of 14% and a cumulative free cash flow of more than $300 million.

Source: Fiverr’s Q2-2024 Shareholders Letter

The weighted average cost of capital (or ‘WACC’) I will use in every scenario will be 12%, and the perpetuity growth rate will be 2%. I also annualized Q1-Q3/2024 results and assumed the CAPEX requirements are going to stay the same every year, at ~$1.3 million. As my followers already know, as an analyst who adheres to the stochastic approach, I will provide different scenarios and assign probabilities to each one.

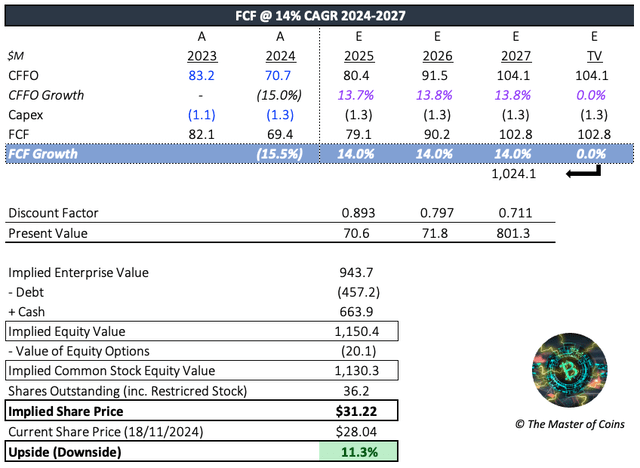

Scenario #1: Free Cash Flow CAGR of 14% Through 2024–2027

In this scenario, I take the management team projections at face value, expecting the company to sport a free cash flow CAGR of 14% throughout 2027. As you can see below, in this scenario, the implied upside is ~11% from the current price, meaning that investors are giving only a slight discount to the management narrative and pricing the stock accordingly.

Author Discounted Cash Flow Model

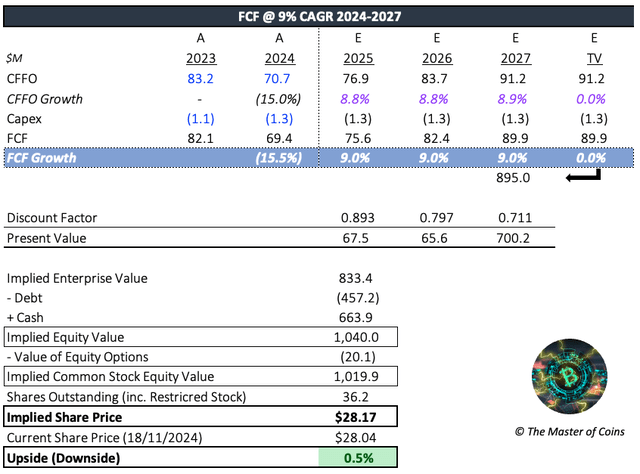

Scenario #2: Free Cash Flow CAGR of 9% Through 2024–2027

In this scenario, I use a more moderate CAGR of just 9%, which can still be considered a healthy growth rate for free cash flows. In this case, the stock seems to trade at a fair value, meaning that although investors are discounting the company’s projections, they are still assigning a significant free cash flow growth.

Author Discounted Cash Flow Model

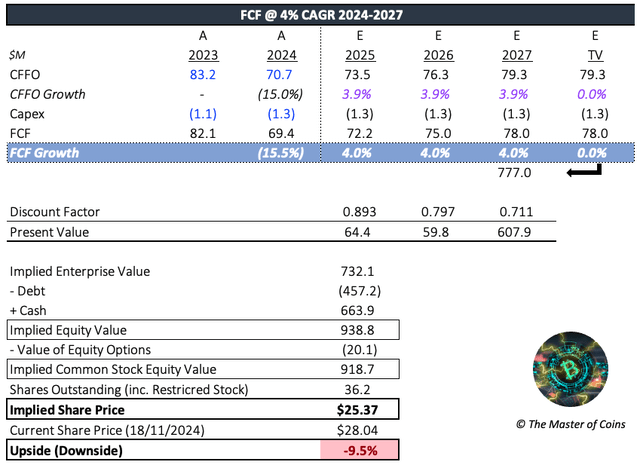

Scenario #3: Free Cash Flow CAGR of 4% Through 2024–2027

In this scenario, I use a much more moderate CAGR of just 4%, a pretty stagnant free cash flow growth. In this case, there is an implied downside of ~10% from the current price level.

Author Discounted Cash Flow Model

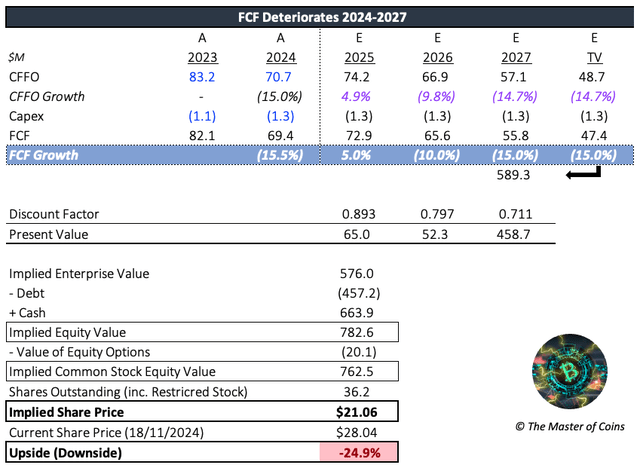

Scenario #4: Free Cash Deteriorates Permanently

In this scenario, I assume that free cash flow will perpetually deteriorate following a muted growth in 2024. In this case, there is an implied downside of ~25%. Although such a scenario may look implausible right now, if the core marketplace suffers from a continuing decline, the related services revenues may hit the brakes as well (as freelancers will be less inclined to buy these services), resulting in a double whammy for the entire ecosystem of Fiverr.

Author Discounted Cash Flow Model

As can be learned from these valuation models, although the market is giving a slight discount to Fiverr’s targets, it’s still pricing in significant free cash flow growth, leaving little room for errors. Any deviation, and it’s fair to assume that the stock will be punished hard. I would assign the following probabilities for each scenario to generate the weighted average price target for the stock:

| FCF CAGR 2024–2027 | 14% | 9% | 4% | Deterioration |

| Price Target | $31.22 | $28.17 | $25.37 | $21.06 |

| Probability | 5% | 10% | 50% | 35% |

Based on these probabilities, the weighted average price target for Fiverr’s stock is $24.44, implying a downside of ~13%, further supporting my ‘Sell’ rating for the stock.

The Verdict

Fiverr’s latest results got a warm reception from Wall Street. The management’s new strategy towards value creation, with concrete timelines and the crème de la crème of value investors—strong free cash flow projections—may provide a major tailwind for the bulls after a few years of stagnation.

The bears, on the other hand, may point out the GMV contraction and the fact that the Take Rate might have become no longer relevant because its growth has been fueled lately by the ‘wrong’ drivers: (1) related services revenue growth and; (2) GMV contraction. Both don’t indicate a healthy marketplace, which is still the core business and source of revenue for Fiverr.

Evaluating Fiverr’s stock using a DCF model, the market appears to believe the management team is capable of executing very close to its plan, pricing in significant free cash flow growth. This leaves little room for error.

As of now, I go with the bears and maintain my ‘Sell’ rating for the stock. I believe the GMV decline is a major red flag to consider, putting more question marks regarding the success of the company’s focus on buyers with larger budgets, benefiting SPB more than Active Buyers. With macro still negative and AI on the back hills of ‘simple services’, the C-Suite will have to do much more to reignite the once-dubbed ‘Amazon of freelancers’

Note:

I have covered Fiverr International Ltd. or ‘Fiverr’ previously, so investors should view this as an update to my earlier articles on the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.