Summary:

- GameStop’s May stock surge was yet again driven by frenzy, but the company’s topline remains weak, with accelerating revenue declines.

- Management capitalized on inflated stock prices, boosting cash reserves, which now constitute a major part of its valuation, yet the issuance diluted shareholders.

- The collectibles segment and profitability improvements show potential.

- Despite optimistic valuation adjustments, GameStop’s per share value still lies significantly below market price, making it a speculative play rather than a sound investment.

NoDerog/iStock Unreleased via Getty Images

Comical Timing Of Recent Coverage

The timing of my first GameStop Corp. (NYSE:GME) coverage in April 2024 could not have been more comical. Because already in the week following the publication, the fundamentally baseless craziness returned to the stock after a more than three-year hiatus since 2021, again leading to massive price surges and repeated short squeezes. In this regard, I still consider the conclusion reached in April to be entirely accurate and would underscore it once again today. My conclusion was that I would steer clear of the GME stock in every sense, both long and short, as market efficiency appears to have suffered significant damage with this stock.

Opportunistic Moves During Market Frenzy

Nevertheless, the GME management cannot really be blamed in this matter – on the contrary, they took advantage of the situation and issued new shares at these wildly inflated prices. As a result, GME now has an astonishing cash balance of over $4.2 billion, or $3.7 billion in net cash, which, based on my very optimistic valuation I will outline later, still accounts for three-quarters of its fundamental equity value. Or, even in relation to the market cap, explains over 30% of it.

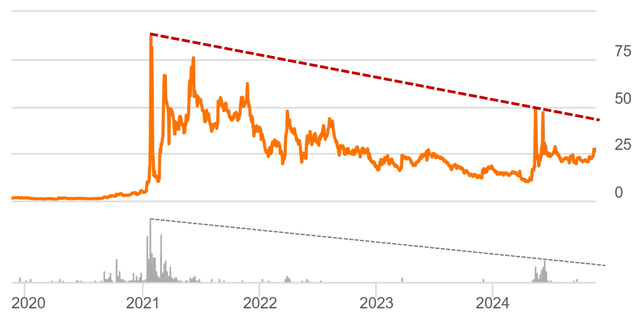

It is also interesting that, despite the resurgence of excesses, the flame no longer seems to carry the same power. See below for a graphical representation – also displayed logarithmically – showing how the new highs still follow a downward trend. The same applies to the trading volumes. This is just a very rough visual observation. Technical chart analysis is by no means my area of expertise, but this nevertheless appears to reflect diminishing hype, even over the long term.

GME stock price & trading volume (Seeking Alpha) GME stock price & trading volume logarithmically (dividendstocks.cash)

Update On The Market Environment

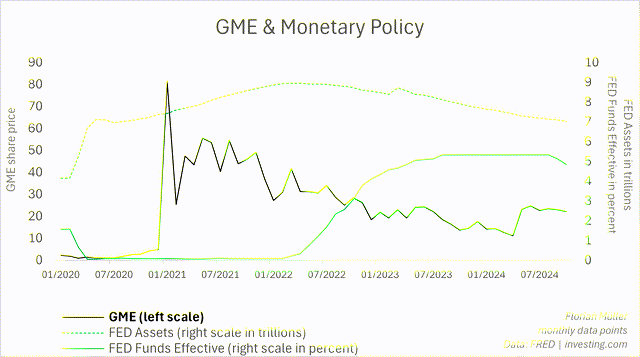

Last time, I also shed light on the monetary context that likely facilitated the frenzy in 2021. One of the primary sources of “free money” enabling investors to engage in such behavior was monetary policy, with Fed assets having doubled, and interest rates slashed in response to the pandemic. Since the latest article, Fed assets have significantly decreased to $7 trillion, which has a restrictive effect – down from a peak of nearly $9 trillion but still well above pre-pandemic levels of just over $4 trillion.

And despite the first rate cuts since the last article, with the Fed Funds effective rate at almost 5%, we are still worlds apart from the near-zero rates that likely made the earlier excesses possible. Long story short, money is no longer free, which dampens such occurrences. That has not changed since April.

Author | Data: FRED, investing.com

GameStop Finally Has A Valid Plan B

“On the other hand, I believe that physical collectibles, as a counterpart to digitalization, might remain in demand among gaming and franchise fans,” I stated in my last article, suggesting that this might be a straw GameStop could cling to for its future direction. This assumption seems to be gaining traction. For instance, GameStop’s reported focus on trading cards prompted SA author Steven Fiorillo to raise his bearish stance to neutral – a move I can even understand.

I also see this as a promising strategy. However, from my perspective, it only justifies moving from a “Strong Sell” to a “Sell”, as my optimistic valuation (detailed later) still comes in significantly below the stock’s market price.

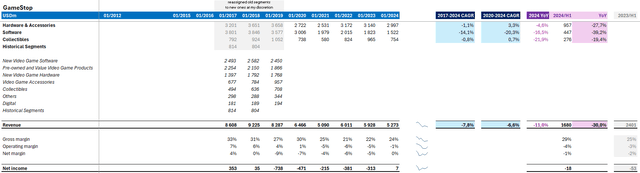

That said, the collectibles segment shrank by 19% year-over-year in the first half of the year. Nevertheless, it has outperformed the core gaming business, which contracted by nearly 30% to 40% over the same period. Additionally, the year-over-year revenue comparison in the collectibles segment might be negatively skewed by the now-discontinued digital asset wallet and NFT business, which was still included in this segment last year.

See below my updated financials overview, showing that the company’s YoY performance for the first half of the year stands at an accelerated -30% for the top line, compared to -11% YoY for FY 2023 (having ended in 01/2024) and a longer-term negative CAGR of -7% to -8%. However, due to efforts to improve profitability, the losses for the first half of the year were significantly reduced from -2% net to -1% net, or from -$53 million to -$18 million. This improvement was driven, among other factors, by a gross margin increase from 25% during last year’s first half to 29% this year, close to historically strong levels. Therefore, considering that the Christmas season is still ahead, I could envision a net profit for the full year 2024 (ending in 01/2025).

Author | Data: dividendstocks.cash, GME filings

Valuation Still Unjustified – GameStop Must Pull The Unknown Out Of Its Hat

So, things are apparently heading in the right direction, but is this enough to justify the company’s market cap?

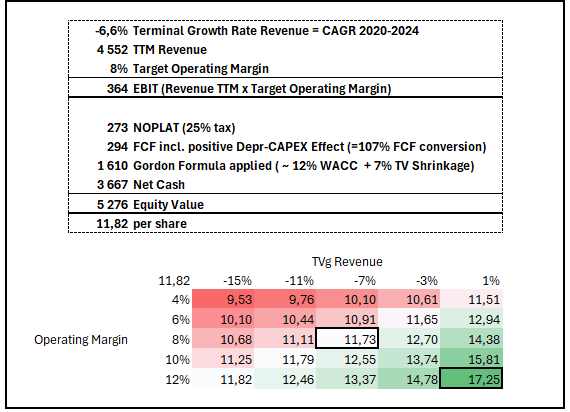

Despite the ever-accelerating revenue declines, I am willing to show some optimism and, unlike last time, apply a lower terminal revenue decline rate, namely the 2020-2024 CAGR of -6.6%, as opposed to the -7.8% CAGR from 2017-2024 used previously. Additionally, more optimistically than before, I applied a higher target operating margin of 8%, which matches the highest operating margin in the company’s history back in 2008. Remember that operating margins are just about to break even on an annual basis, so my assumptions are quite progressive. I apply this to the company’s TTM revenues to arrive at a $364 million target EBIT, adjusted down by taxes and up due to the positive liquidity effect from lower CAPEX in a shrinking business, as outlined in my last article.

The target free cash flow of $294 million is the basis for the Gordon Growth formula to calculate the enterprise value. I use a 12% WACC, up from 11% last time because the cost of equity now weighs much heavier as the market cap has increased and debt was reduced. This increase is despite the fact that I have applied a lower beta of 1.59 for the cost of equity this time, through the blame adjustment that played out positively in this case.

Therefore, my enterprise value is $1.6 billion, and due to the high net cash of $3.7 billion, I arrive at an optimistic equity value of $5.3 billion. This is significantly higher than my last estimate of $1.9 billion, thanks to more optimistic assumptions, but especially due to the cash from the capital raise. However, this has, as is well known, led to a significantly higher share count. On a per-share basis, I now land at a value of just under $12 for GME, still more than 50% below the market price.

Author | Data: dividendstocks.cash, Seeking Alpha

Even assuming 1% growth rather than shrinking revenue and a 12% operating margin does not bring me much above $17, as the sensitivity table shows.

Avoiding This Still Speculative Play

In conclusion, GameStop’s path remains unappealing, with rapidly shrinking revenues, but some positive signals are emerging from its efforts to improve profitability. The collectibles segment also offers a potential growth avenue in itself. The company’s significant cash reserves, driven by opportunistic share issuances during inflated market conditions, play a pivotal role in its valuation, though they are partially offset by dilution. The overall market environment seems to be stifling the dying flame of excessive behaviors over the long term. Despite some more optimistic assumptions, my valuation indicates a per-share price significantly below the current market price, with no upside even under more favorable conditions.

However, the company’s cash on hand presents an upside risk, as it allows it to potentially “pull something new out of the hat” with the substantial funds cleverly raised from the speculators.

But betting on that is again speculating, not investing.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.