Summary:

- MARA Holdings is diversifying beyond BTC mining, exploring data center cohosting, infrastructure integrations, and heat generation partnerships to offset declining BTC profitability.

- MARA’s HODL strategy involves holding BTC for value appreciation while mining and selling Kaspa to cover operational costs, despite increased mining costs post-BTC halving event.

- The firm faces challenges as a late entrant in the data center cooling market and may struggle to gain significant market share with its dual immersion technology.

- I rate MARA as a SELL with a price target of $10.62/share due to added risks from the HODL strategy and potential difficulties in new ventures.

Eoneren

MARA Holdings (NASDAQ:MARA) is positioning itself beyond their single-revenue stream of mining and selling BTC. The firm is actively seeking additional avenues as BTC becomes less profitable as a result of the April halving event and the higher global hashrate, pushing the firm into other related areas, such as data center cohosting with AI inferencing, infrastructure integrations that resemble their own spin on Super Micro Computer’s (SMCI) business, and partnering with municipalities for providing heat generation as a result of BTC mining. Given the potential headwinds at play as the firm transitions their strategy, I recommend MARA with a SELL rating with a price target of $10.62/share at 2x Price/BTC value.

MARA Operations

Management announced their initiative to reinstate their BTC HODL strategy once used in early 2021 during the height of the BTC craze prior to the crypto winter that occurred in the subsequent year.

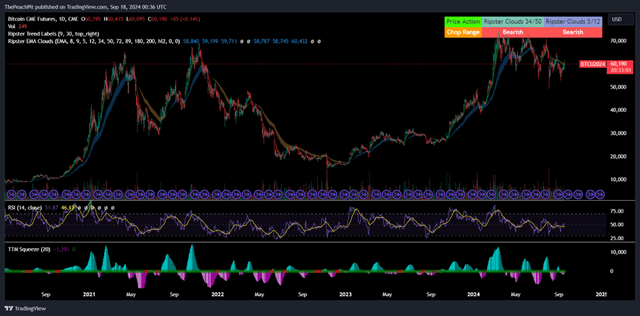

TradingView

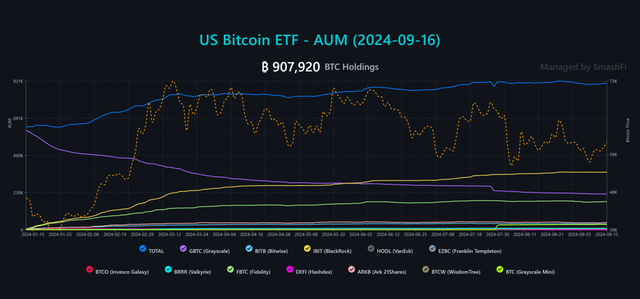

BTC had since recovered and peaked just shy of $75,000/BTC, a major run-up since the decline experienced in 2022. Though BTC has since come off its March highs, the market mechanics have shifted from a more volatile asset that remained out of most investors’ reach to an institutionalized asset that can be held in every retirement account through major brokerages as a result of the launch of BTC ETFs.

I believe that the launch of BTC ETFs has led to more stability in the cryptocurrency, which is potentially one of the factors that has led management at MARA to reinitiate their HODL strategy. As announced in q2’24, MARA purchased $100mm in BTC and will no longer sell mined BTC as part of their HODL strategy.

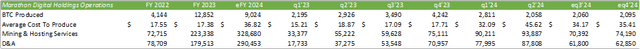

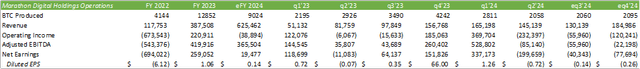

Corporate Reports

Another factor may be margins as a result of the halving event. Though it shouldn’t be considered a 1:1 metric given the hosting services tied into the costs, the average mining & hosting services cost per BTC produced increased from $17.71/BTC in q4’23 to $32.09/BTC in q1’24 and $45.62/BTC in q2’24. Depending on management’s hosting initiatives going forward, this cost per BTC may decline back to around q1’24 levels as the firm delineates from that line of work.

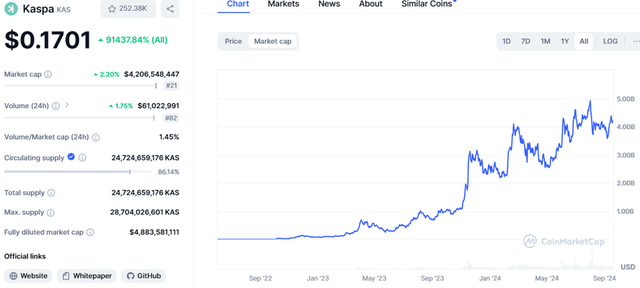

CoinMarketCap

To offset the loss of revenue production as a result of MARA’s HODL mandate, management is mining Kaspa at an 80% margin. Kaspa is a much smaller coin at $4b in market cap with an average daily trading volume of $60mm. According to CoinMarketCap, Kaspa has a max supply of 28.7b coins with 24.7b currently in circulation, leaving roughly 4b of the coin left to mine.

Accordingly, Kaspa is relatively correlated to BTC, offering similar exposure to the BTC market with improved margins. As part of MARA’s HODL strategy, holding BTC with the hopes of price appreciation while selling mined Kaspa to offset mining and operating costs can potentially provide certain value to MARA.

TradingView

My final thought on MARA’s HODL strategy is that the firm may be positioning itself to compete with the BTC ETFs, such as iShares Bitcoin Trust (IBIT), VanEck Bitcoin Trust (HODL), or Grayscale Bitcoin Mini Trust (BTC). Arguably, MARA may be competing closer to MicroStrategy (MSTR), whose initiative is to purchase and “HODL” BTC with the expectation of price appreciation. Given MARA’s $2300mm debt offering in August to purchase $249mm in BTC and $345mm in equity sales to acquire $100mm in BTC in July, the firm is beginning to resemble the leveraged strategy that MicroStrategy is touting.

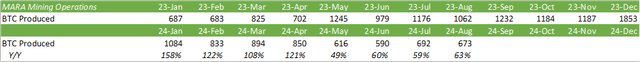

Corporate Reports

Comparing MARA’s BTC mining operations in 2024 to 2023, it is clear that the halving event has significantly impacted operations despite the infrastructure challenges faced in q1-2’24. I have reason to believe that management has realized that pure BTC mining is becoming less and less sustainable, leading to the diversification of revenue streams.

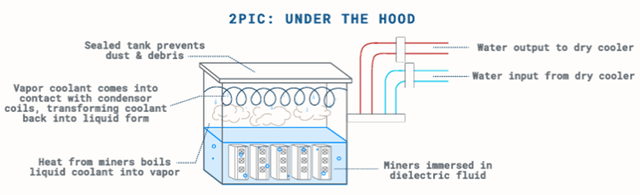

Looking to additional revenue streams MARA is seeking to take on, there may be some uphill challenges that the firm may be faced with being a late mover. Starting with infrastructure, MARA is seeking to enter the data center cooling space to compete with direct air and liquid cooling. Management discussed in their q2’24 earnings call that they will be seeking to enter the market with their two-phase immersion cooling system as a competitor to direct liquid cooling. Accordingly, the immersion systems boasts 2-4x the power density of competing cooling systems and require upwards of 75% the space in the data center. Management also suggested that the firm may enter the server rack space as well, competing with firms like SMCI and now Advanced Micro Devices (AMD) with their recent acquisition of ZT Systems for full-stack design.

Corporate Reports

MARA will also be users of their infrastructure for mining operations. This may play into their goal of co-investment in new data centers to host AI inferencing in addition to their BTC mining in order to act as a load balancer to AI applications. This may play out to MARA’s benefit given the heightened demand for AI factories for training and inferencing; however, I do not believe that the bottlenecks are the data centers themselves but sourcing all the materials in order to construct the data centers. Given that Oracle Corp. (ORCL) is constructing 100 new data centers for AI training and inferencing in partnership with Microsoft (MSFT), there may be a crowding out effect amongst the hyperscalers as MARA attempts to become a new entrant. A co-investment will likely be driven regionally and will likely be driven by enterprises or 2nd & 3rd tier hyperscalers as the majors will likely prefer to leverage their own data center.

Lastly, MARA launched a pilot in Finland to leverage their digital compute assets to offer a low-cost alternative to district heating by converting clean energy into heat on-site. I believe that this feature poses as a strong business case as an alternative to conventional heating given the amount of heat mining machines generate. This is essentially replacing an electricity-to-heat conversion with an electricity-to-BTC mining-to-heat, allowing for the power conversion to be utilized to mine both BTC and generate heat as opposed to just generating heat.

At of q2’24, MARA has launched 2MW as it pertains to the project in Finland that is capable of warming a town of 11,000 residents using their digital asset computing. Management anticipates increasing capacity to 4MW by the end of the year.

MARA Financials

Corporate Reports

MARA did run into a few challenges in q1’24 that bled into q2’24 as it pertains to power transmission and unexpected equipment failures at 3rd party operated sites. As a result, production was significantly impacted by both these factors and the April halving event. MARA also faced headwinds due to the increased global hashrate. The firm also faced cost headwinds as a result of higher hosting and energy costs as the company deploys and energizes mining rigs in both existing and new facilities.

For e2h24, I’m forecasting the firm to improve their daily production as the infrastructure challenges are resolved; however, given that BTC will be held and put sold, revenue may experience a modest sequential decline in eq3’24. I believe that the new HODL operating structure will result in higher mining & hosting costs with a moderation of revenue as the firm seeks to hold BTC. Management suggested in the q2’24 earnings call that a $10,000 price change in BTC will result in a ~$200mm impact on earnings due to their HODL position.

I believe that this will result in revenue reaching $625mm in eFY24 with an aEBITDA margin of 58%. I’m forecasting diluted EPS to come in at $0.14/share for eFY24 as e2h24 margins will offset the positive net income generated in q1’24.

Risks Associated With MARA

Bull Case

With the popularity of holding BTC in retirement accounts and the reinitiation of their HODL strategy, MARA is positioning itself to act as a BTC proxy to compete with the likes of BTC ETFs and MicroStrategy as a leveraged BTC holding company. If the price of BTC appreciates going forward, MARA will be in a strong position to sell BTC at a profitable rate. MARA is also diversifying their revenue streams in heating and infrastructure, allowing for the firm to realize more durable and sustainable earnings going forward.

Bear Case

MARA is a late entrant in the infrastructure space and may not realize the level of market share necessary for their dual immersion technology to be profitable. Despite BTC being more widely held across retirement funds, the risk of a sell-off still remains prevalent given that BTC may be used for raising cash. This may be driven by the investments’ volatility and lack of income generation when compared to defensive stocks. According to Coinspeaker, BTC ETFs experienced a $1.2b outflow between August 26, 2024 through September 7, 2024.

Bitcoin ETF Fund Flows

Valuation & Shareholder Value

Corporate Reports

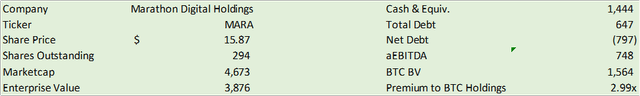

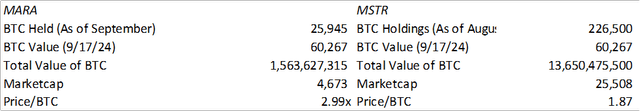

Do note that my valuation summary includes the $300 in debt, the total BTC holdings as of their August 31, 2024 mining update, and the current value of BTC.

Corporate Reports

MARA’s shares trade at a 3x premium to their total BTC holdings. This compares to MSTR’s premium of 1.87x. The ultimate question when considering an investment in MARA is whether the firm’s BTC mining operations deem a higher multiple when compared to a firm that engages in HODL’ing BTC. I believe that given MARA is transitioning their operations from generating revenue through the mining and sales of BTC to alternative avenues, MARA’s financial position may modestly decline in the near-term, resulting in the firm turning to the debt and equity markets to raise capital to both sustain operations and purchase more BTC.

Given this factor, I rate MARA with a SELL rating with a price target of 10.62/share at 2x price/BTC value.

My rationale for the SELL rating is that MARA is adding an additional risk factor to their operations by holding BTC for value appreciation as opposed to mining BTC to generate revenue. Though this strategy may play out in the long run, I believe there are more appropriate avenues to investing in BTC, specifically the BTC ETFs. In addition to this, MARA’s alternative strategies net of Kaspa may not play out due to the firm being a late entrant and the decline in the renewable energy story.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ORCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.