Summary:

- Marathon Digital’s Q2 2024 revenues of $145.1 million missed expectations, and were much lower than the previous quarter’s $165.2 million.

- Despite increasing hash rate, the company’s cost per Bitcoin mined has doubled, making it more expensive than buying Bitcoin directly.

- Bitcoin’s future looks promising with potential price increases, but investing in Bitcoin itself or a Bitcoin ETF may be more profitable than owning Bitcoin miners like Marathon Digital.

Eoneren

I have written about Marathon Digital (NASDAQ:MARA) where I suspected the company would underperform due to the halving event. Now that the event is over, and we have the company’s Q2 2024 results, we can see how it has all played out. This article serves as an update to my original article, with the core thesis that owning Bitcoin itself is better than this miner.

Marathon Digital’s Revenues Missed the Mark in Q2 2024

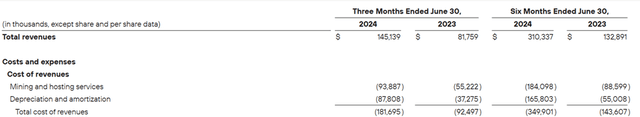

Marathon Digital’s most recent Q2 2024 played out as I hypothesized. After all, if production was cut in half, due to the halving event, and the Bitcoin price did not double, then mathematically there was nowhere for revenue to go but down. The company’s Q2 2024 reported $145.1 million, much lower than the $165.2 million reported last quarter. Analysts expected revenue in Q2 2024 to be $157.1 million, so it can be seen how much Marathon missed the mark on expectations.

However, revenue this quarter was still 78% YoY higher than the $81.8 million reported in Q2 2023. This was primarily driven by the increase in the average price of Bitcoin, which remains much higher compared to where it was a year ago.

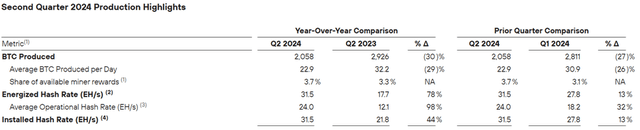

This quarter, the company has made substantial progress on its infrastructure projects and investments. The company grew its operations by more than 10% to a total of roughly 250,000 mining rigs. For the quarter, the company’s installed hash rate is 31.5 EH/s in Q2 2024 with an efficiency of 23.5 joules per terahash.

Marathon Digital aims to continue to improve its mining operations via the deployment of additional S21 Pros and immersion cooling systems. The company has also made strides to get its newly acquired sites in Texas and Nebraska up and running with various infrastructure enhancements like airflow enhancements and electrical upgrades. Hash rates on these sites have improved by 15% – 25% ever since Marathon Digital took over operations. Marathon Digital’s management has reiterated its 2024 guidance of a hash rate of 50 EH/s.

Marathon Digital (Investor Relations)

Bitcoin miners like to show off their increasing hash rate to investors as a sign of progress for the company. The hash rate, for those unfamiliar, is a number that quantifies a network’s power and efficiency. It is a function of the number of computations the miner’s rig can achieve in a second. However, this number is a bit misleading as it isn’t directly tied to revenue, rather what is important is the actual number of Bitcoin mined.

As an example, Marathon Digital’s hash rate has significantly increased over the last year, however due to the poor economics of Bitcoin mining the actual number of Bitcoin obtained has declined. In Q2 2024, Marathon Digital produced 2058 Bitcoins with an energized hash rate of 31.5 and an average operational hash rate of 24 EH/s. This was a 30% decrease or 868 fewer Bitcoins compared to the 2926 Bitcoins mined in Q2 2023. This decline came about despite the much lower energized hash rate of 17.7 and an average operational hash rate of 12.1 EH/s. In other words, Marathon Digital’s energized hash rate and average operational hash rate increased by 78% and 98% respectively, however its total Bitcoin mined decreased by 30%.

Press Release (Marathon Digital)

Profitability Remains Out of Reach

The fact that the number of Bitcoins mined has decreased in the midst of an increasing hash rate is worrying. This is because the hash rate does not increase organically but rather due to substantial investments. According to management in the company’s earnings call;

The company produced 868 less Bitcoin in the second quarter as compared to the prior year period, primarily due to the halving, increased global hash rate and the continued impact of unexpected equipment failures at third-party operated sites and transmission line maintenance, partially offset by an improvement in average operational hash rate.

Digging into the company’s income statement, we can see that the Cost of production has substantially increased from a year ago. In Q2 2023 Marathon Digital’s total cost of revenues was $92.5 million, while in Q2 2024 the total cost of revenues roughly doubled to $181.7 million. This means that the implied cost per Bitcoin grew from $31,612 in Q2 2023 ($92.5 million divided by 2926) to $88,287 ($181.7 million divided by 2058) in Q2 2024.

Press Release (Marathon Digital)

Simply put, it is more expensive for Marathon Digital to mine Bitcoin in Q2 2024 at $88,287 than to simply purchase Bitcoin in the market. The most expensive Bitcoin has ever been during this latest run is approximately $71,500. These numbers could even be worse next quarter, as the halving event took place on April 19, 2024. Meaning there was close to half a month of pre-halving production in these costs.

Bitcoin’s Future Remains Bright

Now just to re-iterate something that may have been missed from my last two bearish takes on MARA stock, I think Bitcoin is a fine investment. There is certainly a case to be made for Bitcoin reaching $100,000 to $200,000 BTC in the near future. Even now, there is a growing acceptance from both the general public as well as the political elite of Bitcoin’s use cases. For example, a poll done by Seeking Alpha has found that more investors are considering buying crypto to balance their portfolios and diversify risks. Seeking Alpha polled over 1,000 subscribers to get their views on cryptocurrencies and the most significant change found is a 10-point shift from 15% to 24% for new holders of crypto and a decrease of 45% to 37% for negative perceptions of crypto. The new spot ETFs were the most popular form of “crypto investment” something that I mentioned in my previous Marathon Digital article weeks ago.

There is also growing acceptance of crypto from the political elite in the US. Both presidential candidates, Trump and Harris, have signaled that their future administration will be friendlier to cryptocurrencies. Trump made headlines in his speech at the 2024 Bitcoin Conference, promising to fire SEC Chairman Gary Gensler. In classic Trump fashion, he concluded his speech with “Have a good time with your Bitcoin and your crypto, and everything else that you’re playing with.” On the Democratic side, the Harris campaign has signaled that it wants to “reset” with crypto companies, signaling a shift away from the Biden Administration’s aggressive SEC enforcement. In other words, politically, Bitcoin and other cryptocurrencies could be in a safer regulatory environment in the near future.

Conclusion and Valuation

Putting this all together, I believe that investors should opt to own Bitcoin or a Bitcoin ETF over Bitcoin miners like Marathon Digital. In the latest quarter, it cost Marathon Digital $88,287 to mine a Bitcoin, while Bitcoin right now is selling at $55,115. Therefore, even if the price of Bitcoin rockets another 60% (from $55,115 to $88,287), Marathon Digital is only breaking even at the gross profit level.

Furthermore, this isn’t an issue that is going away. After two more halving events, roughly 8 years from now, Bitcoin’s price might have to be $353,148 just for Marathon Digital to break even. It’s clear based on the 2023 and 2024 data above that the increase in capacity and hash rate is not enough to offset the loss of production from these halving events and the fact that Bitcoin becomes harder to mine as time goes on.

The caveat to all this though, is that if you are like Cathie Wood CEO of Ark Invest, or Michael Saylor, the co-founder and chairman of MicroStrategy (MSTR) and you believe that Bitcoin will be above $1 million per coin by 2030 or $13 million by 2045. Then, by all means, Marathon Digital’s cost of production will be a drop in the bucket. However, for people like me with more conservative Bitcoin targets, I believe that Marathon Digital is a sell rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.