Summary:

- NetApp’s Q1 2025 earnings were underwhelming, but the company is evolving from traditional storage to “intelligent data infrastructure,” integrating with major cloud providers.

- The AFF A-series and AI investments are strengthening NetApp’s market position, though full transformation will take time.

- Valuation shows NTAP is mildly overvalued; profitability is solid, but revenue growth lags behind sector peers, raising concerns.

- Hold NetApp stock for now; profitability and strategic initiatives are promising, but economic risks and competition warrant caution.

John M Lund Photography Inc/DigitalVision via Getty Images

Thesis

Back in August, when NetApp, Inc. (NASDAQ:NTAP) unveiled its Q1 2025 earnings, the market’s response was what I’d call tepidly sour—disappointed, but not a disaster.

The stock settled into a leisurely amble, channeling within a $115–$130 range. Fast-forward to today, and with FY25 Q2 results on deck (scheduled for release just after the close on Thursday), it’s time for another look. I’ll be going over some recent updates from the company, examining its guidance, valuation metrics, and any other data that might help us piece together what to expect later this week.

NetApp: A Seasoned Contender

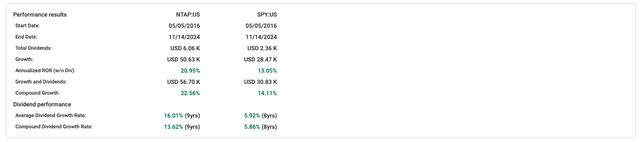

When it comes to tech companies, NetApp, Inc. isn’t exactly the fresh-faced startup brimming with garage-band vibes. It’s a seasoned player in the data infrastructure game with a stock performance that backs up its success. Its growth and dividend returns have comfortably outpaced the broader market, with an annualized rate of return nearing 21% (dividends excluded), well ahead of SPY’s respectable but less dazzling 13%.

The company specializes in unified data storage and integrated data services. But at its core, NetApp offers a range of products that businesses rely on to keep their data in line and accessible. Think servers, SAN (storage area network) and NAS (network-attached storage) systems, networking hardware, and a well-stocked toolkit of software solutions.

But don’t tell NetApp’s CEO, George Kurian that.

In a recent interview, Kurian made it clear that he doesn’t want people to think of the company as just a hardware or storage provider anymore. While NetApp is still strong in the storage industry, the focus is shifting to something bigger: “intelligent data infrastructure.” This means they’re not just helping companies store data but are building smarter systems to make better use of it.

Businesses today, Kurian says, don’t just want storage; they’re asking for tools to analyze, optimize, and use data to improve how they operate and get real results for their business. One way to visualize this is like moving from just keeping books on a shelf to turning those books into actionable insights for better decisions.

To deliver on this vision, NetApp is putting a lot of effort into building software and tools that work really well with big cloud providers like AWS, Microsoft Azure, and Google Cloud. Again, these tools aren’t just about storing data—they’re designed to help businesses actually use their data in better ways. Kurian thinks this approach, which focuses on integration and smarter systems, will make NetApp stand out from competitors who, as he noted, are still stuck with older storage methods or a mix of solutions they’ve cobbled together from buying other companies.

Hardware and AI Investments

That doesn’t mean NetApp is ditching its hardware roots altogether. Far from it. Instead, it’s using its deep knowledge of data management to carve out a spot in the ongoing booming world of AI. Since AI thrives on two things—massive computing power and mountains of data—NetApp has joined forces with top Taiwanese manufacturers like Foxconn and Quanta, famous for their advanced servers. Together, they’re working on systems that blend cutting-edge hardware with NetApp’s data expertise, creating tools built to handle the intense demands of AI.

This mix of intelligent software and AI-ready infrastructure is, we’re told, a sign of NetApp’s thoughtful approach to the future. Kurian seems quite keen to emphasize that the company is evolving beyond the realm of traditional storage. But if their partnerships with hardware manufacturers are anything to go by, it’s clear that such a grand transformation doesn’t exactly happen with the snap of a CEO’s fingers. In other words, it’s going to take a fair bit of time and effort to fully pull off.

AFF A-Series Bolsters Market Position

Meanwhile, NetApp is doing well by broadening the range of products it offers. A big part of this success comes from their AFF A-series, which is an ultra-fast, all-flash storage system built for tough jobs like AI, machine learning, and managing large databases. It runs on their ONTAP software. The AFF A-series has been popping up across all sorts of industries where speed is the name of the game, supporting everything from virtualization to enterprise databases and AI applications. Management claims that by hitting both capacity and performance markets, NetApp has managed to firm up its market position, making high-performance storage a bit less of a luxury and more of a practical choice for companies looking to revamp their data setups.

Expanding Cloud Services

NetApp has also been improving its cloud services, making them better for handling hybrid cloud setups and AI tasks. The company had noted great progress in arenas like Asia-Pacific and Europe, where it’s seeing a steady flow of new customers. In fact, since last quarter, around half of its customers are either brand-new to NetApp or using flash storage for the first time, showing very good growth and momentum in its user base.

Tackling Competition and Cyclicality

As mentioned earlier, NetApp’s CEO talked about competition and how the company is holding its own in the market. In fact, according to discussions on last quarter’s conference call, they have been grabbing more market share in areas like capacity flash and block storage because some of their competitors have been slipping, especially in the high-end and mid-range products. On top of that, AI and its cousin, generative AI, are also opening up some big opportunities where NetApp finds itself in a great spot to handle the data needs for AI systems, and as AI keeps growing, so will the demand for flash storage. Things like generative AI and advanced models (like retrieval-augmented generation, or RAG) are going to need tons of storage, which could help NetApp improve its growth metrics, which I’ll get into in a moment.

Valuation and Growth Metrics

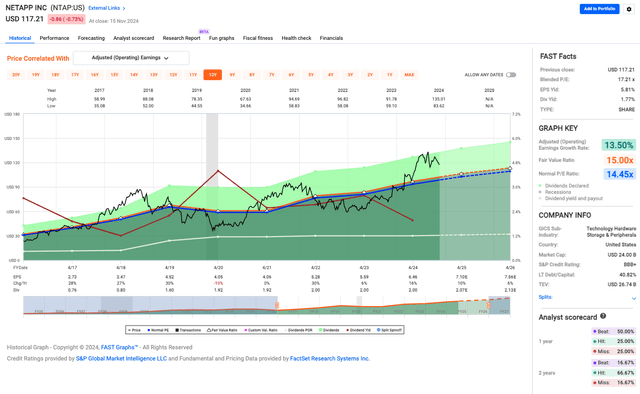

When it comes to valuation, NTAP is sitting at a blended price-to-earnings ratio of 17.21x, a bit above the fair value benchmark of 15.00x. In plain terms, this tells me that the stock is mildly overvalued compared to its usual historical averages. The likely culprit is a touch of investor optimism over the company’s adjusted operating earnings growth rate of 13.5%. Respectable, but not extraordinary for its sector.

Profitability and Forward Risks

Earnings-wise, NTAP delivers a decent EPS yield of 5.81%, which is a nice nod to its profitability that’s also echoed in Seeking Alpha’s A+ profitability grade. Concurrently, NTAP’s growth story leans on that 13.5% adjusted earnings growth rate. The company needs to keep this up and while management has been shrugging it off, I don’t think that competition in data storage and cloud markets will make it easy. In other words, its higher valuation only works if the growth holds steady. With a normal P/E of 14.45x, investors expect consistent results. A tougher economy could test those expectations.

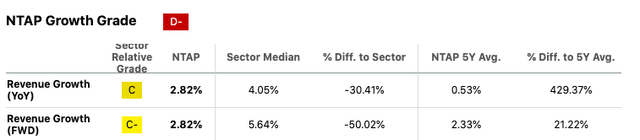

Speaking of growth, NetApp’s SA Growth Grade of D- is telling us that the company has been struggling to keep up with its sector peers, especially in revenue and EPS growth.

Revenue growth is one weak spot with year-over-year growth that sits at 2.82%, trailing the sector median of 4.05%. Forward revenue growth projections look worse, showing a sector-relative drop of 50%. And even though NTAP’s revenue grew 429.37% over five years, the future looks flat.

On the flip side though, profitability growth is definitely solid with EBITDA growing 21.41% year-over-year, crushing the sector’s 2.4%. EBIT growth tells a similar story, with 24.86% growth against the sector’s 2.33%. Even looking forward, EBIT growth of 7.58% edges out the sector’s 7.27%. That noted, while it points to strong cost control and margin management, these gains don’t fully offset that slow revenue growth.

Guidance and Economic Concerns

Meanwhile, in regard to guidance, the company shared its outlook for the year, and their overall tone is one of confidence about how their business is performing, even though, to paraphrase, they mentioned that the overall economy is still a bit uncertain. Uncertainty aside, they’ve raised their revenue expectations for the year to between $6.48 billion and $6.68 billion, which would mean about 5% growth compared to last year. They also expect to keep their profits strong, with their gross margin staying at 71% to 72%. Their operating margin is also expected to hold steady at 27% to 28%. Looking ahead to the second quarter, the company expects revenue to be between $1.565 billion and $1.715 billion. Putting it all together, they estimate their earnings per share for the quarter will be between $1.73 and $1.83.

Q2 Watchlist for Investors

Finally, looking at what might impact the Q2 earnings, the company previously mentioned that broader economic and political issues are still ongoing, which could affect how much customers are willing to spend. On top of that, investors should watch for the slowdown in the U.S. public sector that management highlighted last quarter.

They talked about the market cyclicality and how they could be a problem. Analysts were also a bit twitchy that flash market growth might slow after several strong quarters, especially if tighter economic conditions hit spending. NetApp relies on strategic NAND pre-buys to keep margins up, but that’s risky. Once inventory runs low, margins could take a hit unless prices stay in their favor. Also, AI revenues, while hopeful, are still more promise than paycheck. Meanwhile, flash adoption is picking up speed, but traditional hard drives still hold the fort. The shift to new tech, as always, seems to be taking its time.

And lastly, while gaining some ground in the market, NetApp admits it’s facing stiff competition from the likes of Dell and HPE, particularly in the realms of flash storage and AI. The upshot here is pretty straightforward: staying ahead in this industry means relentless innovation and standing out from the crowd—exactly the sort of strategic juggling act CEO Kurian seems intent on mastering.

Final Take: Hold for Now

As we move into Q2, I’d say NetApp is worth holding on to for now. They’re doing well in terms of profitability and are making calculated initiatives into AI and cloud services, which could drive growth over time. That said, the stock seems a bit overpriced, their revenue growth is slower compared to competitors, and there are some risks tied to the economy and competition so it’s probably best to wait and see if they show more steady growth or the stock price becomes more reasonably priced.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NTAP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.