Summary:

- I don’t think Nvidia Corporation’s upcoming Q3 FY2025 numbers will really surprise investors — demand is predictably outstripping supply, so I expect another profit and positive comments from management.

- Nvidia’s strategic focus on AI and accelerated computing positions it for long-term growth, with significant contributions from generative AI and model training workloads.

- On the other hand, I think the “beat size” will continue to fall, which could lead to a mixed reaction from market participants.

- Nvidia’s leadership in AI infrastructure and increased CAPEX from major tech firms suggest continued demand, but the stock price may face short-term pressure due to valuation premiums.

- NVDA stock is a “Hold”.

BING-JHEN HONG

Intro & Thesis

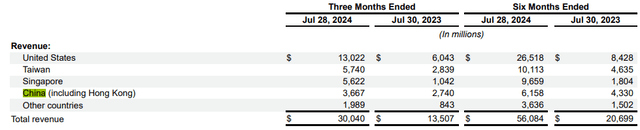

I’d long been skeptical about how high Nvidia Corporation (NASDAQ:NVDA) stock could go – unfortunately for my coverage history (and fortunately for buyers of Nvidia stock) my bearish rating aged like milk, so I decided to reassess my stance in late August this year. The last time I covered NVDA I was previewing its earnings for Q2. I expressed my thoughts that the company’s bottom line or revenue wouldn’t be significantly impacted by the GB200 production delays that many were discussing back then. As time has shown, Nvidia managed to beat Q2 earnings and the stock continued to rise, albeit at a much more modest pace:

Seeking Alpha, the author’s coverage of NVDA stock

Based on the indirect data we have today, I expect Nvidia Corporation (NVDA) is unlikely to be surprised by anything new – the company has significantly beaten consensus in recent quarters, although the extent of the beats has continued to decline. I expect Nvidia to beat the current consensus for the third quarter again without surprising investors with anything new – indirect data tells us that demand for Nvidia’s GPUs is still outpacing supply, providing a solid foundation for future business expansion. I expect management to be positive again on the earnings call, stimulating the idea among market participants that growth isn’t yet exhausted.

In my opinion, however, there’s a risk of a drawdown after the publication of the results. Most of the positive developments are already priced in, and the market could see a potentially weaker earnings beat as the beginning of the end of the upward cycle in the short term. This possibility certainly can’t be ruled out.

Why Do I Think So?

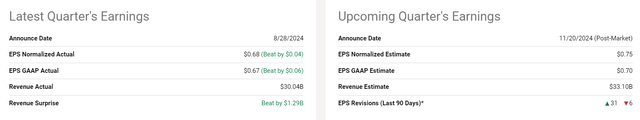

First off, let me briefly overview the Q2 results, as my article came out before they were actually released.

Nvidia has posted a stunning showing in its fiscal Q2 2025 report, generating record revenues of $30 billion – that’s a 15% sequential increase and 122% growth over the previous year. The data center market was the largest contributor to this strong financial performance, which alone accounted for $26.3 billion (up 16% sequentially and 154% YoY). The growing use of generative AI, model training, and inferencing workloads drives the data center’s growth. So naturally, the demand for Nvidia’s Hopper and Blackwell GPU solutions, as well as its networking solutions, has played a critical role in this expansion.

Gaming too experienced significant growth, posting revenues of $2.88 billion, 9% sequentially and 16% year-over-year. It primarily accounts for this increase in demand for RTX-powered PCs and laptops, which are increasingly being utilized for AI. At the same time, Nvidia’s Automotive and Robotics business lines are becoming significant growth areas as the firm posted 37% year-over-year growth in vehicle revenue as the company applied its technology to autonomous vehicle development.

The apps we all are used to use massive amounts of computational power, which Nvidia GPUs are necessary for. So NVDA’s inference platform, which represented more than 40% of data center revenues, is particularly attractive to CSPs, consumer internet providers, and enterprises. That dependence is going to only increase as the next-generation AI engines use more and more compute power, setting Nvidia for long-term growth.

On the other hand, we also saw sequentially reduced gross margins for Nvidia as new products and inventories for low-yielding Blackwell materials were increased. However, the company’s operating cash flow saved the day (NVDA generated ~$14.5 billion in CFO for the quarter). The company used ~$7.4 billion for repurchases and dividends, authorizing an additional $50 billion for buybacks and thus showing the market the management’s focus on shareholder value creation. Furthermore, the gross margin decline was well anticipated, allowing Nvidia to easily beat the consensus expectations for the quarter:

After Trump won the presidential chair, some people started to fear that the new administration’s potential limits on US-China trade may limit Nvidia’s top-line expansion. But I think it’s not really a major threat to NVDA as it continued to limit its exposure to China – the revenue share in that region fell from 20.3% last year to 12.2% as of Q2 FY2025.

Nvidia’s strategic focus on AI and accelerated computing is a major advantage. The ecosystem and the availability of the company’s CUDA software in all major cloud platforms appeal heavily to developers and businesses. The launch of the H200 platform, which offers 40% more memory bandwidth than its predecessor, also consolidates Nvidia’s position as an AI infrastructure leader.

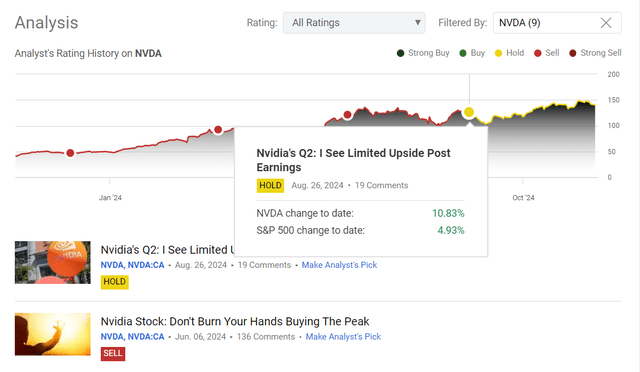

Looking ahead, Nvidia’s management projected ~$32.5 billion in revenue for Q3 FY2025, fueled by continued data center growth and increased demand for Blackwell products. Blackwell production will begin in Q4 and several billion dollars of revenue from this new architecture is anticipated, according to the company. Gross margins are expected to remain at mid-70% due to the continuing move towards new products.

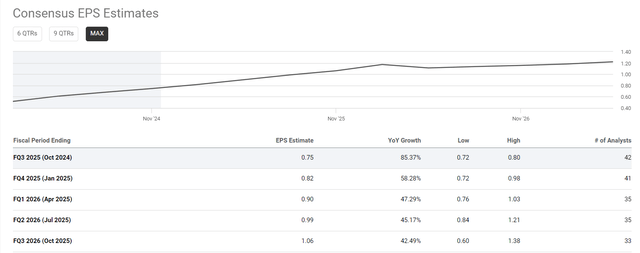

The problem is that the market is already pricing in sales growth to $33.1 billion, which is 1.84% above management’s forecast. This appears to be a slight increase, but this optimism reduces the chances that the forecast will be significantly exceeded. Most likely, the trend of reducing the magnitude of positive surprises will continue in Q3 because in addition to the premium on revenue estimate, we see a premium on EPS forecast. According to Wall Street analysts, Nvidia should demonstrate an EPS growth rate that exceeds the revenue growth rate. This is thanks to its operating leverage, and I think it will be quite difficult for the company to achieve this, as gross margin stagnation is unlikely to go anywhere.

Seeking Alpha, NVDA Seeking Alpha, NVDA

But why do I believe that there will still be another EPS/sales beating for Q3 (albeit not as strong as before due to higher market optimism)?

I recommend revisiting the indirect data I mentioned at the start of the article. Fortunately, most of the major clients – large tech firms – reported their last quarter earnings at the end of October and the beginning of November. This allows us to assess demand by examining the trends in their cloud segments.

Google Cloud’s (GOOGL) (GOOG) revenue growth, for example, jumped to 35% year over year, while Microsoft Azure’s (MSFT) growth – though slower – will likely continue to pick up speed as additional capacity becomes available. This means there’s good demand for Nvidia products as these tech giants continue to invest in AI and cloud infrastructure, which rely heavily on Nvidia GPUs.

In addition, the anticipated surge in capital spending on large cloud providers is a positive sign for Nvidia. Major companies such as Microsoft, Google, and Amazon (AMZN) all announced plans to add CAPEX as a way of scaling their AI and cloud solutions. The resulting increase in spending will likely drive demand for Nvidia GPUs, which are key components for AI and cloud applications.

Goldman Sachs [proprietary source, November 2024]![Goldman Sachs [proprietary source, November 2024]](https://static.seekingalpha.com/uploads/2024/11/19/49513514-17320053497417922.png)

For all these reasons, Nvidia’s leadership position in the market and continued growth in AI and cloud infrastructure indicate good prospects to surpass estimates for earnings per share. This would give the management more room to be positive during the upcoming earnings call.

As Goldman Sachs analysts noted in their November note (proprietary source), the global AI infrastructure market also confirms Nvidia’s ability to exceed expectations. SK Hynix and Samsung have seen a surge in revenues for their high-bandwidth memory (HBM) products, essential to AI workloads, which indicates the huge appetite for AI-related hardware. Advanced Micro Devices’ (AMD) further rise in its forecast for its AI accelerator market and data center GPU revenue also underscores the growing market for AI infrastructure. This explosion in AI use cases across the range of businesses from auto to healthcare indicates that Nvidia’s technology is in demand, laying the foundation for earnings surprises.

So I do not think investors will be in for a big surprise when the Q3 results are published – Nvidia is set for another earnings beat. But again, with the market already giving a premium to management’s guidance and the problems of stagnating margins not going away, I think the beat will be smaller than many expect. This could cause the stock to fall in the short term as it is pressured from the premium to its valuation.

Morningstar Premium, NVDA [proprietary source]![Morningstar Premium, NVDA [proprietary source]](https://static.seekingalpha.com/uploads/2024/11/19/49513514-17320058679461098.png)

I have to say right away that I do not think NVDA is overvalued. If the growth forecasts really come true and the leading position doesn’t lose relevance, then the current 49x in forward P/E ratio is well deserved. On the other hand, such high multiples usually lead to a certain vulnerability of the stock price as soon as the company shows even the slightest sign of weakness. What exactly that sign might be, aside from the actual earnings miss, is a big question, but the market has been unpredictable lately, so I would keep my ears open on the upcoming earnings call.

The Bottom Line

As Nvidia continues to be a dominant player in AI and high-performance computing, the company has a clear opportunity to profit from the rising demand for such solutions, which is driving further growth and shareholder value. However, I don’t think the upcoming Q3 FY2025 numbers will really surprise investors – demand is predictably outstripping supply, so I expect another profit and positive comments from management. On the other hand, I think the “beat size” will continue to fall, which could lead to a mixed reaction from market participants. Given this risk, I wouldn’t over-inflate existing positions in NVDA stock ahead of the earnings results announcement.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!