Summary:

- AT&T has rebounded significantly, with shares up over 40% in the past year, driven by strong free cash flow and improving financial metrics.

- Despite risks like high debt and competition, AT&T’s focus on core business and debt reduction positions it for future capital appreciation and strong dividends.

- AT&T’s consistent growth in subscribers and revenue, coupled with substantial free cash flow, allows for continued debt reduction and potential dividend increases.

- With a lower rate environment, AT&T can refinance high-yield debt, potentially reducing interest expenses by $1-$2 billion annually, enhancing margins and valuation.

PM Images

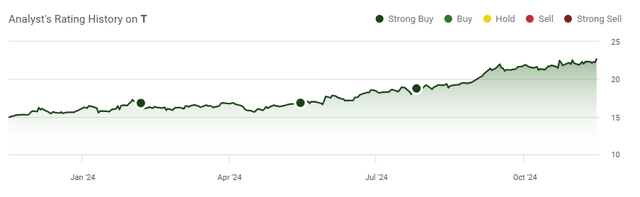

Many investors wrote AT&T (NYSE:T) off as this has been a decade of lost shareholder value. Shares of AT&T traded for just over $35 on November 17th, 2014, and since then, shares have declined by more than -35%. The growing dividend was the only saving grace for a long time, but after failed acquisitions and frustrations, shareholders continued to be bearish about AT&T’s future. Even when shares of AT&T reached their lowest points, I remained bullish because of their large amounts of free cash flow [FCF] and improving financial metrics. I have previously outlined how AT&T could utilize its profitability to strengthen the balance sheet and that it should lead to a stronger valuation. Shares of AT&T have now gone up over 40% in the past year, going from $15.85 to $22.68. I think that management is proving that they are staying the course with shareholder value as a top priority. AT&T continues to improve its net-debt position, grow its user base, and expand the amount of FCF it generates. I think that the shares of AT&T are still undervalued, and we could continue to see an improvement in valuation in 2025. I am very bullish on AT&T as I think it will still lead to future capital appreciation for shareholders while providing strong dividend income.

Following up on my previous article about AT&T

AT&T continues to prove the bears wrong as shares broke out over $20 since my last article was published in July (can be read here). Shares of AT&T have appreciated by 18.37% compared to the S&P 500 climbing 8.04%. When the dividend is taken into consideration, AT&T’s total return is 19.89% over this period. I had discussed why I felt AT&T was making progress and how they would be able to continue deleveraging its balance sheet. AT&T was able to drive in $0.60 of EPS in Q3, which came in ahead of estimates despite its revenue slipping -0.45% YoY. Now that we have clearer monetary policy and more data from AT&T, I am following up with a new article as I am very bullish about AT&T’s ability to drive further value for shareholders in 2025.

Risks to investing in AT&T

Just because I am bullish on AT&T doesn’t mean there aren’t risks to allocating capital toward this investment. AT&T has a large debt load, and if their EBITDA and FCF decline it could create a problem in supporting the dividend and meeting its debt obligations. AT&T also faces stiff competition from Verizon (VZ) and T-Mobile (TMUS) in wireless. AT&T also faces large-scale competitors in broadband internet. With a new administration coming in there is no telling which regulations will be loosened and if any of President Trump’s actions will pave the way for Starlink to compete further into the wireless and broadband sectors. There is also opportunity risk as AT&T has consistently underperformed the market. While I am bullish, there are many reasons to look for other places to allocate capital, as AT&T’s run could be reaching its limits.

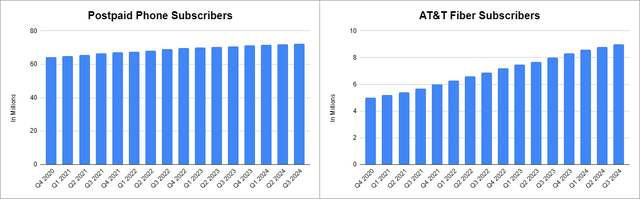

AT&T continues to focus on its core business, and it is working

Since spinning out Warner Brothers, AT&T has focused on its communications business. The proof is in the numbers, and since Q4 of 2020, AT&T has increased its subscribers in both postpaid phone subscriptions and AT&T fiber subscriptions QoQ. In Q3, AT&T added 403,000 postpaid phone net adds with a churn rate of less than 1%. Over the past year, AT&T has added 1.5 million subscribers to their postpaid phone subscriptions, which is an increase of 2.12% YoY. AT&T’s fiber business grew by 200,000 in Q3, which marked the 19th consecutive quarter of net adds. Over the past year, AT&T has increased its fiber subscribers by 12.5%, adding 1 million users. This has helped drive revenue and profitability. In the mobility unit, AT&T’s revenue increased by 4% to $16.5 billion in Q3 YoY, while they saw a 6.7% increase in EBITDA to $9.5 billion YoY. AT&T’s fiber revenue grew 16.7% YoY to $1.9 billion while seeing a growth rate in consumer wireline EBITDA of 8.6% YoY in Q3 to $1.1 billion.

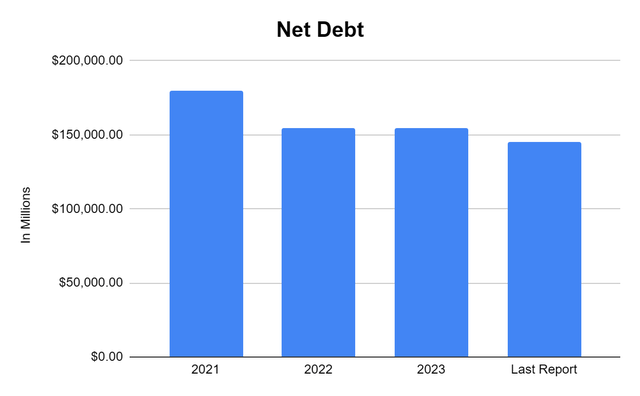

This has led to large amounts of cash from operations and FCF being generated, which is allowing AT&T to improve its net debt position. AT&T generated $10.2 billion in cash from operations and produced $4.93 billion in FCF in Q3. AT&T has produced $13.46 billion in FCF YTD, and they are projecting to generate between $17 and $18 billion in the fiscal year 2024. This means that AT&T will produce between $3.5-$4.6 billion in FCF during Q4. This is one of the main reasons I have remained bullish on AT&T. AT&T is paying a dividend of $1.11 and has 7.17 billion shares outstanding, which means that $7.96 billion of its FCF is being allocated to dividend payments. The combination of spinning out Warner Brothers and generating large amounts of FCF has allowed AT&T to significantly reduce its net debt position. Since 2018, AT&T’s long-term debt has declined by 23.81%, going from $166.94 billion to $127.19 billion. AT&T reduced its net debt position by $1.1 billion in Q3 and by $2.9 billion YoY. Debt has always been one of the largest bear cases, but AT&T is proving that they can not only provide service but also repay its obligations. Since 2021, when AT&T’s net debt ballooned to $180 billion, they have eliminated -19.25% ($34.65 billion) of the net debt on their balance sheet. Debt is no longer this issue in my opinion, and AT&T looks like a leaner company as its net debt to adjusted EBITDA was 2.8x at the end of Q3.

Steven Fiorillo, Seeking Alpha

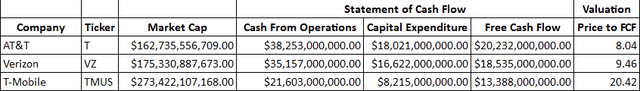

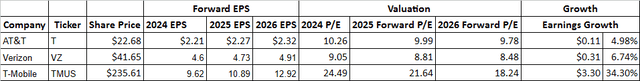

I’m still seeing value in shares of AT&T. Today, AT&T has a market cap of $162.74 billion and a share price of $22.68. Over the TTM, AT&T has generated $20.23 billion in FCF and trades at 8.04 times its FCF. Verizon (VZ) trades at 9.46 times its FCF, while T-Mobile (TMUS) trades at 20.42 times its FCF. AT&T and VZ are both trading at less than 10 times 2026 earnings, with AT&T trading at 9.78 times and VZ trading at 8.48 times compared to TMUS trading at 18.24 times. AT&T may not have a lot of growth on the horizon, but it’s a FCF machine trading at a low valuation, and once its debt gets a bit lower they could reinstate dividend increases again. AT&T is projecting that they will experience 3% growth YoY in mobility and 7% YoY growth in broadband. There is a lot that AT&T can do over the years, and as they retire debt, their interest expenses should decline, which could lead to a larger valuation.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

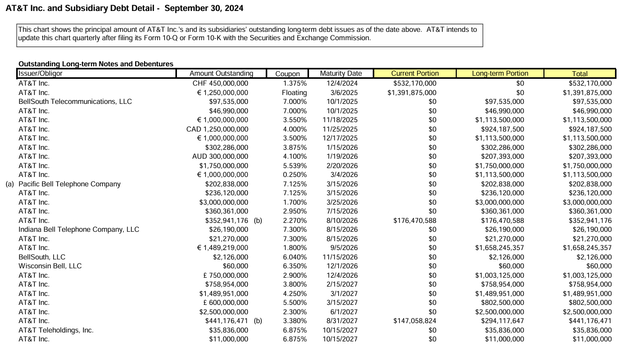

The lower rate environment could be very positive for AT&T

Over the past 4 years, AT&T has paid an average of $6.59 billion in interest expense on an annual basis. In the TTM, AT&T has paid $6.82 billion in interest expenses, which is 5.59% of the annual revenue generated. On the Q3 conference call, AT&T disclosed that more than 95% of its long-term debt was fixed, with a weighted average rate of 4.2%. Just because the average interest on AT&T’s debt is 4.2% doesn’t mean that all of it is at low levels. When I went through AT&T’s debt profile, there are trounces of debt exceeding 6%, 7%, and 8%. The Fed is expected to reduce rates to around 3.5% next year and 3% in 2026. AT&T will have multiple opportunities to issue new debt at lower fixed rates and use the proceeds to eliminate higher-yielding debt. It could improve margins, considering that AT&T spends over $6 billion annually on interest payments, which is over 5% of the revenue generated.

Over the next 3 years, AT&T will have $20.96 billion in long-term debt maturing. AT&T is expected to generate between $17-$18 billion in FCF which is after all their CapEx allocations. So, investing in the company has already occurred, and the remaining FCF can be used for dividends, buybacks, acquisitions, and debt reduction. AT&T is spending $7.96 billion on the dividend on an annual basis. In 2025, if they generate $17 billion in FCF, they will have $9.04 billion remaining, with $4.69 billion in debt maturing. AT&T could eliminate the debt maturing in 2025 and still have $4.35 billion in FCF remaining. If AT&T generated $17 billion in FCF again in 2026, they would have a pool of $21.35 billion in FCF between the retained FCF in 2025 and the $17 billion produced. There is $10.24 billion in long-term debt maturing in 2026. After AT&T repaid these maturities, they would have $11.11 billion in FCF remaining, and after the dividend payments of $7.96 billion, they would be left with $3.15 billion in retained FCF. There is $6.04 billion of debt maturing in 2027, and after AT&T generated $17 billion in FCF again and paid the dividends, they would finish 2027 with $6.15 billion in retained FCF. I am using $17 billion in annualized FCF as this is the low end of AT&T’s projections. It’s entirely possible that AT&T will reduce its debt load by $20.96 billion over the next 3 years while refinancing its higher-yielding debt. This could put AT&T in a position to reduce its interest expenses by $1-$2 billion on an annual basis.

Conclusion

AT&T has been able to claw its way back from sub $15 levels in 2023 and is approaching $23. AT&T is a cash-generating machine, and now that they have spun out or sold non-core assets, I believe that they have the ability to significantly improve the balance sheet while improving margins over the next several years. While some may see AT&T as a low-growth company, I am looking at it as a tremendous value player that can enhance its growth rates over the next several years by reducing debt and improving margins. As AT&T reduces debt, it could lead to a buyback program with its retained FCF. Investors can still get AT&T at less than 10.5 times 2024 earnings with a dividend yield that exceeds 4.8%. As capital comes back into the market from the sidelines, AT&T could be a magnet for value investors, and I think shares could close in at $30 sometime in 2025.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.