Summary:

- Affirm Holdings is experiencing robust growth in sales, Gross Merchandise Volume, and payment transactions, driven by high engagement on its BNPL platform and Affirm Card adoption.

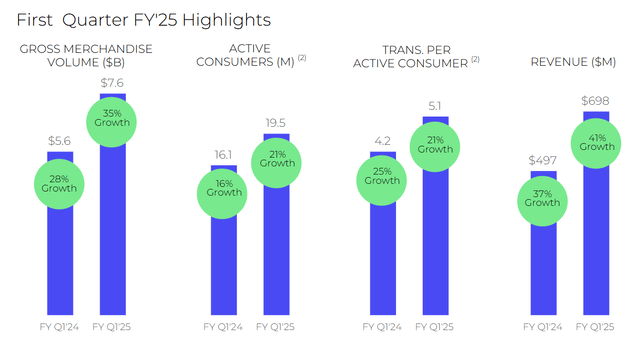

- The company’s 1Q25 earnings report shows a 41% YoY sales increase and a 35% YoY rise in Gross Merchandise Volume, indicating strong business development.

- Lower interest rates could further boost Affirm’s BNPL services, enhancing its profitability and making it a promising long-term investment with a favorable risk/reward profile.

- Affirm Holdings is rated ‘Buy’ due to its potential for substantial growth, efficient cost structure, and promising product lineup, particularly the Affirm Card.

Ratana21/iStock via Getty Images

Affirm Holdings, Inc. (NASDAQ:AFRM) is a buy now, pay later-focused fintech startup that is profiting from considerable growth in its sales, gross merchandise volume, and payment transactions.

In my view, Affirm is primed for a breakout as the company’s 1Q25 earnings painted a very bullish picture in terms of business development. Affirm Holdings is profiting particularly from robust growth with respect to its Affirm Card, which facilitates easy access to the company’s main buy now, pay later product.

BNPL customers are highly engaged on the Affirm platform, and lower short-term interest rates could provide a big boost to the fintech’s buy now, pay later service.

The odds are tilted in favor of investors seeing substantial profitability growth, and I think that the risk/reward profile is favorable for long-term investors.

My Rating History

My last stock classification for Affirm Holdings’ stock was Buy as I perceived the buy now, pay later story to be extremely compelling from an investment point of view.

Affirm Holdings is growing its sales and Gross Merchandise Volume at a fast pace, and profits from growth of the underlying BNPL industry.

I think that Affirm Holdings is poised for substantial growth moving forward and though shares are no longer a steal, I think the fintech has a lot of potential with its Affirm Card.

Affirm Holdings’ Sales Growth And Affirm Card Adoption Are Skyrocketing

Affirm Holdings’ sales amounted to $698 million in 1Q25, reflecting 41% YoY growth. The increase in sales was not as impressive as in 4Q23, which is when sales skyrocketed 48% YoY, but 41% YoY growth is hardly something to complain about.

Key performance indicators like the platform’s Gross Merchandise Volume, customers, and payments transactions all profited from double-digit growth on a YoY basis, proving that Affirm Holdings’ customers are highly engaged and driving substantial growth across the board for the fintech.

Gross Merchandise Volume is the total amount of sales processed over a specified period, and it is a key performance indicator for eCommerce and fintech companies.

In 1Q25, Affirm Holdings’ Gross Merchandise Volume was up 35% YoY to $7.6 billion and the fintech probably has a good quarter coming up as online shopping tends to boom during the December holidays.

First Quarter FY-25 Highlights (Affirm Holdings, Inc.)

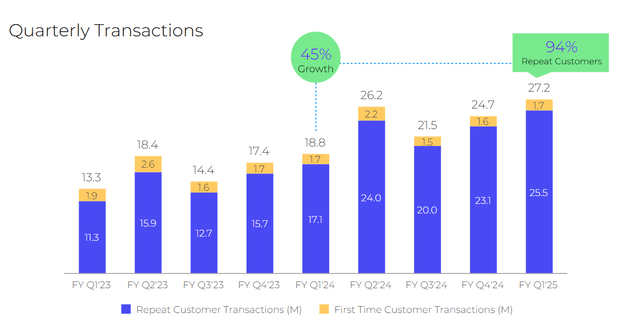

Transactions on the Affirm Holdings’ platform are also booming with growth coming both from repeat customers as well as users that are new to the platform, a good sign if you ask me. In the first quarter, Affirm Holdings’ transactions skyrocketed 45% YoY to 27.2 million.

Quarterly Transactions (Affirm Holdings, Inc.)

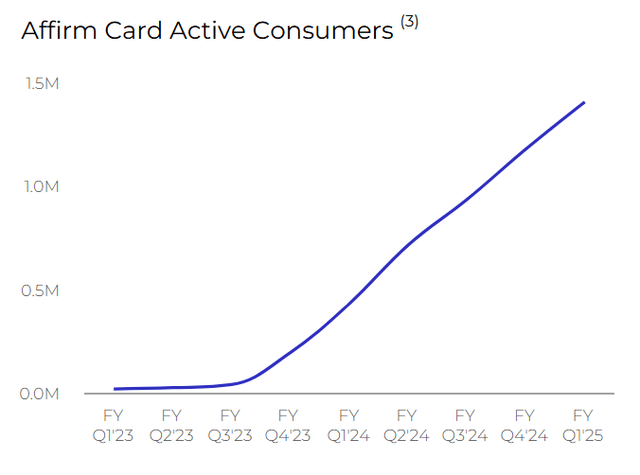

The Affirm Card is making a crucial difference for Affirm Holdings, and it is a top product to keep an eye on in future quarters. The fintech launched the Affirm Card in 2021, and it has seen explosive growth since.

As of September 30, 2024, the fintech had issued more than 1.4 million Affirm Cards and growth has been very impressive since the launch date. In the most recent quarter, the number of cardholders increased by 19% QoQ.

The Affirm Card is a debit card that gives users the optionality to tap into the fintech’s buy now, pay later offer. Users can choose to immediately pay for products and services with their available balance, or sign up for an installment plan without late fees.

Affirm Card Active Consumers (Affirm Holdings, Inc.)

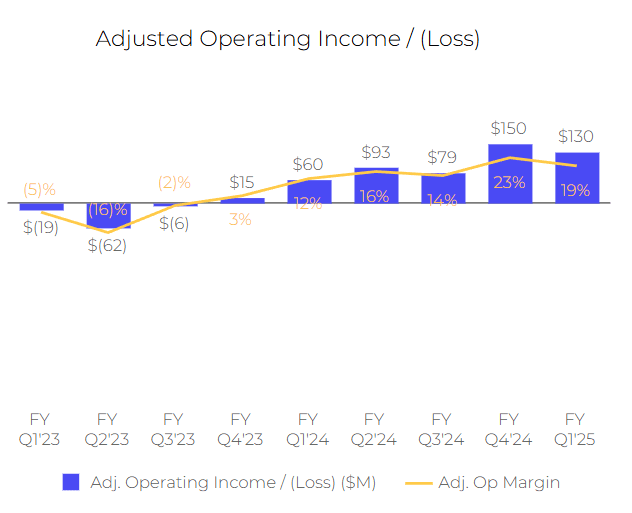

The 2023 financial year was a tough one for Affirm Holdings as the fintech restructured its business and higher interest rates dampened its growth. The fintech has also been challenged in terms of high operating costs, which have weighed on profitability.

With that said, the profit situation at Affirm Holdings has clearly improved, and lower interest rates could be a boon for the buy now, pay later company as well. Fintechs that are active in the lending/credit markets are poised to do well in an environment of lower interest costs as demand for consumer loans tends to increase.

Affirm Holdings’ adjusted operating profits started to surge last year, thanks to the fintech shedding its workforce and focusing a little bit more on costs.

With a more efficient cost structure and more rate cuts likely to be implemented, I think Affirm Holdings is indeed a promising fintech investment.

Adjusted Operating Income (Affirm Holdings, Inc.)

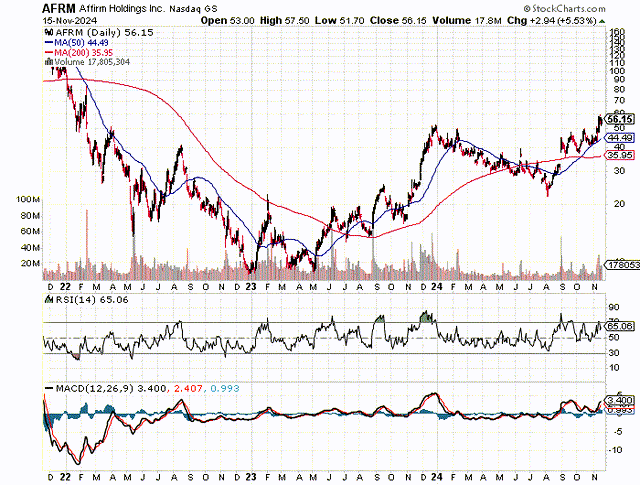

Technical Chart Picture

Affirm Holdings broke out above the 50-day and 200-day moving average trendline in August and has since remained above both indicator trendlines which is a highly bullish setup that could point to another breakout attempt to the upside.

A catalyst for a potential re-rating is a consistent decrease in interest rates. With the U.S. economy also booming and inflation receding, the backdrop for an investment in Affirm Holdings is positive as well.

Based on the Relative Strength Index, Affirm Holdings is not overbought, but it could soon be: The RSI shows a value of 65 (a value above 70 is typically seen as an indicator of overly bullish sentiment).

Moving Averages (StockCharts.com)

Affirm Holdings Is Promising

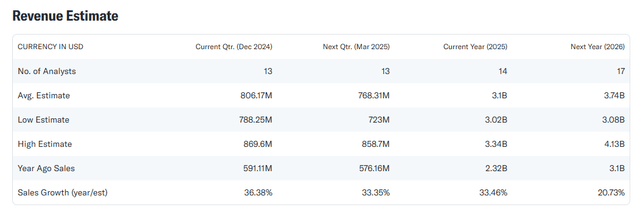

The market presently models $3.74 billion in sales for Affirm Holdings next year, reflecting growth of 21% compared to 34% this year. However, with interest rates poised to normalize and credit becoming cheaper, BNPL products could also see higher take rates, which in turn could spur the startup’s sales growth. As such, I think the consensus estimates here might be a bit conservative.

About 30% sales growth for Affirm Holdings seems like a sensible assumption, particularly in a low-rate environment. Based on the consensus, Affirm Holdings is presently valued at 5.0x leading (next year’s) sales.

Revenue Estimate (Yahoo Finance)

AI-focused lending company Upstart Holdings, Inc. (UPST), which is poised to also profit from lower borrowing rates also, is selling for a sales multiple of 7.8x leading sales. SoFi Technologies, Inc. (SOFI) is selling for a 2025 sales multiple of 5.0x as well.

I think Affirm Holdings, if its fundamentals hold up, could sell at a similar multiple as Upstart Holdings, which is why I am substantially raising my intrinsic value estimate for the fintech from $50 to $87.

Why The Investment Thesis Might Be Wrong

Affirm Holdings, in the short term, will continue to have to deal with profitability challenges. With that said, Affirm Holdings’ key performance indicators point upwards and show strength across the board.

Reaccelerating inflation and a higher-for-longer rate environment might be challenges for the fintech company as they are factors that negatively influence personal loan demand. A recession is obviously also a risk as demand for new loans decreases during such times.

My Conclusion

Affirm Holdings is a very promising buy now, pay later startup investment whose business is firing on all cylinders. In 1Q25, the startup profited from a substantial increase in sales and Gross Merchandise Volume, which is a reflection of the growing demand for BNPL products and services.

In my view, Affirm Holdings is poised to grow its Gross Merchandise Volume and sales in a low-rate environment as demand for personal consumer loans tends to increase when interest rates fall.

I think that Affirm Holdings has a winner product with its Affirm Card also and the stock, in my view, has re-rating potential. The stock has a compelling risk/reward profile and my classification for Affirm Holdings is ‘Buy’.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.