Summary:

- Market trends continue to point to durable cruise demand, with Cruise Lines International Association already projecting robust growth in passengers and capacity through 2027.

- These developments naturally trigger RCL’s raised FY2024 guidance along with the raised consensus forward estimates, with it implying that the worst of the COVID-19 pandemic is behind us.

- If anything, the company continues to report improved balance sheet health attributed to the richer adj EBITDA margins, despite the new fleet deliveries.

- Even so, with RCL already charting triple digit 1Y gains, it is undeniable that the stock is trading at a premium compared to historical trends and its peers.

- We urge investors to not chase the rally at these heights, while recommending traders to take most of their gains upon the reversal of the stock price trend.

DNY59/iStock via Getty Images

RCL Is Now Trading At A Premium After The Overly Exuberant Rally

We previously covered Royal Caribbean Cruises (NYSE:RCL) in July 2024, discussing why we had maintained our Buy rating during the worst of the market correction then, attributed to the improved margin of safety to our long-term PT, accelerated profitable growth prospects, and reinstated dividends.

Combined with the growing bookings and strong demand, it was unsurprising that the management had already achieved its Trifecta Goals eighteen months early for the twelve months ending June 30, 2024 – triggering its compelling investment thesis.

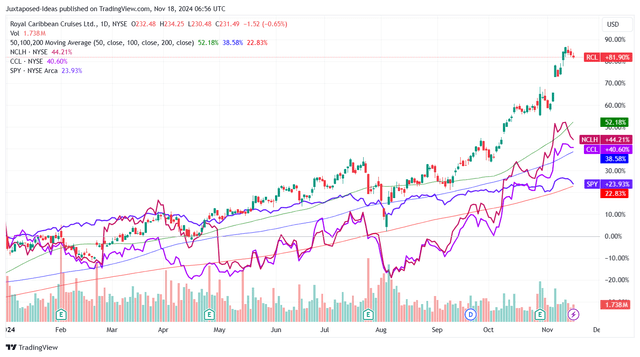

RCL YTD Stock Price

Since then, RCL has had another rich total returns of +49.8%, well outperforming the wider market at +7.2% and many of its cruise peers.

Much of the tailwinds are naturally attributed to the insatiable travel rebound after the COVID-19 lockdowns, significantly aided by the growing awareness to cruise travel, as “the number of new-to-cruise is increasing – 27% of cruisers over the past two years are new-to-cruise, an increase of 12% over the past year.”

Cruise Growth Projections

If anything, the Cruise Lines International Association (“CLIA”) already expects the ocean going cruise passengers to grow at a CAGR of +5.7% from 31.7M in 2023 to 39.7M by 2027, as the global cruise capacity also grows at least by +10% from 2024 to 2028.

Combined with the “substantial innovation, particularly with cruise lines focusing on creating deeper, more immersive experiences at each destination,” one similarly offered by RCL’s collection of ‘private destinations/differentiated experiences across itineraries/global and multi-generational appeal,’ it is unsurprising that the cruise company has reported ten consecutive bottom-line beat quarters.

The same has been observed in FQ3’24, with revenues of $4.88B (+18.7% QoQ/+17.3% YoY), adj EBITDA margins of 42.8% (+3.8 points QoQ/+2.4 YoY/+12.5 from FY2019 levels of 30.3%), and adj EPS of $5.20 (+61.9% QoQ/+35% YoY).

If anything, RCL has further raised their FY2024 guidance for the fourth time (first, second, third, and fourth), with net yields of +11.05% YoY at constant currency (building upon the +13.5% reported in FY2023 compared to FY2019 levels) and adj EPS of $11.59 at the midpoint (+71.1% YoY/ +21.4% from FY2019 levels).

Th management has also hinted at FY2025 outperformance, “with bookings outpacing 2024 levels during the third quarter and into October. Our book load factors are in line with prior years at nicely higher rates, allowing us to further optimize pricing and yield growth as we build the book of business for 2025,” implying a potentially excellent forward guidance in the upcoming FQ4’24 earnings call by early 2025.

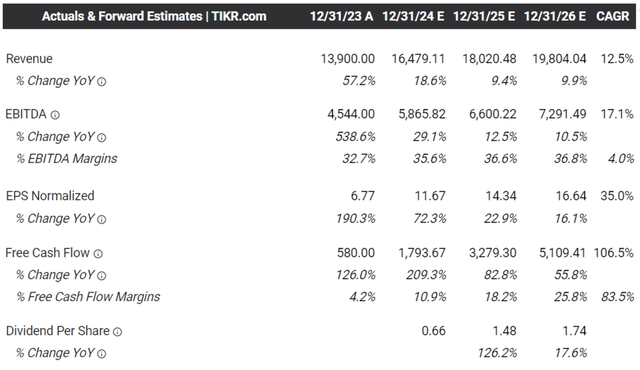

The Consensus Forward Estimates

Combined with the robust insights provided by the rich customer deposits of $5.32B (-14.1% QoQ/+5.7% YoY), we can understand why the consensus have further raised their forward estimates, with RCL expected to chart an accelerated top/bottom-line growth at a CAGR of +12.5%/+35% through FY2026.

This is compared to the original estimates of +10.8%/+24.8% and the historical growth at +6.3%/+23% between FY2014 to FY2019, respectively.

If anything, RCL continues to generate positive Free Cash Flow at $1.08B on a YTD basis (-47% YoY) while reporting healthier balance sheet at a net-debt-to-EBITDA ratio of 2.38x by the latest quarter (compared to 3.34x in FQ2’24, 2.83x in FQ3’23, and 3.35x in FY2019), despite the numerous new fleet deliveries thus far.

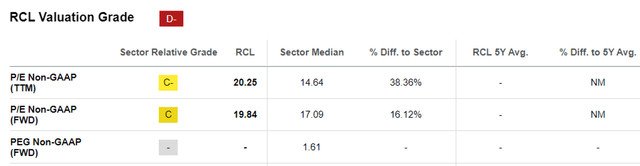

RCL Valuations

These developments may also be why the market has awarded RCL with the premium FWD P/E non-GAAP valuations of 19.84x, compared to the 5Y pre-pandemic mean of 13.54x, with the same trend also observed in its cruise peers, including Carnival Corporation (CCL) at 18.26x/14.51x and Norwegian Cruise Line Holdings (NCLH) at 15.83x/12.74x, respectively.

On the one hand, RCL continues to trade at a reasonable FWD PEG non-GAAP ratio of 1x, based on the projected CAGR of +19.8% from the management’s recently raised FY2024 adj EPS guidance to $11.59 at the midpoint and the consensus FY2026 adj EPS estimates of $16.64.

On the other hand, this ratio seems somewhat elevated when compared to its 5Y pre-pandemic mean of 0.58x and its cruise peers, including CCL at 0.84x and NCLH at 0.64x – implying that RCL’s recent rally may have occurred overly fast and furious, offering interested investors with a minimal margin of safety.

So, Is RCL Stock A Buy, Sell, or Hold?

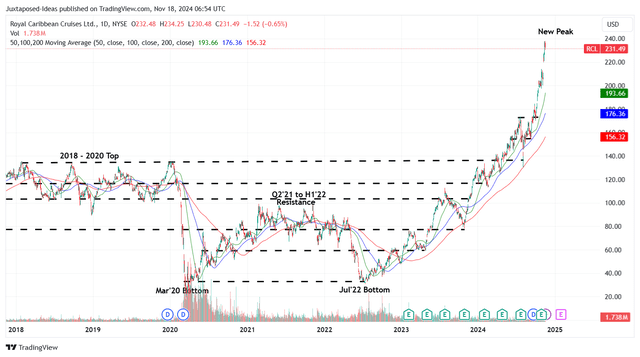

RCL 6Y Stock Price

The same has also been observed in RCL’s continuous upward trend since the July 2022 bottom, with the stock already running away from its 50/100/200 day moving averages while hitting new peaks of $237s.

For context, we had offered a fair value estimate of $131.60 in our last article, based on the LTM adj EPS of $10.08 ending FQ2’24 (+15.9%) and the FWD P/E of 13.06x then (with it nearing the 5Y pre-pandemic mean of 13.54x).

Based on RCL’s raised FY2024 adj EPS guidance of $11.59 (+71.1% YoY), it is apparent that the stock has already run away from our updated fair value estimates of $151.30.

At the same time, based on the consensus raised FY2026 adj EPS estimates from $14.78 to $16.64, there remains a minimal margin of safety to our updated long-term price target from $193 to $217.30.

While the management has reinstated their dividends, the recent price appreciation has also triggered an underwhelming forward yield of 0.66%, compared to the FY2019 averages of 2.5%.

As a result of the relatively underwhelming investment thesis at current inflated levels, we are prudently downgrading the RCL stock from our previous Buy to Hold rating instead.

While the stock currently enjoys great upward momentum, buying power is likely to be exhausted sooner or later, with the eventual correction potentially being painful as FY2025 also brings forth tougher YoY comparisons from the double-digit growths reported in FY2024.

If anything, the management has already warned of a notable FQ4’24 impact from the Hurricane Milton, as observed in the adj EPS guidance of $1.425 (-72.5% QoQ/+14% YoY) missing the consensus estimates of $1.57 (-69% QoQ/+25.6% YoY).

Given the potential capital losses, we urge investors to not chase the rally at these heights, while recommending traders to take most of their gains upon the reversal of RCL’s stock price trend.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.