Summary:

- Alphabet reported strong Q3’24 growth in Google Subscriptions, Platforms & Devices, and Google Cloud, driven by AI investments and product launches.

- Significant margin improvement in Google Cloud, expanding from 3% to 17% year-over-year, suggesting durable growth and future margin accretion.

- Alphabet’s AI advancements in ad generation, Google Search, YouTube, and cybersecurity, along with strategic investments in data centers, support long-term growth prospects.

BlackJack3D/E+ via Getty Images

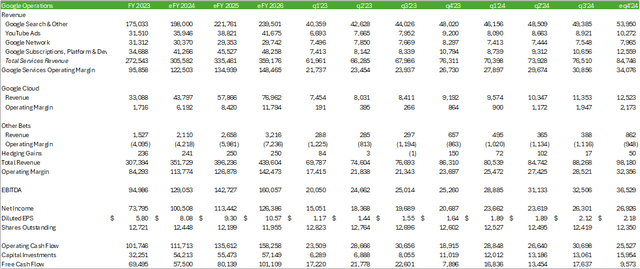

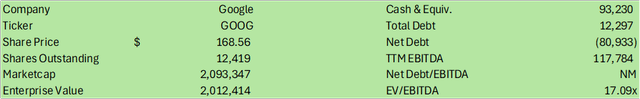

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) reported a strong q3’24 as the Google Subscriptions, Platforms & Devices and the Google Cloud segments accelerated in growth, driven by product launches and continued investments in AI. Alphabet realized significant margin improvement in q3’24 for Google Cloud as operations scale while reducing underlying costs. As the firm continues to optimize operations through the use of internal AI models, I have reason to believe that Alphabet will realize more durable growth and margin accretion going forward. I am upgrading my rating for GOOG shares to a BUY rating with a price target of $187/share at 15.72x eFY25 EV/EBITDA.

Alphabet Operations

Alphabet has been improving its capabilities for creative departments in generating ads with GenAI on Gemini. The firm recently updated its image generation at Google Ads with Imagen 3 to improve its text-to-image model. Management noted that its AI features allow for creatives to develop ad campaigns at a faster rate with stronger performance. I believe this will have the potential to further transform targeted advertisement in which tailored ads can be created for individual groups to improve conversion rates.

Google Services

Google Search & Other

Google Search & Other grew by 12% at the top-line on a year-over-year basis, driven by advancements in AI Overviews, Circle to Search, and new features in Lens.

Google recently rolled out AI Overviews across 100 new countries and territories with the goal of reaching over 1b monthly users. Alphabet brought forth shopping ads to its AI Overviews application for mobile users in the US.

Circle to Search is available on over 150mm Android devices, allowing users to shop and translate text.

In addition to this, Lens has reached over 20b monthly searchers. Accordingly, 1 in 4 searches with Lens has commercial intent. Alphabet recently rolled out shopping ads as part of Lens searches to help connect consumers and businesses.

YouTube

YouTube is experiencing substantial subscription and ad growth, reaching $50b in revenue on a trailing twelve-month basis. This is driven by YouTube TV, NFL Sunday Ticket, and YouTube Music Premium subscription services. As part of its creator initiative, Alphabet announced that the Google DeepMind model for video generation VO will be available for YouTube Shorts in eq4’24.

Platforms & Devices

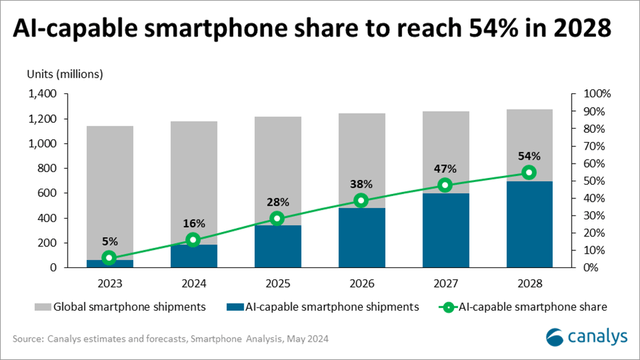

Alphabet announced the release of Pixel 9 that will feature advanced AI models, including Gemini Nano. Despite the strong penetration forecast for AI smartphones, the total global mobile device market is expected to grow by only 3% in CY25.

Google Cloud

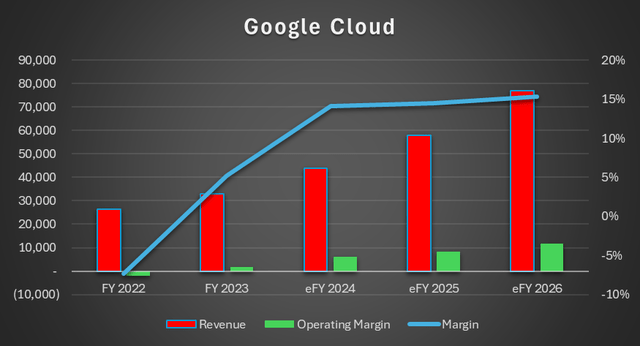

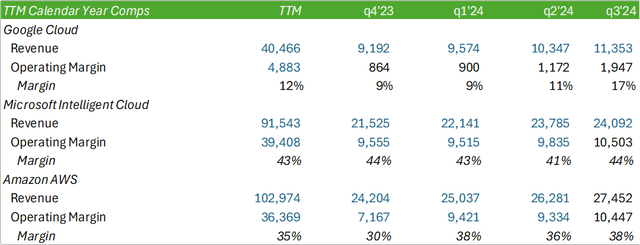

Alphabet realized tremendous growth in its cloud services paired with a significant improvement to its operating margin. Revenue for the segment continues to accelerate, growing by 35% in q3’24 on a year-over-year basis. This segment is beginning to realize economies of scale with a strong operating margin expansion from 3% in q3’23 to 17% in q3’24.

Despite the significant improvement, Google Cloud’s operating margin still trails competing hyperscalers, such as Amazon (AMZN) and Microsoft (MSFT), who reported CYq3’24 operating margins of 38% and 43.60%, respectively. I believe that as Google Cloud scales, operating margins will improve closer to its peers.

Google Cloud growth was driven by expanding infrastructure across Alphabet’s data centers, custom silicon, and global fiber network. As part of its hardware offering, the combination of TPUs and GPUs has reduced inference processing time by more than 50% with a 72% improvement to operating costs.

The firm also remains focused on building internal AI models to improve operational efficiencies. As a result of Alphabet’s AI Overviews, the firm has made incremental machine cost per query improvements, resulting in expanding margins. Accordingly, Alphabet has reduced the costs by more than 90% through hardware investments, improved engineering, and scaled operations of its custom Gemini model.

Alphabet has also experienced scaled usage of its Gemini models across various users, including consumer and business adoption. Management noted that all seven of Alphabet’s products and platforms with more than 2b monthly users use Gemini models. To expand its reach, Alphabet has made Gemini available on GitHub Copilot and is anticipating further expansion.

Gemini is realizing strong attachment from enterprise customers as a result of the improved operational efficiencies. One example management provided was Hiscox leveraging BigQuery with Gemini to reduce the risk analysis process from days to minutes. Positive customer results have led to an 80% growth rate for BigQuery ML over the last 6-month period.

In addition to this, Alphabet is realizing strong growth for its AI-powered cybersecurity solutions, growing by 4x in the last 6-month period. Customers are leveraging Google Threat Intelligence and Security operations to improve detection and response to cyber threats at a significantly reduced time.

Internally, management moved the Gemini development team to work under Google DeepMind to streamline and accelerate post-training work. Google is also heavily leveraging AI throughout the coding process to improve productivity and efficiency with 25% of all new code being generated by AI.

Long-term, one of the major headwinds Alphabet, along with the other hyperscalers, must face is the need to build out baseload capacity to power these data center investments. Similar to the other hyperscalers, Alphabet is directly partnering with the utilities and nuclear power developers in order to secure electricity for future developments.

On October 14,2024, Alphabet partnered with Kairos Power to deploy 500MW of baseload capacity through small modular reactors [SMRs], with the first deployment targeted for 2030. Full capacity is expected to be reached by 2035. Under the agreement, Kairos Power will develop, construct, and operate the SMRs, including selling power to Alphabet through its power purchase agreements.

Other Bets

Management outlined Waymo’s success in their q3’24 results, with over 1mm fully autonomous miles driven while serving 150,000 paid rides. Alphabet is expanding Waymo through both its partnership with Uber in Austin and Atlanta and with a multiyear partnership with Hyundai.

In addition to this, Wing, Alphabet’s drone delivery company, is scaling its partnership with Walmart and is now operating across 11 stores.

Alphabet Financial Position

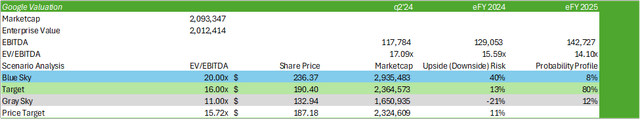

Alphabet realized accelerated growth across multiple segments, including Subscription, Google Cloud, and its Other Bets, which includes Wings and Waymo. I’m forecasting a continuation of this strong growth acceleration in Google Cloud as the firm closes out eFY24, with this drive continuing throughout eFY25-26.

Alphabet invested $13b across technical infrastructure, primarily in services, data centers, and networking equipment in q3’24. Management is anticipating eq4’24 capital investments to remain at similar levels sequentially. In q3’24, Alphabet announced that it plans to invest $7b in its global data center footprint, $6b of which will be in the US.

My forecast for eFY24 total revenue calls for 14% growth to $396b with a diluted EPS of $8.08/share. I’m forecasting growth and margins to remain strong in the coming years as management optimizes internal operations through AI automation and the use of AI agents for coding, as well as improved margins through scaled cloud operations.

Risks Related To Alphabet

Bull Case

Alphabet continues to realize durable growth as Google Cloud continues to scale at an accelerating rate, driven by enterprises adopting GenAI with Gemini. Internally, operations are being consolidated and simplified while being optimized by the firm’s internal use of its AI models to improve its cost structure. I’m expecting the firm’s ad revenue to continue to improve as AI enables creators to more rapidly develop short-form video and other content with the use of GenAI.

Bear Case

Similar to other hyperscalers, Alphabet continues to increase its capital investments to keep up with the growing demand for AI capabilities. This may put Alphabet at risk of overinvesting and overbuilding its data centers, resulting in a potential decline in data consumption rates. A recent report on Seeking Alpha suggested that Nvidia’s (NVDA) new Blackwell AI chips are running into issues with overheating servers, resulting in a potential roadblock for data center buildouts. Depending on the technology stack, I believe this will require more investment in direct liquid cooling technology to improve this issue, leading to potentially higher costs for buildouts.

Valuation & Shareholder Value

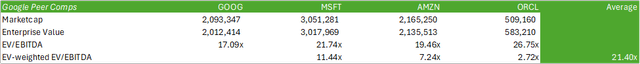

GOOG shares trade at a significant discount to its peers at 17.09x EV/EBITDA. Given the improved margins at its Google Cloud segment, I have reason to believe GOOG’s multiple may have room to migrate closer to its peer cohort. I do not anticipate this to occur in the near-term; but rather, it will improve as Alphabet reports incremental improvements on a quarter-to-quarter basis.

The valuation table below uses an EV-weighted EV/EBITDA in order to control for company size. This allows for a valuation metric that more closely relates the market share commanded by the companies compared.

Using an internal valuation model that applies my eFY25 EBITDA forecast and GOOG’s historical trading premiums, I believe GOOG shares should be valued at $187/share at 15.72x eFY25 EV/EBITDA. I am upgrading my rating to a BUY for GOOG shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.