Summary:

- The Health Care sector faces uncertainty due to speculation about Robert F. Kennedy, Jr. leading HHS, impacting stocks like Johnson & Johnson.

- Despite solid earnings, JNJ shares have been under pressure; I maintain a buy rating due to undervaluation and a strong dividend yield.

- Key risks include health care policy changes, global economic conditions, and competition, but JNJ’s revenue and earnings forecasts remain optimistic.

- Technically, JNJ shows some soft trends, but valuation and EPS growth support a buy rating amid political and regulatory uncertainty.

Sundry Photography

The Health Care sector is often known for its stability during periods of economic turmoil. That’s not the case today, given uncertainty regarding future policy thanks to speculation that Robert F. Kennedy, Jr. will be appointed head of the Department of Health and Human Services (HHS). The independent turned ally of President-elect Trump is an outspoken advocate of alternative methods to personal and family health, including his stance against some vaccines.

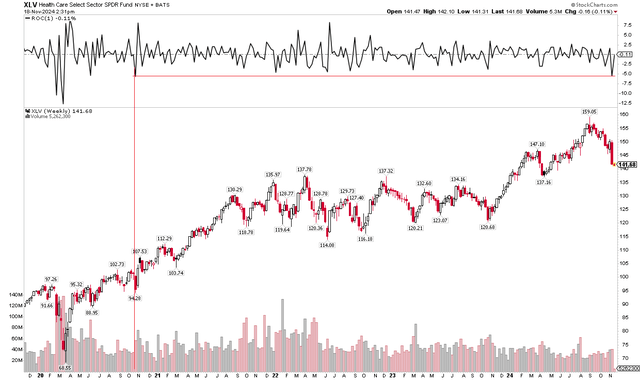

Amid this shaky backdrop, The Health Care Select Sector SPDR® Fund ETF (XLV) endured its worst weekly return in more than four years in the first full week after Trump’s re-election. Within the group, shares of Johnson & Johnson (NYSE:JNJ) have come under pressure despite posting solid earnings results throughout 2024.

I reiterate a buy rating on the $371 billion market cap Pharmaceuticals industry company. Despite its underperformance compared to the S&P 500 in 2024, shares are a decent bargain, while the dividend yield is nearly two percentage points above that of the SPX.

Health Care ETF Skids to its Worst Week Since October 2020

Back in October, JNJ reported a solid set of quarterly results. Q3 non-GAAP EPS of $2.42 topped the Wall Street consensus forecast of $2.21, while revenue of $22.5 billion, up more than 5% from the same period a year earlier, was a material $330 million beat. Shares traded higher by 1.5% in the session that followed as investors took a shine to robust operational results.

It wasn’t all rosy, however, as JNJ’s management team lowered its full-year earnings outlook due to soft softness in its MedTech segment. The firm’s Pharma division scored impressive numbers, though. Investors seemed to generally look beyond JNJ’s reduced current-year operational earnings guidance, which now stands at $9.91 (midpoint), down from $10.05. The good news was that sales forecasts were hiked to verify near $89.6 billion for the full year.

Within the Pharma segment, its key drugs Darzalex, Invega Sustenna, and Stelara were the primary drivers of the revenue beat. Darzalex specifically runs at a 5% growth clip. For 2025, it will be important to see how the drugs’ sales growth performs along with any potential gains in the MedTech segment.

There may also be optimism in the year ahead surrounding JNJ’s oncology, immunology, and neuroscience segments given recent bullish growth in multiple myeloma treatments and generally stable prescription trends.

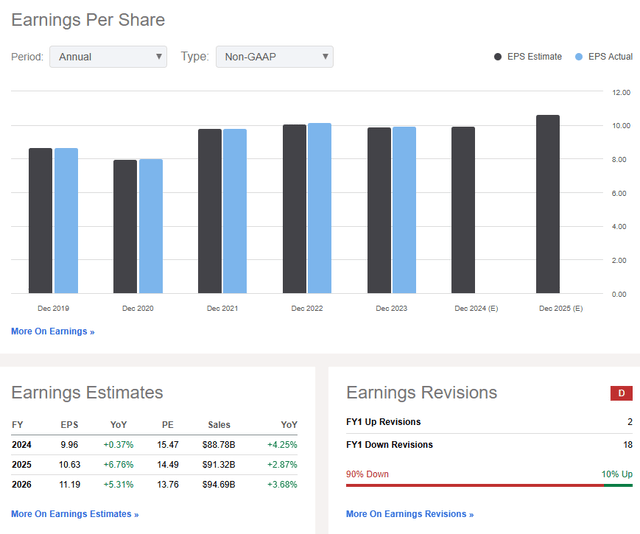

On the earnings outlook, after years of tepid EPS growth, per-share earnings are forecast to rise at a clip in the mid-single digits in the out year through 2026. With revenue gains pacing with inflation, JNJ is by no means a notable growth idea, but the mid-teen P/E multiple is fair at the very least.

Moreover, JNJ is highly profitable and has generated $7.90 of free cash flow per share over the past 12 months. The FCF yield is now 5.1%. Unfortunately, the sell side has turned sour on the Pharma giant – there have been a high 18 EPS downgrades in the past three months compared to just 2 upgrades.

JNJ: Revenue & Earnings Forecasts, EPS Revision Trends

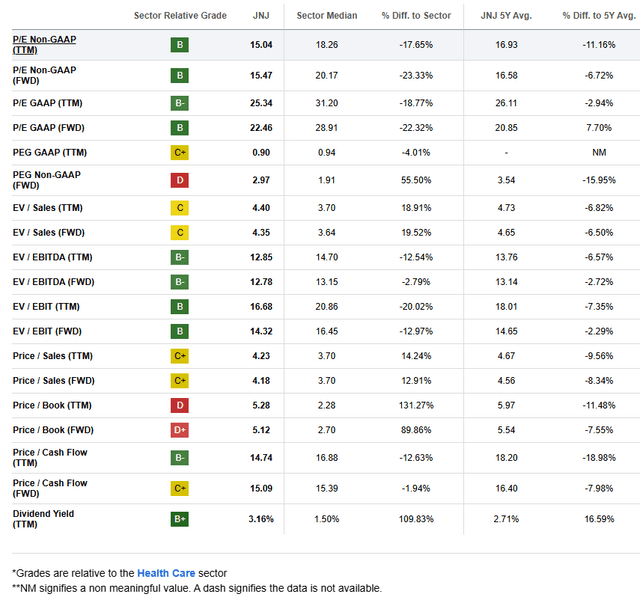

On valuation, I continue to like JNJ from a value perspective. If we assume $10.50 of operating EPS over the year ahead and apply the stock’s 5-year average P/E of 16.6, then shares should trade near $174. That’s a slight reduction from the $180 target I had on the stock back in the second quarter given the softer guidance, but shares still appear as undervalued.

Furthermore, JNJ is on the cheap side on a price-to-sales basis.

JNJ: Attractive on Earnings, Below Historical Average P/S

Key risks include uncertainty over health care policy under the incoming administration, along with a weaker global economy should hefty tariffs be imposed. Also, if JNJ engages in M&A at unfavorable terms, then there’s downside risk to earnings. We also can’t look past the steep rise in the US dollar in the past two months – a strong greenback could negatively impact EPS.

Of course, heightened competition from other pharma companies and weak uptake in its commercial and pipeline products would be negative to the growth story next year. Finally, any further negative news around the talc litigation would be a downside catalyst.

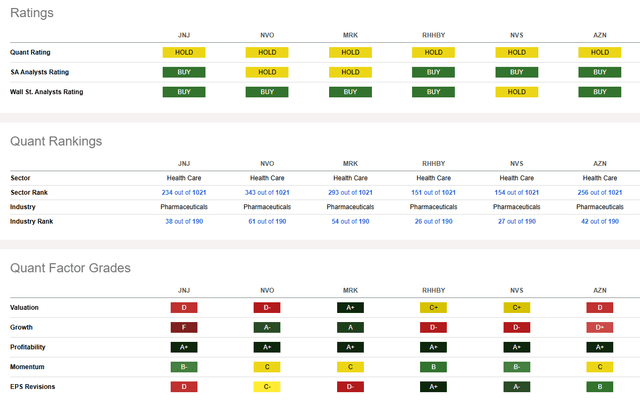

Competitor Analysis

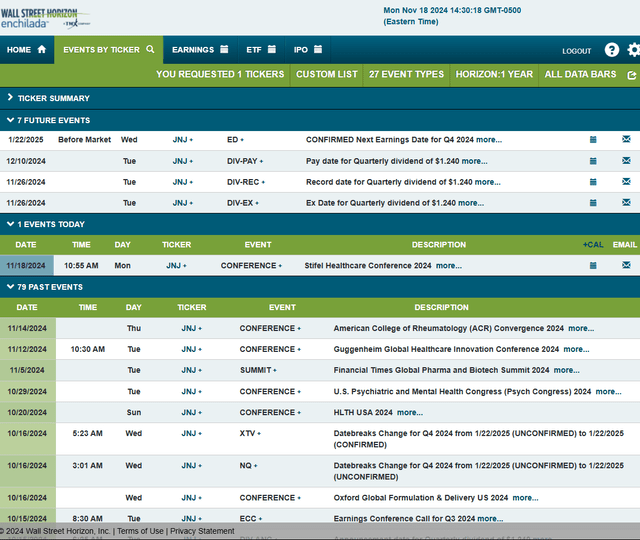

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q4 2024 earnings date of Wednesday, January 22 BMO. Before that, shares trade ex a $1.24 dividend on Tuesday, November 26.

Corporate Event Risk Calendar

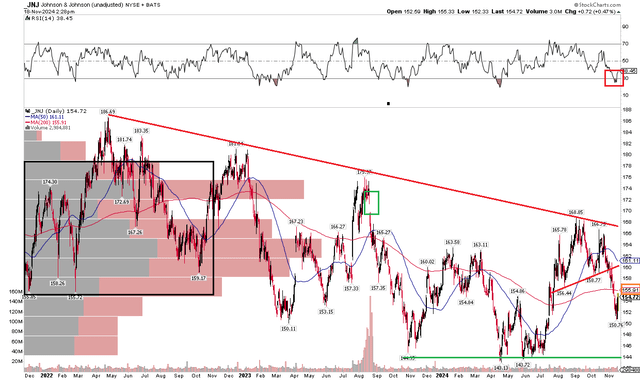

The Technical Take

With shares still on the cheap side, though with a smaller gap up to where I consider fair value to be compared to what it was in Q2, JNJ’s technical situation is largely disappointing. Notice in the chart below that the downtrend resistance line that I have profiled before remains in play. While the stock rose through the $164 resistance level I highlighted in May, the gains were short-lived. A bearish head and shoulder near-term topping pattern unfolded, with a target into the upper $140s. So far, JNJ has held the $150 spot.

Bigger picture, take a look at the long-term 200-day moving average – it’s merely flat in its slope, which is actually modestly encouraging since the broader trend has been lower for quite some time. But with shares under the 200dma and the 50dma, the case can be made that the bears control the primary trend. The stock is just now working off technical oversold conditions, while long-term support now appears at $144.

JNJ: Support Emerges Near $144, $168 Resistance

The Bottom Line

I have a buy rating on JNJ. While I’m not impressed by the technicals, the valuation case is still the primary driver of the thesis. EPS growth next year and a string of bottom-line beats help offset slightly softer FY 2024 guidance numbers from last month’s Q3 report.

I’ll be watching how fundamental trends unfold, given the political and regulatory uncertainty we are currently in the midst of.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.