Summary:

- Medtronic plc reported Q2 earnings today, with revenues of $8.4bn, up 5% year-on-year, adjusted EPS of $1.26, supported by a dividend yielding 3.2%.

- Despite consistent mid-single-digit revenue growth and new product launches, Medtronic’s share price remains flat due to unpredictable net income and modest innovation.

- CEO Geoff Martha highlighted strong performance and innovation in key fields such as diabetes and hypertension, but stopped short of providing specific long-term growth guidance, keeping market sentiment lukewarm.

- Medtronic has potential for high single-digit growth and can deliver MDT shareholders value through strategic M&A, consistent new product launches, and steady, if unspectacular growth.

Halfpoint

Investment Overview

The medical device giant Medtronic plc (NYSE:MDT) announced its second quarter fiscal results ahead of market open today — so far, the market’s reaction has been lukewarm, with shares down ~3% in early trading, to $85, assigning the company a market cap valuation of $109bn.

First, let’s take a look at some headline figures. Revenues for the quarter were $8.4bn, up 5% year-on-year on an organic basis. Adjusted diluted earnings per share (“EPS”) came to $1.26, up 0.8% year-on-year, or 8% on a constant currency basis.

Operating cash flow came to $1.9bn, free cash flow, $1bn, net income, $2.33bn, up from $1.71bn in the prior year period, and current assets were reported as $22.44bn, with $1.4bn cash and $6.6bn of investments, against $3.72bn of current debt, and $24.6bn of long-term debt. Medtronic pays a quarterly dividend of $0.7, which translates to a current annual yield of 3.2%

Revenues were split between Medtronic’s diabetes franchise, which earned $686m of revenues, up 11% year-on-year, cardiovascular, $3.1bn of revenues, up 6%, neuroscience, $2.45bn, up 7%, and medical surgical, $2.1bn, up 0.7% year-on-year. $4.3bn of total revenues were earned domestically, up 3.3%, and $4.1bn internationally, up 7%.

In terms of guidance, Medtronic is forecasting for organic revenue growth of 4.75%-5%. This is up from the 4.5%-5% guided for in Q1, although thanks to a larger FX impact, implied revenue has been narrowed from $33.5bn-$33.7bn, to $33.5bn-$33.6bn, with EPS of $5.44-$5.5. This implies a forward price to earnings ratio of ~16x, a perfectly respectable metric.

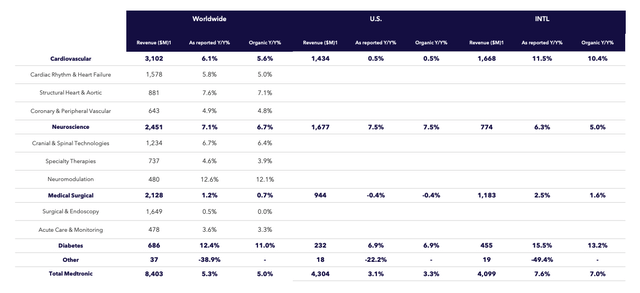

Q2 FY25 revenue by portfolio and geography (earnings presentation)

The above table included in Medtronic’s Q2 ’25 earnings presentation breaks down revenue by portfolio and geography, and shows that there were no underperforming / shrinking segments of the business (apart from “other”), which is an encouraging sign. Neuromodulation and diabetes treatment were the best-performing segments, delivering growth of 12.6% and 12.4% respectively.

Overall Picture: A Solid Quarter By A Good Blue-Chip Company — But Not Enough To Reignite Share Price Growth

Medtronic stock trades at more or less the same value today as it did ten years ago, which is not a particularly encouraging statistic for long-term shareholders, albeit the dividend provides some additional income.

On a five-year basis, shares are down 24% (at the time of writing), having achieved their peak value of $134 in August 2021, at the height of the pandemic era. Performance since has been generally poor, with the nadir coming in October last year, when the stock fell <$70 per share. More encouragingly, shares are up 14% on a 12-months basis, and 4% year-to-date.

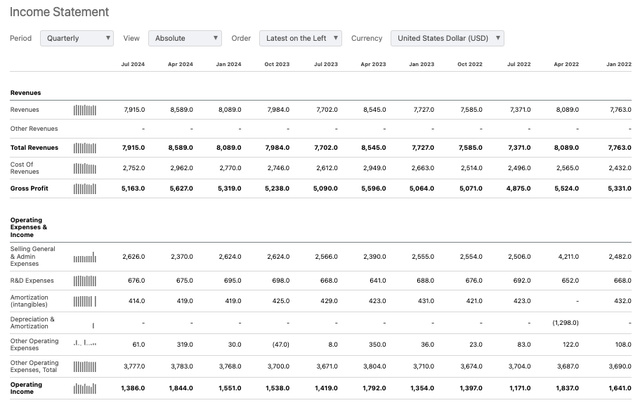

Medtronic quarterly income statements (Seeking Alpha)

If we look at Medtronic’s recent income statements, the issue striking at the heart of Medtronic’s underwhelming share price performance becomes apparent — a lack of compelling top-line revenue growth, and a lack of operating income growth. Net income has also been inconsistent, as shown below:

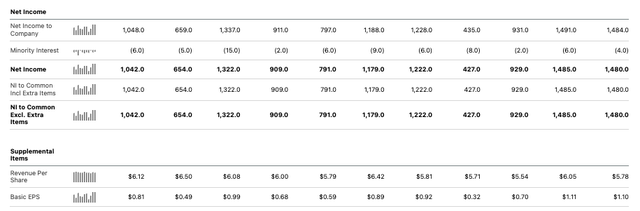

Medtronic net income (Seeking Alpha)

Medtronic’s net income and EPS figures are reminiscent of Forrest Gump’s mother’s box of chocolates — “you never know what you’re going to get.” When the bottom line is unpredictable, the share price is unlikely to grow.

Was there anything in today’s Medtronic earnings that suggests the business is turning a corner?

Medtronic’s Prospects For Growth & Reigniting Shareholder Value

In the earnings call commentary released by Medtronic today, Chairman and CEO Geoff Martha commented that the company had experienced:

yet another quarter of strong results that came in ahead of expectations, and another guidance raise. This makes it eight quarters in a row now of solid, mid-single digit organic revenue growth.

The CEO noted that “We’re delivering durable, mid-single digit revenue growth, which we’ve been doing consistently now for two years,” but also seems to acknowledge the market’s impatience with the incremental pace of growth, adding:

We’ve also been investing to position ourselves in high growth markets. This has led to a wave of recent product approvals across many of our businesses. Look it’s exciting, and it creates a tailwind that this company hasn’t had in a while. We’ve been working hard to put ourselves in a position to win, with revenue growth tailwinds on top of a strong foundation… and now it’s up to us, it’s just up to us to execute and deliver on these opportunities.

In summary, then, Medtronic management is confident of growth, and is poised to deliver. However, it has stopped short of providing any specific detail, for example, guidance for fiscal year 2026, or a long-term compound annual growth (“CAGR”) expectation for the top or bottom line. Thus, it could be accused of hedging its bets somewhat.

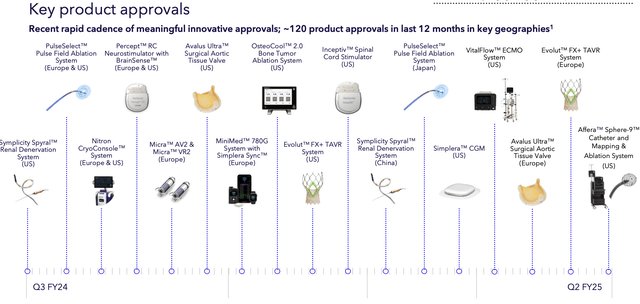

What is undeniable is that Medtronic has launched an impressive number of new products across the past year, as shown below:

Medtronic recent product launches (earnings presentation)

Cardiac Rhythm and Heart Failure (“CRHF”) accounted for $1.6bn of revenues in Q2, but management estimates — in its January J.P. Morgan (JPM) Healthcare conference presentation — that this is a $8bn market. The CEO told analysts that “we nearly doubled the number of physicians using PulseSelect” in the quarter, and talked up the ability of Sphere-9 to “replace competitors’ mapping and RF catheters, allowing us to increase our revenue per case.”

Medtronic also estimates that diabetes is a >$14bn market opportunity for the company, and encouragingly reported 20% growth in its continuous glucose monitoring (“CGM”) business, thanks to its latest 780G “artificial pancreas” product.

Revenues were up 11% year-on-year. It is encouraging that this market opportunity has not been impacted by the GLP-1 agonist drugs Ozempic and Mounjaro, developed by Novo Nordisk (NVO) and Eli Lilly (LLY) respectively. It is also a positive that that growth is being achieved despite competition from the two other CGM med device giants, Abbott laboratories (ABT), and Dexcom (DXCM). In fact, Medtronic’s CEO told analysts on the earnings call that:

We’re investing heavily in Diabetes to expand manufacturing capacity and advance our robust technology pipeline, including our partnership with Abbott on an integrated sensor. These activities support our strategy to be #1 in the fast-growing AID and Smart MDI space, with a technology ecosystem that is focused on achieving better control with less burden.

Turning to hypertension, Medtronic believes the burden of this disease on the healthcare system is “somewhere between $100 and $200 billion a year,” and believes that its simplicity renal denervation system can target >1bn people worldwide, providing “significant, safe, and sustained blood pressure reductions.”

In summary, there are no shortage of opportunities for Medtronic, who invested $1.37bn into R&D in the first half of fiscal year 2025, about the same as in the equivalent period in 2023.

Analysis: Medtronic’s Innovation Tends To be Incremental

Medtronic’s R&D spending in Q2 was 8.6% of revenues, up from 8.2% in the prior year, but its SG&A spending was 32.9% of sales, up from 32.5% in the prior year.

This highlights one of the key impediments to growth at Medtronic in my view. Its business is based more on execution than innovation. New diseases and conditions do not spring up overnight. Innovation among the products treating existing diseases and conditions tends to be slow also, i.e., new products do not tend to outclass older products and demand immediate replacement of the old with the new.

Within the pharmaceutical industry, a new drug might arrive with a best-in-class safety and efficacy profile that leads to widespread adoption, ten years of patent protection, and double-digit billion revenues. However, this does not tend to happen within the medical device industry.

Take diabetes. CGM’s have been incredible growth drivers for medical device companies. Dexcom’s revenues have grown from ~$400m, to >$4bn in less than ten years, but compare that with e.g., Novo Nordisk’s Ozempic — $3bn in its first full year on the market, and ~$14bn last year.

Medical Device companies simply cannot deliver that kind of surge in revenues. They must market and sell more products, and realize a lower margin on sales — albeit still a competitive one — Medtronic’s net income margin was ~13% in Q2.

Nevertheless, my point is that high single digit growth across a business such as Medtronic’s is difficult to achieve. There are plenty of moving parts and innovation is harder to come by, although that does not mean it isn’t achievable.

The good thing about this company is that it launches new products frequently, simultaneously protecting itself against falling revenues of older products, and staying ahead of the competition. The not so good thing is that “blockbuster” (>$1bn per annum) revenue products are rare, competition is intense, and profit margins “good-but-not-great.”

Concluding Thoughts: Medtronic Deserves A Thumbs Up At The Half-Year Stage — High Single Digit Growth Could Create A Lengthy Bull Run

Medtronic has a low price to sales ratio of >3.5x, and a competitive price to earnings ratio. However, it does not have a product that is guaranteed to become a multi-billion selling one within a few years. Thus, the market may shrug and say, investing in Medtronic means I won’t lose money, but I won’t make much money, either.

That, to me, explains the market’s lukewarm reaction to today’s earnings — the headline news is that peak revenue guidance has been ever-so-slightly narrowed, while EPS guidance is basically flat.

Medtronic seems to be heading in the right direction, however, with eight straight quarters of year-on-year growth. The pace of innovation does seem to be picking up also, which opens up the prospect of continued top-line growth — as management has promised.

The bottom line is the major concern. It has been too flat and/or unpredictable to stimulate share price growth. However, I find myself agreeing with management that with good execution, the company has the product pipeline to grow top and bottom lines faster than the market expects.

There is also cash available for M&A — while Medtronic can’t add billions of revenues to its top line in 2026 organically, it could do with some strategic M&A, so I would look out for news on that front.

Medtronic is active in enough growth markets, in my view, with enough new products supported by a strong core base of products in markets where barriers to entry are high, to deliver a positive outcome for shareholders over time.

To date, AI has, in fact, done very little to impact the global healthcare landscape. AI-driven healthcare is one of the worst performing segments of the stock market. However, it may be able to fuel medical device innovation in a way that it cannot — yet — fuel drug development innovation.

In summary, I believe Medtronic has the tools it needs to deliver high single digit growth to top and bottom lines, and drive decent, relatively derisked, if unspectacular gains for shareholders over the next 2–3 years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.