Summary:

- I maintain a ‘hold’ rating for Altria Group due to its declining market share and the ongoing reduction in smoking rates.

- Despite attractive valuation and growth in segments like NJOY and on!, overall market share and cigarette volume continue to decline.

- Revenue growth is driven by higher pricing, but this isn’t enough to offset the weaknesses in the company’s core markets.

- Management’s effective use of cash flows and share buybacks are positive, but the shrinking market and declining market share remain concerning.

prchaec

Whenever I rate a company a ‘hold’, it is my assertion that the stock should experience an upside or downside that is very similar to what the broader market should see over the same window of time. Nobody is perfect and there are cases where I am wrong, sometimes in a good way and other times in a bad way. But every so often, I will be correct or not terribly far off. As an example, I need only point to tobacco giant Altria Group (NYSE:MO). This is the company known for owning the famous Marlboro brand, in addition to other tobacco-related products. It also owns the NJOY e-vapor platform.

Well, back in the very early days of August, I decided to revisit the company. I continued to stress that shares of the business did not look unappealing from a valuation perspective. However, I was worried not only about a continued trend of fewer people smoking. I was also concerned about the business continuing to lose market share compared to other players that are out there. I described that situation as a ‘slow motion train wreck’ and urged investors to tread cautiously. Since then, the stock has generated a return for investors of 9.1%. That is below the 11.6% return experienced by the S&P 500 over the same window of time. But I would argue it’s not a terribly significant disparity that we are talking about.

At the time that I last wrote about the company, investors had access to data covering the second quarter of the 2024 fiscal year. Results now extend through the third quarter of the year. Even though the stock remains attractively priced, market share continues to dip. There does not seem to be any end in sight for this. While the company is enjoying growth in some key areas, I would argue that these improvements are not enough to offset the weaknesses of the company enough to justify an upgrade. Because of that, I’ve decided to keep the firm rated a ‘hold’ for now.

Market Share Up in Smoke

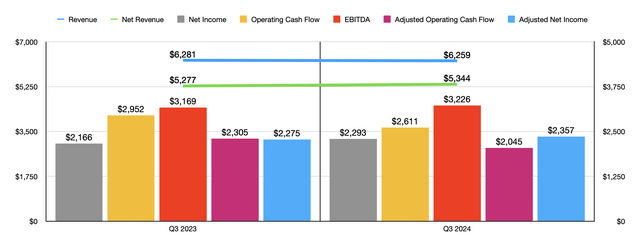

Fundamentally speaking, the picture for Altria Group has been rather mixed as of late. Revenue for the company for the third quarter of 2024 came in at $6.26 billion. This is down from the $6.28 billion the company reported one year earlier. But if we remove excise taxes from the equation, we do get an increase from $5.28 billion to $5.34 billion. This revenue growth for the company can be chalked up in large part to a rise in sales associated with its Smokeable Products segment. Revenue here grew from $4.60 billion last year to $4.65 billion this year. This is the figure that’s net of excise taxes. And unless I state otherwise, all other references to revenue will be on that basis as well.

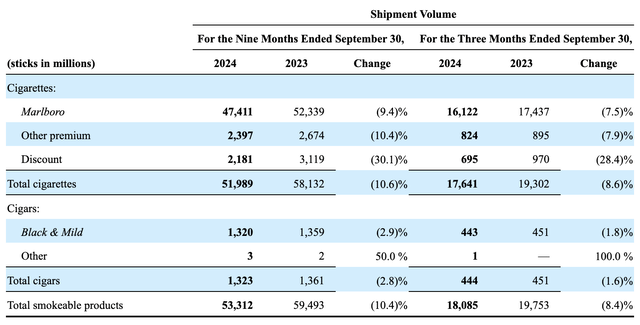

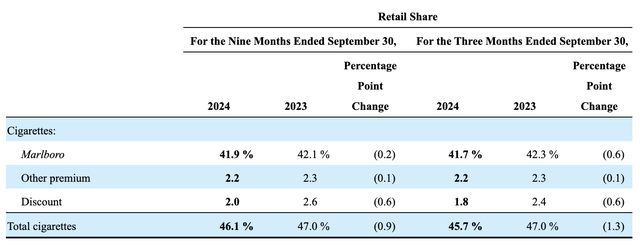

This sales increase for the company might seem peculiar. After all, the company continues to suffer from weakness in its major markets. Year over year for the third quarter, the total volume of cigarettes as measured by sticks decreased 8.6% from 19.30 billion to 17.64 billion. Even the famous Marlboro brand, which accounts for the vast majority of overall volume sales, experienced a 7.5% decline from 17.44 billion sticks to 16.12 billion sticks. When it comes to cigarettes as a whole, the company has experienced a decline in market share. In the third quarter of 2023, Altria Group controlled 47% of the retail market. That was made up mostly of the Marlboro brand that accounted for 42.3% of the total market. Today, these numbers are 45.7% and 41.7%, respectively. But even the other premium and discount categories have seen weakness during this time.

I do understand that the discount market has been a source of relative strength for the industry. In late August of this year, I wrote an article about how JT Group agreed to acquire discount tobacco firm Vector Group in an all-cash deal. The work I did for that article showed that, from 2021 through 2023, the discount cigarette category had expanded from 14.4% of all cigarette sales in the US to 17.5%. This was because of the financial burden being placed on the average consumer. So to see Altria Group experience weakness even in this market is discouraging.

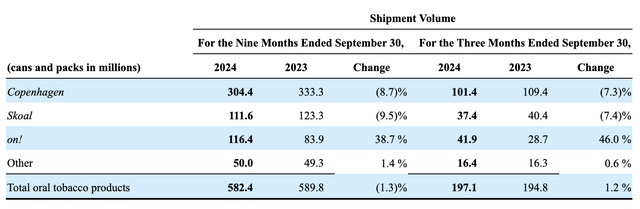

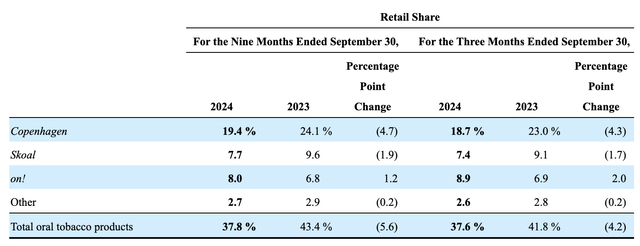

Management did report an increase in revenue associated with the Oral Tobacco Products segment. Sales expanded from $685 million to $722 million. Just like with the Smokeable Products segment, where revenue benefited tremendously (to the tune of $517 million) From higher pricing, the Oral Tobacco Products segment also benefited from increased prices on a year-over-year basis. According to management, higher pricing contributed $51 million of sales increase for the segment. But this doesn’t mean that everything has been going fine.

For starters, while total oral tobacco products saw an increase from 194.8 million cans and packs to 197.1 million on a year-over-year basis, the overall market share in this category also dropped. It fell from 41.8% last year to 37.6% this year. While some investors might be happy about the overall shipment increase, this was really only the result of robust strength associated with the company’s on! brand. That has been a true growth for the business. And from the third quarter of 2023 through the third quarter of 2024, the number of cans and packs shipped jumped from 28.7 million to 41.9 million. Had it not been for this, there actually would have been a decline from 166.1 million to 155.2 million. The end result would have been a decrease in market share from 34.9% down to only 28.7%.

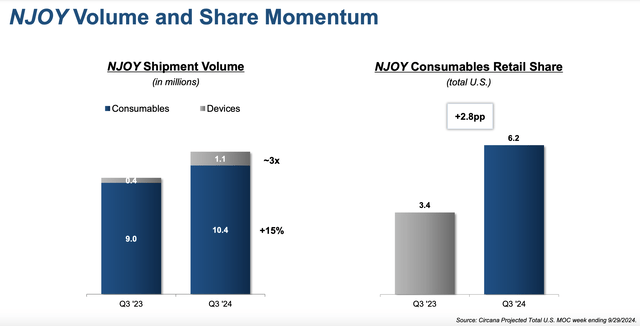

The company’s e-vapor platform continues to experience pretty decent growth year over year. In the third quarter of 2023, NJOY reported 0.4 million device shipments. This year, that number ballooned to 1.1 million. Consumables growth was more modest, expanding from 9 million shipments to 10.4 million shipments. However, that modest growth did not stop the company from almost doubling its retail share of the market for consumables from 3.4% to 6.2%.

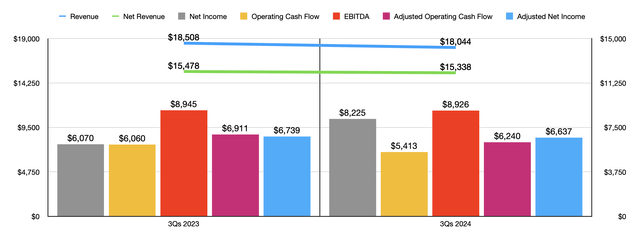

*$ in Millions

The overall growth of the company from a net revenue perspective allowed net profits to rise from $2.17 billion in the third quarter of 2023 to $2.29 billion at the same time this year. Other profitability metrics have been mixed. We did see an increase in adjusted net income from $2.28 billion to $2.36 billion. In addition to this, EBITDA managed to rise from $3.17 billion to $3.23 billion. On the other hand, operating cash flow fell from $2.95 billion to $2.61 billion, while the adjusted figure for this that removes changes in working capital fell from $2.31 billion to $2.05 billion. In the chart above, you can see financial results for the first nine months of this year compared to the same time last year. This shows a very similar trend, The only exception being that adjusted net profits did weaken year over year.

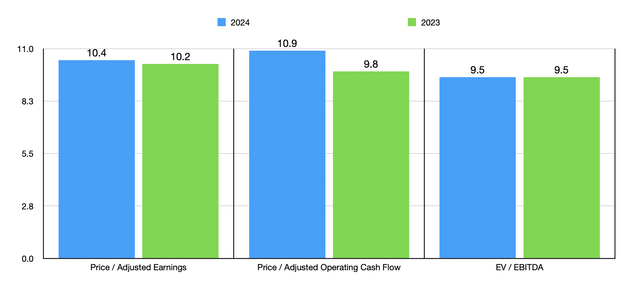

When it comes to valuing the company, shares are attractively priced. Or at least, on an absolute basis, they are. In the chart above, you can see what the stock is valued at using the price to adjusted earnings, price to adjusted operating cash flow, and the EV to EBITDA multiples on a forward basis for 2024 and on a historical basis for 2023. The 2024 earnings are based on the midpoint of guidance for this year of between $5.07 per share and $5.15 per share. That should give us adjusted net profits of $8.82 billion. This is basically in line with what the company achieved last year. Although, because of continued share buybacks, the per-share amount is actually up from the $4.95 reported last year. Adjusted operating cash flow should be somewhere around $8.43 billion, while EBITDA should come in at about $12.08 billion. In the table below, meanwhile, I compared the company to four similar firms. And what I found was that, on a price to operating cash flow basis and on a price to earnings basis, two of the four companies ended up being cheaper than Altria Group was. This number increases to three of the four when using the EV to EBITDA approach.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Altria Group | 10.4 | 10.9 | 9.5 |

| British American Tobacco (BTI) | 6.3 | 5.2 | 10.0 |

| Japan Tobacco (OTCPK:JAPAY) | 15.2 | 14.8 | 8.1 |

| Imperial Brands (OTCQX:IMBBY) | 10.0 | 7.0 | 6.5 |

| Philip Morris International (PM) | 19.8 | 16.9 | 16.1 |

What we have here is a company that, relative to similar firms, looks more or less fairly valued. However, because of the declining market share, I think there is reason to be cautious. The good news is that management is doing a fine job of putting the cash flows generated by operations to good use. Even though I am not a fan of the huge dividends that the company is paying out, with $1.7 billion paid out in the third quarter on its own, I am a fan of its share buybacks. Management where he purchased $680 million worth of stock during the third quarter of the year. And they plan to complete the other $310 million of their buyback program by the end of this year.

Author – Data from American Lung Association

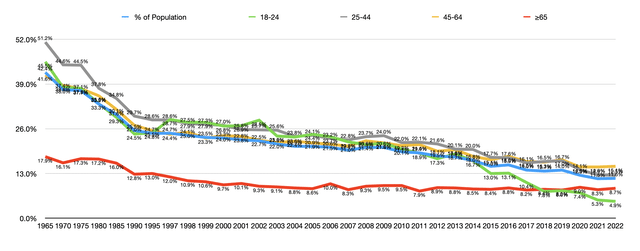

Normally, this is a type of company that I would be bullish on. However, the declining market share really eats at me. But it’s not just that. While the business has been able to capture growth in some areas, such as with NJOY and on!, it is experiencing a decline in market share for its broader operations. Furthermore, this is occurring in a market that is continuing to shrink. As an example of this, we need only look at data covering the past few decades for both adult and youth smokers. In the chart above, you can see that, back in 1965, 42.4% of all adults smoked. By 2022, which is the most recent data that we have available, this number had plunged to 11.6%.

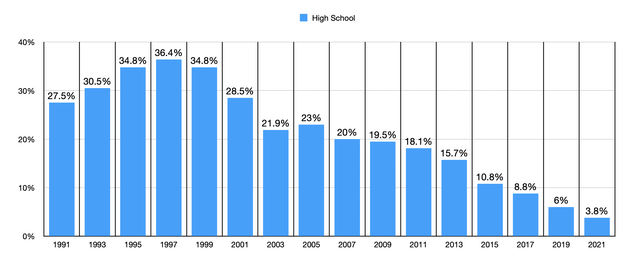

When it comes to a breakdown by age, middle-aged people are more likely to smoke. I would go out on a limb and say that this is because of the premature deaths associated with older smokers. From 1965 through 2022, the percentage of the population aged 65 or older that smokes declined from 17.9% to 8.7%. Those between 45 and 64 saw a decline from 41.6% down to 15.1%. However, for the two age brackets lower than this, 25 to 44 and 18 to 24, rates are lower. Only 4.9% of those in the youngest age bracket smoke. Fortunately, the share of the population in high school that is smoking is also on the decline. We don’t have data for 2022. But for 2021, this number was 3.8%. This is down from the 27.5% experienced back in 1991.

Author – Data from American Lung Association

For the individuals in question and for society more broadly, this is undeniably positive. Smoking is awful for your health. I personally have had several relatives die because of it. This included three of my four grandparents and multiple aunts and uncles. But for investors, this is a major negative. While management has been able to focus on some innovation and while the company has benefited from continued price increases on its products, the end result, however many years out into the future it might be, should be a dying market. While the company might be doing fine now, it is because of these issues and the decline in market share that I believe the stock is trading at such cheap levels.

Takeaway

Based on all the data provided, I must say that I am not a huge fan of Altria Group at this point in time. The company is facing multiple issues. Admittedly, higher pricing and growth in certain key markets has been encouraging. But that’s not enough to justify a ‘buy’ rating, even with how the stock is currently priced. Because of this, I have decided to maintain my ‘hold’ rating for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!