Summary:

- In recent weeks, financial participants have remained pessimistic about Merck’s development prospects, partly due to the nomination of Robert F. Kennedy Jr. as head of HHS.

- However, I believe Mr. Market overreacted to this news, given the strong performance of Merck’s oncology franchise in recent quarters.

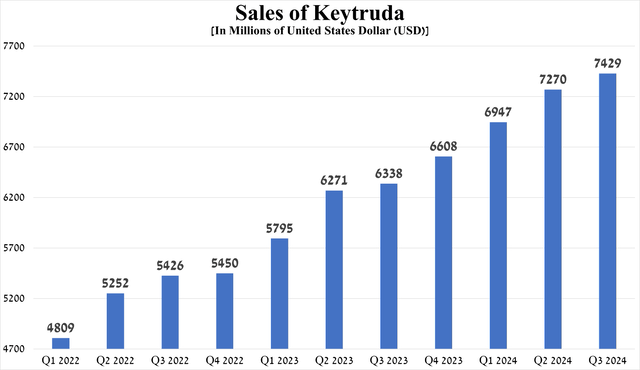

- So, sales of Keytruda amounted to $7.43 billion for the three months ended September 30, 2024, an increase of 17.2% year-over-year.

- In addition to its extremely high dividend yield of over 3%, in this article, you will discover why I upgraded Merck’s rating from ‘Buy’ to ‘Strong Buy.’

Tom Merton/OJO Images via Getty Images

On October 31, Merck (NYSE:MRK) released its financial results for the third quarter of 2024, which demonstrated many positive aspects, as well as some of the difficulties that its CEO Robert Davis has to face, which I will also draw your attention to in this article.

Investment thesis

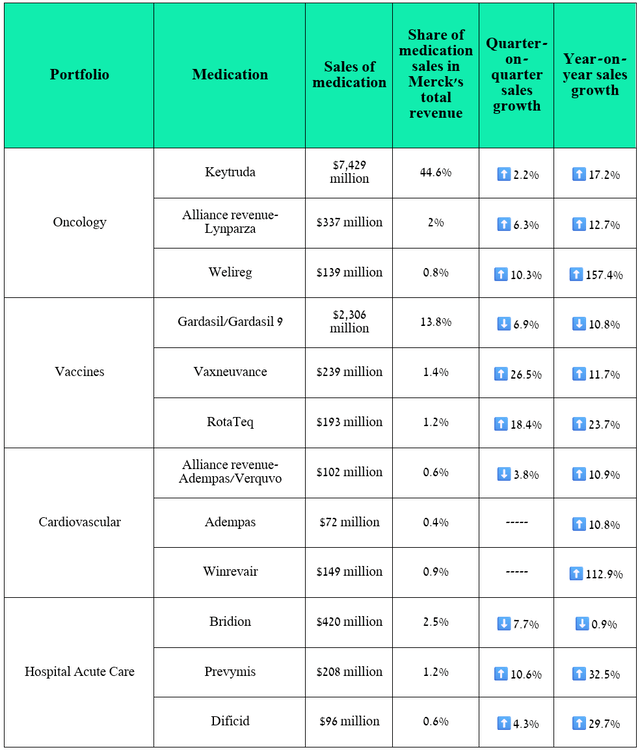

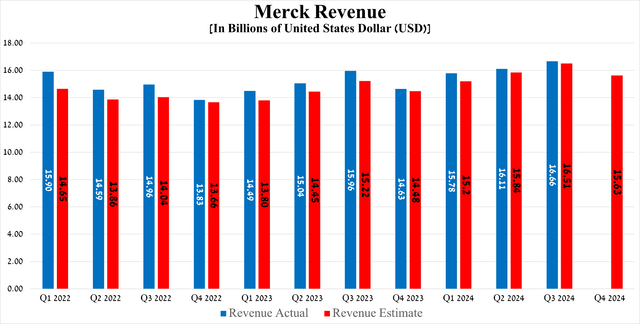

Merck’s revenue was about $16.66 billion for the three months ended September 30, 2024, up 4.39% year over year and beating both my expectations and Wall Streets’, thanks to stronger sales of Keytruda, Winrevair, Prevymis, Welireg, RotaTeq, which also helped offset the decline in demand for its HPV vaccines, called Gardasil and Gardasil 9, and Pneumovax 23, a pneumococcal vaccine.

Meanwhile, its non-GAAP earnings per share reached $1.57 for the third quarter of 2024, which was in line with consensus estimates. However, the completion of the acquisition of EyeBio, which allowed Merck to significantly strengthen its ophthalmology portfolio, and Curon Biopharmaceutical’s CN201, which in turn is an experimental next-generation medication for the treatment of B-cell mediated diseases, led to a temporary year-over-year decline in this financial metric.

So, right at the beginning of the article, I want to note the performance of Welireg, which is becoming one of the key assets in the portfolio of Merck’s marketed drugs, along with its blockbuster PD-1 inhibitor Keytruda and other cancer medications that it commercializes in partnerships with AstraZeneca (AZN) and Eisai (OTCPK:ESALF).

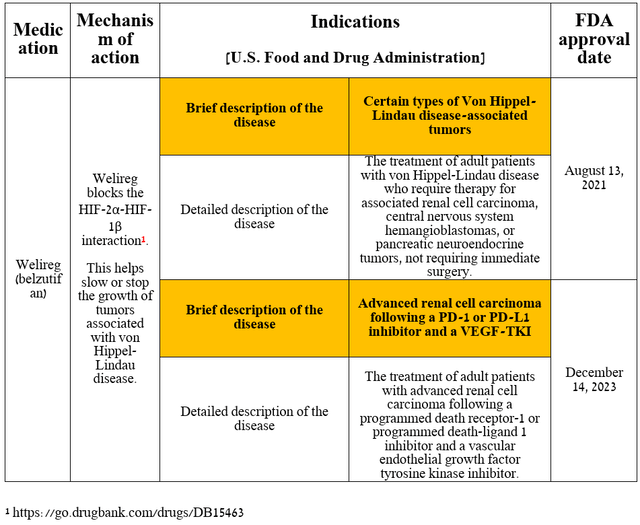

It is a selective HIF-2α inhibitor approved by the FDA, EMA, and other regulatory agencies to treat certain types of cancer associated with von Hippel-Lindau disease.

Source: table was made by Author based on Merck press releases

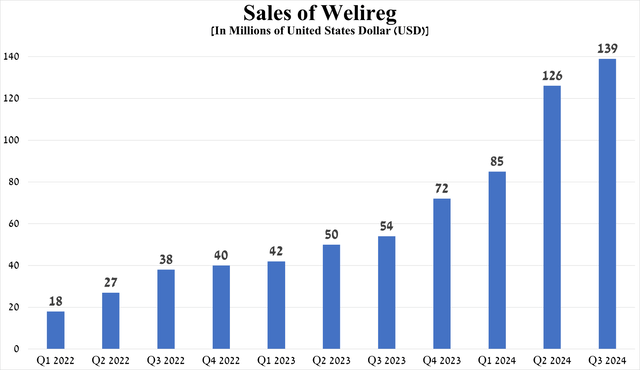

Welireg sales were $139 million in the third quarter of 2024, up 157.4% year over year and 10.3% quarter over quarter.

Source: graph was made by Author based on 10-Qs and 10-Ks

What are the reasons for the increase in demand for Welireg (belzutifan)?

In addition to the expansion of the global renal cell carcinoma treatment market, I highlight two other key factors that have contributed to the acceleration of Welireg’s sales growth since the beginning of 2024.

First, it was approved by the FDA on December 14, 2023, for the treatment of certain patients with advanced renal cell carcinoma. In general, renal cell carcinoma is one of the common types of cancer that forms in the tubules of the kidney. According to the American Cancer Society, 81,860 new cases of this cancer [52.38 thousand in men and 29.23 thousand in women] will be diagnosed in 2024 in the United States.

The second factor that contributed to the sharp increase in belzutifan sales is its widespread introduction into medical practice in the US and abroad.

But that’s not all, as I already noted in the article “Merck: Buy This Bargain Before It’s Gone,” this potential blockbuster is under review in the European Union/Japan for the treatment of a certain group of people with previously treated advanced RCC, as well as in the EU for the treatment of VHL disease.

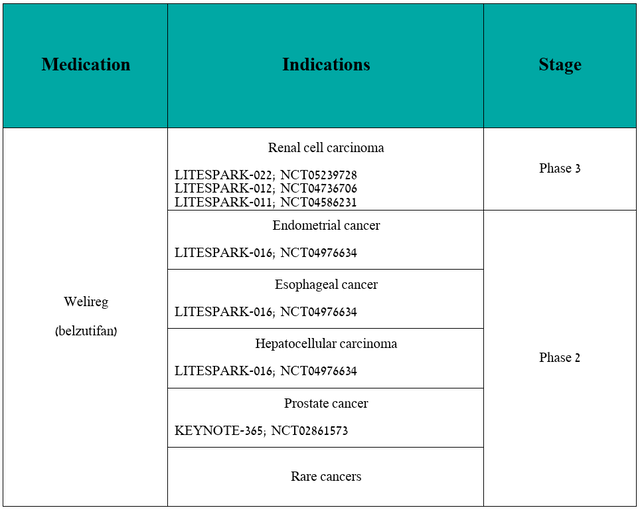

In the table below, I have included updated information about the clinical development program for Welireg [renal cell carcinoma, endometrial cancer, esophageal cancer, hepatocellular carcinoma, prostate cancer, and rare cancers].

Source: table was made by Author based on Merck pipeline

As I often note in articles, dry figures and the cherished word for any financial market participant in the company’s press release “beat” the expectations of Wall Street analysts are undoubtedly important.

However, for me, as a Seeking Alpha analyst who is upgrading Merck’s rating from ‘Buy’ to ‘Strong Buy,’ it is more critical to determine the factors that contributed to this and also those that will have a significant impact on its financial position in the future.

Merck’s Q3 2024 financial results and outlook beyond 2024

First of all, I want to note that Merck’s financial results for the third quarter of 2024 left me with more positive emotions than disappointment and once again confirmed that Keytruda remains a cash cow, mainly due to which the company’s levered free cash flow [LFCF] over the past 12 months exceeded $14 billion, which in turn is 51.4% more than in 2023.

Moreover, this PD-1 inhibitor was able to minimize the negative impact of sluggish demand for the Gardasil franchise in China, as well as less than satisfactory growth rates of RotaTeq sales, which is a vaccine for protection against rotavirus gastroenteritis.

In addition to Welireg, whose performance I discussed earlier, I want to highlight the sales, as well as the setbacks and achievements in the clinical development of some of Merck’s key products and experimental medications.

The following drugs have contributed significantly to Merck’s improved financial position, allowing it to accelerate the pace of development of next-generation product candidates aimed at combating various types of cancer [ifinatamab deruxtecan, patritumab deruxtecan, and quavonlimab], autoimmune diseases [MK-6194, tulisokibart], and diabetic macular edema [MK-3000].

Source: graph was made by Author based on 10-Qs and 10-Ks

So, I believe that these products will continue to play a vital role in increasing the company’s dividend payments for at least the next five years, as well as helping reduce its reliance on Keytruda, which will face increased competition from its biosimilars in the US in 2028.

However, for a more comprehensive understanding of the current situation and the development of Merck’s business in the next five years, it is also necessary to discuss the performance of the main star of its oncology franchise, namely Keytruda [PD-1 inhibitor].

Its total sales were $7.43 billion for the three months ended September 30, 2024, up 17.2% year-over-year and 2.2% quarter-over-quarter, driven in part by growing demand for it to treat certain types of lung, breast, and endometrial cancer.

Source: graph was made by Author based on 10-Qs and 10-Ks

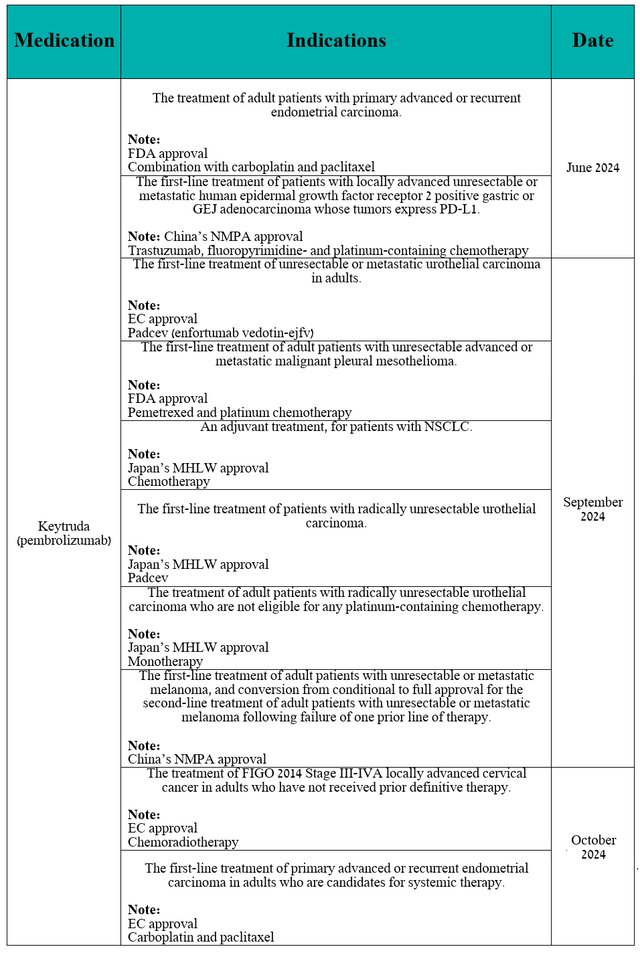

In addition, in the second half of 2024, it received multiple regulatory approvals in the treatment of people with non-small cell lung cancer, unresectable/metastatic melanoma, cervical cancer, urothelial carcinoma, and more, both as monotherapy and in combination with other medications, including Pfizer’s Padcev (PFE).

Source: table was made by Author based on the 10-Q

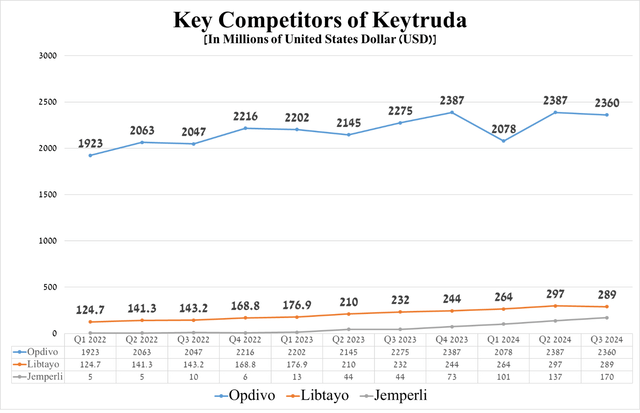

As a result, this allows Keytruda to remain a leader in the global cancer therapeutics market, which is also reflected in its higher sales growth rates relative to competitors, including GSK’s Jemperli (GSK), Bristol-Myers Squibb’s Opdivo (BMY), and Regeneron Pharmaceuticals’ Libtayo (REGN).

Source: graph was made by Author based on 10-Qs and 10-Ks

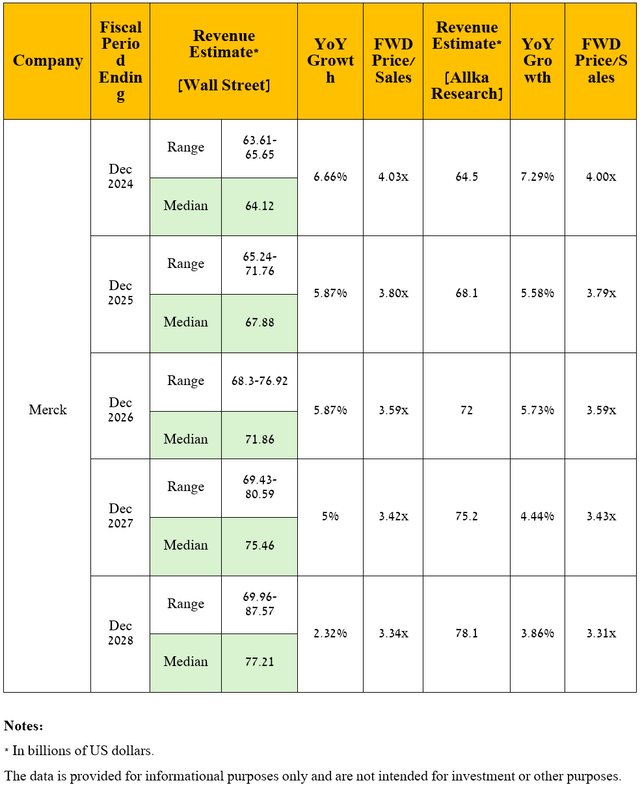

Seeking Alpha offers financial data, as well as Wall Street analysts’ forecasts for Merck’s revenue and earnings per share through 2030 and beyond.

So, Wall Street analysts expect Merck’s revenue for the fourth quarter of 2024 to be between $15.06 billion and $16.33 billion, which implies growth of 6.8% year-on-year.

Source: Seeking Alpha

Meanwhile, its price/sales ratio [FWD] is 3.81x, which is not only 12.1% lower than the 5-year average but also lower than many of its Big Pharma peers, including its key competitors in the global oncology drugs market, such as Novartis [P/S ratio is 4.09x] (NVS), AbbVie [P/S ratio is 5.25x] (ABBV), and Amgen [P/S ratio is 4.52x] (AMGN), thus being the first of the factors that, in my opinion, indicate that the New Jersey-based company is currently trading at a discount.

Now, I’ll zoom out.

I expect Merck’s revenue to continue to grow in the coming years, primarily driven by continued strong demand for its megablockbuster Keytruda, label expansions for Winrevair, Welireg, and Lynparza, potential regulatory approvals of its antibody-drug conjugates, which it is developing in partnership with Daiichi Sankyo, and other product candidates including quavonlimab and favezelimab.

In forecasting the company’s revenue and operating income, I took into account the continued decline in sales of its diabetes portfolio due to increased generic competition and the launch of more effective medicines by Eli Lilly (LLY) and Novo Nordisk (NVO), as well as the loss of U.S. exclusivity for some of its key medications and vaccines including Simponi, Lenvima, and Bridion, the impact of which I discussed in detail in “Merck’s Soaring Stock: Examining The Euphoria Amidst Potential Pitfalls.”

Overall, I anticipate its total revenue to be $78.1 billion in 2028, which firstly implies its average annual growth over the next five years by single-digit percentages [from 3.9% to 7.3%], and secondly, it is in line with the expectations of 13 analysts [$69.96-$87.57 billion]. Accordingly, Merck’s price-to-sales ratio will decrease from 3.9x over the past 12 months to below 3.4x.

Source: graph was made by the Author

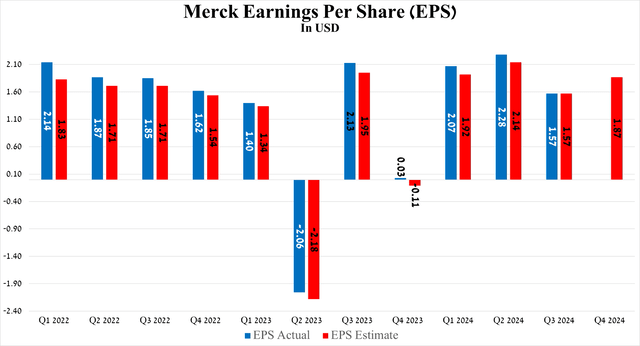

As I have noted in previous articles, let’s move on to a discussion of an equally important financial indicator, namely non-GAAP earnings per share [non-GAAP EPS].

Why?

This needs to be done because it more accurately and comprehensively determines how effective the business strategies implemented under the leadership of Robert Davis are.

So, Merck’s non-GAAP EPS is anticipated to be in the range of $1.80 to $2.13 in the fourth quarter of 2024, implying its growth of more than 61 times year-over-year.

Source: Seeking Alpha

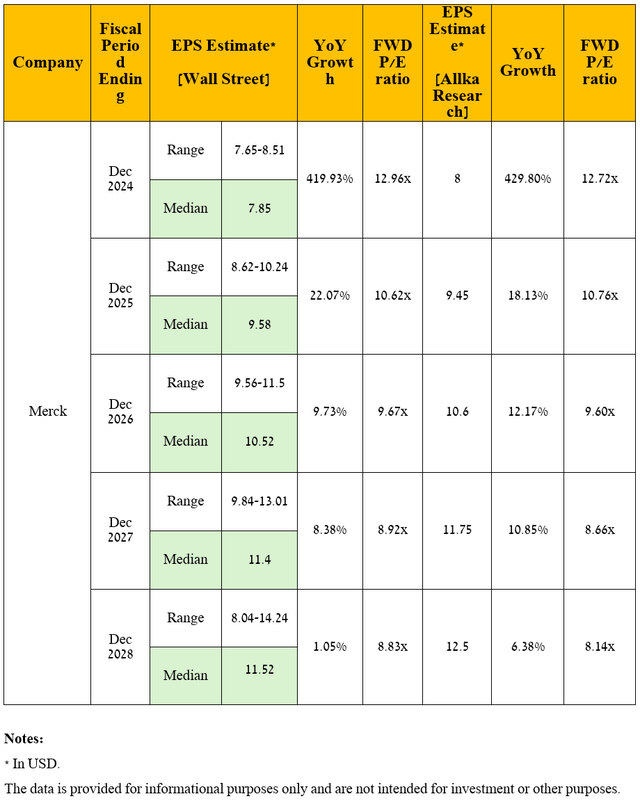

From a global standpoint, I expect Merck’s operating income growth trend to continue through the next five years, mainly due to rising prices and demand for medications in its oncology portfolio.

Moreover, after acquiring several pharmaceutical companies, which allowed the company to significantly strengthen and rejuvenate its pipeline of product candidates and, more importantly, potentially minimize the damage from the loss of Keytruda’s exclusivity in the U.S. in 2028, I expect its R&D expenses to return to $3.1 billion per quarter.

Consequently, due to the anticipated resorting of its management to the share repurchase program in the coming years, as well as the increase in its revenue under my forecast, which was noted earlier, I anticipate the company’s non-GAAP EPS to be $12.50 in 2028, which is slightly above the analysts’ median range [$8.04-$14.24] due to my more optimistic expectations for sales of its oncology franchise, particularly Keytruda, and secondly implies a drop in its P/E ratio from 16.2x to 8.14x.

Source: graph was made by the Author

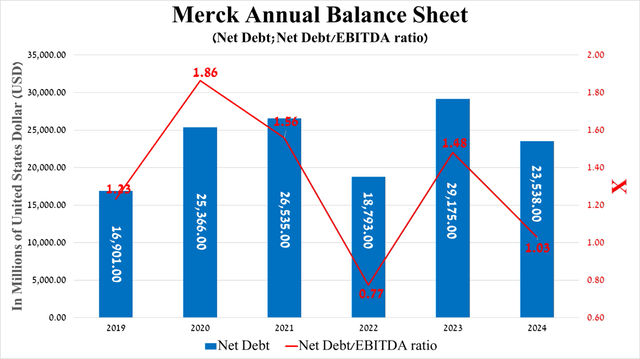

It is equally important to discuss Merck’s debt. In my assessment, it does not pose a risk to its financial position and, more importantly, will allow it to continue acquiring promising assets to develop its oncology and immunology franchises.

Overall, given the growth of its EBITDA year-on-year, including due to the factors I indicated in the article earlier, as well as the increase in total cash and ST investments [$7.09 billion at the end of 2023 and $14.6 billion at the end of Q3 2024], the company’s net debt/EBITDA ratio approached 1x by the end of September 2024.

Source: Seeking Alpha

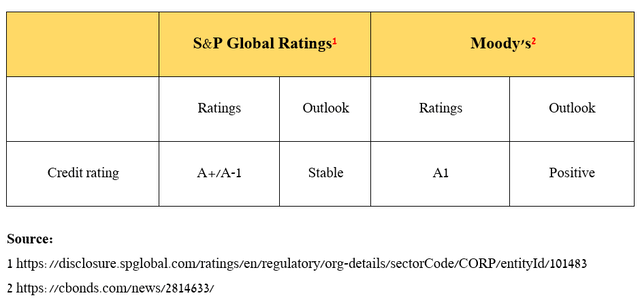

Also, I would like to point out that Merck’s credit ratings from S&P Global Ratings (SPGI) and Moody’s (MCO) remain at investment grade [A+/A1].

Source: table was made by Author

Risks

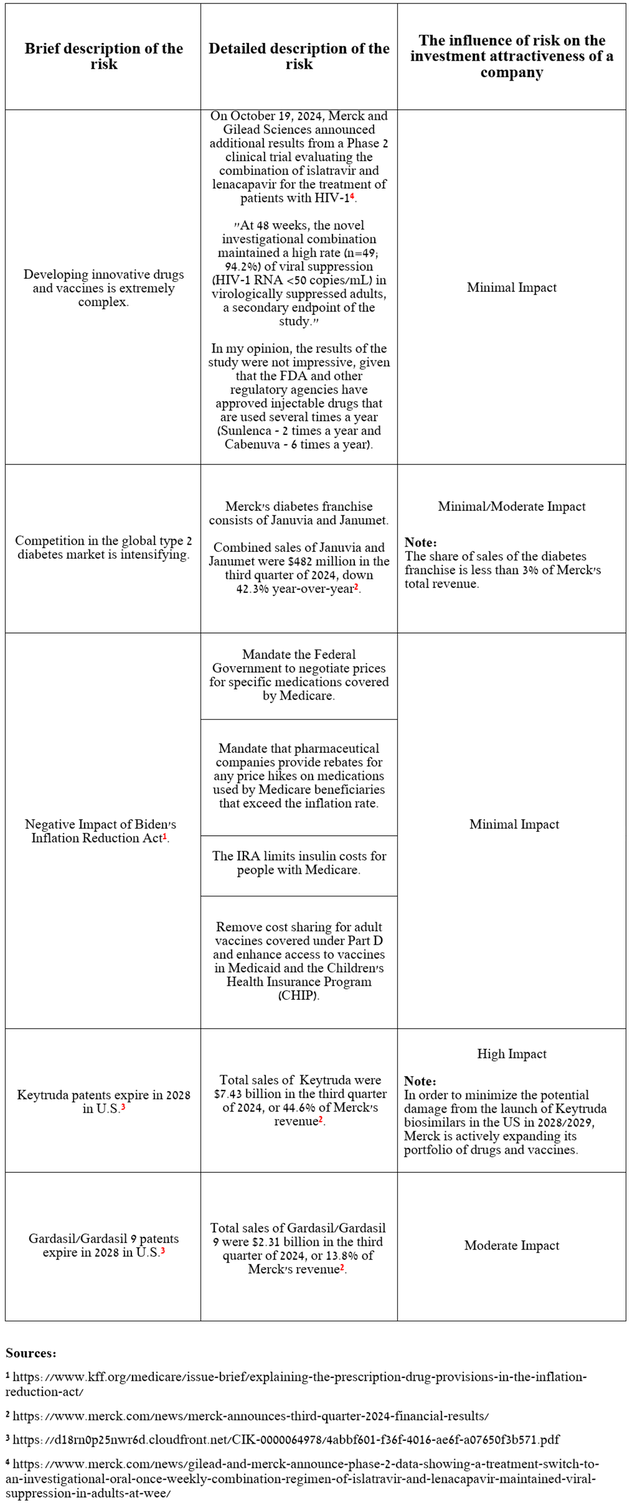

In addition to the expected appointment of Robert F. Kennedy Jr. as head of HHS and a temporary slowdown in demand for the Gardasil franchise, I’ve highlighted several risks in the table below, including Pneumovax 23’s poor performance, that long-term Merck investors should consider to minimize potential losses.

Source: table was made by Author

Takeaway

As a result of a slight reduction in its full-year non-GAAP EPS, primarily due to the completion of the acquisition of CN201 on October 1, Merck’s stock price has reached a strong support zone in the $96-$97 per share range.

Despite the apathy from institutional and retail investors, I believe the company has made significant progress in developing its oncology franchise, including multiple regulatory approvals for Keytruda in the U.S., Japan, the EU, and China.

Ultimately, thanks to stronger sales of Prevymis, Welireg, Vaxneuvance, and Keytruda, lower net debt quarter-on-quarter, and a rich pipeline of experimental drugs, I am upgrading Merck’s rating from ‘Buy’ to ‘Strong Buy.’

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.